Stablecoins have long been considered the backbone of decentralized finance, providing a crucial on-ramp for liquidity, collateral, and day-to-day transactions. Yet in 2025, the DeFi ecosystem is confronting a harsh reality: stablecoin depegs are no longer rare black swan events but an unsettlingly frequent occurrence. In the first week of November alone, Stables Labs’s USDX dropped to $0.82 and Stream Finance’s deUSD collapsed to just $0.10, while Falcon Finance’s USDf joined the list of casualties amid liquidity and collateral concerns. As these events unfold in real time, they are sending shockwaves through protocols and investor portfolios alike.

What Drives Stablecoin Depegs in 2025?

The anatomy of a stablecoin depeg event typically reveals a convergence of systemic vulnerabilities rather than a single point of failure. In 2025, three primary causes have emerged:

- Liquidity Crises: When redemption requests surge, DeFi liquidity pools can be rapidly depleted. Automated market makers (AMMs) may be forced to sell collateral at steep discounts, driving stablecoin prices well below their intended $1 parity.

- Collateral Shocks: Many decentralized stablecoins are backed by volatile assets like ETH or BTC. Sudden price drops in these assets can undermine the value of reserves, leaving the stablecoin undercollateralized and vulnerable to spirals that break the peg.

- Smart Contract Exploits: Vulnerabilities or bugs in protocol code can drain reserves or disrupt stability mechanisms, issues that are notoriously difficult to patch once exploited due to blockchain immutability.

A less-discussed but equally potent risk involves banking partners for fiat-backed stablecoins. Should a reserve bank face insolvency or operational hurdles, even fully backed tokens may lose their peg as confidence evaporates.

The Systemic Risks: How Depegs Ripple Through DeFi

The implications extend far beyond individual tokens losing their pegs. Stablecoins serve as both collateral and settlement layers across lending platforms, DEXs, derivatives protocols, and more. When USDX fell to $0.82 and deUSD cratered to $0.10, entire classes of DeFi applications were thrown into crisis mode:

- Cascading Protocol Failures: Collateral shortfalls force liquidations across lending markets; users who thought they were insulated by “stable” assets find themselves wiped out.

- Panic Selling and Volatility: The loss of peg triggers fire sales as investors scramble for safer assets, exacerbating price swings across crypto markets.

- Erosion of Trust: Repeated failures undermine confidence not just in affected tokens but in the broader DeFi landscape’s reliability and resilience.

This is not merely theoretical: each high-profile depeg increases pressure on remaining protocols and heightens regulatory scrutiny worldwide.

Evolving Insurance Solutions: Can On-Chain Coverage Keep Pace?

The proliferation of stablecoin risk has galvanized innovation in on-chain insurance solutions designed specifically for depeg protection. Unlike traditional insurance models, often slow and opaque, DeFi-native coverage leverages automation for transparency and speed:

- On-Chain Depeg Insurance: Protocols like InsurAce provide real-time monitoring of price feeds with smart contracts that trigger payouts when predefined thresholds (such as USDX dropping below $0.90) are breached.

- Structured Derivatives and Vaults: Platforms such as Y2K Finance let users hedge against specific depeg risks or even take on exposure as underwriters, creating new dynamics for risk-sharing within crypto markets.

This new class of insurance is not without its own risks; oracle reliability, capital adequacy, and payout governance remain open questions as adoption grows. Still, these innovations represent a critical step forward in making DeFi more robust against systemic shocks, a theme we will explore further as we examine how users can proactively protect their portfolios amid ongoing instability.

For DeFi participants, the question is no longer if another depeg will happen, but when. The rapid-fire sequence of events in November 2025 has forced protocols, investors, and risk managers to rethink their approach to DeFi asset protection. Active due diligence on stablecoin collateral models and insurance mechanisms is now essential for anyone deploying capital in decentralized markets.

Navigating the Insurance Landscape: What Works in 2025?

The latest wave of depegs has tested the mettle of DeFi insurance providers. Protocols like InsurAce and Y2K Finance have demonstrated that automated depeg coverage can respond to price triggers with unprecedented speed, sometimes executing payouts within minutes of a stablecoin breach. However, users must carefully read policy terms, coverage often applies only to specific assets and predefined price thresholds. For example, a drop like USDX’s fall to $0.82 may trigger coverage if the policy threshold is set at $0.95 or $0.90, but not if it’s lower.

Importantly, these on-chain models are only as reliable as their oracles and governance structures. A poorly designed oracle can misreport prices during market turbulence, delaying or denying legitimate claims. Meanwhile, capital adequacy remains a looming concern: if too many claims hit simultaneously during a widespread event like deUSD’s collapse to $0.10, even well-capitalized pools could face deficits.

Top DeFi Insurance Protocols for Stablecoin Depeg Protection (2025)

-

InsurAce: A leading multi-chain DeFi insurance protocol, InsurAce offers comprehensive protection against stablecoin depeg events. Its on-chain policies cover major stablecoins, with automated payouts triggered by verified depeg conditions. Learn more.

-

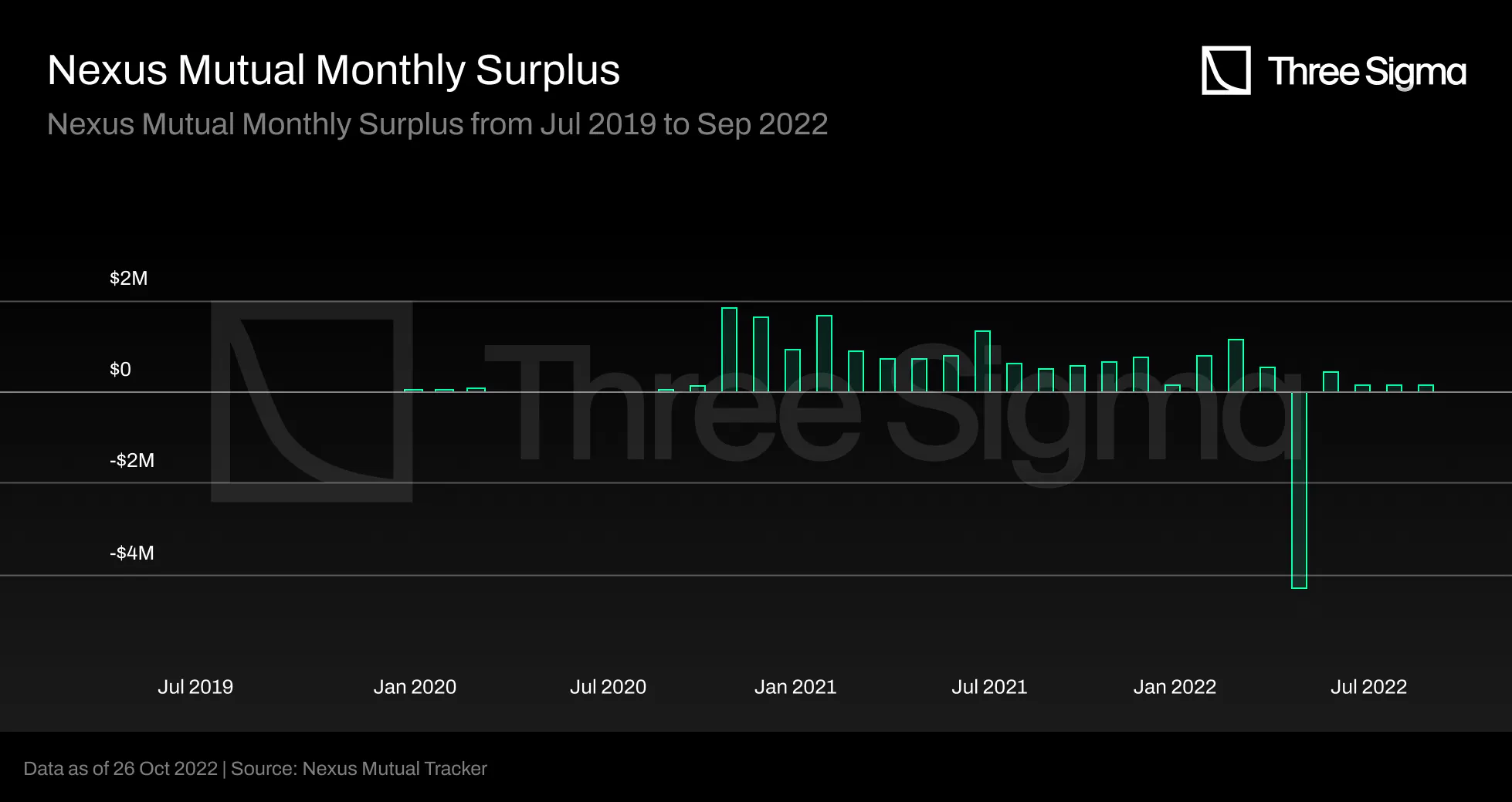

Nexus Mutual: As one of the most established decentralized insurance providers, Nexus Mutual covers smart contract risks and now offers dedicated stablecoin depeg protection. Members can purchase coverage for leading stablecoins and DeFi protocols. Learn more.

-

Y2K Finance: Specializing in depeg risk, Y2K Finance provides structured Depeg Protection Vaults. Users can hedge or insure against specific stablecoin depeg events, including for USDX and deUSD, which recently lost their dollar parity. Learn more.

-

Unslashed Finance: Unslashed Finance is a decentralized insurance protocol offering coverage for stablecoin depegs, protocol hacks, and other DeFi risks. Its flexible policies and capital-efficient pools make it a popular choice for DeFi users. Learn more.

-

OpenCover: Aggregating DeFi insurance options, OpenCover enables users to compare and purchase stablecoin depeg coverage from multiple providers, streamlining the process for maximum protection. Learn more.

For those seeking more nuanced hedges, structured derivatives platforms provide additional layers of defense. By allowing users to either buy protection or underwrite risk for premiums, these platforms introduce new forms of market-based risk transfer, though they also require sophisticated understanding of payout mechanics and counterparty risks.

Best Practices for DeFi Users Amid Ongoing Depegs

No insurance protocol is a silver bullet; prudent users combine several strategies:

- Diversify Stablecoin Holdings: Avoid overexposure to any single issuer or collateral model, spread risk across multiple stablecoins with different reserve mechanisms.

- Monitor Real-Time Coverage: Use tools that track insurance pool solvency and claim activity before purchasing coverage.

- Stay Informed: Follow credible sources for alerts on emerging vulnerabilities and active depeg events.

The events of 2025 have also prompted some protocols to consider making insurance mandatory for certain high-risk activities, a trend reminiscent of traditional finance but with on-chain transparency baked in from the start.

Looking Ahead: Systemic Risk and Regulatory Pressures

The frequency and severity of recent depegs have caught the attention of global regulators. With MiCA taking effect in Europe and new proposals surfacing worldwide, there is growing momentum toward standardized reserve disclosures and stress testing for algorithmic stablecoins. This regulatory scrutiny might eventually shape what qualifies as an insurable event or who can offer compliant coverage within the DeFi ecosystem.

If history is any guide, innovation will continue apace, but so will systemic shocks as new products are tested under live market conditions. For now, robust risk assessment paired with dynamic insurance solutions offers the best path forward for those looking to participate in DeFi without being blindsided by the next peg break.

The story of stablecoins in 2025 is still unfolding, each new event tests not just code or collateral but also collective confidence in decentralized finance itself. As we move deeper into an era where stability must be engineered rather than assumed, informed vigilance remains every investor’s most valuable asset.