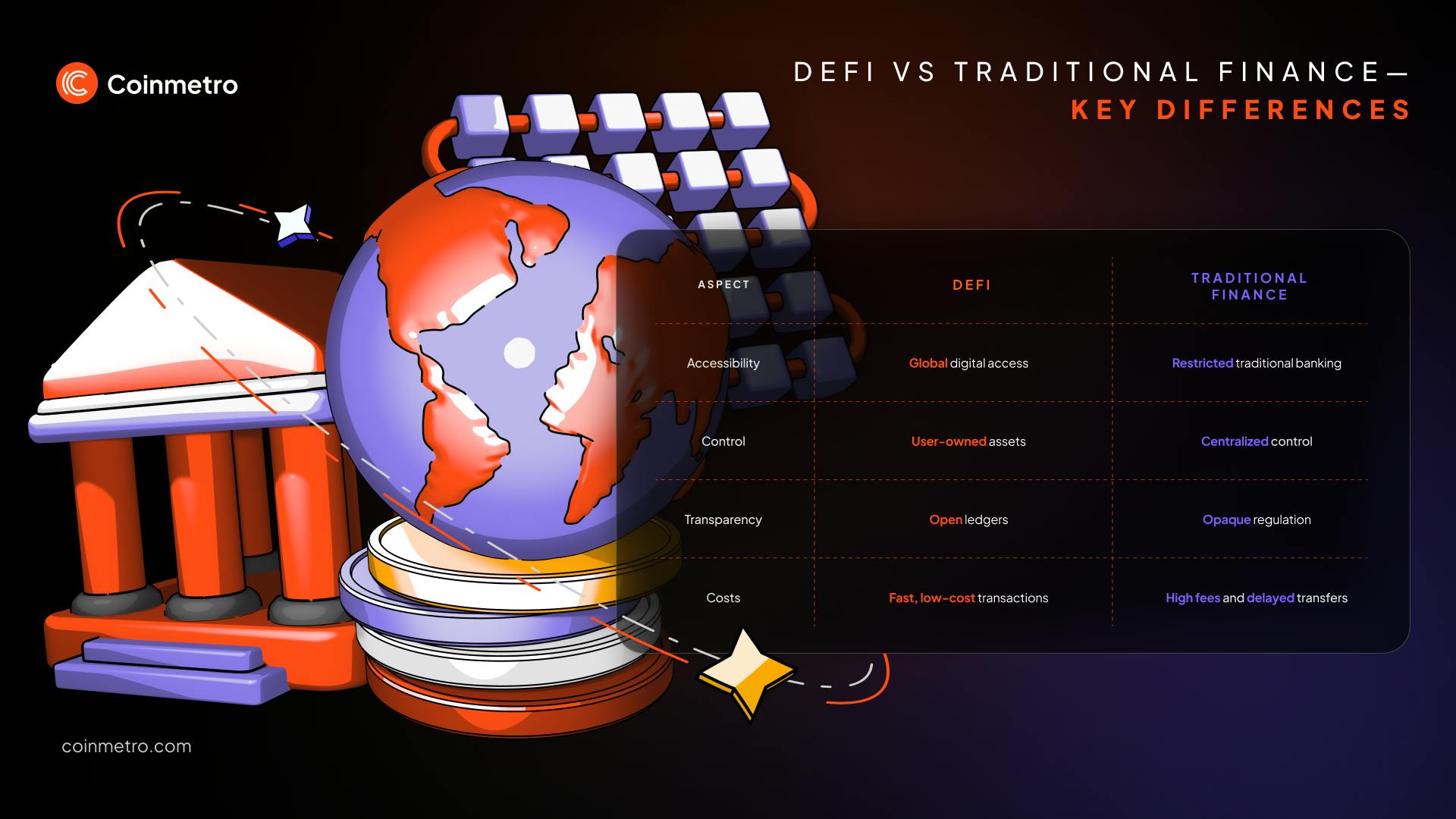

Stablecoins are the backbone of most DeFi strategies, offering a supposed safe haven from market volatility. Yet, as recent years have shown, even the biggest names like USDC, DAI, and USDT can slip from their dollar peg, sometimes for hours, sometimes for days. For DeFi users relying on stablecoins to park capital or execute trades, this risk is more than theoretical. That’s where stablecoin depeg insurance comes in: a new breed of on-chain protection designed to shield your capital from unexpected price swings in so-called “stable” assets.

![]()

What Is Stablecoin Depeg Insurance?

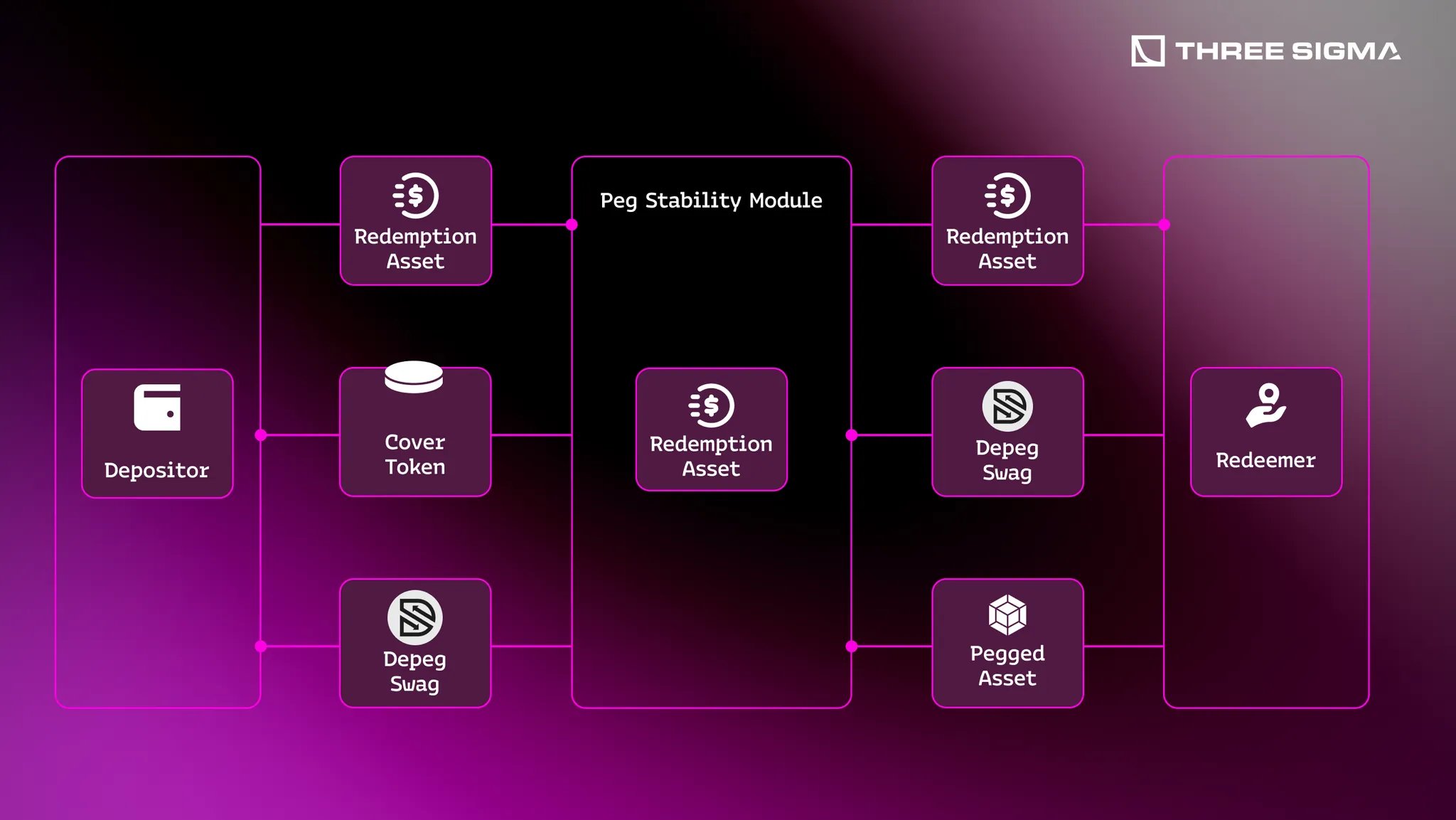

Stablecoin depeg insurance is a decentralized coverage product that protects users against losses if a stablecoin’s price falls below (or rises above) its target peg, usually $1 for USD-backed coins. Unlike traditional insurance, these policies are created and settled on-chain via smart contracts. If your insured stablecoin drops beneath your chosen threshold (for example, $0.95), the policy triggers an automatic payout to cover your loss.

This type of protection is becoming increasingly important as stablecoins face pressure from regulatory changes, liquidity crises, or issues with collateral reserves. Even brief depegs can result in permanent losses if you’re forced to swap or redeem at unfavorable prices.

How Does Depeg Insurance Work?

The process is straightforward but powerful. Here’s what you can expect when purchasing DeFi stablecoin protection:

Steps to Buy and Activate Stablecoin Depeg Insurance

-

Choose a Reputable DeFi Insurance PlatformSelect a trusted platform that offers stablecoin depeg cover, such as Etherisc, OpenCover, or StableShield. Ensure the platform supports the stablecoin you wish to insure (e.g., USDC, USDT, DAI).

-

Select the Stablecoin and Coverage AmountPick the stablecoin (such as USDC, DAI, or USDT) you want to insure and specify the amount you wish to cover. Confirm that your chosen amount meets any minimum coverage requirements (e.g., 2,000 USDC on some platforms).

-

Set Protection ParametersDefine your depeg threshold (e.g., $0.95 for USDC), coverage duration (from 7 days up to 12 months), and any other customizable options. These parameters determine when your insurance activates and for how long.

-

Connect Your Crypto WalletLink your wallet (such as MetaMask or WalletConnect) to the insurance platform to interact with the smart contract and manage your policy securely.

-

Review Premium and Policy TermsCarefully check the calculated premium, which is based on factors like volatility, coverage amount, and duration. Review all policy details, including payout conditions and any exclusions.

-

Pay the Premium and Activate CoverageApprove and pay the premium directly from your wallet. Once paid, your stablecoin depeg insurance becomes active immediately—no waiting period required.

-

Monitor Coverage and Automated PayoutsThe protocol will continuously track the stablecoin’s price using decentralized oracles. If a depeg event occurs and meets your policy’s criteria, the smart contract automatically triggers a payout to your wallet—no manual claim needed.

1. Choose Your Stablecoins and Coverage Amount

Select which assets you want to insure, common choices include USDC, USDT, DAI, BUSD, FRAX, and LUSD, and specify how much coverage you need.

2. Set Your Protection Parameters

You define the depeg threshold that will trigger your policy (e. g. , $0.95), tailoring the risk level to your needs.

3. Pay the Premium

The cost depends on several factors: historical volatility of the chosen coin, your threshold level, coverage amount, and policy duration. Some providers offer annual rates as low as 1.5%. For more details on pricing mechanics and examples of coverage options available today, check out this resource: defilean. xyz.

4. Automatic Monitoring and Payouts

The protocol continuously watches market prices using decentralized oracles that aggregate data from leading exchanges. If a depeg event occurs, say your insured coin trades below $0.95 for one hour, the smart contract automatically executes payment to your wallet without any manual claims process.

Key Features That Set Depeg Insurance Apart

- Instant Activation: Coverage starts right after premium payment, no waiting period required.

- User-Defined Triggers: Customize thresholds and coverage amounts based on personal risk tolerance.

- Transparent Pricing: Premiums are calculated using clear formulas tied directly to volatility data and selected parameters.

- No Middlemen: All payouts are handled by smart contracts; there’s no need to trust an insurer or file paperwork.

- Flexible Terms: Choose durations ranging from one week up to twelve months for maximum flexibility in portfolio management.

If you’re curious about how these features compare across different providers or want an up-to-date look at available policies, including minimum coverage requirements, this guide is worth exploring: decrypt. co.

While the mechanics of stablecoin depeg insurance are elegant, users should approach these products with a clear understanding of their strengths and limitations. Not every depeg event is covered equally, and policy terms can vary widely between providers. For example, some protocols may only insure against price drops below a certain threshold (like $0.95) for a specific duration, while others might exclude losses caused by regulatory crackdowns or systemic failures.

What to Watch Out For: Coverage Limits and Exclusions

Before purchasing any DeFi stablecoin protection, review the policy’s fine print. Many insurance providers impose minimum coverage requirements, sometimes as high as 2,000 USDC, potentially excluding smaller investors from participation. Additionally, payout caps may limit the total compensation you receive even if your losses exceed your insured amount.

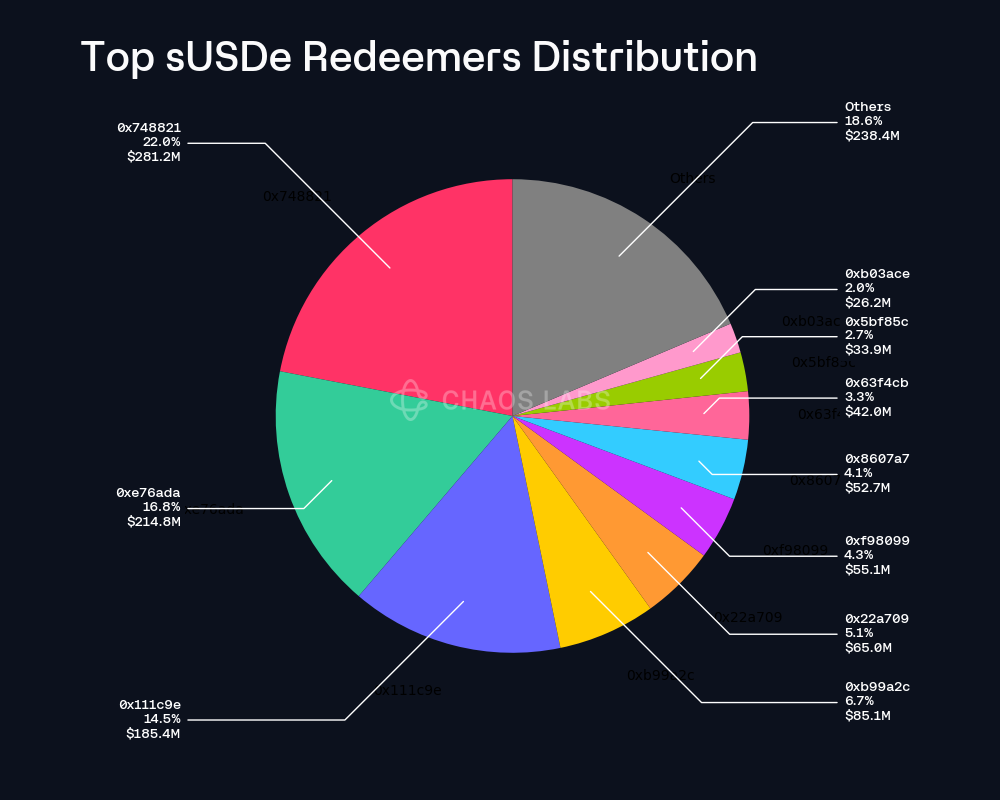

It’s also crucial to understand what triggers a valid claim. Most protocols rely on decentralized oracles that aggregate prices from multiple exchanges to detect a depeg event. However, if market volatility causes a brief price dip that recovers within minutes, your policy may not activate unless the threshold is breached for an extended period (often one hour).

Comparing Stablecoin Insurance Providers

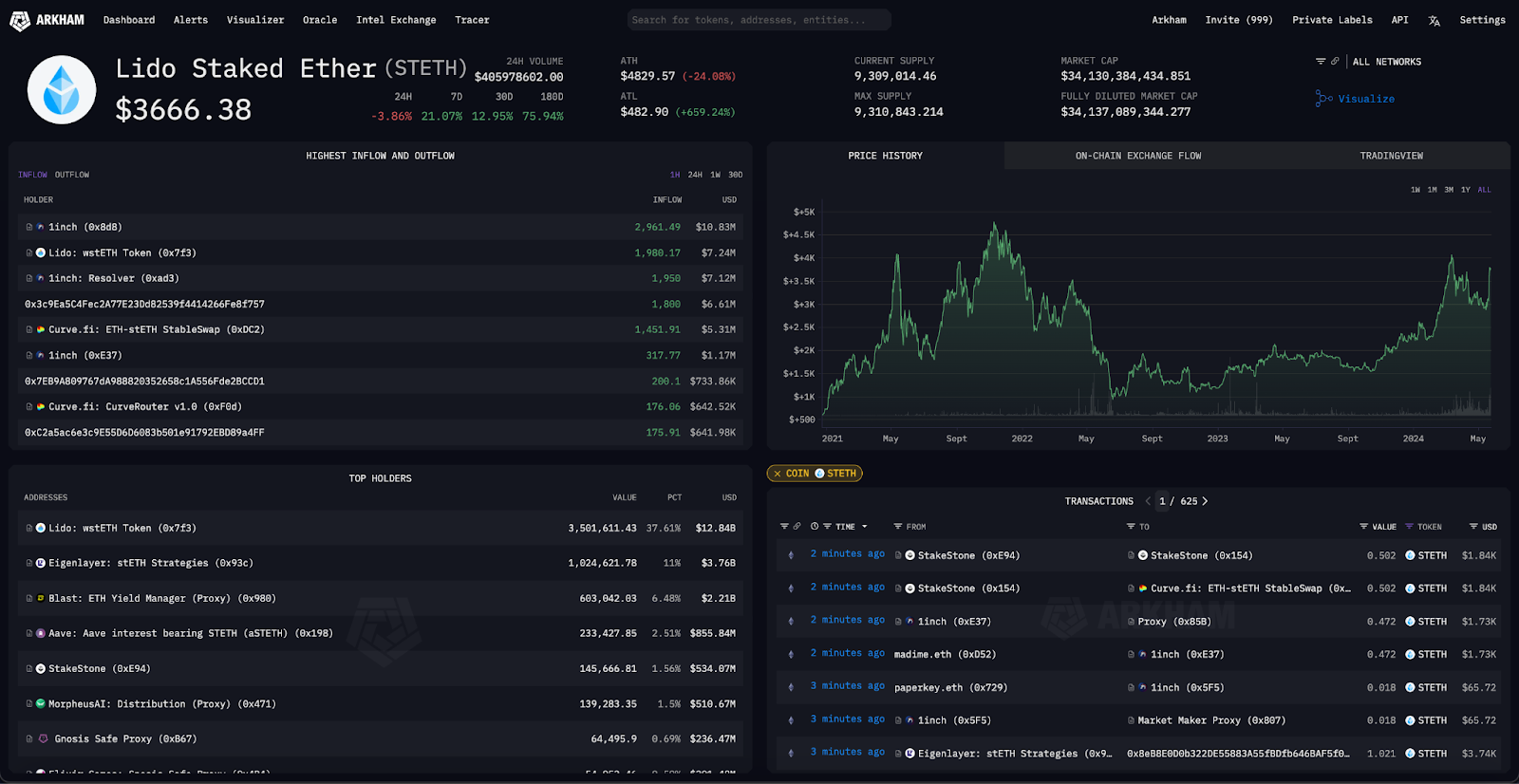

The DeFi landscape now features several specialized stablecoin insurance providers. Each has its own approach to pricing, risk assessment, and claims processing. Some notable protocols include Etherisc’s USDC depeg coverage and newer entrants like Stable Shield and OpenCover. To help you compare options at a glance:

Top Stablecoin Depeg Insurance Providers Compared

-

Nexus Mutual: One of the largest DeFi insurance protocols, Nexus Mutual offers Depeg Cover for major stablecoins like USDC, DAI, and USDT. Users can customize coverage amount, depeg threshold, and duration, with transparent on-chain pricing and automated smart contract payouts.

-

Etherisc: Etherisc provides USDC Depeg Protection with policies that automatically pay out if USDC drops below a user-defined threshold (e.g., $0.95) for a specified period. Coverage is managed via decentralized smart contracts, and Etherisc is known for its peer-to-peer insurance model.

-

InsurAce: InsurAce offers Stablecoin Depeg Cover for assets such as USDT, USDC, and DAI. Features include flexible coverage terms, competitive premiums, and instant activation. The platform supports multi-chain coverage and leverages decentralized oracles for price monitoring.

-

OpenCover: OpenCover aggregates stablecoin depeg insurance products from multiple providers, allowing users to compare coverage options, premiums, and policy terms in one place. Its platform emphasizes transparency and ease of access for DeFi users seeking protection against depegging events.

-

Unslashed Finance: Unslashed Finance provides Depeg Protection for various stablecoins, with customizable coverage parameters and automated, trustless payouts. The protocol pools risk across multiple DeFi products, offering diversified protection and competitive rates.

For those seeking deeper analysis or current policy offerings, including details on supported stablecoins, premium rates, and minimum/maximum coverage amounts, visit defilean. xyz. This resource aggregates up-to-date data across multiple DeFi insurance platforms.

Best Practices for Stablecoin Risk Management

No single solution offers complete protection in DeFi, but layering strategies can significantly reduce your exposure to stablecoin volatility. Here are some actionable tips:

- Diversify Your Holdings: Don’t put all your capital in one stablecoin or protocol.

- Regularly Review Insurance Policies: Terms can change quickly; stay informed about your coverage and any protocol updates.

- Combine On-Chain Protection With Off-Chain Research: Monitor news about regulatory shifts or reserve transparency issues that could impact peg stability.

- Set Realistic Thresholds: Lower thresholds mean more expensive premiums; balance risk appetite with cost efficiency.

- Monitor Market Conditions: Use decentralized analytics tools to track liquidity trends and early warning signs of stress in major stablecoins.

The evolution of DeFi insurance is making it easier for individual investors and DAOs alike to manage risk proactively rather than reactively. By leveraging automated payouts, transparent pricing models, and customizable protection parameters, users can navigate the uncertain waters of digital asset markets with more confidence, and less sleepless nights worrying about sudden depegs.

If you’re serious about safeguarding your portfolio from unforeseen shocks in the stablecoin market, exploring dedicated depeg insurance options should be at the top of your DeFi risk management checklist.