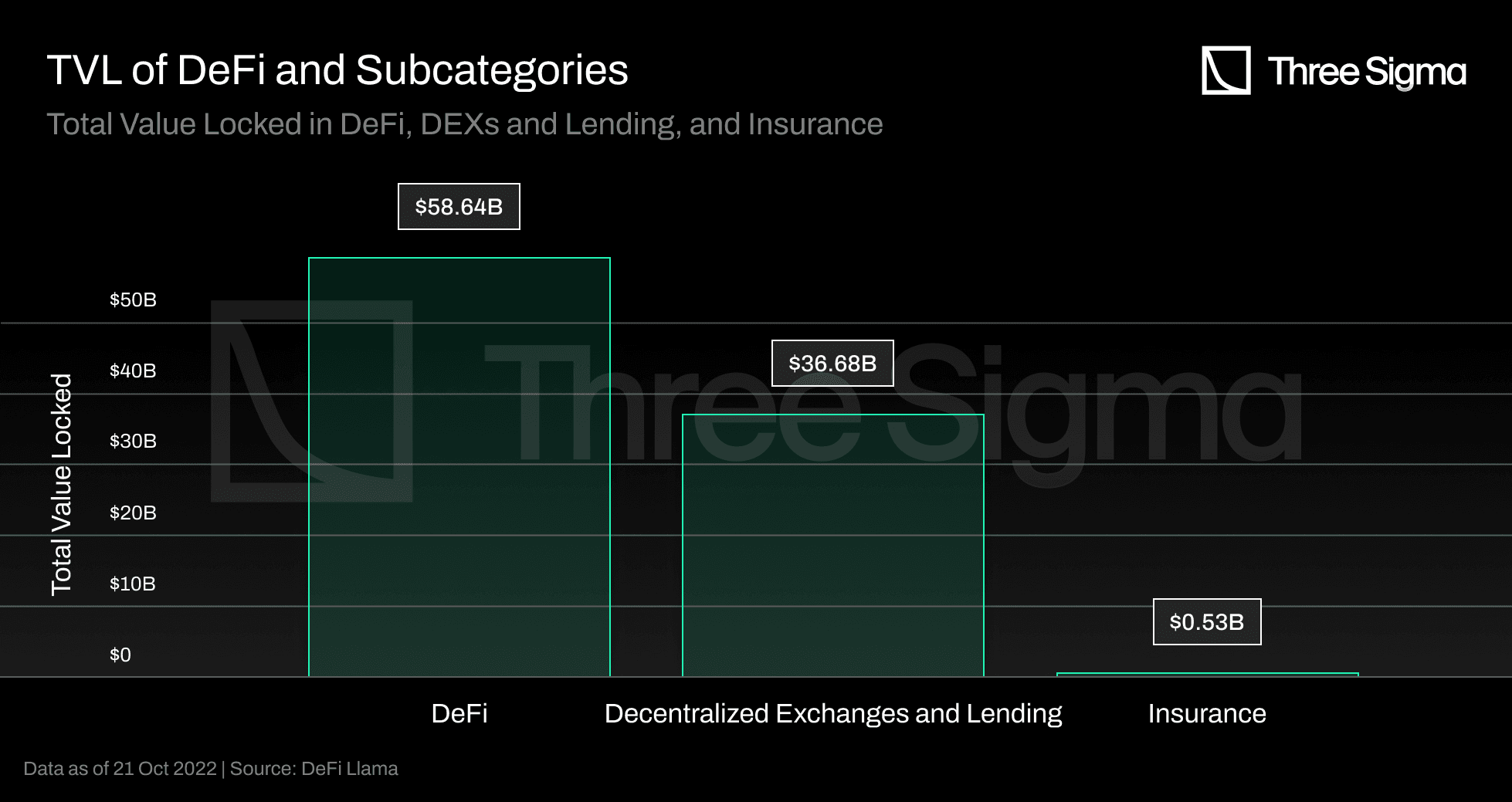

Stablecoins have become the backbone of decentralized finance, but as 2024 unfolds, the risk of depegging remains a real threat for DeFi users and protocols. The collapse of UST in 2022 and several minor depeg events since have made one thing clear: stablecoin risk insurance is no longer a luxury, it’s a necessity. With the global Depeg Insurance market reaching $420 million this year and projected to grow at a robust 28.7% CAGR through 2033, choosing the right provider is more important than ever.

Why Stablecoin Depeg Protection Is Essential in Today’s DeFi

Most DeFi portfolios rely on stablecoins like USDT, USDC, or DAI to park value or facilitate trades. Yet, these tokens are susceptible to technical failures, regulatory shocks, and black swan events that can cause their price to slip below $1.00 – sometimes dramatically. In the past year alone, multiple stablecoins briefly dipped under critical thresholds (e. g. , $0.95), triggering panic and losses across protocols.

DeFi insurance providers now offer specialized coverage for these scenarios. Policies are designed to reimburse users if a covered stablecoin loses its peg by falling below an agreed threshold for a set duration. This is especially vital for anyone using stablecoins as collateral or holding large balances on-chain.

Key Players: Comparing Top DeFi Insurance Providers for 2024

The landscape has matured rapidly with leading protocols competing on transparency, automation, and claims reliability. Here are four standout providers offering stablecoin depeg protection this year:

- Nexus Mutual: Operates as a DAO with member-driven claim approvals. Paid out over $1 million during Hodlnaut’s halted withdrawals and offers robust depeg coverage across major stablecoins.

- InsurAce: Multi-chain coverage (Ethereum, BNB Chain, Polygon). Notably processed $12 million in payouts after Terra’s UST collapse, demonstrating both capacity and responsiveness.

- Bridge Mutual: Focuses on staking-based pools for stablecoin failures and smart contract exploits. BMI token holders participate in governance and liquidity provision.

- Etherisc: Open-source templates with automated smart contract-based payouts; emphasizes transparency and user empowerment.

If you want a detailed comparison of these providers’ strengths and weaknesses, including premium rates and payout records, check out our dedicated guide at Top DeFi Insurance Protocols Protecting Against Stablecoin Depegs in 2024.

The Most Important Factors When You Compare DeFi Coverage

No two policies are alike. To make an informed decision when conducting your own DeFi insurance comparison, focus on these critical dimensions:

- COVERED STABLECOINS and SCENARIOS: Does the policy cover just USDC/USDT? Or does it also include algorithmic or niche asset-backed coins? Some protocols only insure certain types of depegs (e. g. , below $0.95 for more than one hour).

- PAYOUT STRUCTURE and LIMITS: Understand both the premium cost and payout cap per claim. For example, InsurAce may offer higher maximums but stricter eligibility windows; Nexus Mutual may require community voting but provide more flexible terms.

- PAYOUT SPEED and CLAIMS PROCESS: Automated parametric triggers mean faster settlements, great during volatile events, but some platforms still use manual voting which can delay compensation when you need it most.

- CREDIBILITY and SECURITY TRACK RECORD: Look at historical payouts (like InsurAce’s $12 million post-UST) and how providers responded to past crises; avoid platforms with unresolved claims or ambiguous terms.

You can dive deeper into how these mechanisms work, including what triggers a valid claim, in our explainer: How Stablecoin Depeg Insurance Works: A Guide for DeFi Users.

Diversification and Real-Time Monitoring: Beyond Traditional Insurance

No insurance product can cover every scenario perfectly. Many sophisticated users now combine policies from multiple providers while spreading stablecoin exposure across different assets to minimize systemic risk. Real-time monitoring tools like those featured at depegwatch. com also help users react quickly if warning signs appear, sometimes making all the difference before losses become permanent.

Another practical consideration is the cost-to-benefit ratio of your chosen policy. Premiums can vary significantly between providers, and while the cheapest option may look attractive, it’s crucial to weigh this against payout reliability, coverage limits, and historical responsiveness during previous depeg events. For instance, InsurAce’s rapid $12 million payout after the UST collapse set a new industry benchmark for speed and transparency, whereas some competitors have faced criticism for slow or disputed claims.

A Practical Checklist for Comparing Stablecoin Depeg Insurance

Tip: Always review both the technical documentation and user feedback before committing capital to any DeFi insurance protocol. Community sentiment can reveal hidden pain points or strengths that aren’t obvious from the marketing materials alone.

Transparency is another non-negotiable. Top-tier protocols publish their reserves, claims history, and even real-time solvency metrics on-chain. This level of openness allows users to audit risk pools themselves and boosts trust, especially when millions of dollars are at stake. If a provider doesn’t make this data easily accessible, consider it a red flag.

For those seeking more granularity in their decision-making process, we’ve created an in-depth side-by-side breakdown of leading protocols’ strengths and weaknesses at How to Protect DeFi Assets from Stablecoin Depegs: Comparing Top Depeg Insurance Providers. This resource covers everything from premium formulas to governance models so you can tailor your coverage strategy to your risk appetite.

Comparing DeFi Insurance Providers for Stablecoin Depeg Protection

-

Nexus Mutual: Premium Rates: Typically 2–5% per year, depending on the stablecoin and coverage amount. Claim Speed: Decentralized governance votes on claims, usually resolved within 7–14 days. Coverage Limits: Up to $1 million per policy; covers major stablecoins like USDT, USDC, and DAI.

-

InsurAce: Premium Rates: As low as 1.5% per year for stablecoin depeg cover, with rates varying by risk and duration. Claim Speed: Hybrid process—automated triggers for some events, with most claims processed in 3–7 days. Coverage Limits: Up to $5 million per policy; supports USDT, USDC, DAI, and select algorithmic stablecoins.

-

Bridge Mutual: Premium Rates: Starts at 2% per year, adjusted by pool utilization and risk assessment. Claim Speed: Claims reviewed and voted on by BMI token holders, typically within 10–14 days. Coverage Limits: Up to $2 million per policy; covers USDT, USDC, and DAI depeg events.

-

Etherisc: Premium Rates: Generally 2–4% per year, depending on stablecoin and policy terms. Claim Speed: Parametric, automated payouts for eligible events—often within 1–3 days of depeg confirmation. Coverage Limits: Up to $500,000 per policy; covers leading stablecoins including USDT, USDC, and DAI.

Staying Ahead: Trends and Tools for Smarter Risk Management

The fast-moving nature of DeFi means that new insurance products are emerging almost monthly. Some protocols now offer parametric policies that trigger instant payouts based on on-chain price feeds, no governance vote required. Others are experimenting with bundled coverage (e. g. , combining smart contract exploit protection with stablecoin depeg insurance) for more holistic portfolio safety.

If you’re managing significant assets on-chain or running a DAO treasury, consider layering these tools with automated alerts and cross-chain monitoring services. Real-time dashboards, like those found at depegwatch. com, can help you spot early warning signs before a peg breaks entirely. When seconds matter during market volatility, having actionable intel is as important as having insurance itself.

The bottom line? The right DeFi insurance provider offers more than just a payout, it provides peace of mind in an unpredictable market. By comparing coverage scope, claims processes, cost structures, and transparency standards across providers like Nexus Mutual, InsurAce, Bridge Mutual, and Etherisc, you’ll be better equipped to withstand whatever 2024’s volatile landscape throws your way.