Stablecoins are the backbone of decentralized finance, providing a bridge between volatile crypto assets and the relative stability of fiat currencies. Yet, as recent history has shown, even these so-called ‘stable’ coins are not immune to market shocks and systemic failures. The phenomenon of stablecoin depeg events, when a stablecoin trades significantly away from its intended value, has become a critical risk factor for DeFi users, investors, and protocols alike.

What Triggers a Stablecoin Depeg?

At its core, a stablecoin depeg occurs when the token’s market price deviates from its reference asset, typically the US dollar. This deviation can be downward or upward, but the most concerning cases involve a drop below $1, triggering panic and potential contagion across DeFi platforms. Understanding the mechanics behind these events is essential for anyone looking to navigate or hedge DeFi risk.

- Liquidity Shocks: A sudden surge in redemption requests can drain a stablecoin’s reserves or on-chain liquidity pools. For example, in October 2023, USDR plummeted to $0.51 after mass withdrawals exhausted its DAI reserves, leaving only illiquid collateral behind.

- Reserve or Counterparty Risks: Stablecoins backed by off-chain reserves face exposure to insolvency or regulatory issues at custodial institutions. In March 2023, USDC lost over 12% of its value when $3.3 billion of reserves were trapped in the collapsed Silicon Valley Bank.

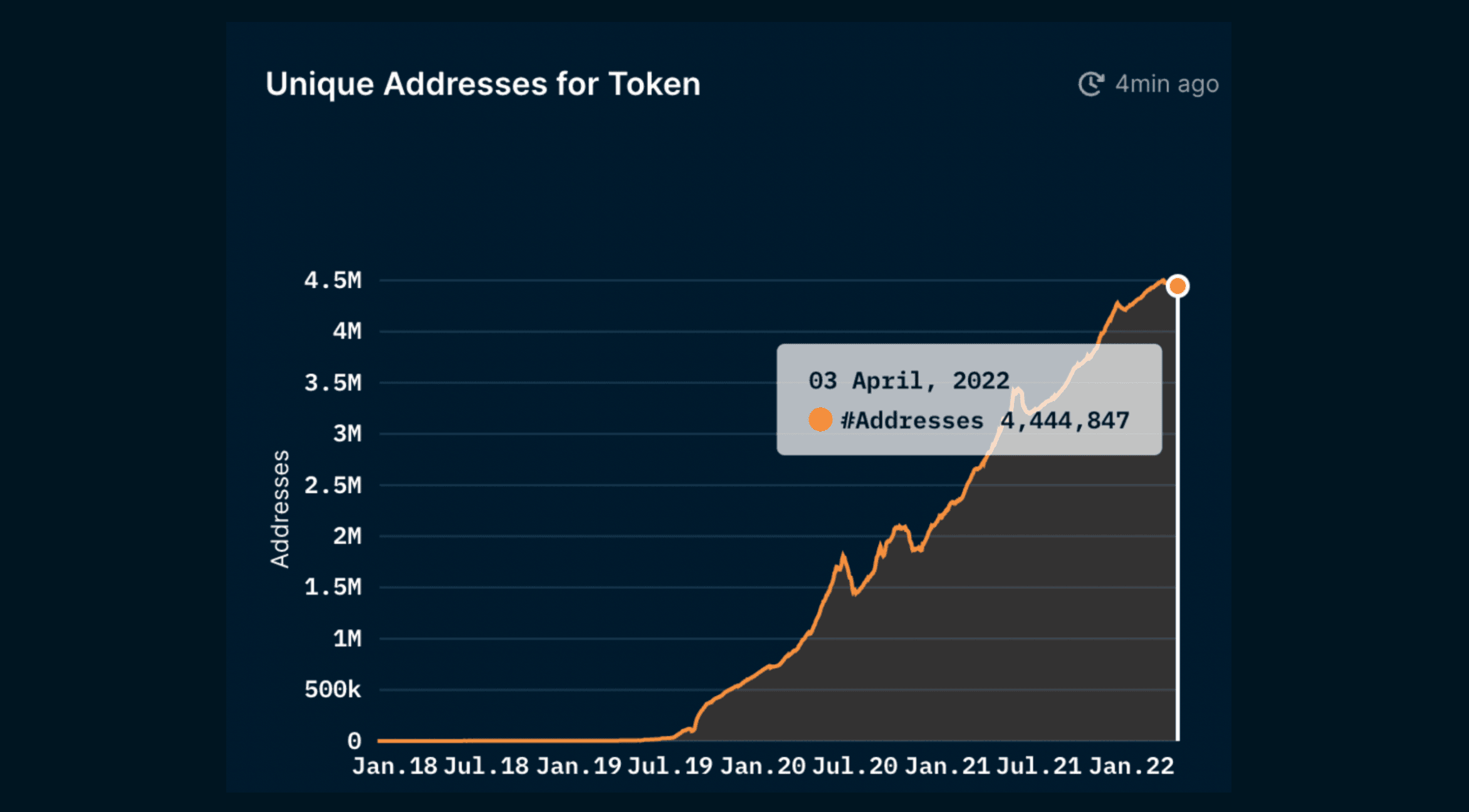

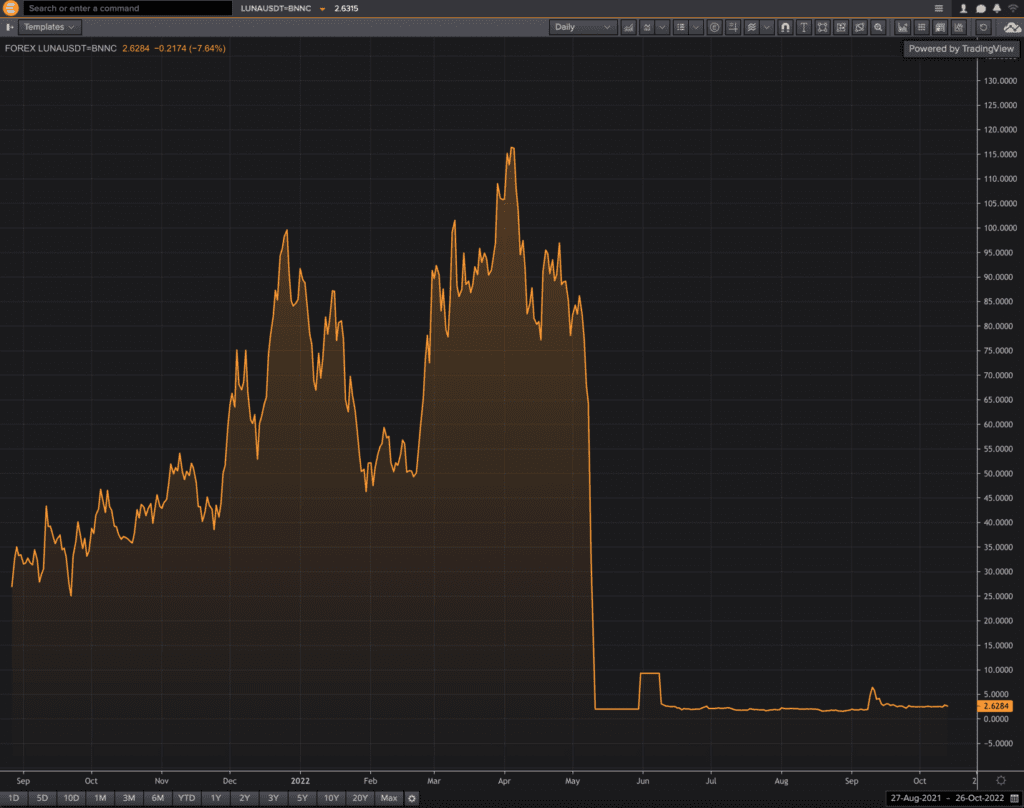

- Mechanism Failures: Algorithmic stablecoins use smart contracts and incentives to maintain their peg. Failures here can be catastrophic, as seen with Terra’s UST collapse in May 2022, which erased billions in value.

- Market Panic and Macro Stress: Widespread sell-offs or global economic stress can trigger mass redemptions and push stablecoins off their peg, as witnessed during the October 2025 downturn.

Recent Stablecoin Depeg Events: Data-Driven Analysis

Let’s examine the most impactful depeg events of the past two years to shed light on the mechanics and consequences of stablecoin instability:

Major Stablecoin Depeg Events and Key Lessons

-

TerraUSD (UST) Collapse – May 2022: Terra’s algorithmic stablecoin, UST, lost its dollar peg and fell as low as $0.30 after its stabilization mechanism failed. Outcome: The collapse wiped out billions in market value and led to regulatory scrutiny. Lesson: Algorithmic models without robust collateral are highly vulnerable to market shocks.

-

USDC & DAI Depeg – March 2023: Following the collapse of Silicon Valley Bank, $3.3 billion of USDC reserves were frozen, causing USDC to drop over 12% below its $1 peg and DAI to experience significant volatility. Outcome: Both stablecoins regained their pegs after Federal Reserve intervention. Lesson: Even asset-backed stablecoins face counterparty and banking risks.

-

USDR Depeg – October 2023: A liquidity crunch triggered by mass redemptions drained USDR’s liquid DAI reserves, leaving only illiquid tokenized real estate as collateral. USDR’s price plummeted to approximately $0.51. Outcome: USDR failed to recover its peg, underscoring the dangers of illiquid backing. Lesson: Stablecoins with illiquid collateral can quickly become insolvent during stress events.

-

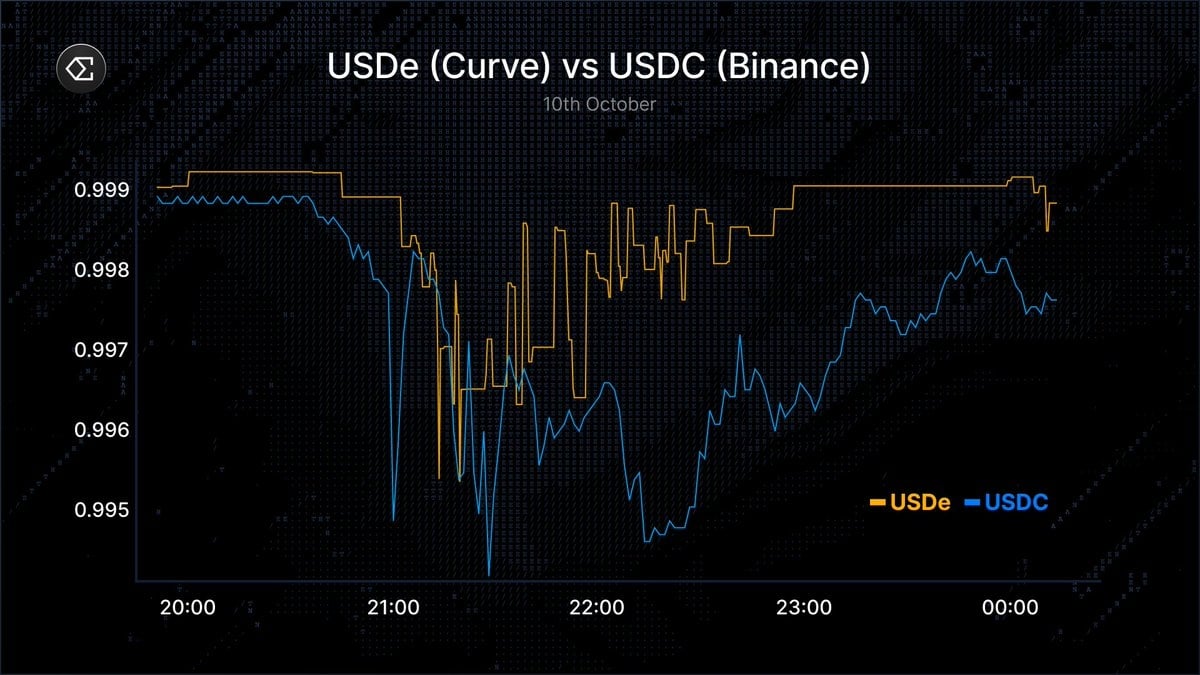

Market-Wide Stablecoin Deviations – October 2025: During a broad crypto market downturn, several leading stablecoins briefly deviated from their pegs as investors rushed to liquidate positions. Outcome: Most stablecoins quickly re-pegged, but the event highlighted systemic risks. Lesson: Macro stress can simultaneously impact multiple stablecoins, emphasizing the need for diversification and monitoring.

USDC and DAI (March 2023): The collapse of Silicon Valley Bank sent shockwaves through the stablecoin ecosystem. USDC, with $3.3 billion of reserves inaccessible, dropped over 12% below its peg. DAI, heavily collateralized by USDC, also experienced volatility. Only swift intervention by the Federal Reserve restored confidence and the peg. Read more about the USDC depeg case study.

USDR (October 2023): When redemption requests spiked, USDR’s liquid DAI reserves were depleted, leaving only illiquid tokenized real estate. The price crashed to $0.51, highlighting the dangers of illiquid collateral and the speed at which confidence can evaporate.

For a more comprehensive breakdown of these events and their implications for DeFi users, see this deep dive on stablecoin depeg causes and mitigation.

How DeFi Users Can Mitigate Stablecoin Depeg Risk

With the frequency and impact of depeg events rising, robust risk mitigation is no longer optional. Here are proven strategies used by informed DeFi participants:

- Diversify Stablecoin Holdings: Avoid single-asset exposure by holding a basket of stablecoins with different collateral and governance models (e. g. , USDC, DAI, LUSD). This approach spreads risk and increases portfolio resilience.

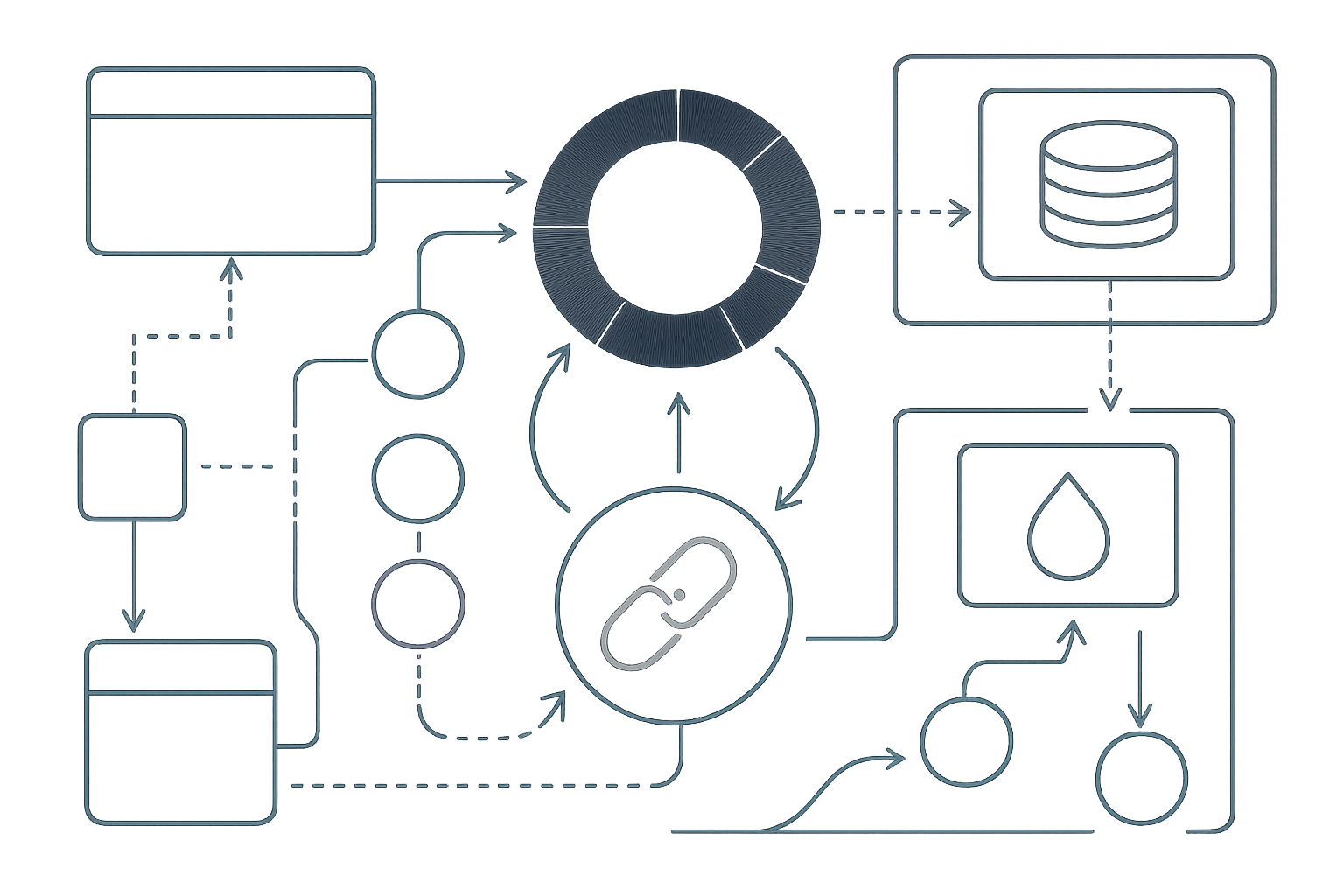

- Utilize Depeg Hedging Tools: Platforms like Cork Protocol now offer derivatives that pay out if a stablecoin drops below a set threshold, allowing users to hedge against depegging events.

- Monitor Stablecoin Health: Leverage analytics platforms such as DepegWatch. com for real-time peg tracking and early warning alerts.

- Engage with On-Chain Insurance Providers: Decentralized insurance protocols like Nexus Mutual and Etherisc offer stablecoin depeg protection, paying out if covered assets lose their peg.

For step-by-step guidance on how to implement these strategies, check out this guide to hedging stablecoin depeg risk.

In 2025, the evolution of stablecoin insurance has accelerated in response to these high-profile depeg events. Decentralized protocols are now offering more sophisticated, parametric products. For example, Etherisc’s launch of USDC depeg protection represents a shift toward automated, transparent payouts based on on-chain price oracles, removing the need for lengthy claims processes and subjective loss assessments. This innovation is a direct answer to user demand for real-time, trust-minimized risk transfer mechanisms in DeFi.

Comparing Depeg Insurance Solutions: What Should DeFi Users Look For?

With the landscape expanding, not all depeg coverage is created equal. When evaluating stablecoin insurance options, consider the following key factors:

Major Stablecoin Depeg Insurance Protocols Compared

-

Etherisc USDC Depeg Protection: Offers parametric insurance for USDC depegging events. Payout Trigger: Automatic payout if USDC trades below $0.99 for a specified period on major exchanges. Coverage Limit: Up to the insured amount selected by the user, subject to platform maximums.

-

Nexus Mutual: Provides Depeg Cover for stablecoins like USDC and DAI. Payout Trigger: Claims are paid if the covered stablecoin remains below $0.99 for 24 consecutive hours on specified price feeds. Coverage Limit: User-selected, up to the maximum capacity available in the pool.

-

InsurAce: Offers Stablecoin Depeg Cover for assets such as USDT, USDC, and DAI. Payout Trigger: Payouts occur if the stablecoin price falls below $0.88 for 24 hours, based on CoinGecko data. Coverage Limit: User-defined, with platform-specific maximums per policy.

-

Uno Re: Provides Depeg Insurance for major stablecoins. Payout Trigger: Payout is triggered if the insured stablecoin drops below $0.98 for a continuous period (typically 24 hours), as measured by trusted oracles. Coverage Limit: Up to the purchased coverage amount, with overall protocol caps.

-

Chainproof: Specializes in regulated DeFi insurance, including stablecoin depeg protection for institutional clients. Payout Trigger: Customizable, typically based on deviation below $0.99 for a defined duration. Coverage Limit: Tailored to client needs, often with higher limits for enterprise users.

Payout Triggers: Some protocols pay out if the stablecoin trades below a specific threshold (e. g. , $0.98 for USDC) for a defined period, while others require on-chain oracle confirmation or a governance vote. The more objective and transparent the trigger, the better for users seeking certainty.

Coverage Limits: Policy limits vary widely. Some platforms cap individual payouts, while others pool risk across many users. Assess whether coverage limits match your exposure and portfolio size.

Premium Structure: Premiums can be fixed, variable, or even dynamically adjusted based on market volatility. During times of elevated risk, expect premiums to spike, just as we saw during the March 2023 USDC scare.

For an in-depth comparison of leading insurance protocols and their mechanisms, see this analysis of depeg hedging and insurance solutions.

The Role of Regulation and Oracles in Depeg Risk

Regulatory clarity is beginning to reshape the stablecoin insurance market. New frameworks, such as those emerging from the GENIUS Act and updated SEC guidance, are pushing protocols toward greater transparency in reserve management and payout processing. However, oracle vulnerability remains a persistent risk: if price feeds are manipulated or malfunction, insurance payouts may fail or trigger erroneously. Leading protocols are mitigating this through multi-oracle aggregation and on-chain dispute resolution mechanisms.

“The next generation of DeFi insurance must not only cover smart contract exploits, but also address oracle manipulation and systemic stablecoin risk. “

Proactive Steps for DeFi Users in 2025

Given the lessons of USDC, UST, and USDR, here’s a practical roadmap for protecting your assets against stablecoin instability:

Stay Informed: Subscribe to analytics tools and set up alerts for real-time peg deviations. Early awareness is your best defense.

Hedge and Insure: Combine derivatives-based hedges with on-chain insurance for layered protection. Don’t rely solely on diversification, use every tool at your disposal.

Understand Protocol Risks: Before allocating capital, research each stablecoin’s collateral model, redemption mechanics, and historical resilience during stress events. Not all pegs are created equal.

The reality is that stablecoin depegs will remain an ongoing risk as DeFi continues to grow and evolve. By embracing data-driven strategies, leveraging both insurance and analytics platforms, and staying vigilant about protocol design, users can substantially mitigate downside exposure, even in the face of future market shocks.

If you’re looking for more technical deep dives or case studies on recent depeg events, including detailed breakdowns of USDC, UST, and USDR, explore our dedicated resource on stablecoin depeg triggers and protection strategies.