Stablecoins are the backbone of many DeFi strategies, offering the promise of price stability in a volatile crypto landscape. Yet, even these digital dollars are not immune to risk. When a stablecoin trades away from its intended value, usually $1, this is called a depeg. Understanding why this happens is crucial for anyone looking to protect their assets and navigate DeFi with confidence. Let’s break down the four most significant triggers for stablecoin depegging in today’s market and actionable strategies to mitigate these risks.

Collateral Liquidation Cascades: When Reserves Aren’t Enough

Many leading stablecoins, such as DAI or GHO, use an over-collateralized model to maintain their peg. In theory, each stablecoin is backed by more value than it represents. However, if the collateral backing these coins drops sharply in price, think of a sudden ETH crash, it can trigger mass liquidations. This cascade can quickly drain reserves and cause the stablecoin to lose its peg.

Protection strategy: Vigilance is key. Regularly monitor collateralization ratios on your chosen platforms and diversify your holdings across several stablecoins with strong, transparent reserves. This reduces exposure to any single point of failure if one asset’s collateral value collapses.

Oracle Failure or Manipulation: The Risk of Bad Data

Stablecoins rely on oracles to fetch real-time price data for assets used as collateral or for redemption. If an oracle fails or is manipulated, whether due to technical glitches or malicious actors, the protocol might misprice assets. This can result in under-collateralization or faulty redemptions, pushing the coin off its peg.

Protection strategy: Choose stablecoins that utilize robust, decentralized oracle networks with proven track records. For added security, consider DeFi insurance products that specifically cover oracle-related incidents and mispricing events.

Governance or Protocol Exploits: Bugs Can Break the Peg

No codebase is perfect. Governance attacks or bugs in smart contracts can allow bad actors to drain reserves, alter redemption mechanisms, or otherwise destabilize a stablecoin’s system. Recent history is filled with examples where protocol exploits have led directly to severe depegs and loss of user funds.

Protection strategy: Favor protocols that undergo regular audits and have active governance communities that respond swiftly to threats. Explore exploit coverage insurance options that reimburse users in the event of smart contract vulnerabilities being exploited.

Top Stablecoin Depeg Triggers & How to Protect Yourself

-

Collateral Liquidation Cascades: Over-collateralized stablecoins can lose their peg if a rapid drop in collateral value triggers mass liquidations. Protection strategy: Monitor collateralization ratios and diversify holdings across stablecoins with strong, transparent reserves, such as USDC or DAI. Use analytics platforms like DeFiLlama to track reserve health.

-

Oracle Failure or Manipulation: Inaccurate price feeds can cause stablecoins to misprice assets, leading to depegging. Protection strategy: Choose stablecoins using robust, decentralized oracle networks like Chainlink, and consider DeFi insurance from providers such as Nexus Mutual that covers oracle-related incidents.

-

Market Liquidity Shocks: Sudden surges in redemptions or loss of confidence can overwhelm liquidity pools, causing the price to slip below the peg. Protection strategy: Spread capital across multiple stablecoins (e.g., USDC, USDT, DAI) and use platforms offering depeg insurance, such as Nexus Mutual or InsurAce.

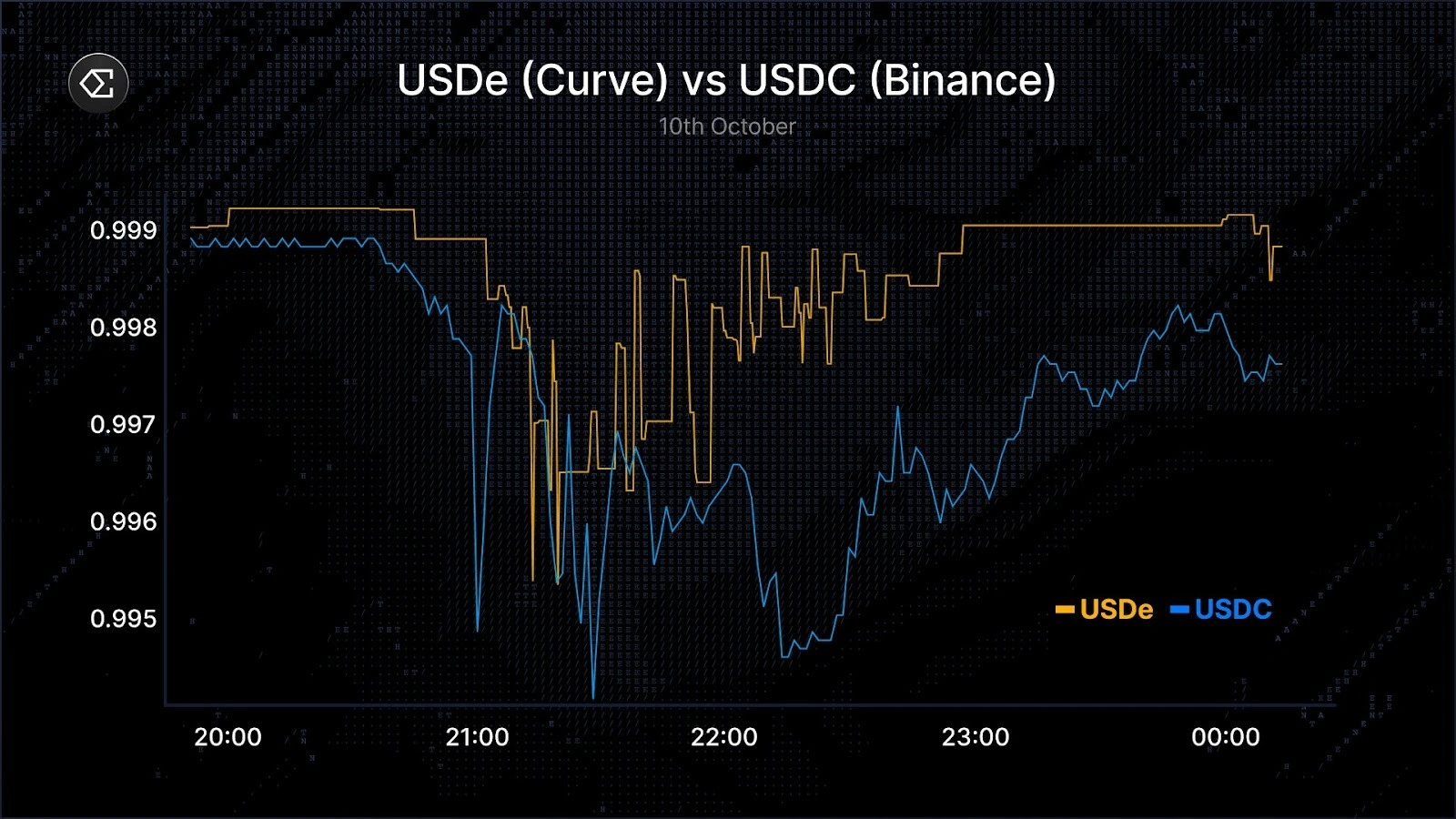

Market Liquidity Shocks: When Confidence Disappears

The final key trigger for depegging comes from liquidity shocks, a sudden surge in redemptions or a crisis of confidence can overwhelm even well-collateralized pools. When too many users try to exit at once, prices slip below $1 as liquidity dries up and panic selling takes hold.

Protection strategy: Spread your capital across multiple reputable stablecoins rather than betting on just one. Platforms now offer specialized depeg insurance, which can provide payouts if your chosen coin trades significantly below its peg for a defined period.

While stablecoin depegs are unsettling, they’re not inevitable disasters for informed investors. The right risk management approach can turn potential losses into manageable events. Let’s recap the most significant triggers and the best ways to shield your assets from each.

Top Stablecoin Depeg Triggers & Protection Strategies

-

Collateral Liquidation Cascades: Over-collateralized stablecoins can lose their peg if a rapid drop in collateral value triggers mass liquidations. Protection strategy: Monitor collateralization ratios and diversify holdings across stablecoins with strong, transparent reserves. Platforms like MakerDAO provide real-time collateral data, while stablecoins such as USDC and USDP are known for transparent reserve reporting.

-

Oracle Failure or Manipulation: Inaccurate price feeds can cause stablecoins to misprice assets, leading to depegging. Protection strategy: Choose stablecoins using robust, decentralized oracle networks such as Chainlink, and consider DeFi insurance from providers like Nexus Mutual that covers oracle-related incidents.

-

Market Liquidity Shocks: Sudden surges in redemptions or loss of confidence can overwhelm liquidity pools, causing the price to slip below the peg. Protection strategy: Spread capital across multiple stablecoins and use platforms like Unslashed Finance that offer depeg insurance for added protection.

Market liquidity shocks, in particular, highlight why diversification is so important. Even if a single stablecoin faces a crisis, whether from a collateral collapse, an oracle malfunction, or a governance exploit, having exposure to multiple coins can soften the blow. However, keep in mind that during broad market stress, even diversified baskets can experience correlated depegs. That’s where specialized DeFi insurance products come in: they offer payouts if your stablecoin drops below its peg for a set time, providing another layer of peace of mind.

For those who want to go further in their risk mitigation journey, DeFi insurance protocols now cover a range of threats, from oracle failures to smart contract exploits and depeg events. These products are evolving rapidly and can be tailored to your specific exposure and risk tolerance. Before purchasing coverage, review policy terms carefully: check what triggers a payout, how claims are processed, and any exclusions that might apply.

Staying Ahead: Monitoring and Managing Stablecoin Risks

To keep your portfolio resilient:

- Monitor real-time collateralization ratios on protocols like MakerDAO or Aave; set alerts for sharp drops.

- Check audit histories and governance activity for any stablecoin you hold.

- Review oracle architecture; robust decentralized oracles like Chainlink reduce single points of failure.

- Use reputable exchanges and wallets with strong compliance standards to minimize operational risks.

By understanding these mechanisms, and acting early, you can avoid being caught off-guard by sudden price swings. The DeFi landscape rewards those who stay vigilant and proactive about risk management.

If you’re new to DeFi insurance or want a deeper dive into recent depeg incidents, check out our recommended resources below:

Stablecoins will remain essential tools for crypto investors seeking stability amid volatility, but only if you understand their vulnerabilities and take steps to protect yourself. As always, diversify to thrive!