Stablecoins are the backbone of decentralized finance, acting as dollar-pegged settlement layers and liquidity engines for protocols, exchanges, and wallets. Yet, the specter of a stablecoin depeg – when a stablecoin like USDC, USDT, or DAI fails to maintain its $1.00 peg – remains one of the most disruptive risks in DeFi. Recent events have underscored the urgency for robust risk management tools, with on-chain insurance protocols emerging as indispensable allies for users seeking protection against these destabilizing shocks.

Why Stablecoin Depegs Are a Critical Threat to DeFi

Unlike traditional money market funds, stablecoins promise instant settlement and composability but lack the regulatory safety nets banks enjoy. When a stablecoin loses its peg – even briefly – it can trigger cascading liquidations, protocol insolvencies, and user losses across the ecosystem. As S and P Global notes, five major stablecoins account for over 90% of the $125 billion market cap (as of June 2023), amplifying systemic risk if just one falters.

The reality is stark: even top-tier assets like USDC have experienced depegs below $0.995 during periods of stress. For users who rely on stablecoins as collateral or for savings, this volatility is unacceptable without reliable hedging instruments.

The Mechanics Behind On-Chain Stablecoin Depeg Insurance

On-chain insurance protocols provide stablecoin depeg insurance using smart contracts that automate claims and payouts based on transparent rules. The latest innovation comes from Etherisc’s launch of parametric USDC depeg protection: if USDC’s price falls below $0.995 and stays there for more than 24 hours, insured users receive automatic compensation – no paperwork or manual claims required (see Etherisc documentation).

This parametric model is powered by decentralized oracles such as Chainlink that continuously monitor stablecoin prices in real-time. By integrating these oracles directly into smart contracts, protocols ensure that any qualifying depeg event triggers an instant payout to policyholders.

This approach eliminates human error and bureaucracy while providing confidence that coverage will be honored exactly as coded. It’s a leap forward in transparency compared to legacy insurance products.

Key Players in On-Chain Depeg Coverage

Leading On-Chain Protocols for Stablecoin Depeg Insurance

-

Etherisc has launched parametric USDC depeg protection, automatically compensating users if USDC falls below $0.995 for over 24 hours. Payouts are triggered by smart contracts and verified via Chainlink oracles, ensuring transparency and speed.

-

Nexus Mutual provides community-driven insurance against DeFi risks, including stablecoin depegs. Members collectively assess and underwrite risks, enhancing decentralization and trust within the protocol.

-

InsurAce delivers multi-chain insurance solutions covering stablecoin depegs, smart contract exploits, and more. Its integration across multiple blockchains makes depeg protection accessible to a broad range of DeFi users.

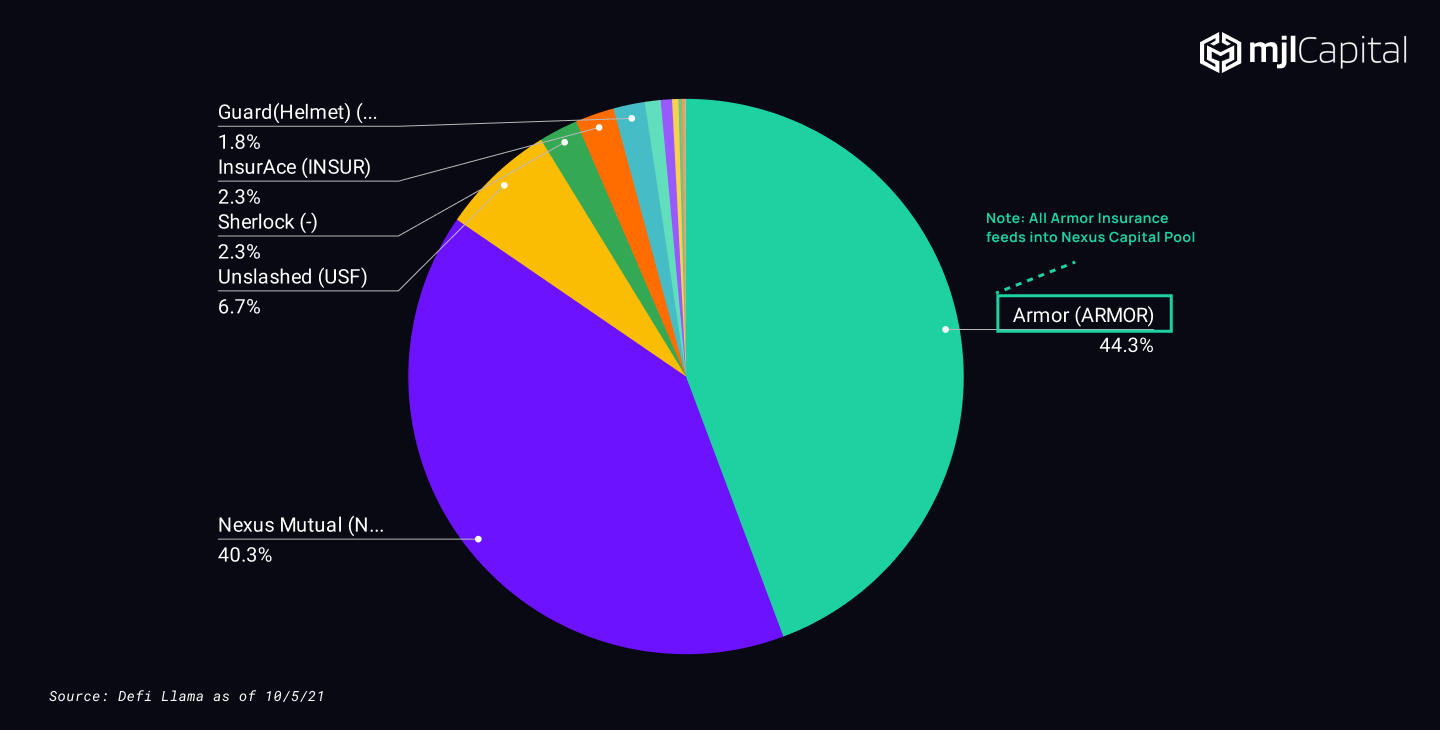

The sector has rapidly matured with several standout protocols now offering on-chain depeg coverage:

- Etherisc: Specializes in parametric protection for USDC holders using automated claims via Chainlink oracles.

- Nexus Mutual: Leverages community underwriting to provide coverage against both smart contract exploits and stablecoin depegs.

- InsurAce: Multi-chain platform covering a broad spectrum of risks including stablecoin instability across various blockchains.

This diversity allows users to tailor their DeFi risk management strategies according to asset exposure and protocol preference.

Main Advantages: Transparency, Automation and Decentralization

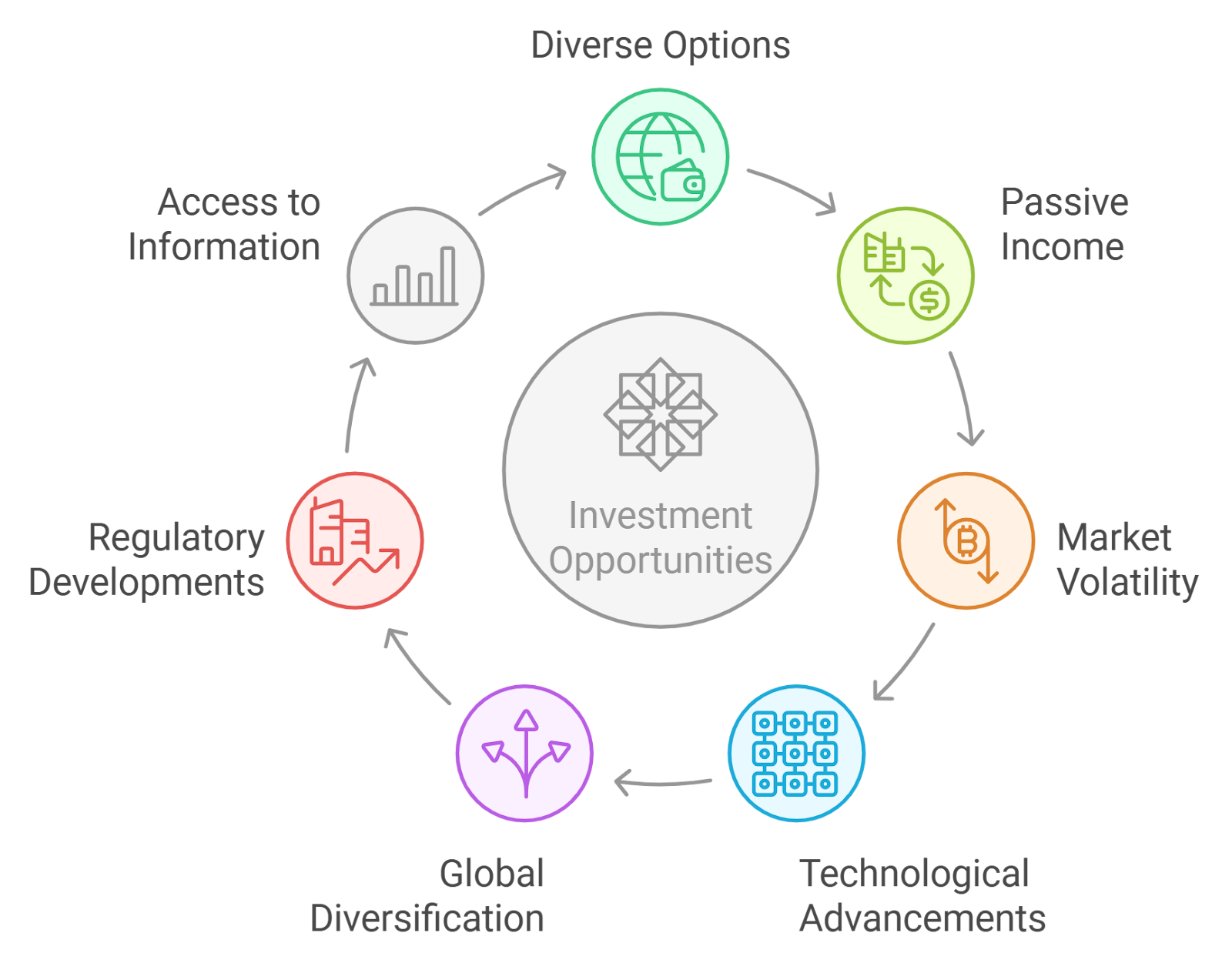

The adoption of these protocols brings three core advantages to DeFi users seeking USDC depeg protection, among other covers:

- Transparency: All policy terms and payouts are visible on-chain; nothing is hidden behind opaque legalese.

- Automation: Claims are executed instantly when conditions are met – no delays or subjective assessments.

- Decentralization: By removing centralized intermediaries, these solutions align with the ethos of open finance while reducing single points of failure.

The rise of instant payout DeFi insurance has fundamentally changed how sophisticated investors approach digital asset allocation – not just by reducing tail risk but by enabling more confident participation in yield-generating opportunities across the ecosystem.

As the DeFi landscape evolves, the integration of smart contract insurance for stablecoins has become a strategic imperative for both individual users and institutional participants. No longer a theoretical safeguard, on-chain depeg coverage is being actively deployed in response to real market events. The rapid expansion of protocols like Etherisc, Nexus Mutual, and InsurAce reflects a maturing risk management culture that goes beyond speculative trading to prioritize capital preservation.

How Users Can Access and Compare Stablecoin Depeg Insurance

Obtaining stablecoin depeg insurance has been streamlined through user-friendly web apps and integrations with leading DeFi dashboards. For example, Etherisc’s platform allows users to select the exact amount of USDC they wish to cover and view available risk bundles in real time. Policies are priced dynamically based on prevailing market conditions and pool liquidity, giving users granular control over their risk exposure.

Comparing protocols is crucial: each platform has its own parameters for what constitutes a depeg event, payout structures, and supported assets. Some offer coverage for brief deviations below $1.00 (such as USDC falling under $0.995), while others may require more prolonged or severe price drops. Multi-chain support is also a key differentiator as users increasingly interact with assets across multiple blockchains.

Steps to Choose the Right Stablecoin Depeg Insurance Protocol

-

Assess Supported Stablecoins and Coverage Scope. Ensure the protocol covers the specific stablecoins you use (e.g., USDC, USDT, DAI) and offers protection against relevant depeg scenarios. Review the exact depeg thresholds and event definitions—such as Etherisc’s USDC policy, which triggers if USDC falls below $0.995 for over 24 hours.

-

Evaluate the Protocol’s Payout Mechanism. Prefer protocols with parametric, automated payouts via smart contracts—this ensures you receive compensation promptly and transparently when depeg conditions are met, as seen with Etherisc’s automated USDC depeg protection.

-

Verify Oracle Integration and Data Reliability. Check if the protocol relies on reputable decentralized oracles (e.g., Chainlink) for real-time price feeds. Reliable oracles are crucial for accurate and timely depeg detection and triggering payouts.

-

Research Protocol Reputation and Security Track Record. Investigate the protocol’s history, audits, and community trust. Established names like Etherisc, Nexus Mutual, and InsurAce have proven security practices and transparent operations.

-

Compare Policy Terms, Premiums, and Exclusions. Analyze coverage limits, premium costs, claim procedures, and any exclusions. Use platforms like OpenCover to compare offerings and find the best fit for your risk profile and budget.

-

Check Platform Accessibility and User Experience. Confirm the protocol supports your preferred blockchain (e.g., Ethereum, BNB Chain, Polygon) and offers an intuitive interface for policy management and claims.

For those new to this space or seeking deeper insights into policy mechanics, comprehensive guides are available to help evaluate options and understand how stablecoin depeg insurance works in practice. These resources demystify technical jargon and empower users to make informed decisions about their financial security.

The Future of DeFi Risk Management: Beyond the Peg

Looking ahead, we can expect on-chain insurance protocols to expand beyond simple peg protection into more sophisticated products that cover a broader range of risks – from algorithmic stablecoin failures to systemic liquidity crunches. As regulatory scrutiny intensifies and institutional capital flows into DeFi, demand for verifiable, automated insurance solutions will only grow.

This evolution will likely see deeper integration between DeFi insurance protocols and core financial infrastructure such as DEXs, lending markets, and asset managers. Imagine a future where every stablecoin transaction is automatically insured against depegging risk by default – not an optional add-on but a seamless layer underpinning all digital finance activity.

The bottom line is clear: in an environment where even blue-chip stablecoins can break their peg momentarily, robust risk transfer mechanisms are no longer optional but essential. On-chain instant payout models offer transparency and trust at scale – empowering users with tools once reserved for institutions.

The next chapter of DeFi’s growth story will be written by those who embrace proactive risk management as a core strategy rather than an afterthought. For anyone serious about safeguarding their assets in this dynamic ecosystem, engaging with on-chain depeg coverage is not just prudent – it’s non-negotiable.