Stablecoins are the backbone of decentralized finance, underpinning everything from liquidity pools to lending protocols. Yet, as 2024 has shown, no peg is immune to market stress or systemic shocks. The risk of a stablecoin depeg – where the price strays from its intended value – is not just theoretical. Recent volatility and high-profile incidents have underscored why DeFi insurance for stablecoin depeg events is now essential for anyone serious about DeFi asset protection.

Why Stablecoin Depegs Are a Top Threat in 2024

Stablecoins like USDC, USDT, and DAI are designed to maintain a 1: 1 peg with the US dollar. However, this stability can unravel due to collateral shortfalls, regulatory crackdowns, or cascading liquidations. When a depeg event occurs – even if temporary – it can trigger massive losses for DeFi users who rely on these assets for trading, yield farming, or as collateral.

The consequences go beyond price dips. Protocols that use stablecoins as core collateral can become undercollateralized overnight. Automated liquidations and smart contract failures often follow. In this environment, risk management in DeFi means more than diversification; it means having dedicated protection against depeg scenarios.

The Rise of Dedicated Stablecoin Depeg Insurance Protocols

The good news is that 2024 has seen a surge in innovative insurance solutions tailored specifically for stablecoin instability. These protocols offer policies that pay out when a covered stablecoin loses its peg by a defined threshold for a set period – typically ranging from 5% to 20% deviation over 24 hours.

Let’s break down the top five DeFi insurance protocols providing specialized stablecoin depeg protection in 2024. Each brings unique mechanics and coverage structures to the table:

Top 5 DeFi Insurance Protocols for Stablecoin Depeg Protection

-

InsurAce offers multi-chain DeFi insurance, including dedicated coverage for stablecoin depeg events. Users can insure their assets against losses if a stablecoin loses its peg, with flexible policy terms and support for major blockchains.

-

Nexus Mutual is a leading decentralized insurance platform providing coverage for stablecoin depegging, smart contract exploits, and custodial risks. Its community-driven claims process ensures transparency and trust for DeFi users seeking robust protection.

-

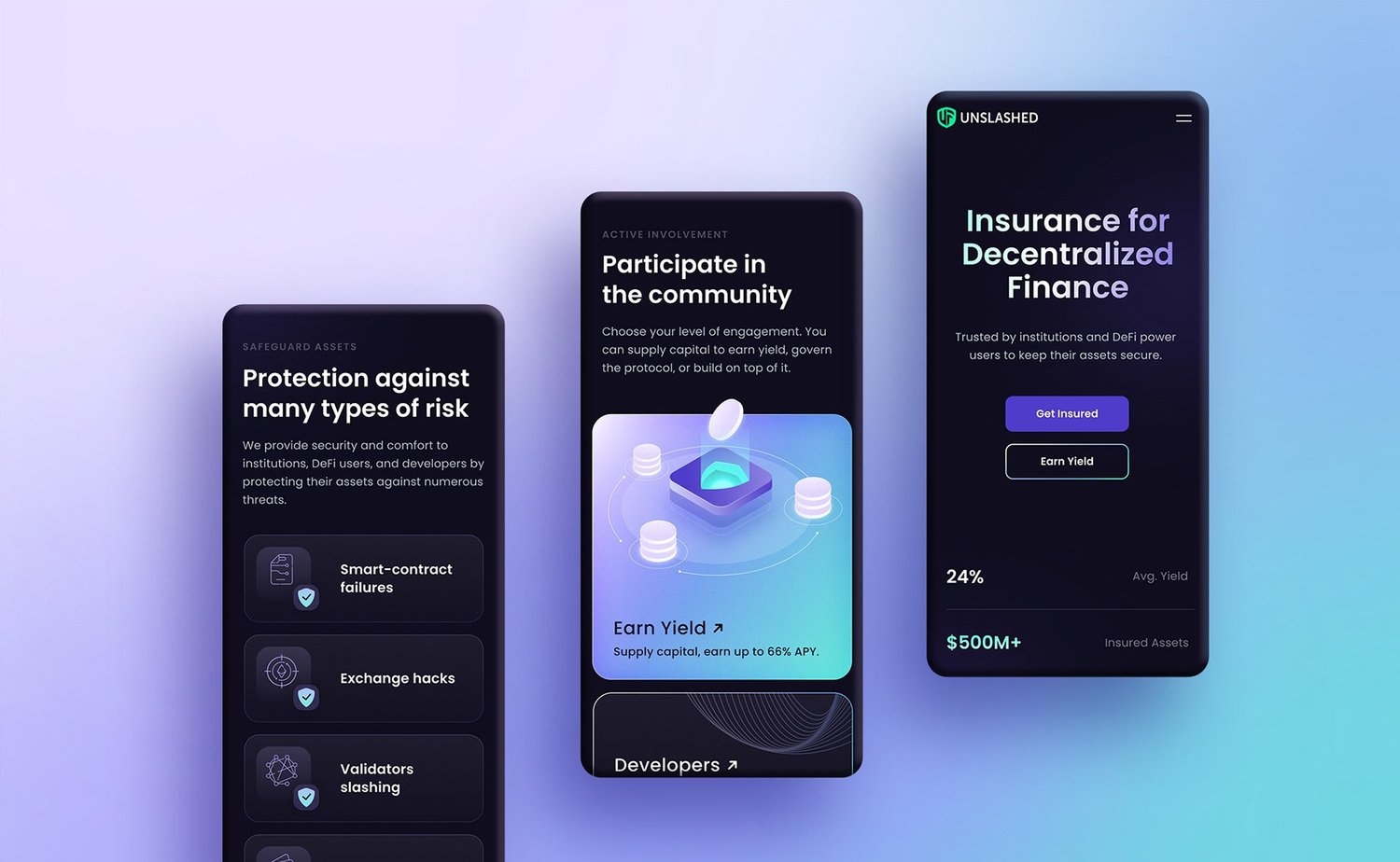

Unslashed Finance specializes in real-time, capital-efficient DeFi insurance, including stablecoin depeg protection. The protocol pools capital to offer immediate, on-chain coverage for a variety of DeFi risks.

-

Neptune Mutual focuses on parametric insurance for DeFi, providing coverage for stablecoin depeg incidents and protocol exploits. Its marketplace model allows users to purchase tailored policies for specific risks in the DeFi ecosystem.

-

Amulet Protocol delivers decentralized insurance solutions with a focus on stablecoin depeg protection, particularly within the Solana ecosystem. Amulet features transparent claims processing and aims to make DeFi insurance accessible and reliable.

An Overview of Leading Stablecoin Depeg Insurance Providers

1. InsurAce: As one of the most established multi-chain insurance platforms, InsurAce offers comprehensive coverage against both smart contract exploits and stablecoin depegs. Users can tailor policies based on which assets they hold and their risk appetite. Payouts are triggered when supported stablecoins deviate from their peg beyond specified limits.

2. Nexus Mutual: Known for its community-driven claims process and robust capital pool, Nexus Mutual covers losses arising from major depegs across leading stablecoins. Its decentralized approach ensures claims are assessed transparently by members rather than centralized administrators.

3. Unslashed Finance: This protocol stands out for its flexible underwriting model and real-time monitoring tools powered by decentralized oracles. Unslashed Finance enables users to insure against sharp price drops in specific stablecoins while offering customizable policy durations and payout conditions.

4. Neptune Mutual: Specializing in parametric coverage models, Neptune Mutual focuses on automating payouts based on objective price data feeds rather than subjective claims assessments. This reduces delays and disputes during volatile market conditions, a critical advantage during sudden depegs.

5. Amulet Protocol: Built with Solana ecosystem compatibility in mind but expanding cross-chain in 2024, Amulet Protocol delivers straightforward depeg cover with transparent pricing structures and rapid claim settlements via smart contracts.

Selecting the Right Coverage: What Matters Most?

No two protocols are identical when it comes to triggers, premiums, exclusions or claims processes. For example:

- Payout Triggers: Some require a sustained deviation (e. g. , more than 24 hours below $0.95), others pay out after shorter windows or smaller deviations.

- Premium Cost: Rates vary based on protocol TVL (total value locked), historical claim frequency, and specific risk parameters per asset covered.

- User Experience: Decentralized vs semi-centralized claims processing can affect settlement speed, vital during fast-moving market events.

If you’re new to these products or want an in-depth walkthrough of how they work under the hood (including real-world payout examples), see our guide How Stablecoin Depeg Insurance Works: A Guide for DeFi Users.

Choosing the right stablecoin depeg protection 2024 solution depends on your portfolio composition, trading strategy, and risk profile. For high-frequency traders or liquidity providers, protocols with automated parametric triggers like Neptune Mutual and Amulet Protocol offer peace of mind by removing human discretion from claims. On the other hand, if you value a more nuanced, community-driven approach to complex events, where edge cases are possible, Nexus Mutual’s member-voted process may appeal despite potentially longer settlement times.

For those seeking cross-chain flexibility and broad coverage menus, InsurAce remains a go-to. Its multi-chain integrations mean you can protect assets across Ethereum, BNB Chain, Polygon, and more, all under a single policy dashboard. Meanwhile, Unslashed Finance’s modular policy design lets users fine-tune coverage for specific stablecoins and event durations, ideal for advanced DeFi users who want granular control over their insurance spend.

Practical Steps: Maximizing Your DeFi Asset Protection

To get the most out of these protocols in 2024:

- Compare coverage terms: Don’t just look at premiums, scrutinize how each protocol defines a depeg event. Some might only cover major stablecoins like USDC or DAI; others extend to algorithmic or region-specific tokens.

- Check payout speed: Automated payouts (parametric models) are usually faster but may be less flexible in ambiguous scenarios. Community-assessed claims (like Nexus Mutual) can address gray areas but may take longer.

- Diversify your insurance: Consider splitting coverage across two or more protocols to hedge against any single protocol’s operational risk or capital shortfall during systemic events.

- Monitor protocol solvency: Review TVL and recent claim history on dashboards before purchasing coverage. A well-capitalized pool is critical during industry-wide stress events.

The landscape is evolving rapidly. New entrants may emerge with innovative models for stablecoin depeg protection as regulatory scrutiny increases and real-world asset backing becomes standard. Staying agile, and regularly reviewing your insurance stack, is key to long-term resilience in DeFi.

Final Thoughts: The Future of Stablecoin Risk Management

The era where DeFi users could ignore stablecoin risk is over. As adoption grows and regulators circle, robust risk management in DeFi will increasingly hinge on dedicated insurance solutions that keep pace with market innovation.

The five protocols highlighted here, InsurAce, Nexus Mutual, Unslashed Finance, Neptune Mutual, Amulet Protocol, represent the frontier of DeFi asset protection in 2024. Each offers unique strengths for different user types and market conditions. By understanding their mechanics and aligning them with your portfolio needs, you can transform stablecoin volatility from an existential threat into a manageable risk.