DeFi insurance protocols have become a frontline defense in the ongoing battle against smart contract exploits, leveraging rigorous audit processes to protect user funds and protocol integrity. The high-profile hacks of previous years have made one fact clear: unvetted code is an existential risk for decentralized finance. For insurance providers, whose value proposition hinges on trust and payout reliability, integrating robust smart contract audits is not just best practice, it’s a strategic imperative.

![]()

Why Smart Contract Audits Are the Bedrock of DeFi Insurance Security

Smart contract audits are comprehensive assessments performed by specialized security firms or automated tools to identify vulnerabilities, logic errors, and potential exploits before attackers can exploit them. For DeFi insurance protocols, these audits serve dual roles:

- Risk Quantification: Audits inform risk scoring models that determine policy pricing and eligibility.

- Loss Prevention: By identifying critical flaws pre-deployment, audits reduce the likelihood of catastrophic exploits that could trigger mass claims or insolvency events.

The auditing process typically combines automated static analysis with manual code review. Tools like Slither and MythX scan for common vulnerabilities such as reentrancy bugs, integer overflows, and logic errors. However, automation alone is insufficient, seasoned auditors must contextualize findings and assess complex attack vectors unique to each protocol.

The Multi-Layered Audit Approach: Beyond Code Review

The most resilient DeFi insurance platforms treat audits as an ongoing process rather than a one-off checkbox. Here’s how leading protocols structure their audit strategies:

- Automated Static Analysis: Integrated into CI/CD pipelines to flag vulnerabilities in real time whenever code changes are proposed.

- Formal Verification: Mathematical proofs validate that contracts behave as intended across all possible scenarios, a gold standard for mission-critical logic like claims processing or payout triggers.

- Economic Model Audits: Evaluations of tokenomics and incentive structures to prevent economic exploits such as flash loan attacks or oracle manipulation. This layer is essential for insurance protocols covering both technical and financial risks.

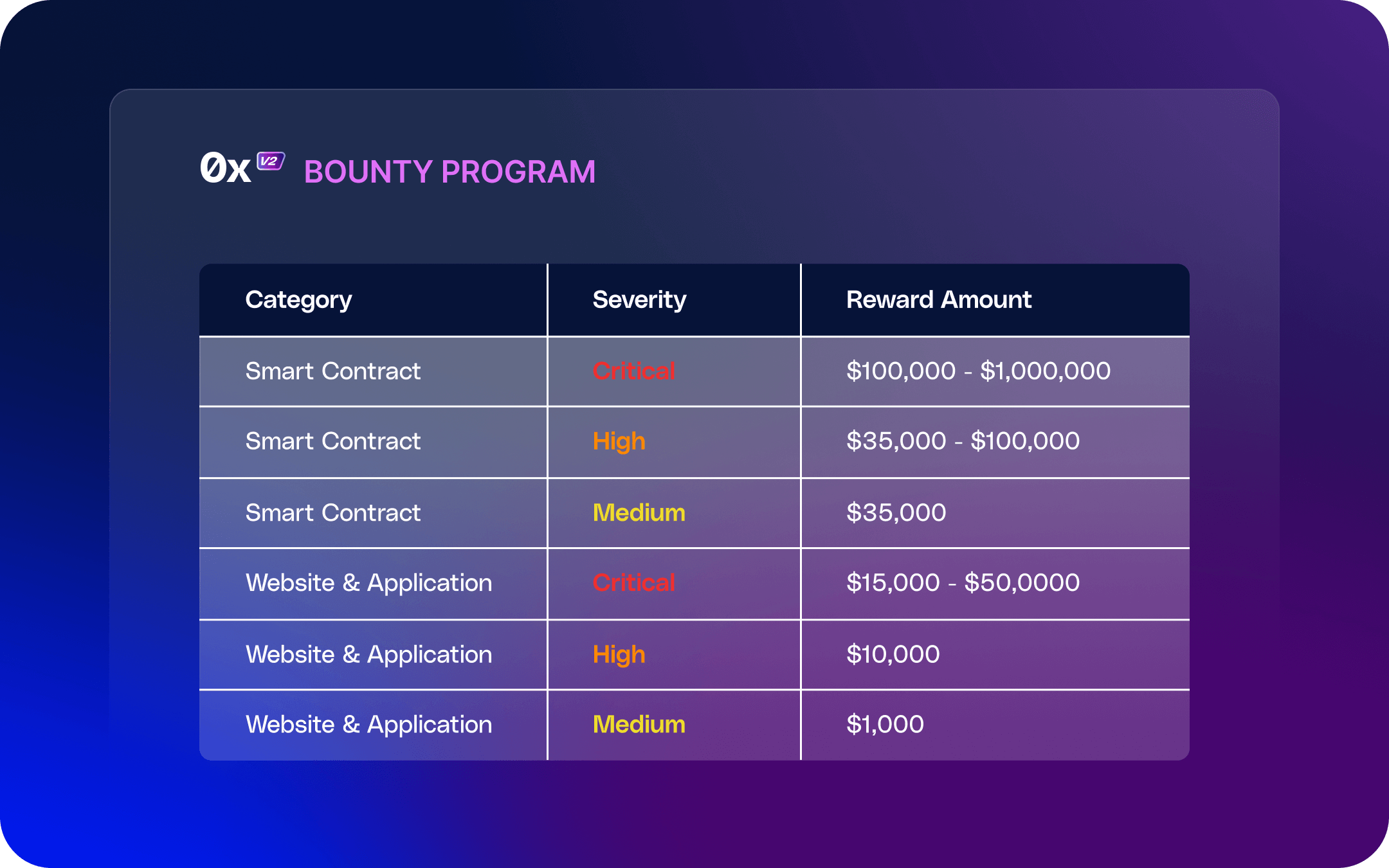

- Bug Bounty Programs: Incentivizing ethical hackers to discover vulnerabilities post-launch has become industry standard. Platforms like Sherlock have demonstrated the value of community-driven security reinforcement.

This holistic approach is vital because even well-audited contracts can harbor undiscovered bugs. Insurance underwriters increasingly require proof of recent, reputable audits before offering coverage, reflecting the sector’s shift from reactive compensation toward proactive prevention.

The Real-World Impact: Reducing Exploit Risks Across the Board

The impact of thorough audits extends far beyond technical assurance; it directly influences the viability and sustainability of DeFi insurance offerings. As noted in industry analyses, audits now shape everything from premium calculations to claim eligibility criteria. Insurers routinely integrate audit outcomes into their underwriting frameworks, a trend explored in detail in our guide on DeFi risk assessment for underwriters.

A notable trend for 2025 is the decline in simple exploit frequency, thanks in part to standardized bug bounty programs and continuous audit cycles. However, sophisticated attacks persist, underscoring the need for layered defenses such as multi-signature controls and emergency stop mechanisms. For more on common pitfalls even audited contracts face, see our analysis on why audited smart contracts still get exploited.

Insurance protocols that excel in risk mitigation go a step further by integrating real-time monitoring and adaptive security practices. This means continuously assessing the protocol’s threat landscape and swiftly patching vulnerabilities as new attack vectors emerge. The most advanced DeFi insurance providers also collaborate with white-hat communities, leveraging ongoing bug bounty programs to crowdsource security expertise and maintain a robust defense posture. These efforts are not just theoretical; they have demonstrably reduced the frequency and severity of exploits, with 2025 data showing a marked drop in successful attacks against protocols with rigorous audit and bounty frameworks.

Top 5 Audit-Driven Security Practices in DeFi Insurance

-

Automated Static Analysis: Leading DeFi insurance protocols integrate automated tools like Slither and MythX to scan smart contract code for vulnerabilities such as reentrancy and integer overflows before deployment.

-

Formal Verification: Mathematical proofs are used to verify that smart contracts behave as intended under all scenarios, reducing the risk of logic errors and exploits. This practice is increasingly adopted by top protocols for mission-critical contracts.

-

Economic Audits: Protocols collaborate with specialized firms like Three Sigma to assess economic models and tokenomics, ensuring that incentive structures are secure and resistant to manipulation or economic attacks.

-

Bug Bounty Programs: Platforms such as Immunefi and Sherlock host bug bounty programs, incentivizing ethical hackers to discover and report vulnerabilities in exchange for financial rewards.

-

Regular Protocol Updates: DeFi insurance protocols routinely deploy security patches and upgrades to address newly discovered threats, maintaining resilience against evolving exploit techniques.

Yet, the limitations of audits must be acknowledged. No security review can guarantee absolute safety. Attackers are constantly innovating, and even the best-reviewed code can fall victim to novel exploits or overlooked edge cases. This is why insurance protocols are increasingly adopting a multi-layered defense strategy, combining audits, formal verification, economic analysis, and operational safeguards, to minimize both technical and financial risks. For users and investors, this translates to more reliable coverage options and fewer catastrophic losses.

It’s also worth noting that smart contract audits are now a key differentiator for DeFi insurance platforms. Protocols that can demonstrate a history of comprehensive audits by reputable firms attract higher-quality capital and enjoy greater user trust. In contrast, those with lax security practices face higher premiums, lower coverage limits, or outright exclusion from insurance markets. This dynamic is reshaping the competitive landscape of DeFi insurance and raising the baseline for protocol security across the sector.

For developers and project teams seeking coverage, understanding the audit requirements of leading insurers is critical. Most underwriters demand not only recent audit reports but also evidence of responsive governance, such as rapid patching of disclosed vulnerabilities and transparent incident reporting. For an in-depth look at how to strategically select insurance for smart contract exploit protection, consult our resource on choosing the best DeFi insurance.

Strategic Takeaways: Audits as a Pillar of Sustainable DeFi Insurance

Ultimately, smart contract audits are no longer a luxury, they are table stakes in DeFi insurance security. As protocols mature and attackers become more sophisticated, only those platforms with rigorous audit regimes and adaptive risk management will remain viable. For users evaluating insurance options, scrutinizing a protocol’s audit history should be as important as analyzing its premium structure or claims process.

The future of DeFi insurance hinges on relentless vigilance: continuous auditing, incentivized community participation via bug bounties, and swift operational response to emerging threats. These pillars not only protect individual protocols but also strengthen trust in decentralized finance as a whole, a prerequisite for mass adoption.