Smart contract exploit insurance is rapidly becoming a cornerstone of DeFi risk management. As decentralized finance platforms expand, users are increasingly exposed to threats like protocol hacks and code vulnerabilities. Traditional insurance models can’t keep pace with the speed, complexity, or transparency that DeFi demands. Enter next-gen DeFi insurance coverage: policies governed by code, executed by smart contracts, and tailored to protect against the unique risks of the decentralized ecosystem.

Why Smart Contract Exploit Insurance Matters in DeFi

Unlike legacy finance, where banks and intermediaries can absorb or mitigate losses, DeFi puts users directly in control – and at risk. A single bug or exploit can drain millions from a protocol overnight. Recent attacks have highlighted just how vulnerable even audited projects can be. Smart contract exploit insurance steps in to fill this gap, offering financial protection against:

- Reentrancy attacks: Where attackers repeatedly withdraw funds before balances update.

- Oracle manipulation: When external data feeds are compromised to trigger unintended contract behavior.

- Flash loan exploits: Where attackers use instant loans to manipulate prices and drain liquidity.

The goal? To give users peace of mind when interacting with innovative – but sometimes risky – DeFi protocols.

How Does Smart Contract Exploit Insurance Actually Work?

The process is refreshingly transparent compared to traditional claims departments. Here’s the typical flow:

How DeFi Smart Contract Exploit Insurance Works

-

1. Select and Purchase Coverage: Users choose a reputable DeFi insurance provider—such as Nexus Mutual or InsurAce—and purchase coverage for specific smart contracts or protocols. Premiums are calculated based on risk factors, coverage amount, and duration.

-

2. Monitor for Exploits or Incidents: The insurance protocol continuously monitors covered smart contracts for suspicious activity or exploits, using on-chain data, security audits, and community reporting to detect incidents quickly.

-

3. Incident Verification: When a potential exploit is detected, the protocol verifies the event through transparent on-chain evidence, third-party audits, and sometimes decentralized community voting to confirm legitimacy.

-

4. Claims Submission: Affected users submit claims detailing their losses through the protocol’s platform. This process is often automated or involves decentralized governance to review the claims.

-

5. Claims Assessment and Approval: The protocol assesses submitted claims using automated smart contracts, community voting, or a combination of both to determine validity and prevent fraudulent claims.

-

6. Payout Distribution: Once a claim is approved, the insurance protocol automatically disburses compensation to affected users, helping them recover from losses caused by the exploit.

-

7. Continuous Risk Evaluation: Leading platforms like InsurAce and Ensuro use AI-driven analytics and real-time security metrics to reassess risk and adjust premiums or coverage terms as needed, ensuring ongoing protection.

1. Coverage Purchase: Users select an insurance provider and specify which protocol or smart contract they want covered. Premiums are calculated based on factors like risk level, coverage amount, and duration. Some platforms even allow custom policies for specific contracts.

2. Incident Detection: If an exploit occurs, the protocol verifies it using on-chain data, audits, and community reports. This minimizes delays and disputes over whether an event qualifies for coverage.

3. Claims Processing: Affected users submit claims detailing their losses. Many leading providers use decentralized voting or automated processes to assess validity – removing human bias from the equation.

4. Payout Distribution: Once approved, compensation is distributed directly from the pool of staked capital or mutual fund reserves.

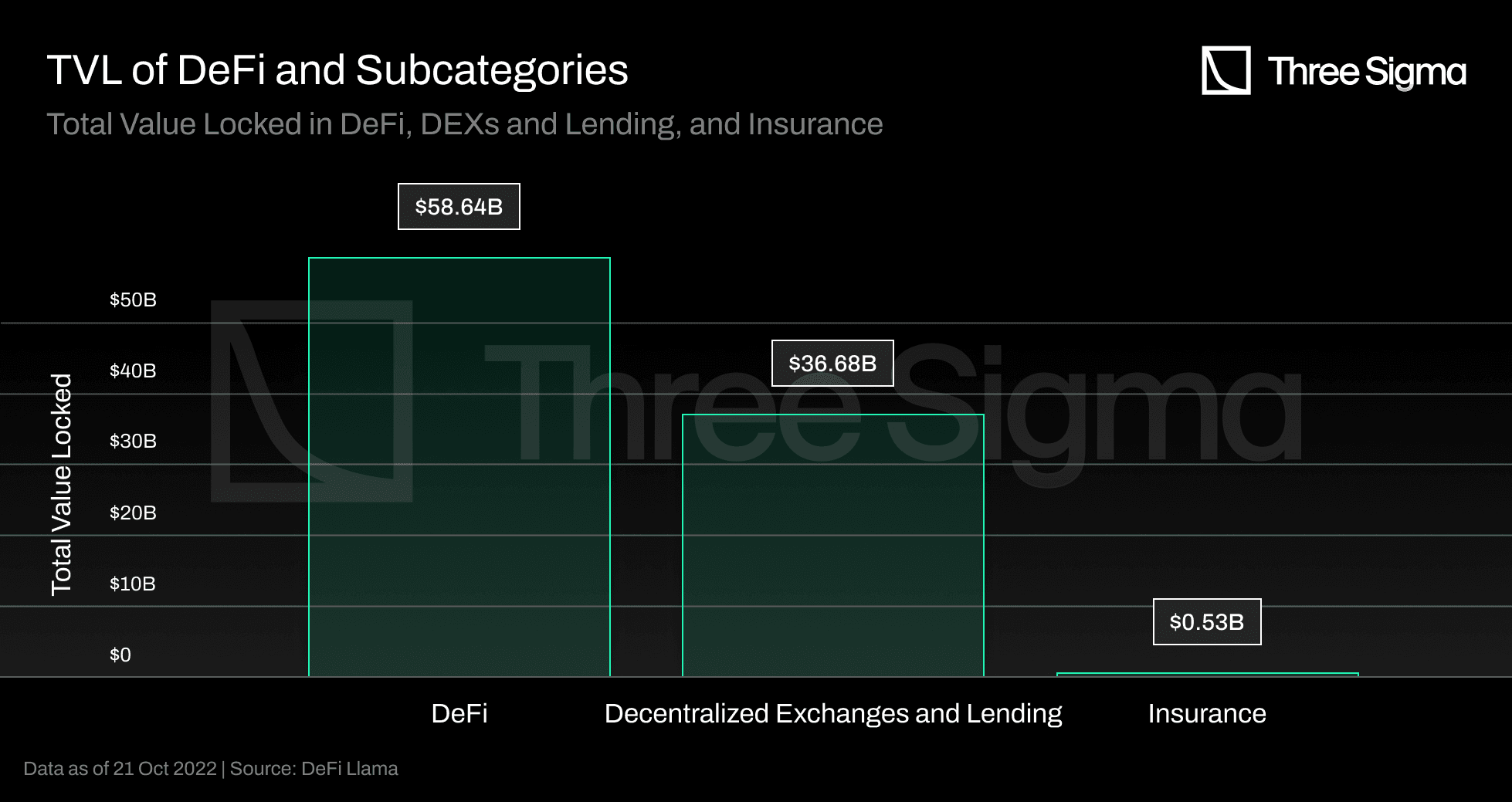

The Players: Leading DeFi Insurance Providers

The landscape is evolving fast but several platforms have emerged as leaders in DeFi hack protection. Here’s a quick snapshot:

- Nexus Mutual: Operates as a decentralized mutual fund where members pool funds and vote on claims related to smart contract failures or exchange hacks.

- InsurAce: Offers multi-chain coverage for various protocols including protection against both exploits and stablecoin depegs.

- Ensuro: Focuses on parametric products (like flight delay payouts) while bridging traditional and decentralized finance models.

If you’re comparing options or want more details on these providers’ strengths and weaknesses, check out our curated list at Best DeFi Insurance Platforms for Smart Contract Exploit Coverage in 2024.

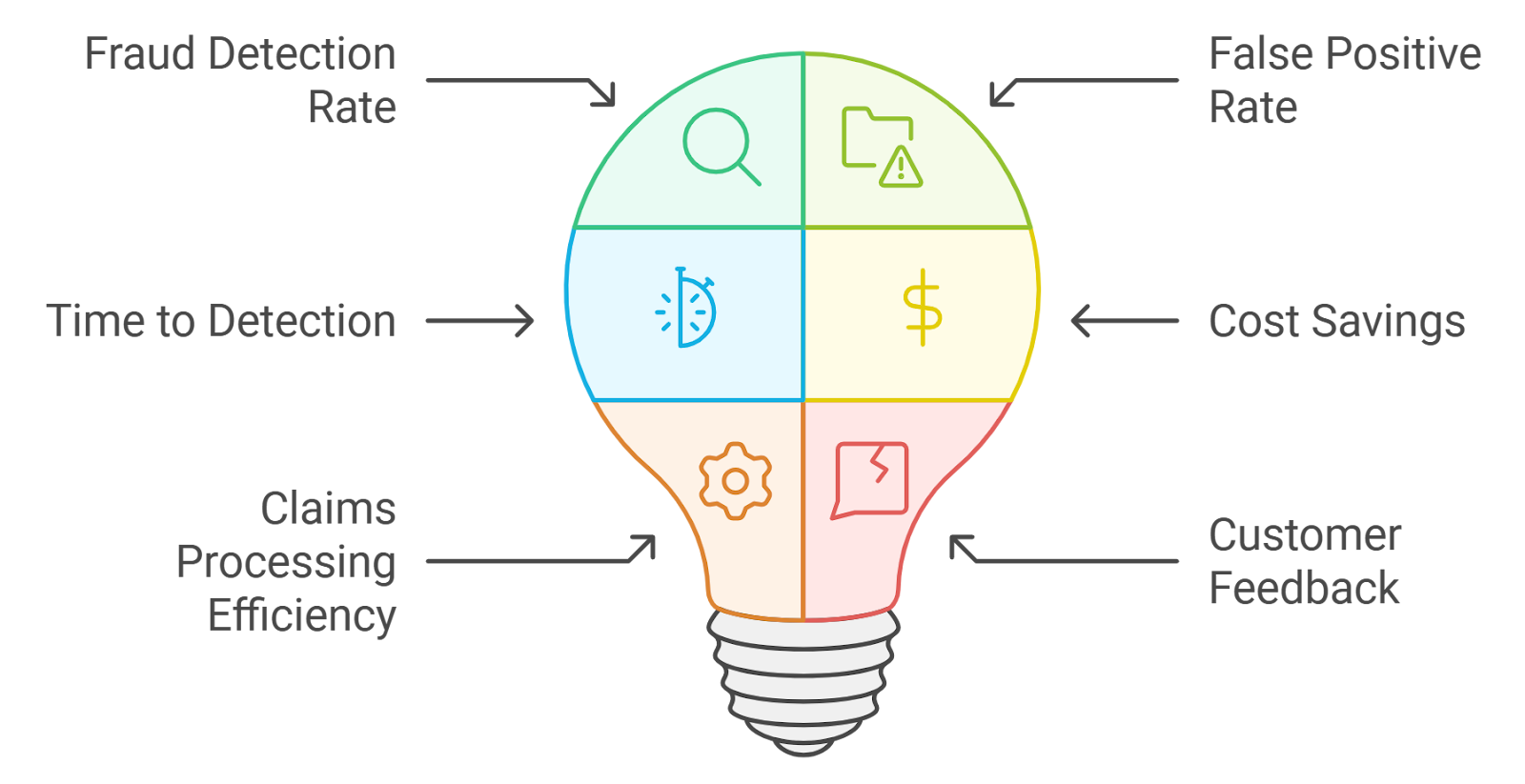

Challenges Facing DeFi Insurance

Despite the promise of smart contract exploit insurance, several hurdles remain before it can achieve mainstream adoption. One major challenge is determining fault in complex exploits. When a hack affects multiple protocols or involves intricate attack vectors, pinpointing responsibility can be contentious. This is especially true in cases of cross-chain exploits or when vulnerabilities stem from integrations rather than core protocol code.

Another persistent issue is preventing fraudulent claims. Since payouts are often automated and pools are community-funded, robust verification mechanisms are critical. Many DeFi insurance providers leverage decentralized governance and on-chain audits to validate incidents, but the risk of abuse still exists, especially as attackers become more sophisticated.

Finally, there’s the delicate act of balancing premiums and pool solvency. If premiums are set too high, users may opt out altogether; too low, and the fund risks being depleted after a major exploit. Dynamic pricing models and AI-driven risk assessments are emerging as solutions, adjusting premiums in real time based on security metrics and market conditions.

The Future of Smart Contract Exploit Coverage

The next wave of DeFi insurance is already taking shape. Parametric insurance models, which trigger instant payouts based on predefined events (like on-chain exploit detection), are gaining traction for their speed and transparency. Cross-chain coverage is also rising in importance as users increasingly interact with protocols across multiple blockchains, demanding protection that travels with their assets.

AI and machine learning are poised to revolutionize risk assessment, enabling providers to analyze vast swathes of on-chain data and dynamically update coverage terms. Expect smarter underwriting, quicker claim approvals, and policies that adapt to evolving threat landscapes.

Would you trust an AI-powered DeFi insurance protocol over a human-governed mutual?

With DeFi insurance evolving rapidly, new protocols use AI to automate risk assessment and claims, while traditional mutuals rely on human governance and community voting. Which approach would you trust more to protect your assets from smart contract exploits?

How to Choose the Right DeFi Insurance Provider

No two protocols, or policies, are alike. Before purchasing coverage, consider these factors:

- Protocol Reputation: How transparent is the provider? Do they publish audits and claims history?

- Covers Offered: Some focus solely on smart contract exploits; others include stablecoin depegs or governance attacks.

- Payout Structure: Is compensation automatic or subject to community voting?

- User Experience: How simple is it to file a claim? What’s the average payout time?

If you’re not sure where to start, our guide on how to choose the best DeFi insurance for smart contract exploit protection in 2024 breaks down everything you need to know before committing your capital.

Taking Action After an Exploit: Filing Your Claim

If you’re ever caught in a protocol hack, acting quickly is crucial. Most leading platforms require prompt notification and supporting evidence (such as transaction hashes or loss calculations). The good news: modern DeFi insurance protocols streamline this process with automated forms and transparent workflows. For a detailed walkthrough, including what documents you’ll need, see our step-by-step guide: How to File a Claim After a DeFi Smart Contract Exploit.

Why Knowledge Is Your Best Defense

The decentralized future demands new tools for self-protection, and smart contract exploit insurance sits at the heart of this shift. By understanding how these policies work, staying up-to-date on provider innovations, and knowing your rights as an insured user, you’re not just hedging against loss, you’re helping build a safer ecosystem for everyone involved.

Stay vigilant, stay informed, and remember: knowledge is your best defense in DeFi risk management.