As decentralized finance (DeFi) matures, the hunt for sustainable, uncorrelated yield intensifies. Tokenized reinsurance protocols are emerging as a powerful solution, bridging the gap between crypto-native capital and the vast, real-world insurance sector. By converting reinsurance contracts into blockchain-based tokens, these protocols unlock access to a $750 billion market historically reserved for institutional players, with projections aiming at $2 trillion within the next decade.

How Tokenized Reinsurance Protocols Operate

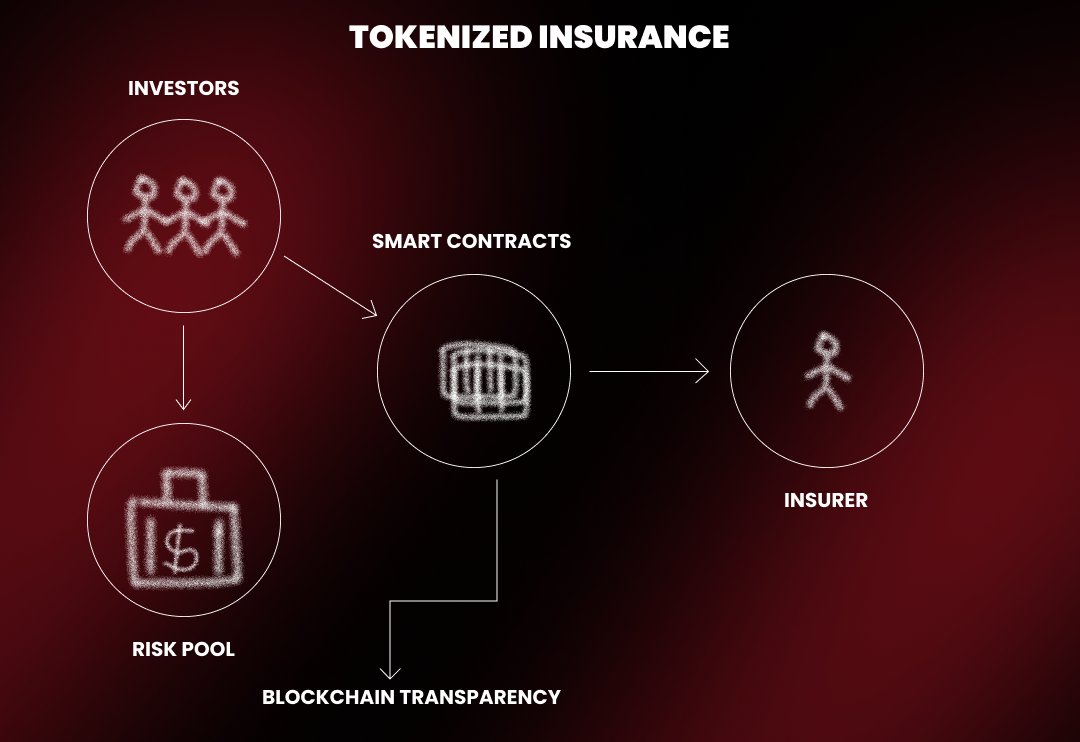

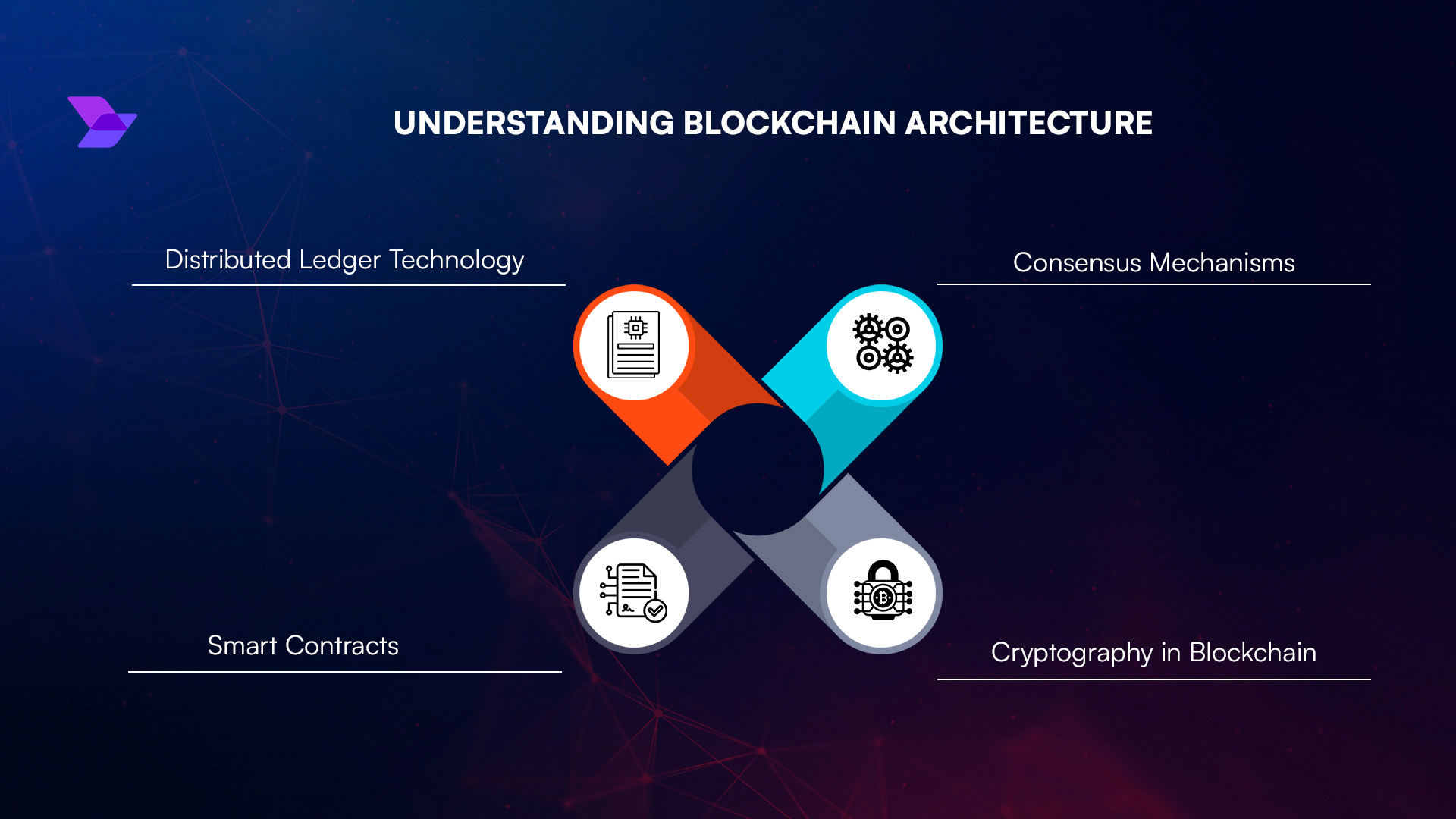

The mechanics behind tokenized reinsurance DeFi protocols are both innovative and robust. At their core, these platforms allow users to deposit stablecoins into smart contracts, which are then pooled and deployed into diversified portfolios of reinsurance contracts. For example, Re Protocol offers two primary token options:

- reUSD: A low-risk, principal-protected token that earns yield from safe assets like U. S. Treasury bills or established DeFi strategies, with a targeted APY of 6, 10%.

- reUSDe: A higher-yield token that takes on actual underwriting risk, sharing in insurance profits and targeting 15, 23% APY.

This capital is then allocated by experienced actuarial and underwriting teams across sectors such as health, property, business, and climate insurance. Premiums collected from these contracts generate returns that are distributed back to token holders based on portfolio performance.

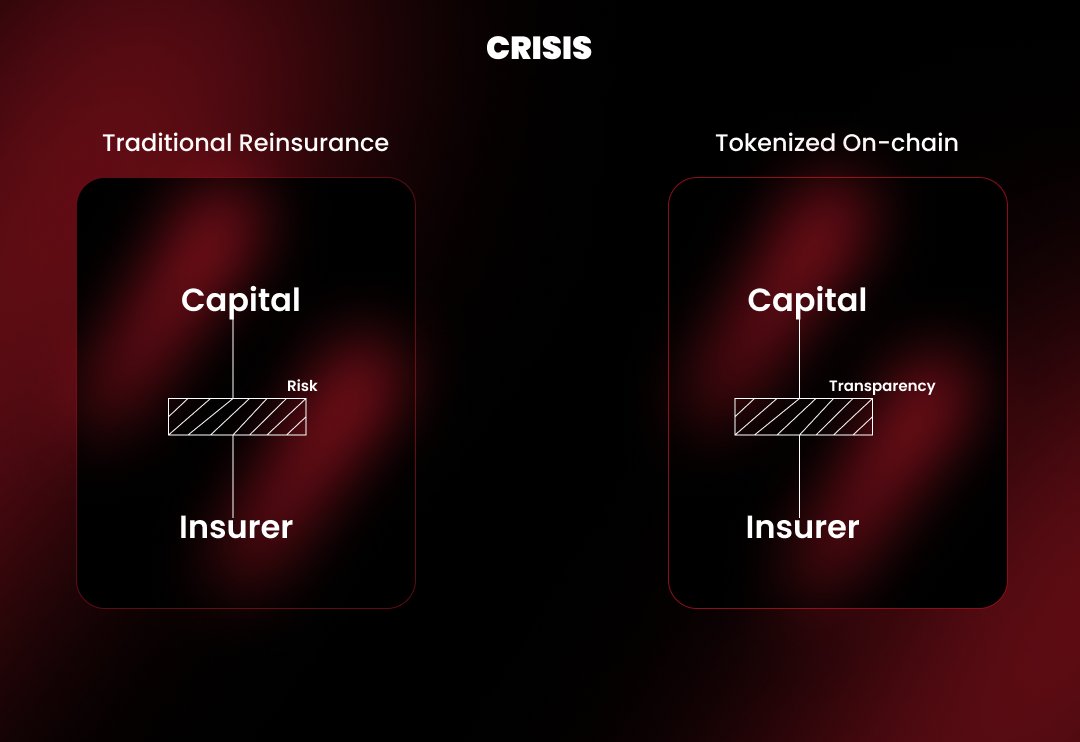

Real-World Yield Meets On-Chain Transparency

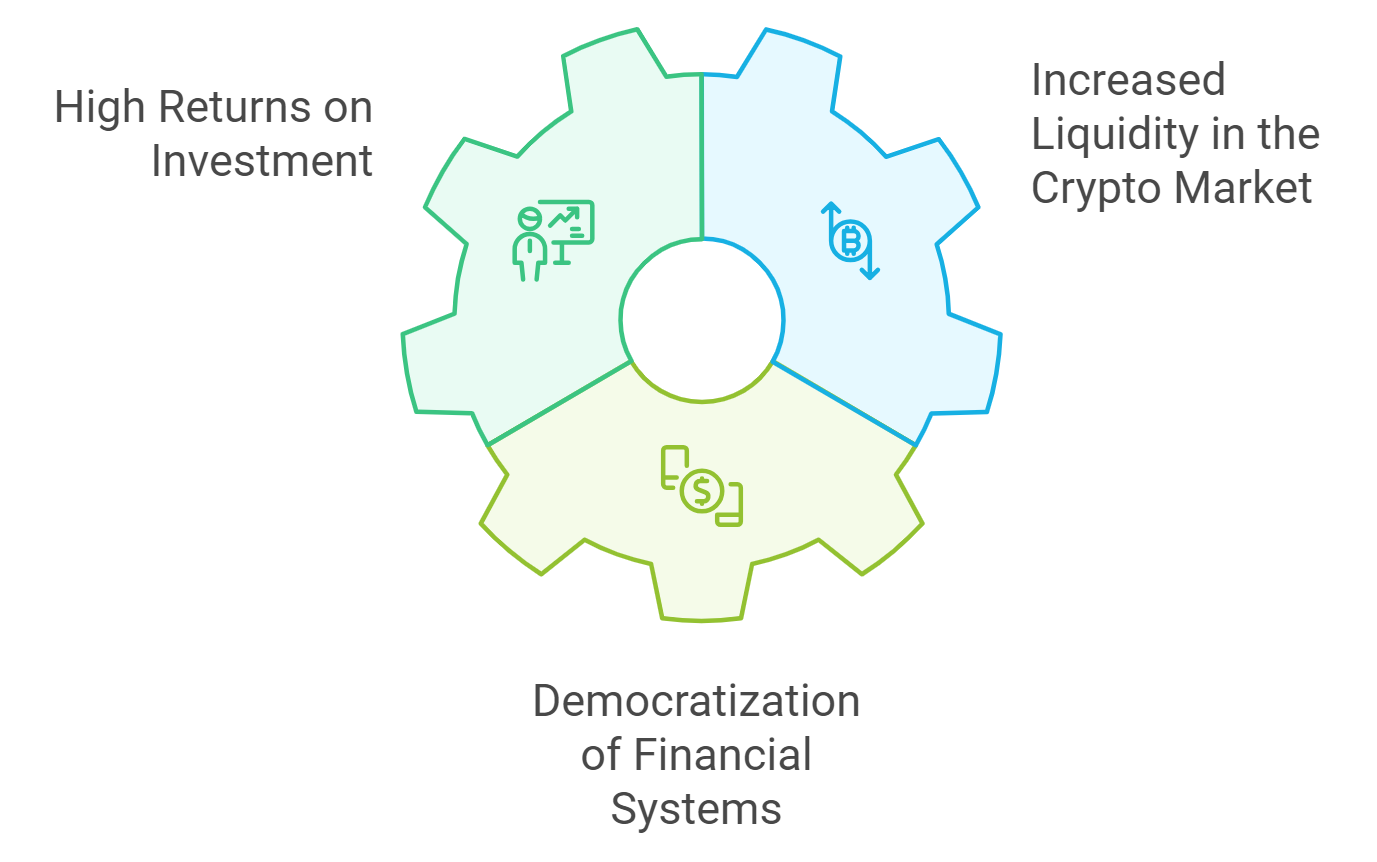

One of the most compelling advantages of tokenized reinsurance is yield diversification. Unlike traditional DeFi strategies that rely heavily on crypto lending or liquidity mining, reinsurance yields are fundamentally uncorrelated with digital asset markets. This means that even during periods of crypto volatility, returns sourced from global insurance premiums can remain stable.

Transparency is another major benefit. Every transaction, premium payment, and claim is immutably recorded on-chain. This not only reduces administrative overhead but also gives investors unprecedented visibility into how their capital is deployed and how returns are generated. For a comprehensive breakdown of these mechanisms, see this resource.

Top Benefits of Tokenized Reinsurance for DeFi Users

-

Diversified, Uncorrelated Yields: Tokenized reinsurance protocols like Re and OnRe give DeFi users exposure to insurance premium returns, which are uncorrelated with crypto and traditional financial markets. This enhances portfolio diversification and reduces dependence on crypto market cycles.

-

Attractive, Real-World APY: By pooling capital into reinsurance contracts, users can earn yield rates up to 23% APY (e.g., Ethena x Re partnership for sUSDe holders) based on actual insurance premiums and performance, not just speculative crypto trading.

-

On-Chain Transparency & Auditability: All transactions, premium flows, and claims are recorded on blockchain (e.g., Avalanche for Re Protocol), providing real-time transparency and simplifying audits for participants.

-

Enhanced Liquidity & Composability: Tokenized reinsurance positions (e.g., reUSD, reUSDe, ONe) can be traded on secondary markets or used as collateral in DeFi lending protocols, unlocking liquidity and enabling integration with other DeFi products.

-

Access to Regulated, Real-World Assets: Protocols like Ensuro and Re operate under regulated frameworks (e.g., Bermuda, U.S.), giving DeFi users confidence that their capital is deployed in compliant, real-world insurance contracts.

-

Professional Risk Management: Capital is allocated by experienced actuarial and underwriting teams (e.g., Re Protocol), ensuring risks are assessed and managed according to industry standards, which helps protect investor principal.

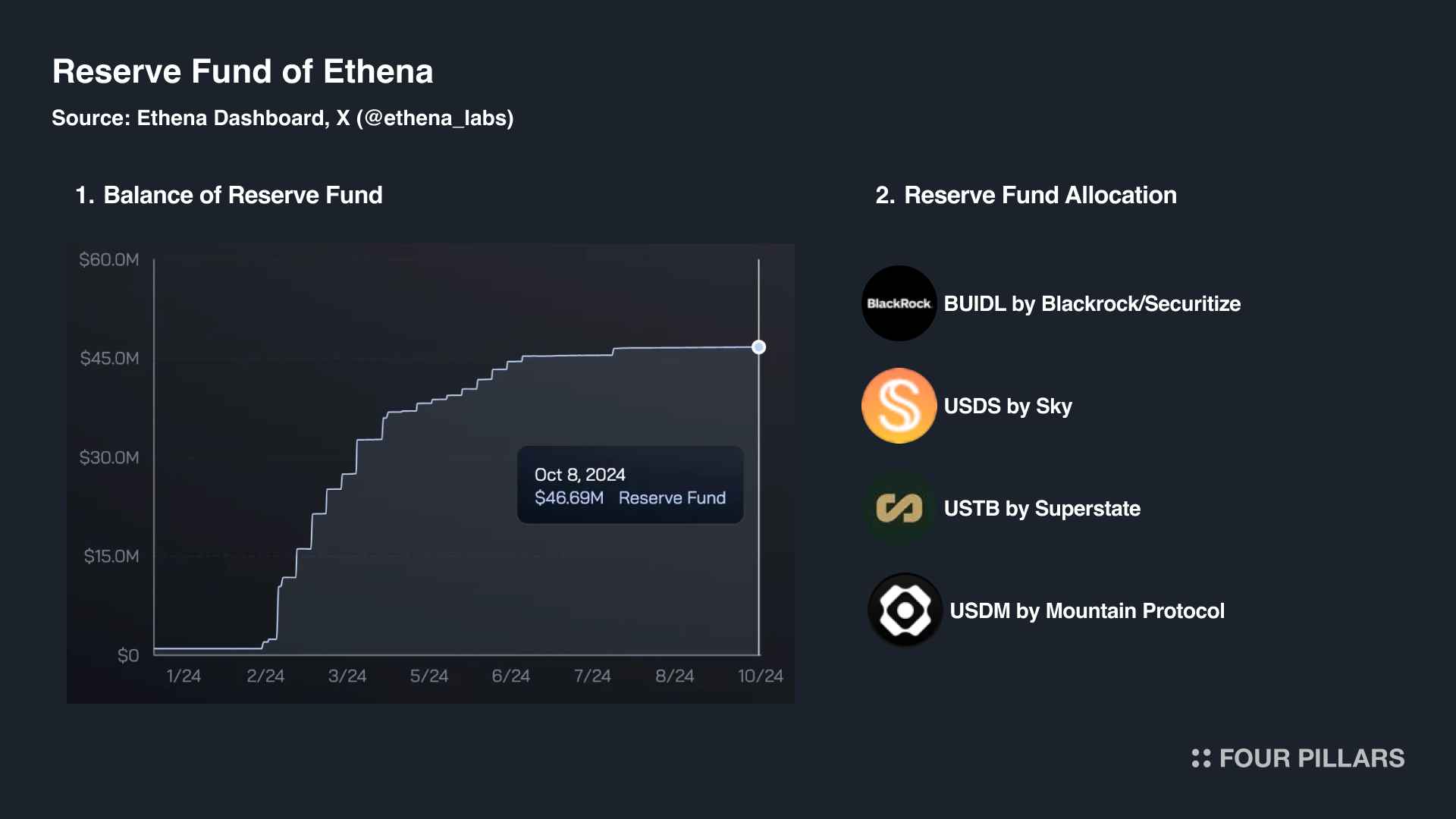

Recent Developments: Institutional Yield Comes On-Chain

2025 has seen pivotal partnerships and product launches in this space. In April, Ethena announced a collaboration with Re Protocol that enables holders of USDe and sUSDe stablecoins to lock their tokens as reserve assets for underwriting real-world insurance. This integration allows users to earn up to 23% APY by supporting sectors like health and climate insurance directly on-chain.

Similarly, the launch of OnRe’s ONe accumulating token brings a structured yield product combining reinsurance performance, collateral yield, and token incentives. Projected returns currently reach up to 36.5%, offering a compelling alternative for DeFi investors seeking stable yet scalable sources of yield tied to real economic activity.

These advances underscore a broader trend: as DeFi evolves beyond speculative yield farming, protocols like Re and OnRe are building bridges to institutional-grade opportunities once out of reach for most crypto users. For more on how these pools deliver real yield on-chain, see this detailed guide.

Risk management and regulatory clarity are at the heart of these innovations. Platforms like Ensuro are leveraging established frameworks in Bermuda to ensure that on-chain underwriting pools meet global compliance standards. This regulatory rigor, combined with blockchain’s auditability, allows both retail and institutional investors to participate in DeFi reinsurance pools with a higher degree of confidence than is typical for most crypto-native yield products.

Another game-changing aspect is the increased liquidity and composability of tokenized reinsurance positions. Unlike traditional reinsurance investments, where capital is locked for years, DeFi protocols allow users to trade their positions on secondary markets or use them as collateral in lending protocols. This flexibility attracts a broader range of participants, from sophisticated funds to everyday DeFi users seeking stablecoin insurance yield alternatives.

Key Considerations for DeFi Investors

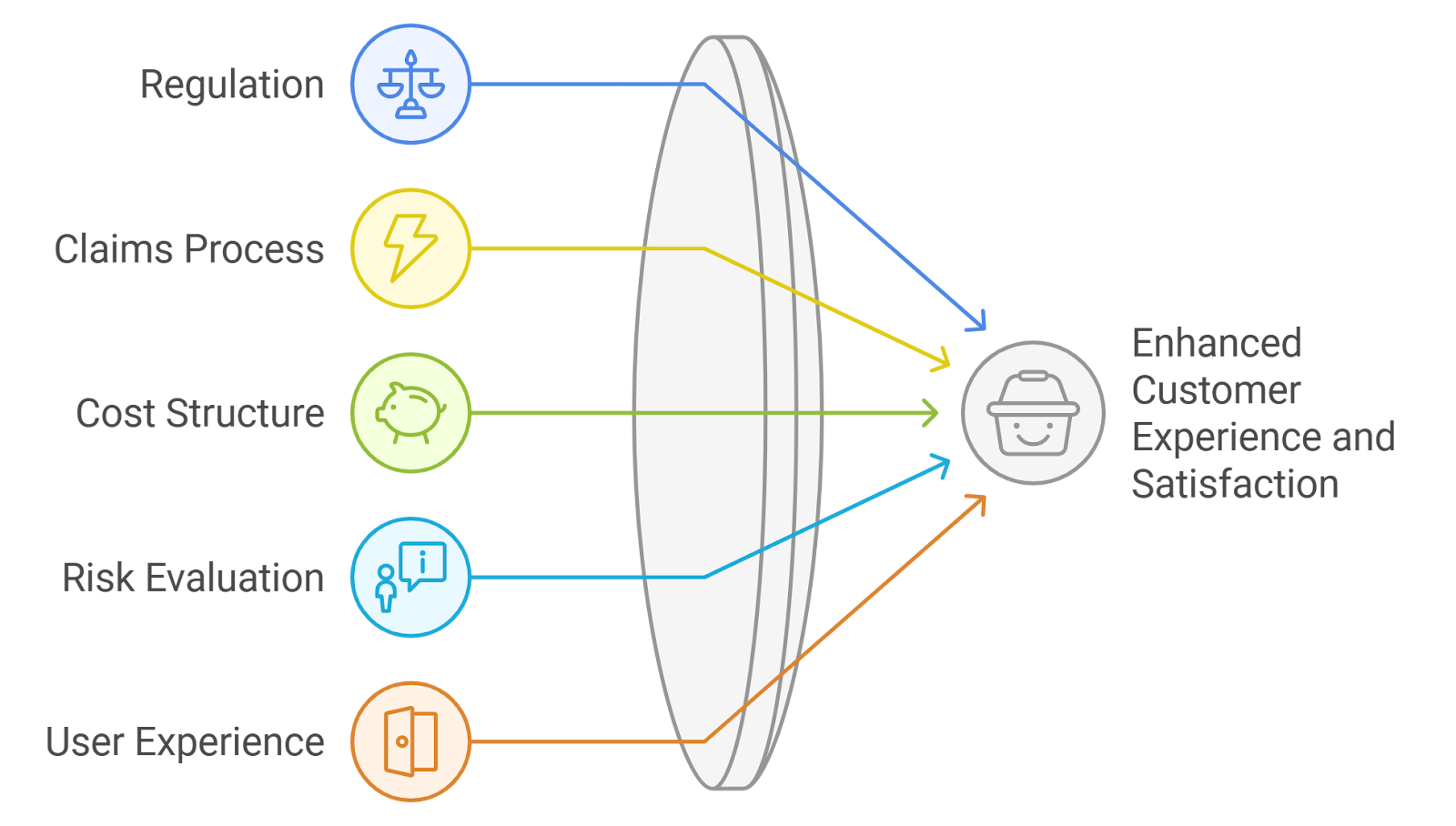

While tokenized reinsurance unlocks new frontiers for yield generation, it is not without risks. Underwriting insurance contracts, especially those tied to climate or catastrophic events, introduces real-world risk factors that are distinct from smart contract exploits or stablecoin depegs. Investors should scrutinize:

Key Risks and Due Diligence for Tokenized Reinsurance DeFi Protocols

-

Regulatory and Legal Risks: Tokenized reinsurance protocols operate at the intersection of insurance and DeFi, subject to evolving regulations. Confirm that platforms such as Re or OnRe are compliant with relevant jurisdictions, possess necessary licenses, and have clear disclosures about investor protections.

-

Underlying Insurance Portfolio Risk: Returns are generated from real-world insurance contracts. Assess the diversification, underwriting standards, and loss history of the underlying portfolios managed by protocols like Re and OnRe. Concentrated or poorly underwritten exposures can amplify losses during adverse events.

-

Liquidity and Redemption Constraints: Tokenized reinsurance assets may have limited secondary market liquidity or redemption windows. Review lock-up periods, withdrawal terms, and secondary market options for tokens such as reUSD, reUSDe, or ONe before investing.

-

Transparency and Reporting: Reliable protocols provide on-chain transparency and regular performance reporting. Evaluate whether the protocol offers real-time portfolio data, claims history, and third-party attestations—features emphasized by platforms like Re and Ensuro.

-

Counterparty and Operational Risks: The performance of tokenized reinsurance depends on the solvency and reliability of off-chain partners (e.g., insurers, underwriters, custodians). Investigate the reputation, financial health, and risk management practices of these counterparties.

-

Yield Sustainability and Incentive Structures: High yields (e.g., up to 23% APY on sUSDe via Re) may not be sustainable if driven by token incentives rather than genuine insurance profits. Scrutinize the sources of yield and the proportion coming from protocol incentives versus real-world premium income.

It’s also important to note the evolving landscape of DeFi institutional yield. As more real-world assets (RWAs) like reinsurance premiums are tokenized, expect increased collaboration between traditional insurers and blockchain projects. This convergence could drive even greater transparency, efficiency, and risk-adjusted returns across the sector.

The Road Ahead: Scaling Real-World Insurance in DeFi

The momentum behind tokenized reinsurance in DeFi is undeniable. With protocols like Re and OnRe connecting crypto liquidity to a $750 billion reinsurance market, projected to reach $2 trillion in the next decade, DeFi users now have access to yields that are both sustainable and uncorrelated with crypto cycles. This marks a significant evolution from speculative yield farming to real-world insurance yield opportunities.

For those seeking robust, data-driven income streams, tokenized reinsurance pools offer a compelling proposition: transparent, regulated access to an asset class previously reserved for institutional giants. As adoption accelerates, expect further product innovation, deeper integrations across DeFi, and new risk management tools tailored to this emerging frontier.