The launch of STBL’s USST stablecoin was one of the most anticipated events in DeFi for 2025, but within hours of going live on October 10, the stablecoin depegged from its $1 target, trading as low as $0.96 on Curve Finance. As of October 12, USST had only marginally recovered to $0.9776, with a market capitalization of approximately $967,000 and just 52 holders. The Curve pool reported $965,000 in liquidity, $484,000 in 24-hour trading volume, and net outflows of $466,000. This rapid destabilization has put the spotlight on stablecoin launch vulnerabilities and the evolving landscape of DeFi risk management.

USST’s Depeg: A Day-One Stress Test for DeFi

USST’s depeg wasn’t just a price blip; it was a live-fire test of what can go wrong when a new stablecoin confronts real market pressures. Despite being backed by tokenized real-world assets (RWAs) like U. S. Treasuries and collateralized loan obligations (CLOs), USST’s peg broke almost immediately after launch. The incident underscores how even well-capitalized, overcollateralized stablecoins are not immune to launch-time liquidity shocks or cascading confidence failures.

“The USST depeg is a textbook case of why robust liquidity and stress testing are non-negotiable for new DeFi protocols. “

Key Factors Behind the USST Depeg

- Liquidity Constraints: The Curve pool’s $965,000 in liquidity was insufficient to absorb $484,000 in trading volume and $466,000 in net outflows. This thin liquidity amplified price swings and made it easy for even modest sell pressure to push USST below its peg.

- Market Confidence: The rapid depeg eroded trust among early adopters, creating a feedback loop where falling prices triggered more redemptions and less willingness to hold USST.

- Collateral Complexity: While real-world asset backing brings theoretical stability, the process of tokenizing and integrating RWAs introduces operational delays. If collateral can’t be quickly liquidated or rebalanced, the stablecoin’s peg becomes vulnerable during high-stress events.

Major Risks When Launching a Stablecoin

-

Insufficient Liquidity at Launch: Without enough liquidity, even moderate trading can cause a stablecoin to deviate from its peg, as seen with USST dropping to $0.96 shortly after launch on Curve Finance.

-

Overreliance on Illiquid Collateral: Backing stablecoins with assets like tokenized U.S. Treasuries or CLOs can introduce delays and complexities, making it harder to maintain a consistent peg during market stress.

-

Poor Market Confidence and Communication: Rapid depegging can erode trust, leading to reduced demand and further instability. Transparent, timely updates are essential to reassure investors and users.

-

Inadequate Stress Testing: Launching without comprehensive simulations or stress tests can leave vulnerabilities undiscovered, increasing the risk of depegging when real trading begins.

-

Concentration of Holdings: If a small number of wallets control most of the supply—as with USST’s 52 holders—large trades can disproportionately impact price stability and liquidity.

Market Data and Price Prediction: Where Does USST Go From Here?

At the time of writing, USST is trading at $0.9776, still below its intended $1 peg. With only 52 holders and ongoing net outflows, the path to recovery remains uncertain. The depeg event has already been widely discussed across the DeFi community, with some experts warning that the incident could have long-term implications for both STBL protocol adoption and broader confidence in real world asset stablecoins.

USST Stablecoin (USST) Price Prediction 2026-2031

Professional outlook based on post-launch depeg, DeFi market trends, and evolving stablecoin fundamentals.

| Year | Minimum Price | Average Price | Maximum Price | % Change vs Current Price (Avg) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.94 | $0.98 | $1.02 | +0.2% | Stabilization phase; protocol improvements and liquidity measures aim to restore peg |

| 2027 | $0.95 | $0.99 | $1.04 | +1.2% | Gradual recovery as market confidence rebuilds and adoption increases |

| 2028 | $0.96 | $1.00 | $1.06 | +2.3% | Broader DeFi integration and regulatory clarity support price normalization |

| 2029 | $0.97 | $1.01 | $1.08 | +3.3% | Matured collateral system and improved market mechanisms drive peg resilience |

| 2030 | $0.98 | $1.02 | $1.10 | +4.3% | Potential for full peg restoration as USST becomes a top DeFi stablecoin |

| 2031 | $0.98 | $1.03 | $1.12 | +5.4% | Optimistic scenario: USST achieves robust adoption, or, if issues persist, remains slightly below peg |

Price Prediction Summary

USST’s price outlook shows a gradual recovery trajectory following its initial depeg event. Assuming successful protocol upgrades, deeper liquidity, and growing market trust, the stablecoin is likely to approach its intended $1 peg over the next few years. However, downside risks remain if market confidence or collateralization mechanisms falter. The range of predictions reflects both the possibility of persistent volatility and the potential for full peg restoration.

Key Factors Affecting USST Stablecoin Price

- Liquidity provisioning and depth on major DeFi platforms

- Investor and market confidence after the depeg incident

- Regulatory developments impacting stablecoins and DeFi

- Collateral quality, transparency, and diversification

- Adoption by other protocols and integration with DeFi primitives

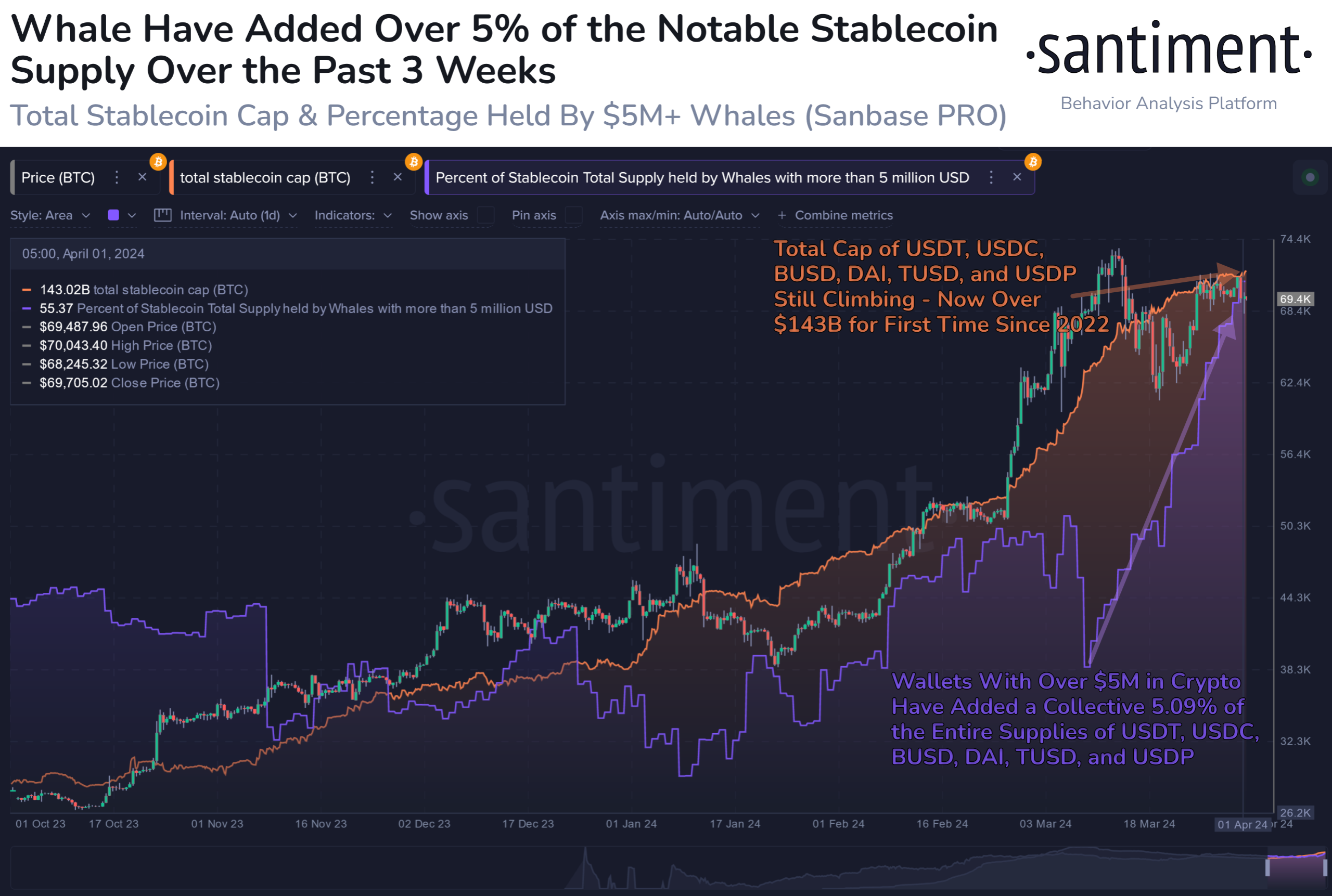

- Competition from established stablecoins (USDT, USDC, DAI, Ethena USDe, etc.)

- Technological upgrades and risk management enhancements by STBL protocol

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

For a deeper breakdown of what went wrong on launch day and how crypto investors can learn from these stress failures, see the detailed analysis at DepegWatch.

Lessons for DeFi Risk Management

The USST depeg is a stark reminder that launching a stablecoin is as much about managing liquidity and community expectations as it is about designing a sound collateral structure. Protocols must prioritize:

- Adequate Liquidity Provision: Deep initial liquidity is essential to absorb volatility and prevent price slippage.

- Robust Collateralization: Ensuring collateral can be rapidly liquidated or rebalanced is vital for peg stability.

- Clear Communication: Transparent updates during high volatility help maintain investor trust and reduce panic selling.

- Comprehensive Testing: Stress tests and simulations before launch can expose vulnerabilities that might otherwise go unnoticed until it’s too late.

Beyond the technical and market mechanics, the USST incident has catalyzed a re-examination of risk frameworks across the DeFi sector. The event’s timing, amid rising scrutiny on real world asset stablecoins, has only amplified calls for more rigorous safeguards and insurance solutions tailored to both protocol teams and end-users.

DeFi Insurance: Mitigating Stablecoin Launch Vulnerabilities

One of the most actionable takeaways from the USST depeg is the urgent need for DeFi insurance solutions that address launch-phase volatility and peg failure. Protocols and investors alike can benefit from coverage products specifically designed for:

- Stablecoin Depeg Events: Insurance that pays out if a stablecoin trades below a defined threshold for a set period, helping users hedge against sudden losses.

- Smart Contract Exploits: Coverage for technical vulnerabilities that may be exploited during high-volume launch windows.

- Liquidity Attacks: Protection against coordinated withdrawals or manipulation in shallow pools, risks that were acutely exposed in the USST case.

Providers are already innovating with parametric coverage, real-time monitoring, and on-chain claims processing. These tools are poised to become standard practice as the DeFi insurance market matures alongside increasingly complex stablecoin designs.

How Investors Can Respond to Stablecoin Peg Failures

For DeFi participants, the USST episode is not just a cautionary tale but a call to action. Here are practical steps investors can take to navigate future stablecoin launches and mitigate risk exposure:

Proven Strategies to Manage Stablecoin Depeg Risk

-

Diversify Across Multiple Stablecoins: Spreading funds among established stablecoins like USDT (Tether), USDC (USD Coin), and DAI can help mitigate losses if one depegs, as each has unique collateral and risk profiles.

-

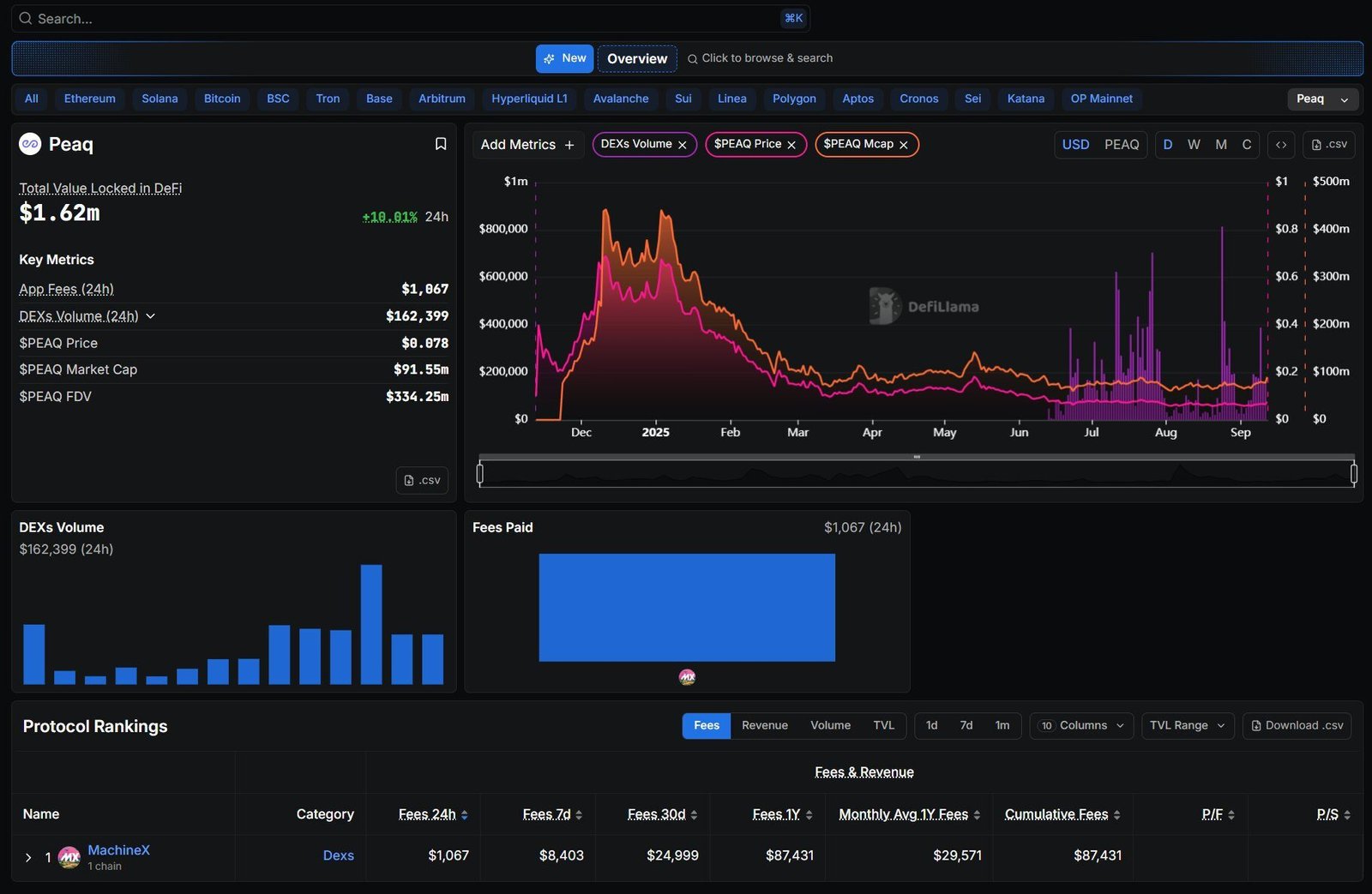

Utilize On-Chain Risk Monitoring Tools: Platforms such as DeFiLlama and Nansen provide real-time analytics on stablecoin liquidity, peg status, and smart contract health, enabling investors to react swiftly to depegging events.

-

Leverage Decentralized Exchanges with Deep Liquidity: Trading on high-liquidity platforms like Uniswap and Curve Finance can allow faster exits or arbitrage opportunities during periods of instability, reducing slippage and losses.

-

Monitor Collateral Transparency and Audits: Prioritize stablecoins that regularly publish proof-of-reserves and undergo third-party audits, such as Circle’s USDC or Tether’s USDT, to assess the reliability of the underlying collateral.

-

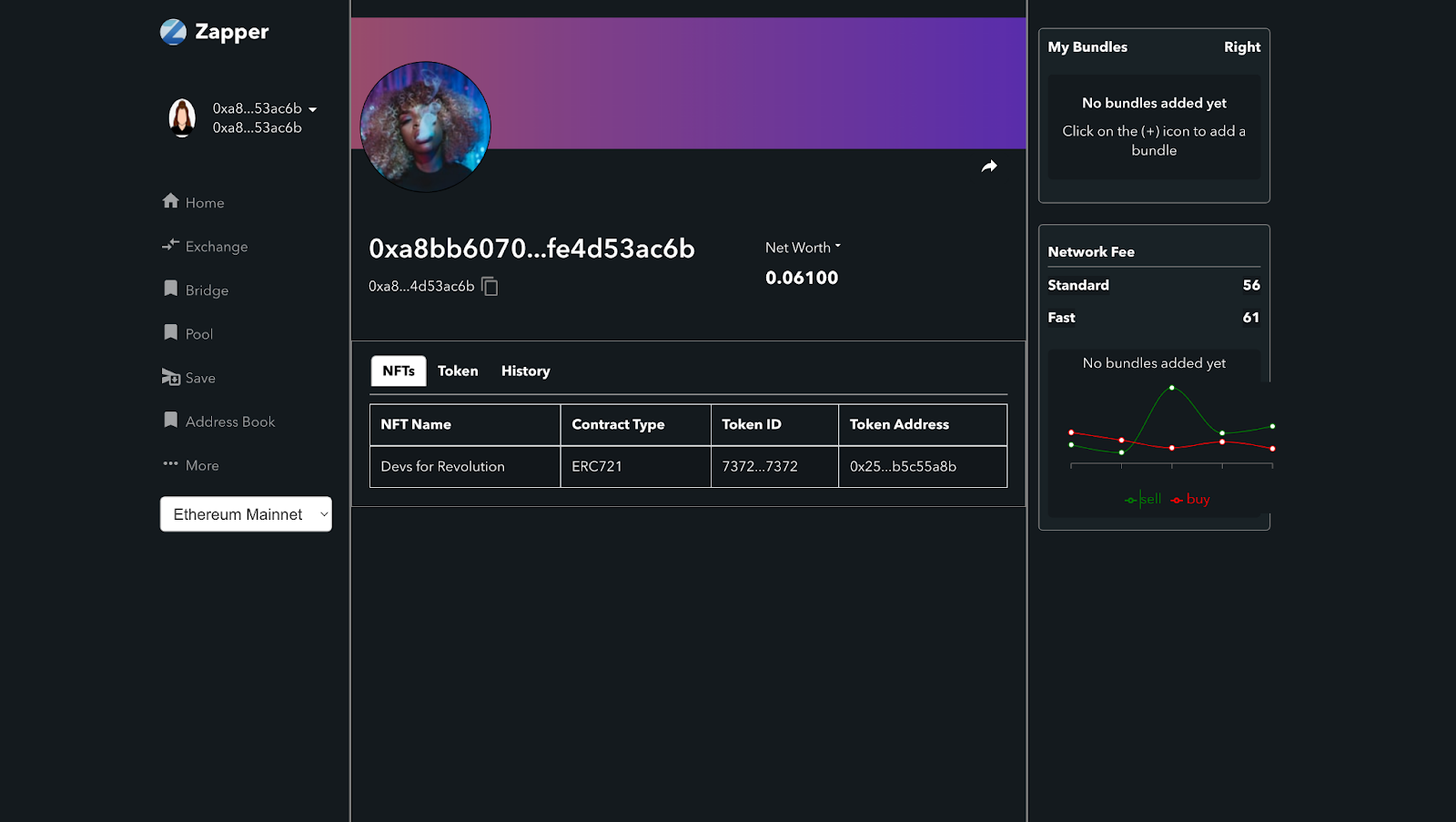

Set Automated Alerts and Stop-Loss Orders: Use portfolio management tools like Zapper or DeBank to set price alerts and automate withdrawals if a stablecoin falls below a set threshold (e.g., USST dropping to $0.96), helping to minimize drawdowns.

Additionally, investors should closely monitor on-chain metrics such as pool liquidity, net inflows/outflows, and collateral transparency before committing significant capital to new stablecoins. Early warning signs, like rapid outflows or widening price spreads, can provide critical exit signals long before a full depeg materializes.

What’s Next for STBL and the RWA Stablecoin Sector?

The immediate challenge for the STBL protocol is to restore confidence and stabilize USST’s price. This will likely require a combination of liquidity incentives, improved collateral management, and enhanced transparency around RWA integration. The broader sector must also grapple with the reality that even the most sophisticated collateral models are only as resilient as their weakest operational link.

As of this writing, USST remains below its intended peg at $0.9776. Whether it can regain parity, and whether investors will trust new RWA-backed stablecoins in the wake of this event, will shape the next phase of DeFi’s evolution. For those seeking a comprehensive post-mortem and actionable insights on the USST launch, DepegWatch offers an in-depth analysis.

“The lesson is clear: in DeFi, resilience is engineered, not assumed. Every launch is a live experiment in risk management. “

Ultimately, the USST depeg is a teachable moment for the entire ecosystem. It reinforces the imperative for robust stress testing, transparent collateral practices, and the integration of advanced DeFi insurance products. As protocols and investors adapt, the goal remains unchanged: to build stablecoins and risk management frameworks that can weather both market turbulence and the scrutiny of an increasingly sophisticated user base.