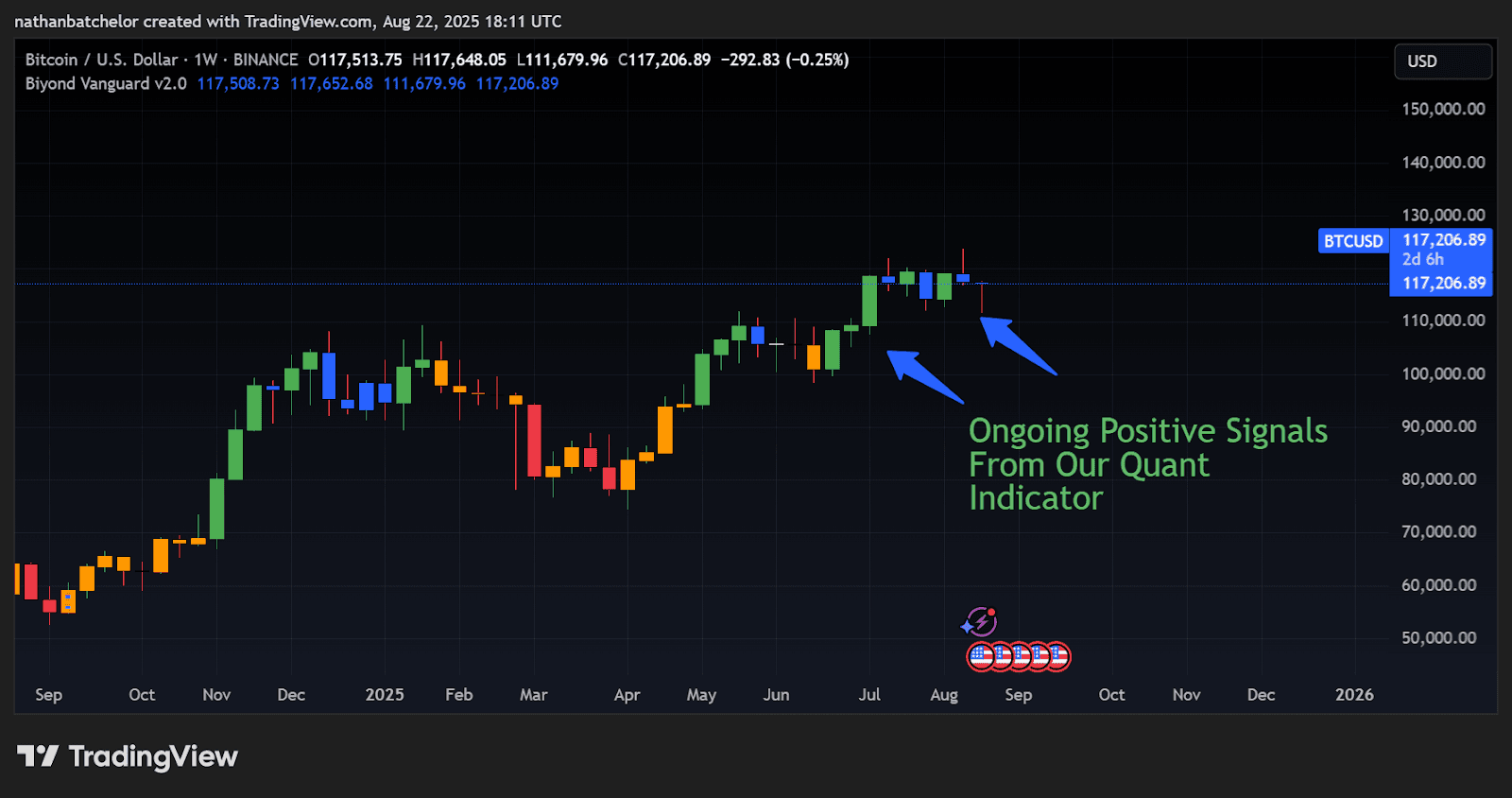

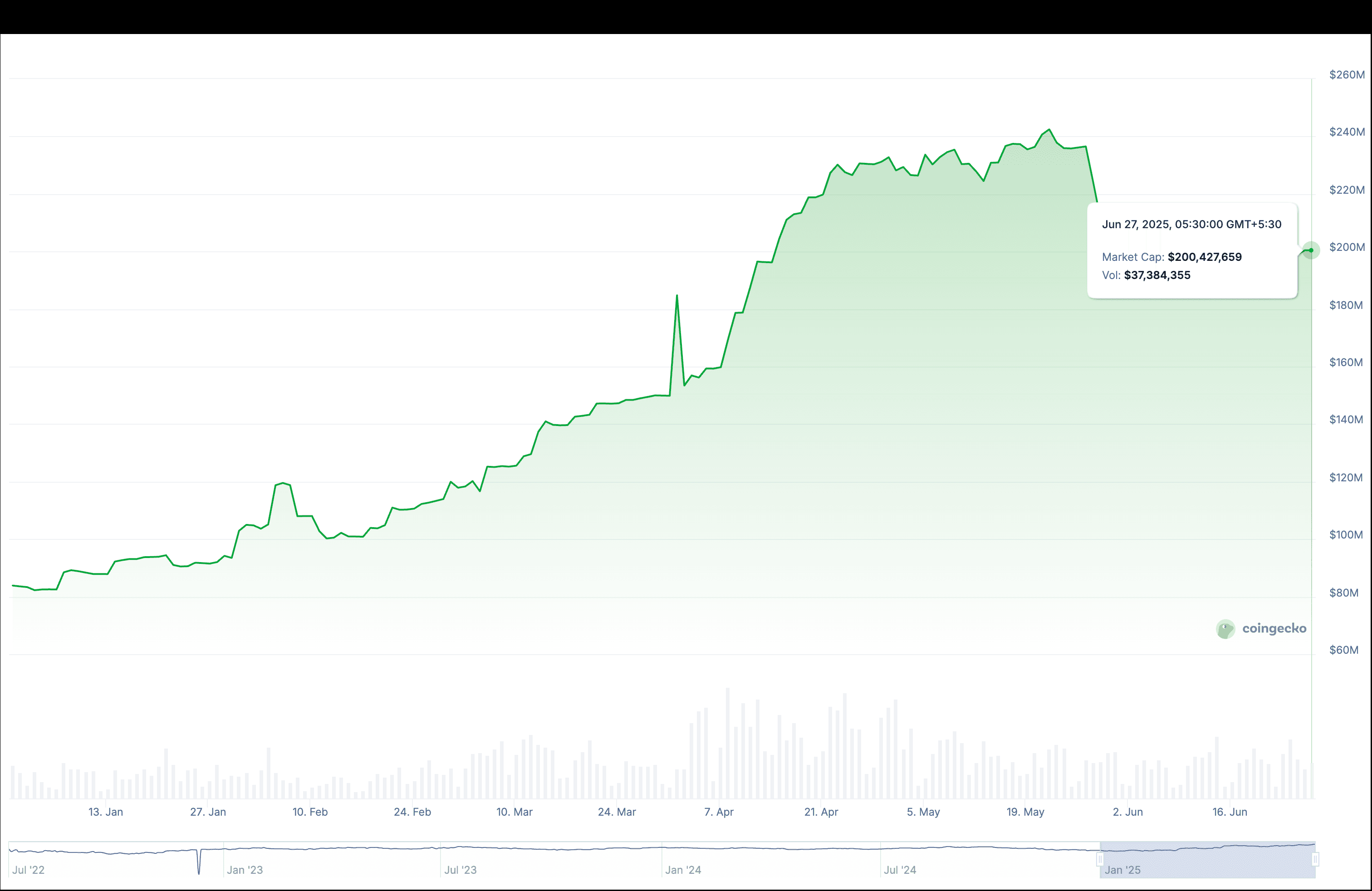

Stablecoins are designed to be the bedrock of DeFi, offering a digital dollar that’s supposed to remain immune to crypto’s notorious volatility. But in June 2025, this illusion was shattered for many users as both USDE and USST experienced dramatic depegging events, with USDE dropping by 7.99% over the month and USST facing similar turbulence. These events sent shockwaves through the ecosystem, raising urgent questions about the true risks behind stablecoins and what DeFi users can do to protect their assets.

What Happened: Anatomy of the June 2025 Stablecoin Crash

The crash began with a sudden wave of market volatility that exposed cracks in several stablecoin models. According to AInvest, USDE’s price fell sharply from its $1 peg, reflecting a loss of confidence as investors rushed for exits. Meanwhile, USST’s algorithmic mechanisms failed under pressure, causing its value to spiral away from $1.

This wasn’t just a technical hiccup – it was a stress test that revealed deep vulnerabilities in collateral management, transparency, and peg-maintenance mechanisms across DeFi’s most popular stablecoins.

The Core Risks: Why Did USDE and USST Lose Their Peg?

Collateral Instability: One of the biggest red flags was the quality of collateral backing these coins. USDE’s reserves included not only blue-chip assets like Bitcoin (BTC) and Ethereum (ETH), but also lower-liquidity altcoins. Most notably, $50 million worth of USDE was minted against DOLO – a token with only $14.2 million in market cap. When markets turned south, this illiquidity became catastrophic.

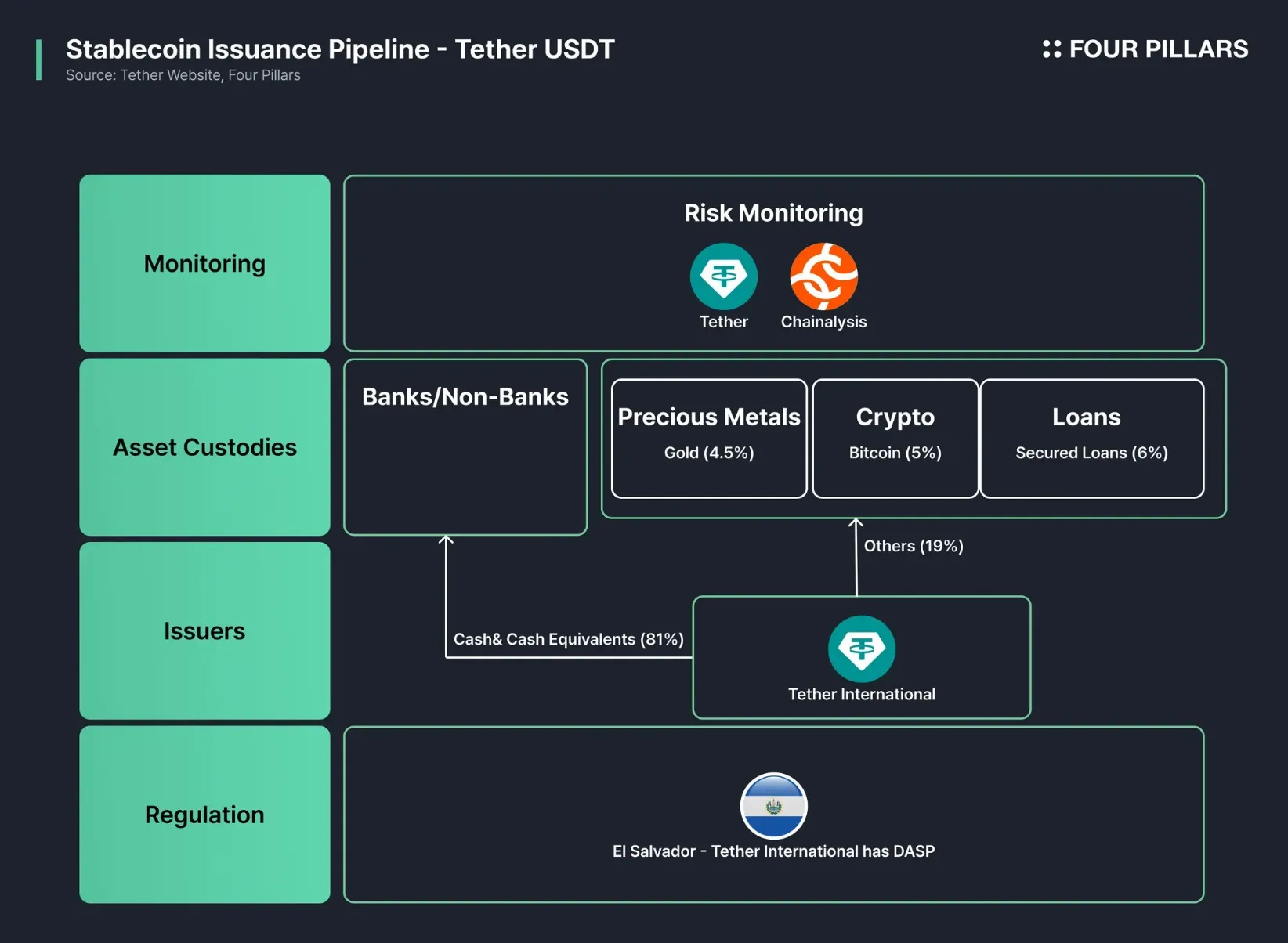

Lack of Transparency: Transparency is non-negotiable in DeFi risk management. Yet only 4% of USDE’s reserves were visible on-chain – the rest were off-chain or opaque, fueling skepticism about whether redemptions could actually be honored during stress periods (OKX analysis). This opacity directly undermined user trust.

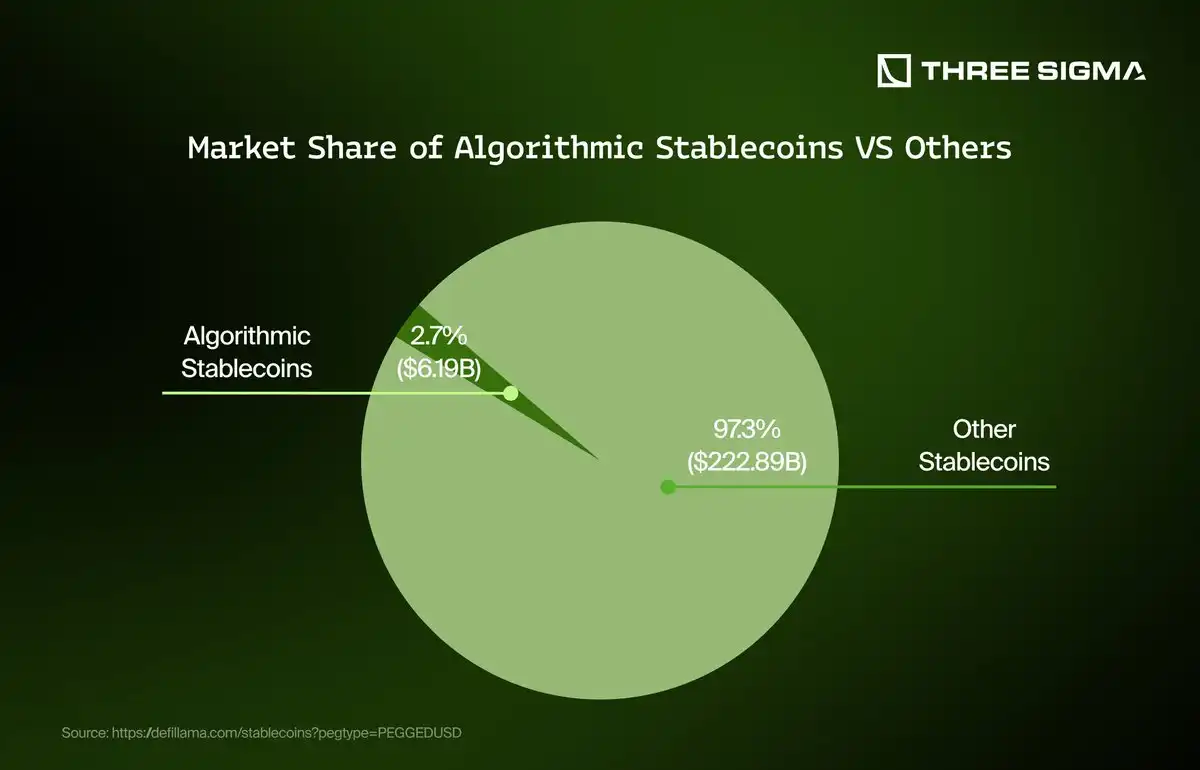

Algorithmic Vulnerabilities: Unlike asset-backed coins, algorithmic stablecoins like USST depend on code-based incentives and supply adjustments to maintain their peg. In theory, this should work automatically; in practice, extreme volatility overwhelmed these algorithms. The result? A rapid downward spiral as users lost faith and redemption mechanisms broke down (Smart Liquidity breakdown).

USDE Stablecoin Price Stability Prediction (2026-2031)

Projected price ranges for USDE after the June 2025 depegging event, considering market, regulatory, and technology factors.

| Year | Minimum Price | Average Price | Maximum Price | Notes / % Change (vs. $1 peg) |

|---|---|---|---|---|

| 2026 | $0.96 | $0.99 | $1.02 | Volatility persists; regulatory reforms underway; -4% to +2% deviation |

| 2027 | $0.97 | $1.00 | $1.03 | Improved transparency; partial recovery; -3% to +3% deviation |

| 2028 | $0.98 | $1.00 | $1.04 | Market stabilizes; adoption of stricter audits; -2% to +4% deviation |

| 2029 | $0.98 | $1.01 | $1.05 | Tech upgrades; competition from CBDCs; -2% to +5% deviation |

| 2030 | $0.99 | $1.01 | $1.06 | Mature regulatory framework; DeFi integration; -1% to +6% deviation |

| 2031 | $0.99 | $1.02 | $1.08 | Full MiCA compliance; peak competition; -1% to +8% deviation |

Price Prediction Summary

USDE is expected to gradually regain greater price stability following the 2025 depegging, but will likely remain vulnerable to short-term volatility, regulatory shifts, and competition from both centralized and decentralized stablecoins. While average prices are projected to hover near the $1 peg, min/max ranges reflect ongoing risks of brief depegs or overcorrections, especially during periods of market stress or innovation.

Key Factors Affecting USDE Stablecoin Price

- Regulatory clarity and enforcement (e.g., MiCA, STABLE Act)

- Transparency and quality of collateral reserves

- Adoption of third-party audits and real-time reserve proofs

- Advancements in stablecoin technology and risk management

- Competition from algorithmic, fiat-backed, and central bank digital currencies (CBDCs)

- Broader crypto market sentiment and volatility

- User trust and adoption rates in DeFi applications

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Domino Effect: How Market Volatility Exposes Stablecoin Mechanisms

The June 2025 crash was more than just a blip – it was a real-world stress test for every stablecoin mechanism on the market. As panic set in across DeFi protocols, redemption queues grew longer and liquidity dried up fast. Even well-collateralized coins felt pressure as users questioned whether any peg could truly hold under systemic duress.

Key Factors Behind USDE and USST Depegging in June 2025

-

Collateral Instability: USDE’s reserves included volatile assets like Bitcoin (BTC), Ethereum (ETH), and low-liquidity tokens such as DOLO. Notably, $50 million USDE was minted against DOLO, which had a market capitalization of just $14.2 million, amplifying depegging risk during downturns.

-

Lack of Transparency: Only 4% of USDE’s reserves were visible on-chain, with 96% held off-chain. This opacity fueled skepticism about the true backing of the stablecoin and eroded user confidence.

-

Algorithmic Vulnerabilities: USST relied on complex algorithms to maintain its peg. During extreme market volatility in June 2025, these mechanisms failed, causing rapid and substantial devaluation.

-

Market Volatility: The June 2025 crypto crash triggered sharp shifts in demand and liquidity, straining stablecoin mechanisms and leading to significant slippage from the $1 peg for both USDE and USST.

This collective loss of confidence triggered feedback loops where every attempted redemption or sale pushed prices further from their targets – classic bank run dynamics now playing out on-chain at lightning speed.

“Stablecoin depegs aren’t black swan events anymore – they’re structural risks that every DeFi user needs to understand. “

Lessons Emerging from DeFi Stablecoin Failures

If there’s one clear lesson from June 2025, it’s that not all pegs are created equal – and not all are built to last through crisis conditions. Users learned quickly that:

- Transparency matters more than ever.

- Diversified collateral is critical for resilience.

- Algorithmic designs carry unique vulnerabilities.

- Market conditions can overwhelm even robust mechanisms.

This reckoning is forcing both developers and investors to rethink how they evaluate risk in synthetic dollar assets going forward.

As the dust settled, the June 2025 stablecoin depegs left a mark on DeFi risk analysis. USDE and USST’s instability wasn’t just a technical footnote; it was a wake-up call for the entire ecosystem. The aftermath saw liquidity pools drained, lending protocols scrambling to reprice collateral, and countless users re-evaluating their approach to stablecoin exposure.

For those holding USDE, the reality of seeing a supposedly safe asset dip nearly 8% below its peg was jarring. Even now, with HyperEVM Bridged USDE (HyperEVM) at $1.00, the scars of that volatility linger in user sentiment and protocol design. The lesson for DeFi users is clear: stablecoin risk isn’t theoretical. It’s an ever-present factor that demands vigilance and proactive management.

How to Protect Your DeFi Assets: Risk Mitigation Strategies

So what concrete steps can you take to guard against future stablecoin failures? Here are actionable strategies every DeFi participant should consider:

Checklist: Protecting DeFi Assets from Stablecoin Depeg Risks

-

Choose Stablecoins with Transparent ReservesPrioritize stablecoins like USDC and DAI that provide regular, on-chain proof of reserves and undergo third-party audits. Transparency helps users verify collateral adequacy and reduces the risk of hidden vulnerabilities.

-

Assess Collateral Quality and DiversificationReview the collateral backing your stablecoin. Favor stablecoins with diversified, high-quality assets (e.g., fiat currencies, U.S. Treasuries, blue-chip cryptocurrencies) over those heavily reliant on low-liquidity or volatile tokens.

-

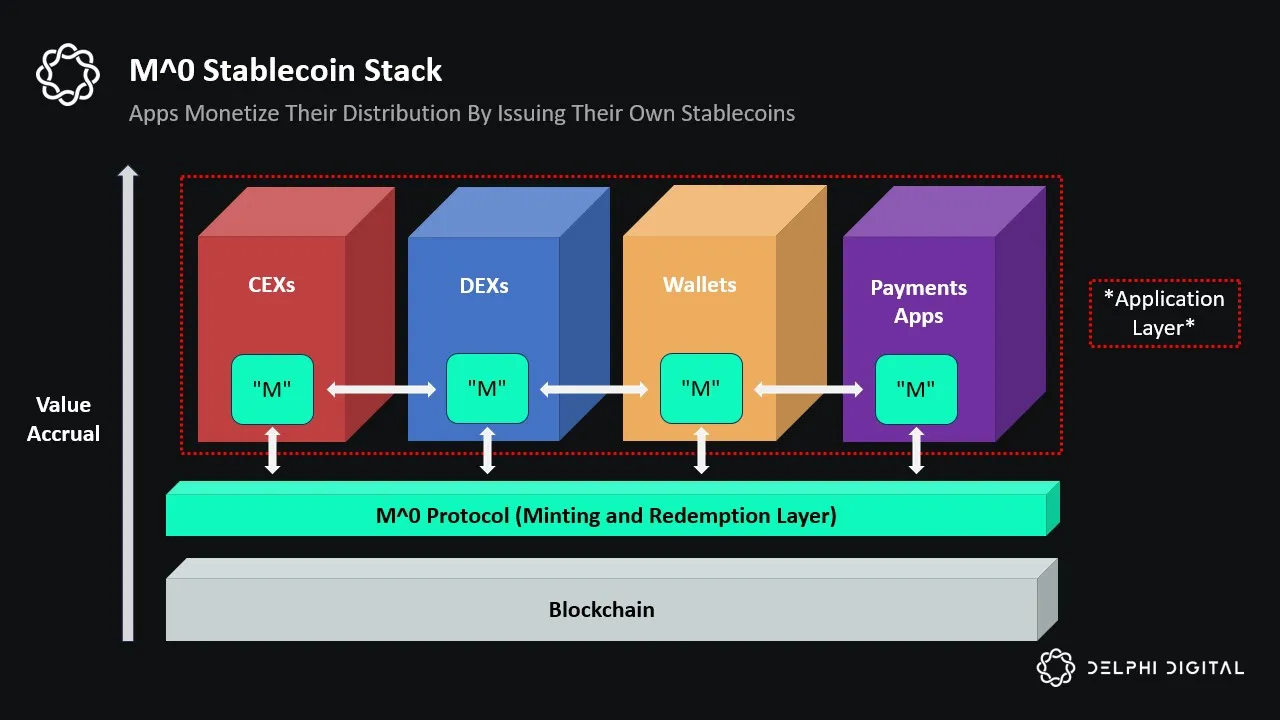

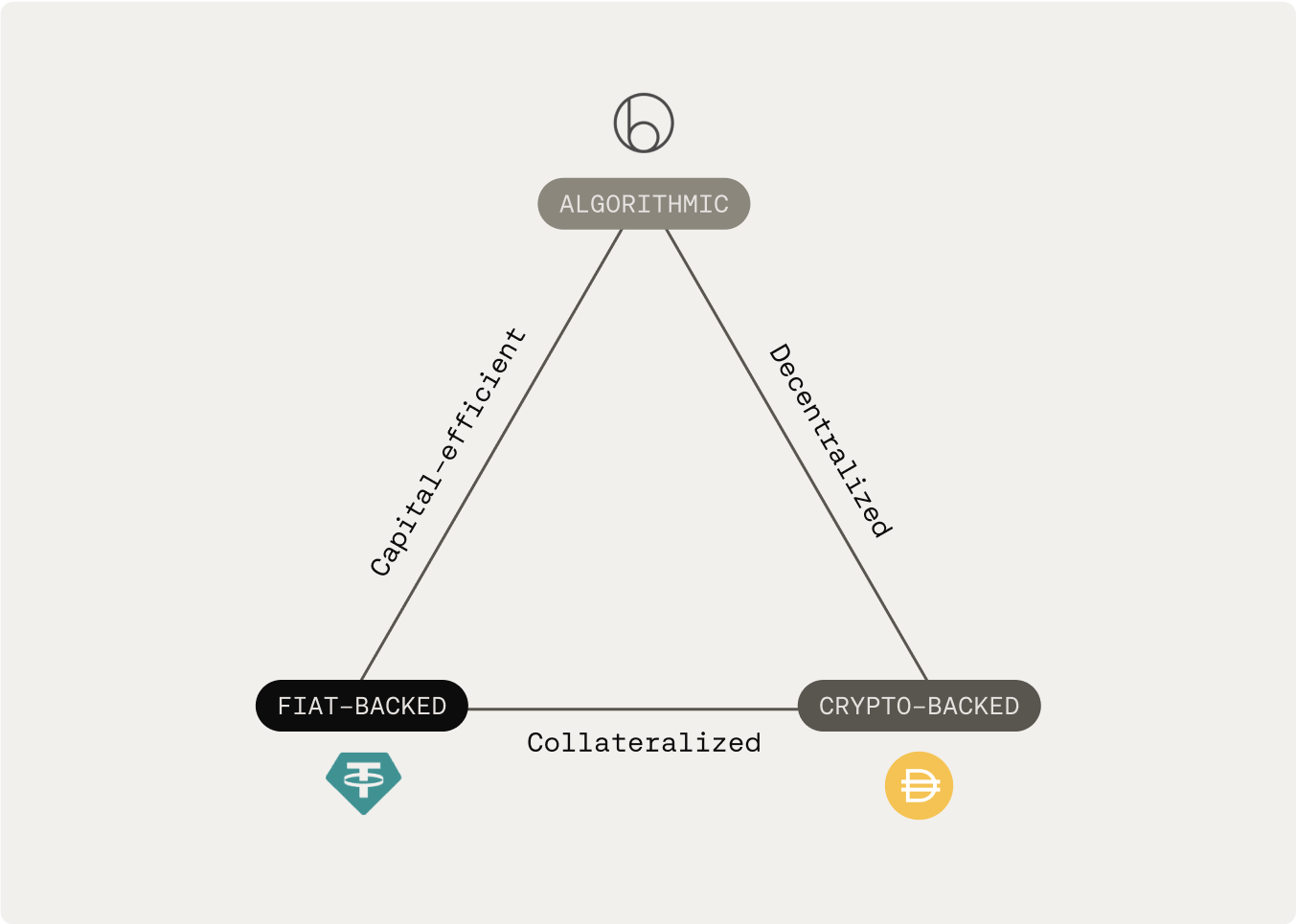

Understand the Stablecoin’s Peg MechanismLearn whether the stablecoin is fiat-backed, crypto-collateralized, or algorithmic. Algorithmic stablecoins like USST have historically shown higher depegging risk during market stress.

-

Monitor Market Conditions and Stablecoin PriceStay alert to market volatility and monitor your stablecoin’s price on reputable platforms such as CoinGecko or CoinMarketCap. For example, in June 2025, USDE dropped by 7.99% from its $1 peg, highlighting the importance of vigilance.

-

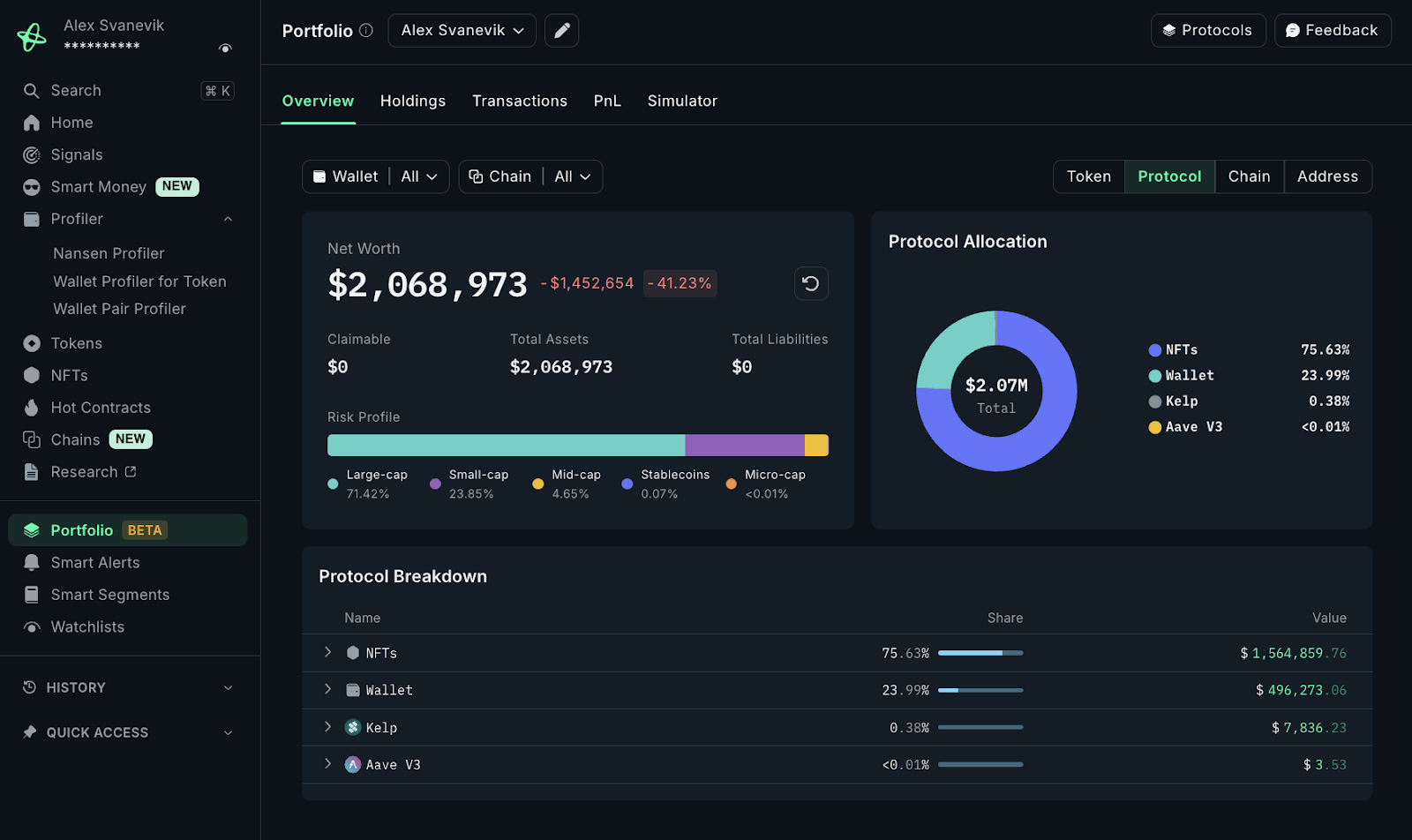

Diversify Across Multiple Stablecoins and PlatformsAvoid concentrating assets in a single stablecoin or protocol. Use a mix of established stablecoins (e.g., USDC, DAI, USDT) and spread holdings across reputable DeFi platforms to minimize exposure to a single point of failure.

-

Set Up Automated Alerts and Stop-LossesUtilize DeFi tools like DeBank or Zapper to track your stablecoin positions and set up price alerts or stop-loss orders to react quickly to depegging events.

-

Regularly Review Regulatory DevelopmentsKeep up-to-date with evolving regulations such as the MiCA framework in the EU, which aims to enhance stablecoin transparency and consumer protections.

- Favor transparency: Stick with stablecoins offering real-time, on-chain proof of reserves and regular third-party audits. Opaque projects can hide dangerous leverage or illiquidity.

- Diversify your stablecoin holdings: Don’t put all your digital dollars into one asset or protocol. Spread risk across multiple coins with different collateral models.

- Monitor liquidity and redemption mechanisms: Choose coins with deep secondary markets and robust redemption frameworks so you’re not trapped during market stress.

- Stay informed about regulatory changes: New rules like the STABLE Act 2025 can impact how certain stablecoins operate or are backed (AInvest).

The growing sophistication of attack vectors – from oracle manipulation to governance exploits – means that even well-designed coins aren’t immune. Always weigh yield against risk; high returns often signal hidden dangers lurking beneath the surface.

Looking Ahead: What Will Shape Stablecoin Security?

The events of June 2025 have already spurred new conversations among developers, auditors, and regulators. Expect to see more rigorous reserve disclosures, automated circuit breakers for redemptions, and smarter oracle integrations designed to withstand volatility spikes (Smart Liquidity breakdown). The MiCA framework in Europe is also pushing for higher standards in transparency and consumer protection across all digital assets.

If you’re building or investing in DeFi, now is the time to demand better from your stablecoins: clearer audits, diversified collateral portfolios, real-time data feeds, and robust contingency plans for black swan events. Remember that even today’s most trusted coins can unravel if core risks go unaddressed.

The bottom line? Stablecoins will remain a pillar of crypto finance – but only if users stay vigilant about their underlying risks. Knowledge is your best defense in this evolving landscape.