Stablecoin depeg events have become one of the most acute risks in decentralized finance (DeFi) as the market matures in 2024. With billions of dollars locked in protocols relying on stablecoins as a source of liquidity and collateral, even minor deviations from the $1 peg can trigger cascading liquidations or impermanent loss. Recent incidents underscore that no stablecoin is immune, whether algorithmic or fiat-backed, making robust risk management essential for DeFi participants.

Why Stablecoin Depeg Risk Is Rising in 2024

Several converging factors have elevated depeg risk this year. Regulatory scrutiny is tightening, with frameworks like the EU’s MiCA mandating stricter reserve ratios for issuers. Meanwhile, macro volatility and on-chain liquidity fragmentation have exposed weaknesses in both centralized and algorithmic stablecoin models. Even USDC, long considered a benchmark for stability, has seen short-lived but significant deviations from its peg under stress scenarios.

With these developments, DeFi insurance for stablecoin depeg has moved from a niche offering to a portfolio staple. According to The Defiant, Etherisc’s parametric USDC depeg cover, powered by Chainlink oracles, has been a notable milestone, providing automated payouts if USDC trades below a preset threshold and fails to recover within a specific window.

Key Strategies to Protect Assets from Stablecoin Depegging

Top Strategies to Protect DeFi Assets from Stablecoin Depegs

-

Diversify Stablecoin Holdings: Reduce risk by allocating assets across multiple reputable stablecoins such as USDC, DAI, and USDT. Assess each stablecoin’s collateralization and mechanism to ensure true diversification.

-

Utilize Depeg Protection Products: Leverage decentralized insurance platforms like Etherisc, which offers automated USDC depeg protection powered by Chainlink. These products provide payouts if a stablecoin loses its peg and fails to recover within a set period.

-

Implement Hedging Strategies: Use derivatives such as put options and perpetual futures on platforms like SuperEx to hedge against potential stablecoin price drops. These tools allow you to lock in sell prices or take short positions for risk mitigation.

-

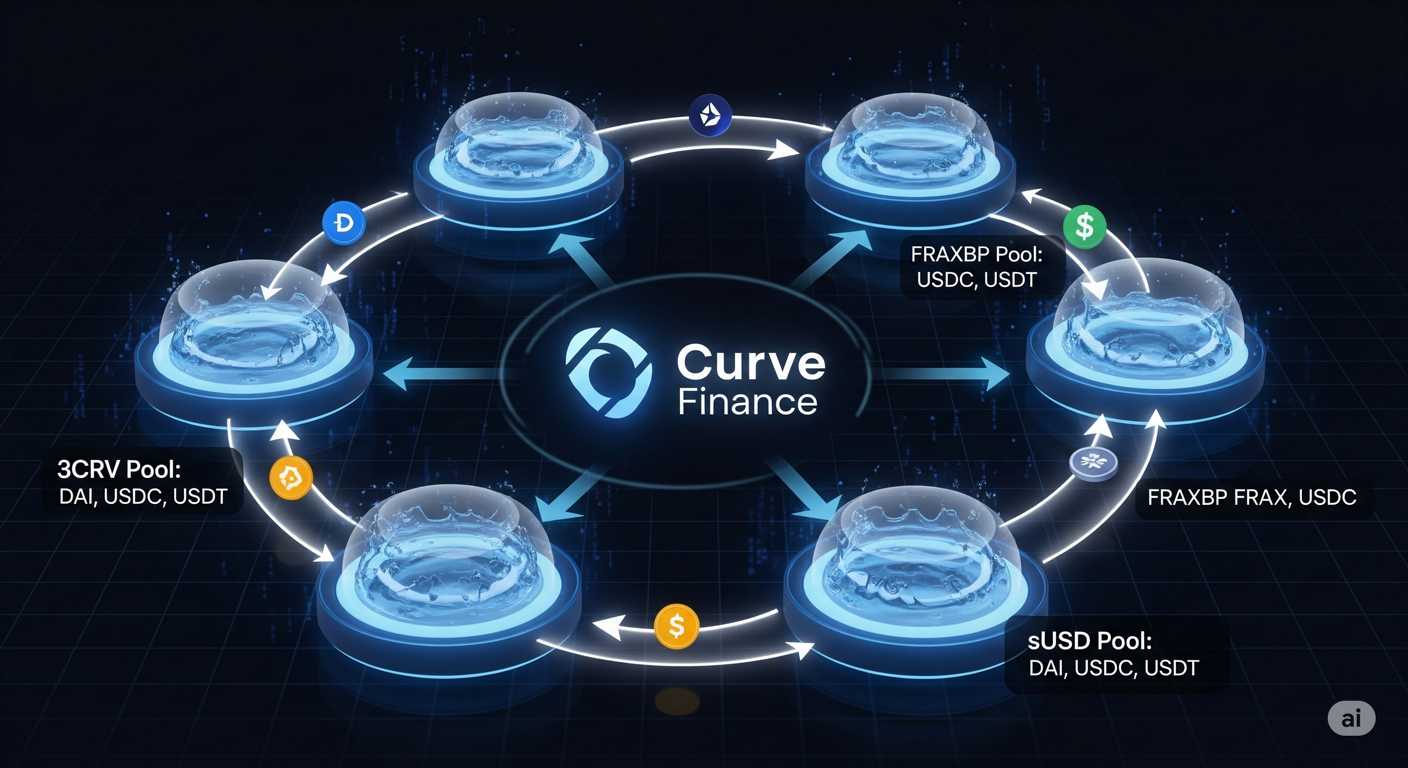

Engage in Liquidity Pool Hedging: Provide liquidity to stablecoin pairs on AMMs like Curve and Uniswap. Earn trading fees and benefit from advanced features such as concentrated liquidity and impermanent loss protection to offset minor depegs.

-

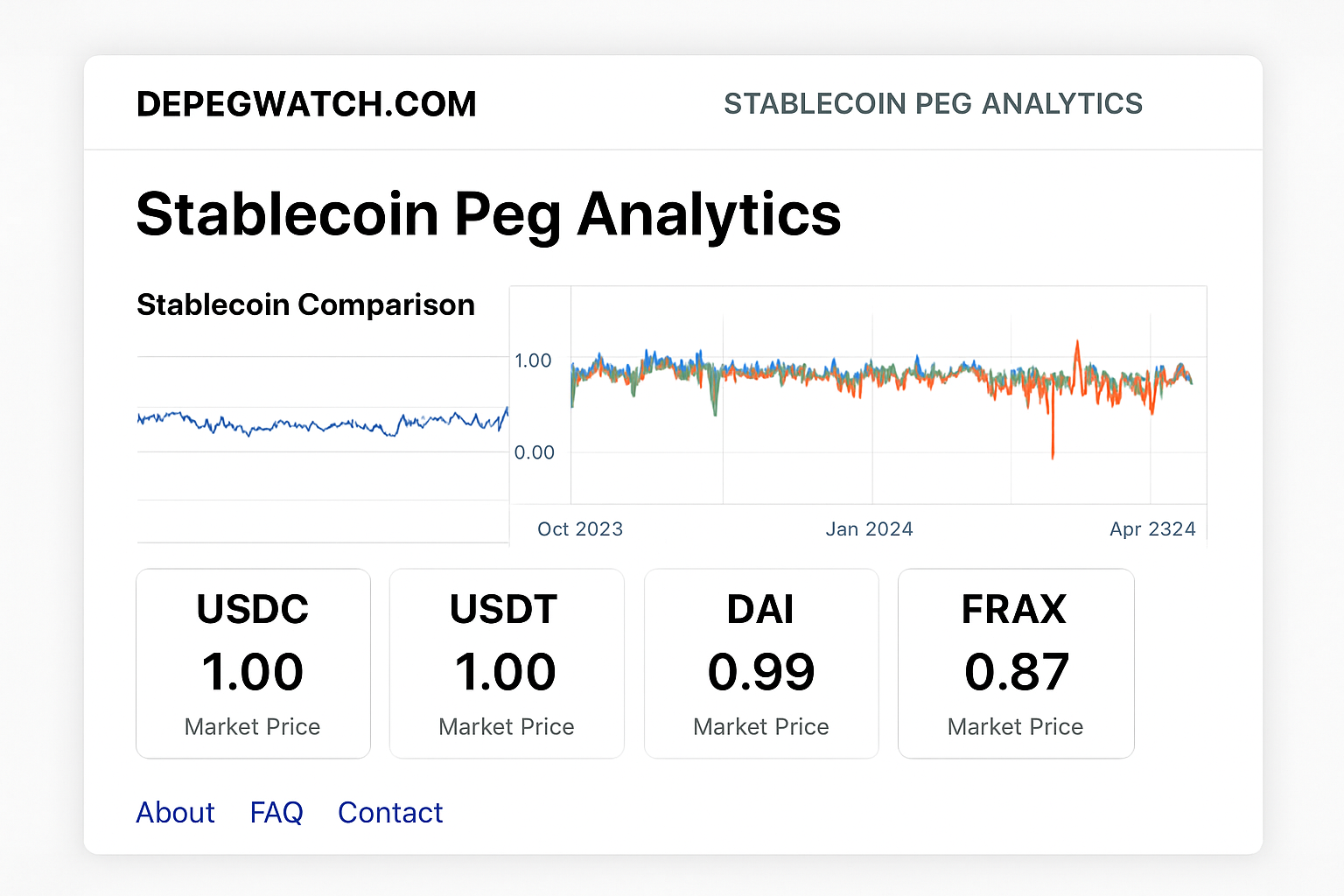

Monitor Stablecoin Pegs in Real-Time: Use analytics platforms like DepegWatch.com to track live price feeds and receive alerts for peg deviations. Early detection enables prompt portfolio rebalancing or activation of hedging strategies.

-

Stay Informed on Regulatory Developments: Follow updates on regulations such as the EU’s MiCA framework, which enforces strict liquidity and reserve requirements for stablecoin issuers. Regulatory awareness helps anticipate risks and adapt strategies accordingly.

Asset protection is multi-layered. Here are the foundational tactics:

- Diversify Stablecoin Holdings: Spread exposure across multiple reputable stablecoins, such as USDC, DAI, and USDT, to avoid single-point failures. But remember: not all diversification is equal; analyze collateralization mechanisms and audit transparency.

- Purchase Depeg Insurance: Platforms like InsurAce, Nexus Mutual, Opium Insurance, and Etherisc now offer specialized stablecoin depeg coverage, often with parametric triggers for swift settlement.

- Deploy Hedging Instruments: Use put options or perpetual futures to short at-risk stablecoins. This can offset losses if a peg breaks.

- Engage in Liquidity Pool Hedging: AMMs like Curve offer pools where trading fees can counterbalance mild depegs, especially when paired with impermanent loss protection features.

The Role of Real-Time Monitoring and Automation

The difference between minor inconvenience and catastrophic loss often comes down to speed of response. Modern analytics platforms such as DepegWatch. com aggregate live price data and on-chain signals to flag early signs of instability. Customizable alerts let investors rebalance portfolios or trigger hedges at predefined thresholds, critical when seconds count in volatile markets.

This kind of proactive monitoring is essential not just for whales but also retail users who lack the resources for manual vigilance around the clock.

Selecting the Right Stablecoin Depeg Insurance Provider

The decentralized insurance landscape has matured rapidly since 2023. Key players include InsurAce (multi-chain coverage), Nexus Mutual (smart contract bugs plus select depegs), Tidal Finance (customized pools), Ease (no-premium model), Neptune Mutual (parametric solutions), and Etherisc (USDC-specific cover). Each provider offers unique terms regarding covered events, payout mechanisms, premiums, and exclusions.

A comparative analysis should focus on claim transparency, oracle reliability (for parametric triggers), protocol solvency ratios, user reviews, and integration with your preferred DeFi stack. For an up-to-date list of options see Alchemy’s overview of 11 decentralized insurance dapps.

For those seeking stablecoin depeg coverage in 2024, understanding the nuances between providers is critical. For example, Etherisc’s USDC protection leverages Chainlink oracles for price verification and offers pre-defined payout logic, while InsurAce emphasizes multi-chain support and customizable policy durations. Nexus Mutual, long known for smart contract exploit insurance, has expanded into stablecoin-specific products but maintains a rigorous claims assessment process. Premiums are typically denominated in crypto, with some protocols offering dynamic pricing based on real-time risk metrics.

It’s advisable to review each protocol’s documentation on claim eligibility and settlement times. In the event of a market-wide depeg, liquidity constraints may delay payouts, so opt for platforms with robust capital reserves and transparent proof-of-reserves reporting. Also, consider whether insurance is custodial or non-custodial; non-custodial models give you greater control over your assets during the policy term.

Integrating DeFi Risk Management into Your Portfolio

Effective DeFi risk management for stablecoins is not a set-and-forget exercise. Regularly reassess your portfolio’s exposure as new stablecoins launch and regulatory frameworks evolve. Use automated rebalancing tools to adjust allocations in response to real-time peg deviations or shifts in protocol risk ratings. Many DeFi dashboards now integrate alerting systems that can execute pre-programmed trades or swaps when certain thresholds are breached.

Additionally, consider blending insurance with hedging strategies, such as holding put options while maintaining active depeg cover, to create a layered defense. Some advanced users even deploy algorithmic bots that monitor on-chain flows and execute mitigation trades at the first sign of instability.

Staying Ahead: Education and Community Insights

The landscape of stablecoin depeg insurance providers evolves rapidly as new exploits are discovered and patched. Engaging with community forums, following DeFi security researchers on social media, and participating in governance discussions can provide early warnings about systemic risks or upcoming protocol changes. Peer-to-peer knowledge sharing remains invaluable, oftentimes, crowdsourced intelligence identifies vulnerabilities before official audits do.

Top Community Resources for DeFi Insurance Trends

-

DeFi Insurance Subreddit (r/DeFiInsurance): A highly active forum for discussions, news, and user experiences on decentralized insurance protocols, including stablecoin depeg coverage and risk management strategies.

-

Nexus Mutual Community Forum: Nexus Mutual’s official forum (forum.nexusmutual.io) is a hub for updates on new insurance products, governance proposals, and technical analysis of DeFi insurance trends.

-

InsurAce Telegram Group: The InsurAce Protocol Telegram channel offers real-time updates, AMAs, and direct Q&A with the team on DeFi insurance innovations and platform developments.

-

DepegWatch.com: This analytics platform (depegwatch.com) provides live monitoring of stablecoin pegs, incident alerts, and educational content on depeg protection and insurance solutions.

-

CoinGecko DeFi Insurance Section: CoinGecko’s Insurance category tracks DeFi insurance tokens, market data, and project news, helping users stay informed about the latest trends and coverage options.

-

Etherisc Community Discord: The Etherisc Discord server is a gathering place for technical discussions, product announcements, and collaborative research on parametric insurance and stablecoin depeg coverage.

Finally, always verify that your chosen protocols undergo regular third-party audits and have established bug bounty programs. Transparency around reserves, claims processing data, and payout history should be non-negotiable when selecting any risk mitigation tool in DeFi.

Final Thoughts: Building Resilience Amid Uncertainty

The reality is that no single solution can fully eliminate the threat of stablecoin depegging events, but by combining diversification, real-time monitoring, robust insurance products, automated hedging strategies, and continuous education, investors can materially reduce their downside exposure. The tools for protecting assets from stablecoin depeg are more sophisticated than ever before, yet they require diligence to deploy effectively.