Stablecoin payments are rapidly evolving, with user demand for speed, reliability, and simplicity pushing the boundaries of what blockchain infrastructure can deliver. In 2025, Stablechain emerged as a purpose-built Layer 1 network, laser-focused on optimizing stablecoin transactions, particularly those involving Tether’s USDT. With USDT currently holding steady at $1.00 on Polygon, Stablechain’s unique approach promises to redefine how both consumers and enterprises interact with digital dollars in everyday life.

Why the World Needs a USDT-Native Blockchain

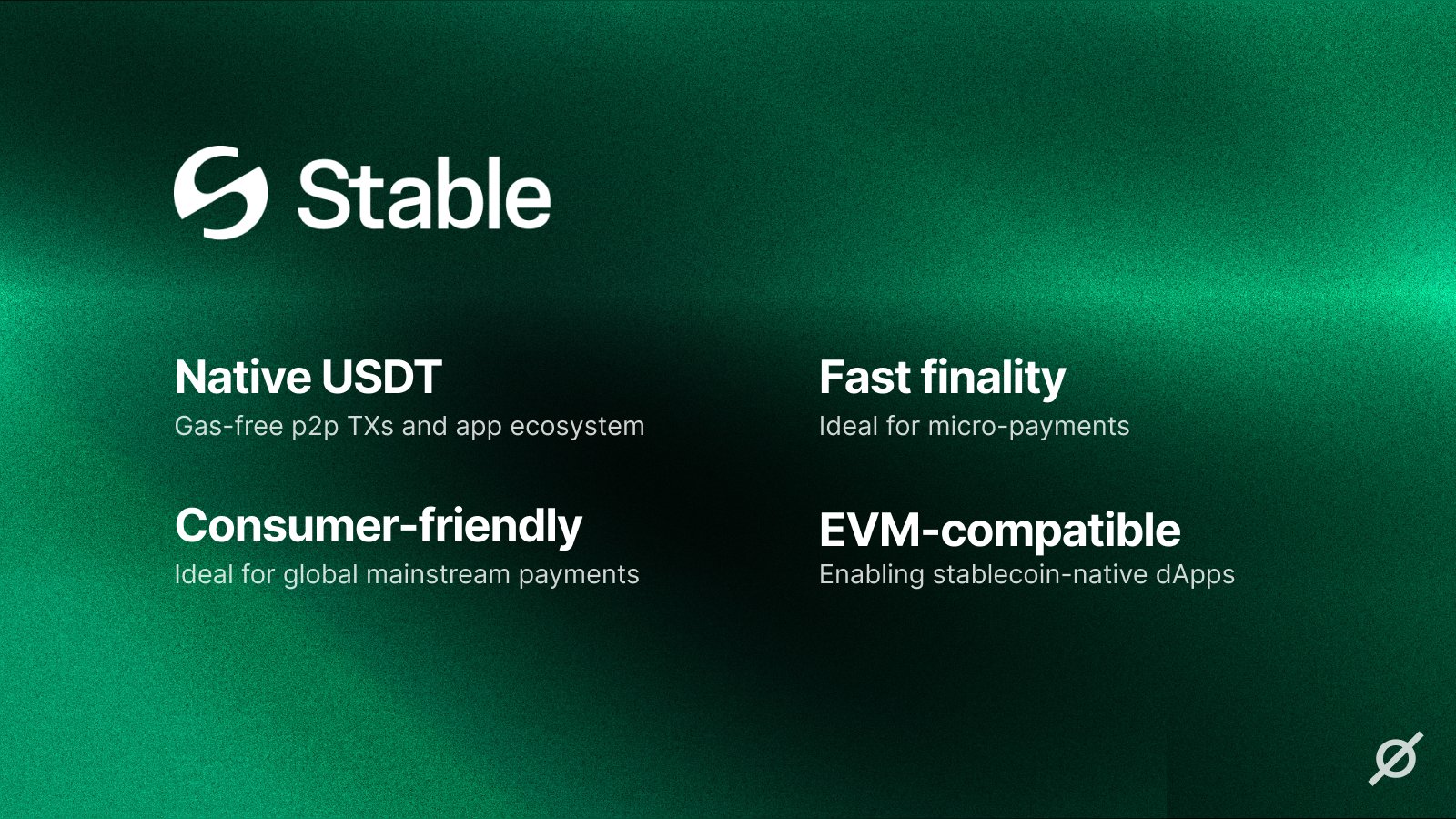

Stablecoins have become the backbone of crypto payments infrastructure. Yet even as platforms like Stables and KAST Card make it easier to spend or off-ramp stablecoins globally, users still face friction: unpredictable gas fees, slow settlement times during peak demand, and the hassle of managing multiple volatile tokens for transaction costs. Enter Stablechain, a Layer 1 for stablecoins that replaces these pain points with a streamlined experience where USDT is both the gas token and settlement asset.

This design means users no longer need to hold ETH or another native token just to pay for network fees. Instead, transactions, from micro-payments to enterprise-scale transfers, are settled in real time using the world’s most liquid stablecoin. The result is a more intuitive user journey that mirrors traditional fintech apps while preserving all the benefits of DeFi’s open architecture.

Key Features: Speed, Scalability, and EVM Compatibility

Stablechain isn’t just about convenience, it’s engineered for performance:

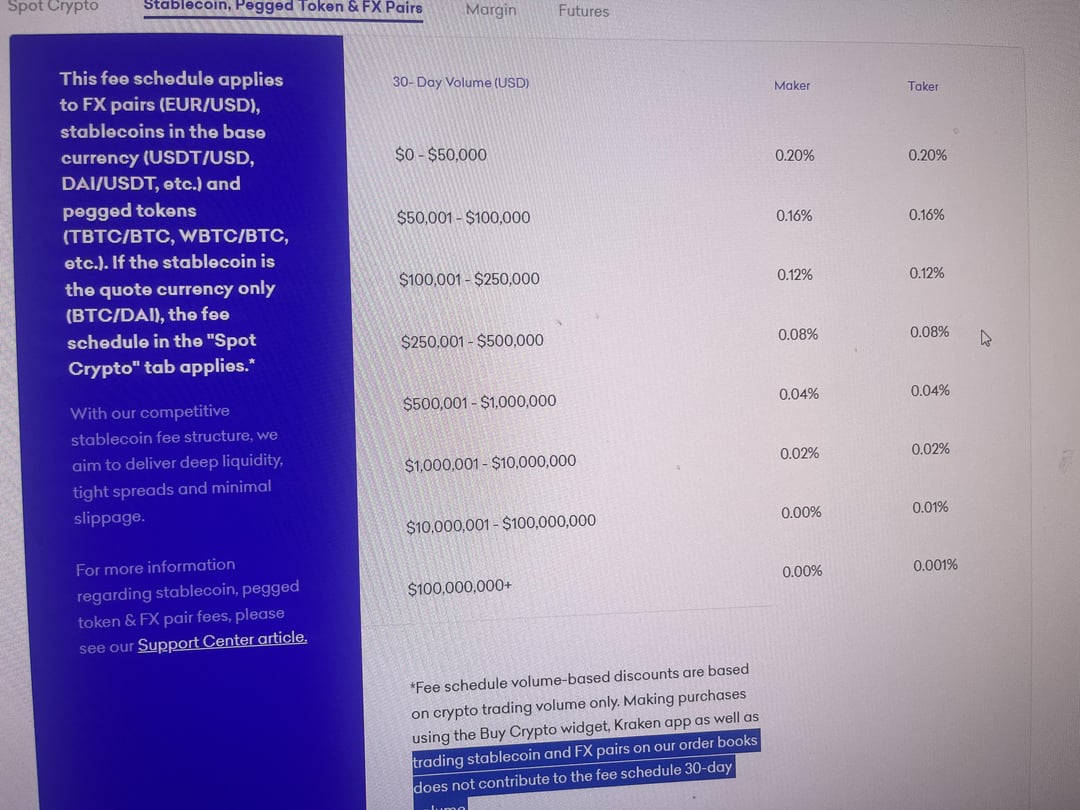

- USDT as Native Gas Token: Every transaction fee is paid directly in USDT at $1.00, eliminating currency conversion headaches.

- High Throughput and Sub-Second Finality: The network handles thousands of transactions per second with near-instant confirmation, critical for point-of-sale payments and institutional settlements alike.

- Enterprise-Grade Scalability: Dedicated blockspace ensures predictable speeds and fees even during periods of high demand, a must-have for global payment providers.

- EVM Compatibility: Developers can port existing Ethereum-based applications to Stablechain without rewriting code, unlocking rapid innovation in DeFi stablecoin transfers and payment dApps.

This technical foundation positions Stablechain as a compelling alternative to legacy networks struggling with congestion or volatile fee structures.

Pioneering Partnerships and Regulatory Tailwinds

The momentum behind Stablechain isn’t just technical, it’s financial and regulatory too. In July 2025, the project closed a $28 million seed round led by Bitfinex and Hack VC, drawing support from institutional heavyweights like Franklin Templeton and KuCoin Ventures. These funds are earmarked for scaling infrastructure and expanding global access to USDT-powered payments.

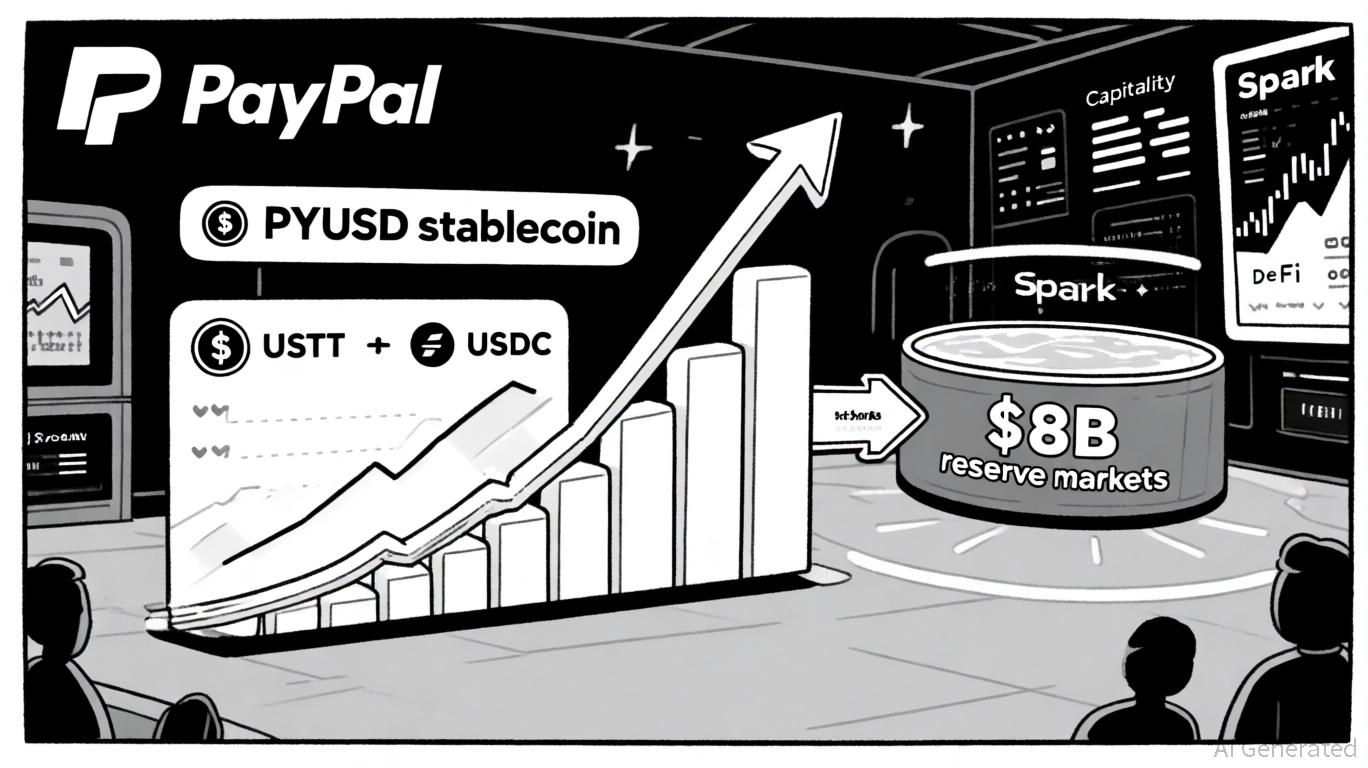

The September 2025 announcement of a strategic partnership with PayPal further underscores Stablechain’s ambition. By integrating PayPal’s PYUSD into its ecosystem, Stablechain broadens its liquidity base while giving users more options for seamless cross-border payments, a move that could set new standards across stablecoin payment platforms.

This all unfolds against the backdrop of the GENIUS Act in the United States, a landmark law providing regulatory clarity for stablecoin operations by establishing clear guidelines for banks building digital payment rails. With this supportive legal environment, Stablechain is well-positioned to attract both retail users seeking frictionless spending experiences (like those offered by Stables Money) and enterprises looking for reliable on/off ramps into fiat currencies worldwide.

The Competitive Edge: Real-World Impact

As consumer reviews from Australia’s Stables app highlight, smooth UI/UX and fast off-ramps are now baseline expectations, not luxuries, in crypto payments. By removing volatility concerns (no need to juggle multiple coins), offering sub-second settlement speeds, and enabling direct integration with mainstream players like PayPal, Stablechain shows how an EVM compatible stablecoin chain can bridge today’s usability gap between crypto natives and mainstream adopters.

For developers and fintech innovators, Stablechain’s EVM compatibility is a game changer. It allows rapid deployment of payment apps, wallets, and DeFi protocols without the friction of learning a new stack. This not only accelerates time-to-market for new stablecoin solutions but also lowers costs for teams building on the network. The result? A fertile ecosystem where next-gen payment tools, like the Stable Pay wallet or global remittance dApps, can flourish with minimal technical hurdles.

Top Benefits of Using Stablechain for Stablecoin Payments

-

USDT as Native Gas Token: Stablechain allows users to pay transaction fees directly in USDT, eliminating the need for a separate, volatile gas token and simplifying the payment process.

-

High Throughput & Sub-Second Finality: The network supports thousands of transactions per second with sub-second block finality, ensuring payments are processed quickly and reliably.

-

Predictable, Low Transaction Fees: By using USDT for fees and optimizing for stablecoin payments, Stablechain offers consistent and transparent transaction costs, avoiding the unpredictable gas fees common on other blockchains.

-

Enterprise-Grade Scalability: Stablechain provides dedicated blockspace for enterprises, enabling predictable speeds and fees for high-volume payment operations.

-

Seamless Developer Experience: With full EVM compatibility, developers can easily deploy existing Ethereum-based applications on Stablechain, accelerating innovation in stablecoin payments.

-

Strategic Partnerships & Ecosystem Growth: Recent partnerships, including with PayPal for PYUSD integration, and $28 million in seed funding led by Bitfinex and Hack VC, are expanding Stablechain’s utility and liquidity.

-

Supportive Regulatory Framework: Launching alongside the GENIUS Act in the US, Stablechain benefits from new regulatory clarity, making it a compliant and future-ready platform for stablecoin payments.

Institutional players are especially drawn to Stablechain’s promise of enterprise-grade scalability. Predictable transaction speeds and fees are critical for high-volume use cases, think payroll disbursements, cross-border settlements, or merchant payments at scale. By offering dedicated blockspace and eliminating native token volatility, Stablechain gives businesses the confidence to integrate stablecoin payments into their core operations.

Mitigating Risks: Security, Depeg Protection, and User Trust

Despite their stability, stablecoins like USDT are not immune to risks. Smart contract exploits and de-pegging events have rattled user confidence in the past. Here’s where Stablechain’s architecture provides an additional layer of reassurance. With robust network security measures, ranging from audited smart contracts to real-time transaction monitoring, the platform aims to minimize exploit vectors that have plagued other chains.

Moreover, the emergence of DeFi insurance products and depeg protection tools is set to dovetail with Stablechain’s infrastructure. Users can expect integrated options for insuring their USDT balances or safeguarding against sudden price deviations from $1.00, further boosting trust in stablecoin-powered commerce.

Looking Ahead: The Roadmap for Global Adoption

The future of stablecoin payments will be shaped by networks that deliver both performance and peace of mind. With its focus on speed, cost-effectiveness, regulatory alignment, and seamless user experience, Stablechain is well positioned to become the backbone of digital dollar transactions worldwide.

The upcoming rollout of features like multi-currency support (beyond USDT), deeper integration with fiat on/off ramps (as seen in apps like Stables Money), and enhanced developer tooling will only strengthen its appeal. As more users join the Stable app waitlist and enterprises pilot cross-border payment flows on this EVM compatible stablecoin chain, expect adoption curves to steepen rapidly through 2026.

Stablechain isn’t just another Layer 1, it’s a blueprint for how digital assets can power everyday commerce without compromise. For those seeking a deeper dive into how this USDT-native blockchain is redefining the future of payments infrastructure, see our detailed guide at /how-stablechain-is-redefining-stablecoin-payments-usdt-native-layer-1-explained.