When a smart contract exploit hits a DeFi protocol, the aftermath can be chaotic and costly. For users who have taken the precaution of purchasing DeFi insurance, knowing exactly how to file a claim is critical. The process has evolved rapidly, leveraging self-executing contracts and decentralized governance to deliver faster, more transparent outcomes than legacy insurers ever could. Yet, despite these advances, successfully navigating the DeFi insurance claim process requires precision and preparation.

DeFi Insurance Claims: What Makes Them Different?

Unlike traditional insurance where adjusters and paperwork dominate, DeFi insurance leans on smart contracts, on-chain data, and community voting to assess claims. This shift means that users must engage directly with decentralized protocols and often participate in governance processes to validate their losses. Understanding these distinctions is key to avoiding delays or denials during your claim following a smart contract exploit.

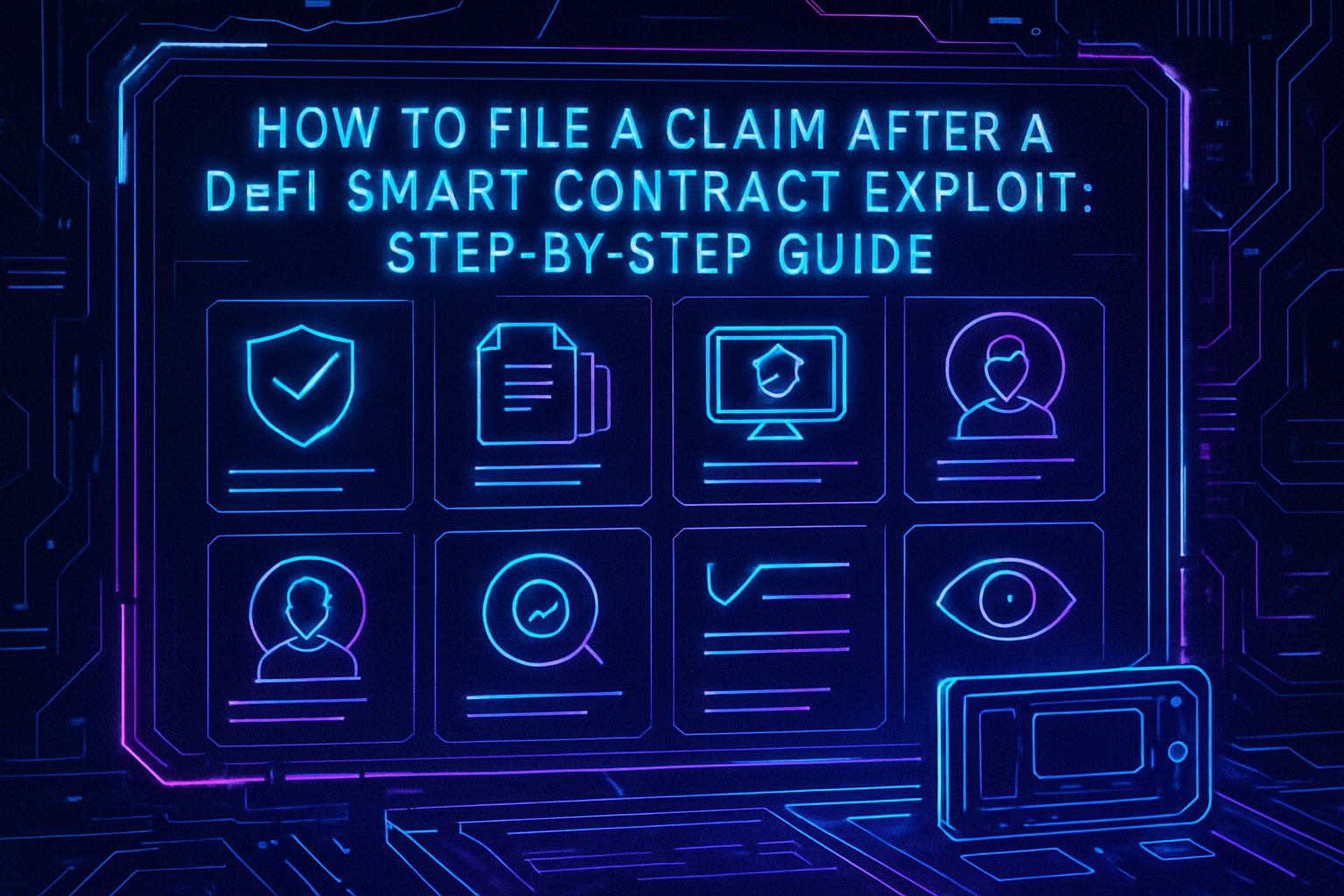

Below is a step-by-step guide tailored for today’s leading DeFi coverage protocols. Each step corresponds precisely to how modern decentralized insurance platforms handle claims after an exploit.

Your Step-by-Step Guide: Filing a Claim After a Smart Contract Exploit

5 Essential Steps in the DeFi Insurance Claim Process

-

Verify Coverage and Incident Eligibility: Before taking action, review your DeFi insurance policy (e.g., Nexus Mutual, InsurAce) to confirm the exploit is covered. Ensure your loss aligns with the policy’s terms, such as protection against smart contract vulnerabilities or protocol failures.

-

Collect and Prepare Required Documentation: Gather all evidence related to the exploit. This includes incident details, affected wallet addresses, transaction hashes, screenshots, and relevant on-chain data. Well-prepared documentation strengthens your claim.

-

Submit Claim via DeFi Insurance Platform Interface: Access your insurance provider’s platform (e.g., Nexus Mutual). Connect your wallet, select your policy, and follow the guided claim submission steps. Upload all required documentation and verify wallet ownership as prompted.

-

Participate in Claims Assessment or Voting (if applicable): Many DeFi insurance protocols use decentralized governance. Community members or token holders review your claim and vote on its validity. Engage with the process if your input is required, and monitor voting progress.

-

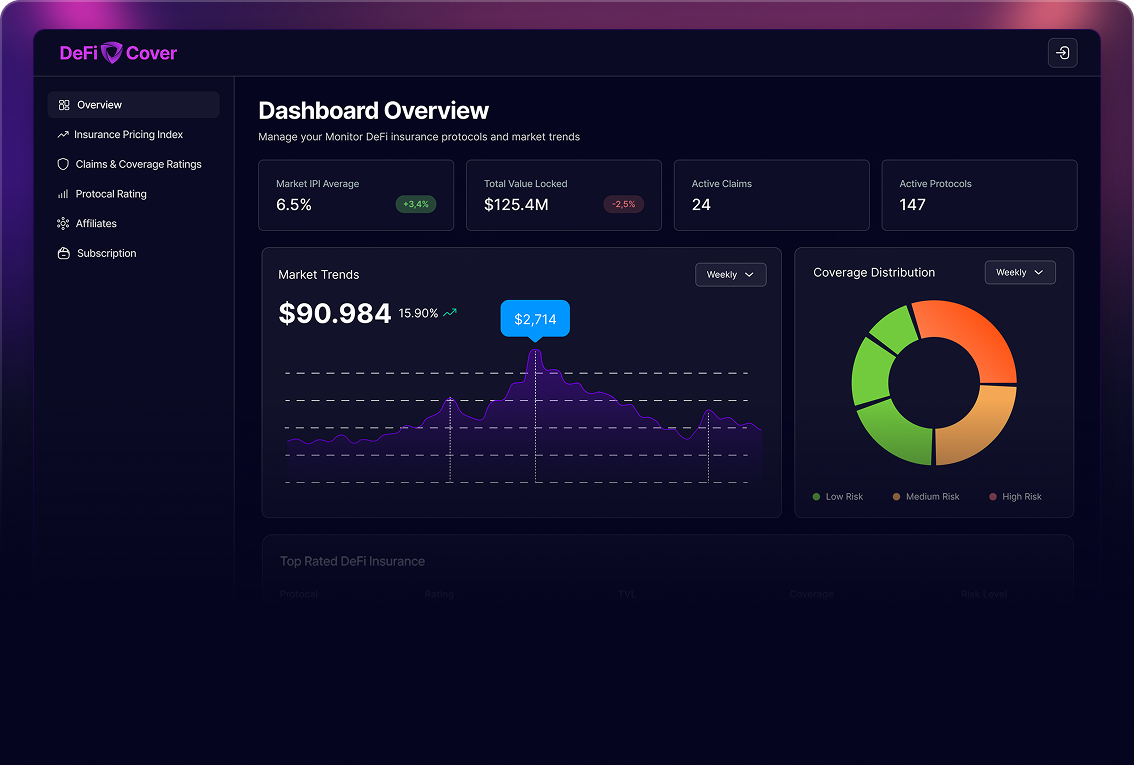

Monitor Claim Status and Receive Payout: Track your claim’s progress through the platform’s dashboard. If approved, payouts are typically processed automatically to your wallet. If denied, review the feedback and consider submitting additional information or appealing if allowed.

1. Verify Coverage and Incident Eligibility

Before anything else, confirm that your loss qualifies under your specific DeFi insurance policy. Most policies are explicit about what constitutes a covered event – for instance, direct losses from unauthorized withdrawals due to code vulnerabilities or economic failures in protocols like Aave or Compound. Review your policy details carefully; if you’re unsure whether your incident is covered, consult the platform’s documentation or community forums.

2. Collect and Prepare Required Documentation

This step can make or break your claim’s success rate. Gather all necessary evidence:

- Incident Details: Date, time, and description of the exploit

- Affected Wallet Addresses: All impacted wallets must be listed

- Proof of Loss: Screenshots, transaction hashes, on-chain analytics – anything that validates your claim

The more thorough you are here, the smoother your claim will proceed through assessment.

3. Submit Claim via DeFi Insurance Platform Interface

Navigating the platform interface is usually straightforward but demands attention to detail. Log into your provider’s dApp (such as Nexus Mutual), connect your wallet, select the relevant policy under ‘My Covers, ’ then initiate your claim submission. You’ll be prompted to enter incident details and upload supporting documents. Some protocols may require you to sign messages from affected wallets as proof of ownership.

The Role of Community Assessment and Real-Time Monitoring

The next steps provides participating in claims assessment or voting, then monitoring status until payout, are where DeFi’s unique model stands apart from TradFi insurers. Community involvement ensures transparency but also means you need to stay engaged during voting periods.