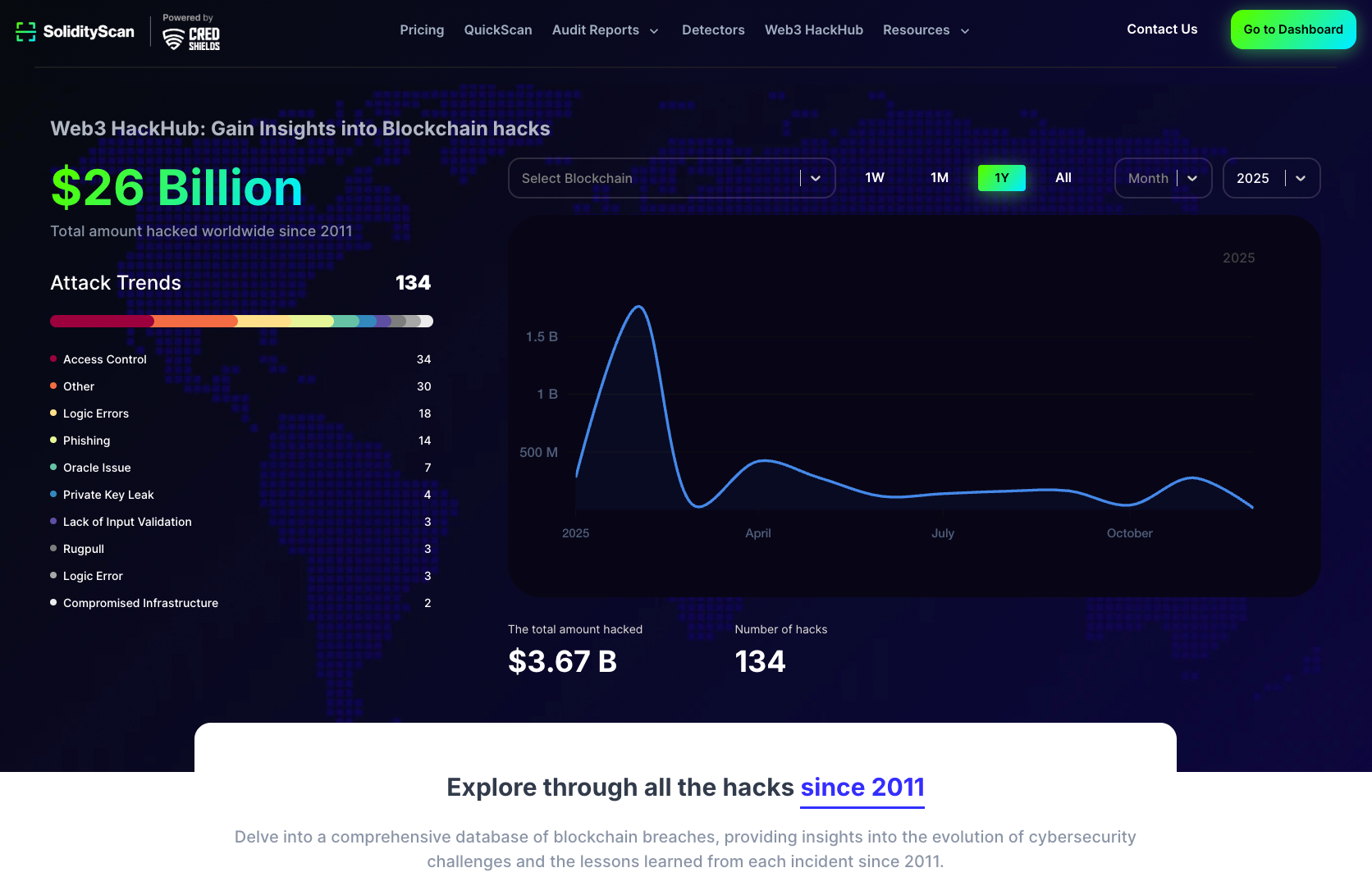

In the fast-evolving world of DeFi, chained smart contract exploits have emerged as a stealthy predator, linking vulnerabilities across multiple protocols to unleash devastating losses. Just look at the recent Truebit Protocol incident: a smart contract flaw let attackers mint tokens for pennies, draining $26 million and cratering the TRU token by 99%. This wasn’t a isolated hit; it rippled through interconnected systems, highlighting the brutal reality of DeFi multi-contract attacks in 2026.

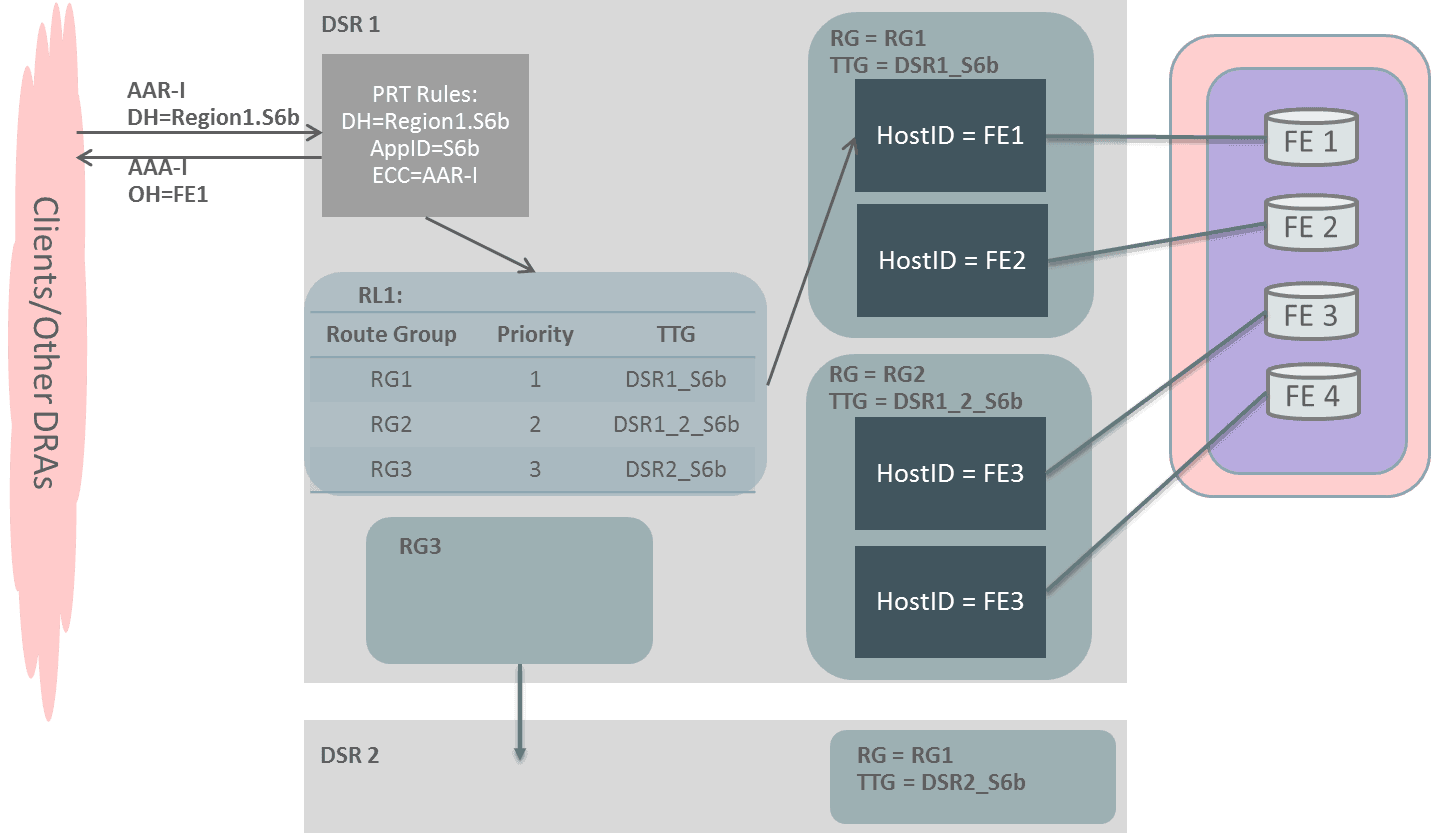

These attacks exploit the very fabric of DeFi’s composability. One weak link in a cross-protocol chain can trigger a domino effect, where a reentrancy bug in Protocol A funnels funds into a flawed oracle in Protocol B. As a swing trader who’s navigated DeFi’s choppy waters, I can tell you: ignoring these risks is like sailing without a lifeboat. The updated landscape demands smart contract insurance 2026 that covers these complex cascades, not just single-point failures.

Decoding the Mechanics of Chained Exploits

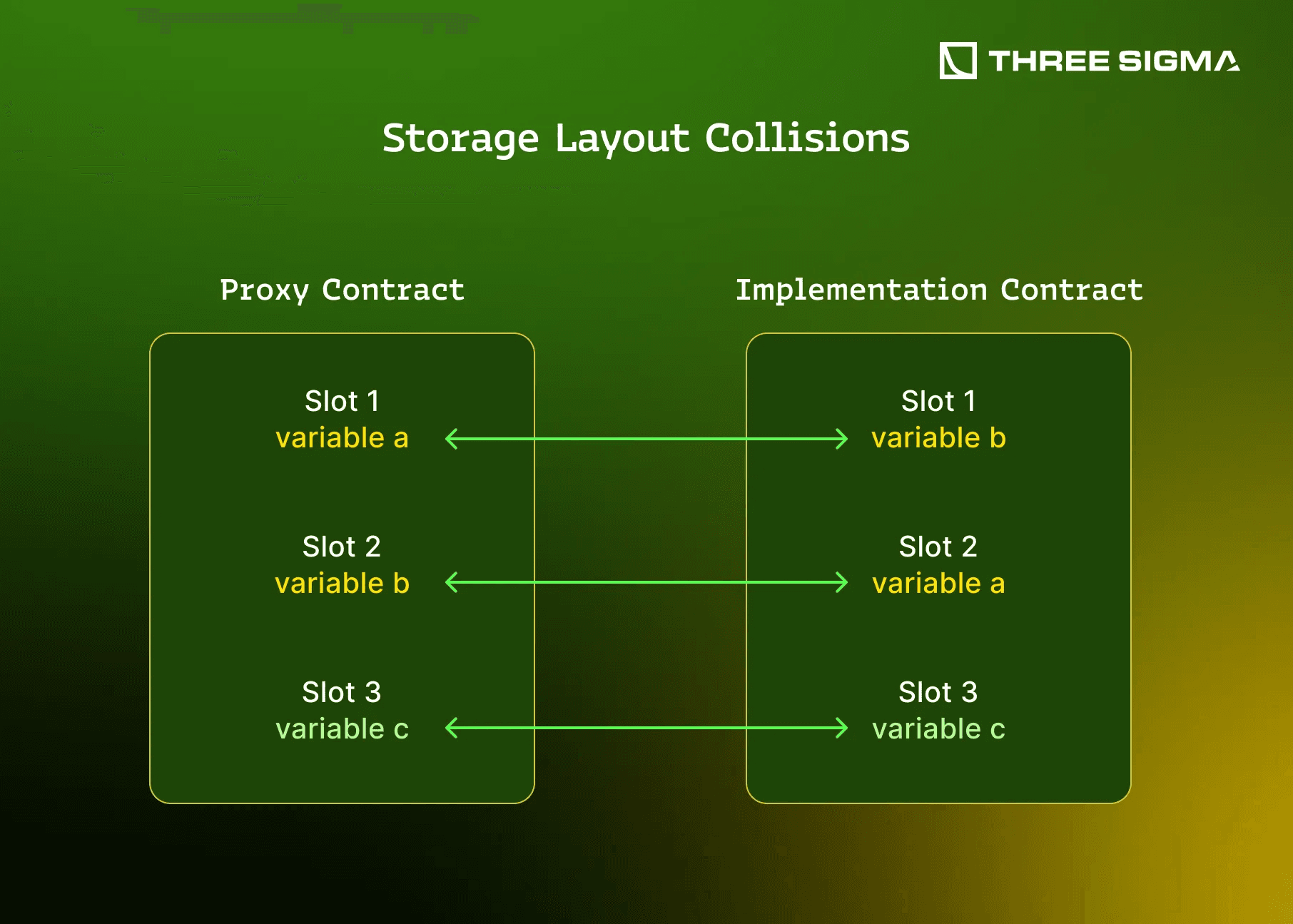

Chained exploits thrive on DeFi’s permissionless nature. Attackers probe for gaps like improper access controls or unchecked inputs, then chain them across protocols. The OWASP Smart Contract Top 10 for 2026 flags reentrancy attacks, integer overflows, and access control flaws as perennial threats. In the Truebit case, a minting vulnerability snowballed because dependent contracts didn’t validate inputs rigorously.

Top 5 Chained Exploit Vulnerabilities

-

Reentrancy Attacks: Attacker calls back into contract before state updates, enabling fund drainage across protocols. Seen in The DAO hack.

-

Access Control Flaws: Improper permissions allow unauthorized calls to sensitive functions in interconnected contracts.

-

Integer Overflow/Underflow: Pre-Solidity 0.8 arithmetic wraps values, manipulable in multi-contract interactions.

-

Oracle Manipulation: Flash loans skew price feeds, cascading failures in dependent DeFi protocols.

-

Input Validation Failures: Unchecked inputs enable malicious data propagation through chained contracts.

Why do these persist? Many protocols prioritize speed over audits, and composability amplifies flaws. A comprehensive ScienceDirect review underscores advances in bug detection, yet human error lingers. For retail investors like you, this means DeFi exploit coverage isn’t optional; it’s your shield against the next Truebit.

2026’s Alarming Exploit Trends and Losses

We’re not talking hypotheticals. Early 2024 saw $45 million lost to 16 smart contract exploits, averaging $2.8 million each. Fast-forward to 2026, and cross-protocol vulnerability protection is paramount as aggregators and bridges become prime targets. AInvest reports $9.11 billion in losses from 2023-2024 alone, driven by input validation slips and similar woes.

CrossCurve’s recent breach raised cross-chain alarms, while Truebit’s $26 million saga proves multi-contract attacks are here. Quecko’s 2026 security outlook warns of escalating bridge hacks and Web3 threats. Nexus Mutual and InsurAce are stepping up, but coverage gaps remain for rug pulls and phishing.

Evolution of DeFi Insurance Against Multi-Contract Risks

DeFi insurance has matured beyond basic hacks. Nexus Mutual, a pioneer, covers smart contract exploits, governance attacks, and more. InsurAce brings multi-chain muscle, tackling stablecoin depegs alongside vulnerabilities. Yet, as Coinbureau notes, they often sidestep off-chain fraud.

Protocols now weave in automated tools, peer reviews, and bug bounties. White-hat collaborations and third-party audits, per Blockchain Council, cut risks sharply. Still, no universal framework exists, and audit costs sting. For sustainable investing, pair diversified portfolios with robust DeFi exploit coverage. I’ve diversified into these policies myself; they provide peace amid volatility.

Beinsure highlights emerging smart-contract failure products tailored for coding flaws. As threats chain ever tighter, 2026 demands insurance that anticipates the cascade, not just the spark.

Providers like Nexus Mutual don’t just insure; they empower users through mutual pools where claims are assessed by community members. This decentralized approach aligns incentives, reducing moral hazard. InsurAce, meanwhile, shines in multi-chain scenarios, covering exploits that span Ethereum, Solana, and beyond. For cross-protocol vulnerability protection, their policies extend to aggregator risks, a hotbed for chained exploits.

Comparison of Top DeFi Insurance Providers for Chained Exploits

| Provider | Coverage Types | Chains Supported | Premium Range |

|---|---|---|---|

| Nexus Mutual | Smart contract failures, governance attacks | Ethereum, Optimism, Arbitrum | 1-3% annually |

| InsurAce | Smart contract vulnerabilities, stablecoin depegs, exchange hacks | Multi-chain (Ethereum, BSC, Polygon, Avalanche) | 0.8-2.5% annually |

| Cover Protocol | Smart contract exploits, protocol risks | Ethereum, Polygon | 1.5-4% annually |

Choosing the right policy requires scrutinizing coverage scopes. Does it explicitly include chained attacks? Look for terms addressing ‘dependent protocol failures’ or ‘composability risks. ‘ Premiums vary by protocol risk scores, often 1-5% of covered assets annually. As someone with CFA Level II under my belt, I advise starting small: cover your largest positions first, like liquidity pools prone to oracle manipulations.

Practical Steps to Secure Your Portfolio in 2026

Beyond insurance, layer defenses. Run your own due diligence with tools like Etherscan for contract verification or Slither for static analysis. Diversify across audited protocols, and never ape into unvetted aggregators. Bug bounties have paid out millions, per DefiCoverage. org, proving proactive hunting works.

I’ve swung trades through 2024’s $9.11 billion loss wave by sticking to insured DeFi plays. When Truebit imploded, my covered exposure limited fallout to under 2%. Sustainable investing means blending insurance with vigilance; it’s not set-it-and-forget-it.

The Road Ahead: Innovating Against Evolving Threats

DeFi’s future hinges on formal verification and AI-driven audits to preempt chained exploits. OWASP’s 2026 Top 10 pushes for standardized risk assessments, while platforms integrate real-time monitoring. Insurance will evolve too, perhaps with parametric triggers that auto-payout on verified exploits, slashing claim disputes.

Challenges like high audit costs and coverage exclusions persist, but momentum builds. Peer-reviewed deployments and white-hat alliances, as Blockchain Council notes, fortify the ecosystem. For retail investors, this convergence means safer composability without sacrificing yields.

Embrace smart contract insurance 2026 as your portfolio’s backbone. In DeFi’s wild frontier, where one exploit chains into catastrophe, insured diversification lets you thrive amid uncertainty. Stay informed, stay covered, and trade with confidence.