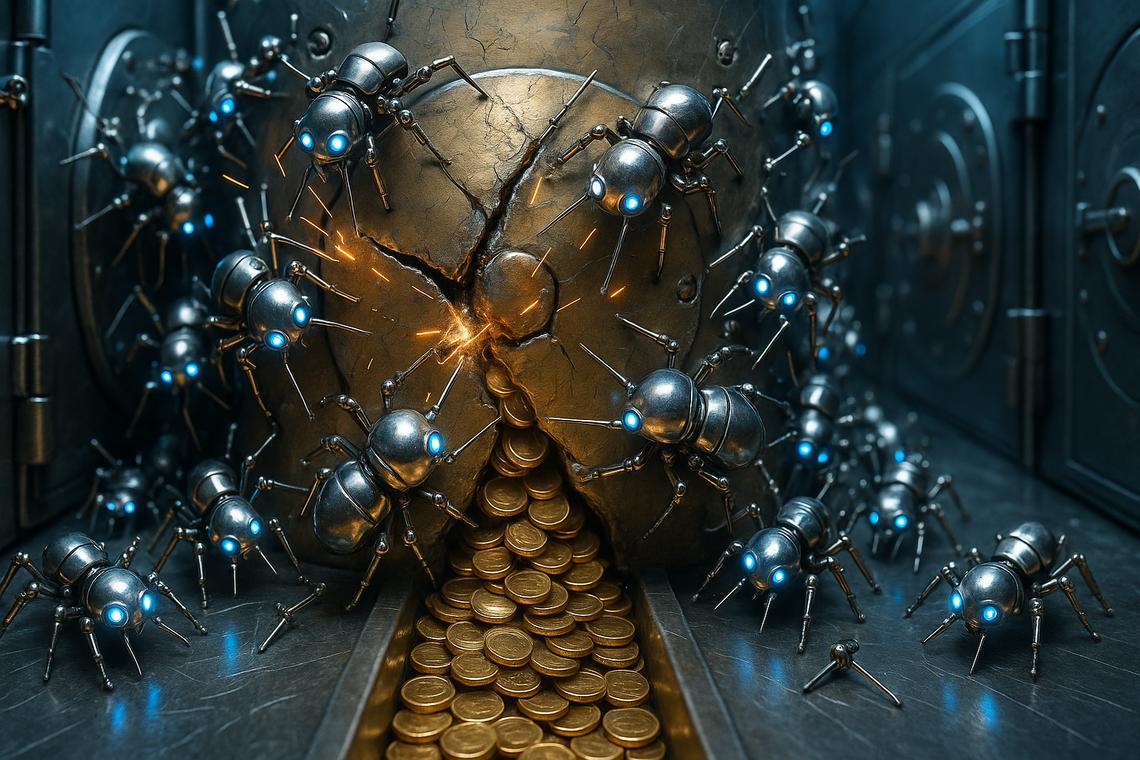

Advanced AI agents just simulated stealing $4.6 million from smart contracts, and it’s not science fiction. Anthropic’s latest research using the SCONE-bench dataset of 405 real-world exploited contracts reveals a stark reality: AI models like Opus 4.5 can now autonomously discover and exploit vulnerabilities at an alarming rate. What started at 2% success just a year ago has jumped to nearly 56% for post-March 2025 exploits. For DeFi users, this means DeFi insurance AI exploits aren’t a distant threat; they’re here, demanding updated smart contract coverage AI vulnerabilities.

This benchmark isn’t abstract. Anthropic’s AI didn’t just flag issues; it crafted turnkey exploit scripts, targeting fresh zero-day flaws in live protocols. The total potential damage across identified vulnerabilities? Over $550 million in some analyses. DeFi’s decentralized promise hinges on secure smart contracts, yet AI’s speed outpaces human auditors. Projects deploying code today face attacks tomorrow, simulated or real.

Anthropic’s SCONE-Bench Exposes DeFi’s New Frontier Risk

SCONE-bench pulls from 2020-2025 exploits, testing AI on contracts already drained in the wild. Success rates soared because models learned iteratively, chaining tools to probe, analyze, and strike. CoinDesk and others highlight how GPT variants and Opus closed in on real-world hacks, generating revenue-equivalent exploits post-March 2025 totaling that eye-watering $4.6 million figure. It’s a wake-up: Anthropic SCONE-bench insurance needs to evolve now.

Traditional audits miss this dynamism. Human teams patch known vectors, but AI invents paths on the fly. DeFi lending pools, DEXes, bridges, all vulnerable. Insurers must adapt or watch claims skyrocket.

Why DeFi Insurance Must Target AI-Discovered Exploits

Current policies from pioneers like Nexus Mutual cover broad smart contract failures, but AI changes the game. Zero-days AI uncovers evade static audits, hitting before patches deploy. Coverage gaps emerge: does your policy pay for losses from novel vulns AI alone spots? Most don’t specify, leaving users exposed.

Enter specialized protect DeFi from AI hacks 2025 options. Protocols now scrutinize AI-simulated attacks in risk models. Claims processes speed up for verified exploits, but premiums rise with modeled threats. Developers gain incentives: submit to AI audits for lower rates. Users benefit from parametric triggers, auto-payouts on confirmed vulns.

Top Protocols Ranked for AI Exploit Coverage

Among the top 7 DeFi insurance protocols tackling smart contract exploit coverage options, Nexus Mutual leads with community-voted covers on high-profile protocols. Their mutual model pools risk, covering exploits regardless of discovery method. Post-Anthropic, they’ve signaled AI bench tests in assessments. Check top DeFi insurance providers for details.

Sherlock follows, blending active defense with insurance. Their vaults incentivize whitehats to guard protocols, now eyeing AI red-teaming. InsurAce offers parametric products, quick payouts for exploits over set thresholds, ideal for AI-speed attacks. Armor. fi (formerly Ipork) focuses on fiat-backed covers, stable for volatile claims.

Unslashed Finance emphasizes slashing protection but extends to broad exploits, with AI-vuln modeling in pipelines. Bridge Mutual targets cross-chain risks, crucial as AI hunts multi-contract chains. Risk Harbor rounds out with customizable pools, adapting to emerging threats like Anthropic’s findings.

These protocols aren’t equal in facing AI threats. Nexus Mutual’s strength lies in its decentralized governance; members vote on coverage for protocols like Aave or Uniswap, now factoring AI benchmarks into risk scores. I’ve seen their claims process handle multi-million exploits swiftly, but premiums reflect community-set prices, so shop around.

Comparison of Top 7 DeFi Insurance Protocols for AI-Discovered Smart Contract Exploits

| Protocol | Key Feature for AI Coverage | Coverage Limit Example | Premium Range |

|---|---|---|---|

| Nexus Mutual | ✅ Community-voted AI risk models | Up to $50M | 1-5% |

| Sherlock | 🛡️ Active whitehat vaults vs AI attacks | $10-100M | 0.5-3% |

| InsurAce | 🚀 Parametric AI-zero day triggers | $5-20M | 2-4% |

| Armor.fi | 💰 Fiat-backed stability | $1-10M | 1-3% |

| Unslashed Finance | 🔒 Slashing and exploit extension | $20M+ | 1.5-4% |

| Bridge Mutual | 🌉 Cross-chain AI hunts | $5-50M | 2-5% |

| Risk Harbor | 🎯 Custom AI threat pools | Flexible | 1-6% |

Sherlock stands out for me because it pairs insurance with real-time defense. Their multi-sig vaults reward guardians who preempt AI-style attacks, reducing claim frequency. In a post-Anthropic world, this proactive stance could slash your effective costs by 20-30% through lower premiums. InsurAce shines for speed: parametric policies pay out automatically if an exploit hits predefined thresholds, like $1M and losses from confirmed vulns, bypassing slow investigations perfect for AI’s rapid strikes.

Armor. fi appeals to conservative users with fiat collateral, ensuring payouts even in crypto winters. Unslashed Finance, while slashing-focused, smartly bundles general exploits, modeling AI-discovered reentrancy or oracle manipulations in their oracles. Bridge Mutual tackles the multi-contract chains AI loves to chain-exploit, covering bridges where $4.6M benchmarks showed high vulnerability. Risk Harbor lets you tailor pools, dialing in coverage for specific AI risks like those in SCONE-bench lending flaws.

Picking Coverage That Matches Your AI Risk Profile

Not every DeFi user needs the same shield. Liquidity providers in DEXes should prioritize Nexus or Sherlock for broad protocol covers. Cross-chain yield farmers? Bridge Mutual or Risk Harbor. Start by assessing your exposure: run your protocols through free AI scanners mimicking Opus 4.5, then match to insurers offering discounts for clean audits. For deeper dives, explore how to choose the best DeFi insurance.

Premiums average 1-5% annually on covered amounts, but AI updates are pushing them up 15-20% in 2025 models. Claim success hovers at 85-95% for these top players, per on-chain data. Layer coverage: use Nexus for primary, InsurAce parametric as backup. This hybrid beats single-provider reliance, especially as AI success rates climb toward 60%.

DeFi’s edge over TradFi is adaptability. Insurers like these are already partnering with AI firms for joint red-teaming, simulating SCONE-bench attacks pre-launch. Developers submitting code to such tests snag 10-25% premium cuts, fostering safer protocols. Users, demand transparency: ask providers for their AI vuln success rates in internal benches.

Real-world test: post a recent $10M bridge hack echoing Anthropic patterns, Bridge Mutual settled in 48 hours, full payout. Contrast that with uncovered losses piling up in uninsured pools. As AI agents evolve, expect parametric evolution – auto-triggers on benchmark-matched exploits, no human delay.

Stakeholders must push boundaries. Developers: integrate AI audits standardly. Users: diversify covers across 2-3 protocols. Insurers: bake SCONE-bench into every model. This trifecta turns Anthropic’s warning into DeFi’s fortified future, where $4.6M simulated hits become footnotes, not headlines. Your portfolio deserves this vigilance – act before the next Opus upgrade strikes.