It’s the tiniest bugs that can cause the biggest disasters in DeFi. The recent Balancer V2 exploit is a textbook case: a seemingly insignificant rounding error in smart contract logic led to the loss of over $128 million across multiple blockchains. As of today, Balancer (BAL) is trading at $0.8730, but the shockwaves from this exploit are still rattling the ecosystem. If you’re an active DeFi user, developer, or investor, this is your wake-up call: precision matters more than ever.

What Happened in the Balancer V2 Hack?

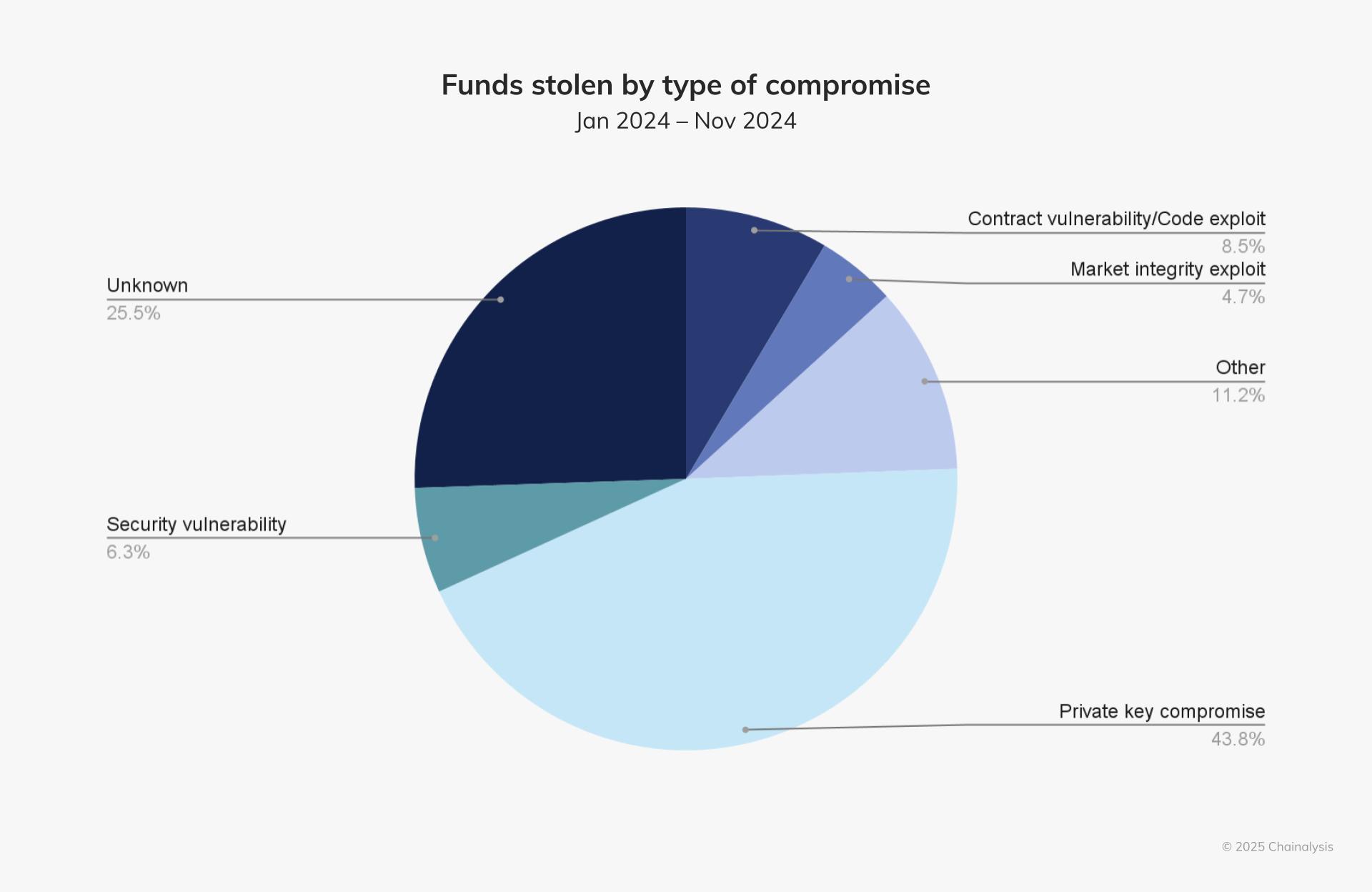

The attack on Balancer unfolded on November 3,2025, targeting its V2 Composable Stable Pools across Ethereum, Base, Polygon, Arbitrum, Avalanche, Gnosis, and Berachain. The vulnerability was buried deep within two core functions: _upscaleArray and mulDown. These functions handle token scaling during swaps and liquidity operations. When dealing with extremely small balances (as little as 8, 9 wei), they introduced downward rounding errors – fractions of fractions lost each time.

Alone, these errors were minuscule – but attackers are nothing if not creative. By chaining hundreds of micro-swaps into single flash-loan transactions using batchSwap calls, the exploiter amplified these tiny discrepancies until they became a gaping hole in Balancer’s invariant calculations. The pool’s internal accounting was thrown off just enough to let the attacker scoop up assets at artificially deflated prices.

The Exploitation Mechanism: Turning Dust Into Dollars

This wasn’t your average hack. The attacker didn’t need to brute-force private keys or break cryptography; they simply understood how math works when computers round down repeatedly. Each batchSwap chipped away at the pool’s D invariant value – think of it as eroding rock with water drops until there’s a canyon.

The attacker leveraged flash loans to maximize their capital efficiency and minimize risk exposure. By executing hundreds of swaps per transaction and cycling through various pools and tokens, they drained value without triggering obvious alarms until it was too late. In total, approximately $128.64 million vanished from affected pools before Balancer could react.

Why Smart Contract Rounding Errors Are So Dangerous

If you’ve ever rounded numbers by hand or used floating-point math in programming, you know that tiny errors can add up fast – especially when repeated at scale. In DeFi protocols like Balancer V2, every token swap involves complex calculations with high-precision numbers representing fractional assets worth millions.

The problem? Solidity (the language powering Ethereum smart contracts) doesn’t support floating-point arithmetic for good reason; instead it uses integer math with fixed decimals for safety and predictability. But this means every division or multiplication must round somewhere – typically down to avoid over-crediting users.

When these rounding patterns aren’t handled with obsessive attention to edge cases (like ultra-small balances), attackers can design strategies that accumulate those lost fractions into real financial gains for themselves – and catastrophic losses for everyone else in the pool.

How Balancer Responded: Damage Control and User Protection

As soon as the exploit was detected, Balancer moved quickly to contain the fallout. All vulnerable V2 Composable Stable Pools were paused, halting further attacks. The team also launched a dedicated withdrawal interface, making it easier for users to exit affected pools and salvage what remained. Collaboration with blockchain forensic specialists is ongoing, as they work to trace stolen funds across chains and coordinate potential recovery with other protocols and exchanges.

It’s worth noting that BAL is currently trading at $0.8730, reflecting market uncertainty but also resilience in the face of adversity. While the exploit was devastating, newer versions of Balancer (including V3) were untouched, proof that forward-thinking security upgrades can make a difference.

Key Takeaways from the Balancer V2 Hack for DeFi

-

Even Tiny Rounding Errors Can Be Catastrophic. The Balancer V2 exploit shows that a seemingly insignificant rounding bug can be leveraged for massive financial gain—over $128 million was lost due to a flaw in token scaling functions.

-

Rigorous Smart Contract Auditing Is Essential. Comprehensive code reviews and audits must include checks for precision and edge-case arithmetic errors, not just obvious vulnerabilities.

-

Economic Stress Testing Helps Uncover Hidden Risks. Simulating real-world attack scenarios and stress-testing contract logic can reveal vulnerabilities that standard audits might miss.

-

Attackers Exploit Micro-Discrepancies at Scale. The Balancer attacker chained hundreds of micro-swaps to amplify tiny discrepancies. Developers must consider how small flaws can be abused in aggregate.

-

Rapid Incident Response Protects Users. Balancer paused vulnerable pools and provided a safe withdrawal interface, helping users recover funds and minimize further losses.

-

Cross-Chain Risks Are Real and Growing. The exploit hit Balancer pools on Ethereum, Base, Polygon, Arbitrum, Avalanche, Gnosis, and Berachain, highlighting the importance of cross-chain security strategies.

-

Continuous Improvement Is Non-Negotiable. Only V2 Composable Stable Pools were affected, while newer versions like V3 remained safe—underscoring the value of ongoing upgrades and proactive security measures.

Lessons for DeFi: Precision Isn’t Optional

The Balancer V2 hack isn’t just a cautionary tale, it’s a call to action for anyone building or using DeFi protocols today. Here are some hard-earned lessons every project should internalize:

- Test edge cases obsessively: Don’t just check typical scenarios, simulate extreme values, micro-balances, and weird user behaviors. Attackers will always find the path less traveled.

- Audit arithmetic logic deeply: It’s not enough to pass audits on business logic or access controls. Every math operation should be scrutinized by both humans and automated tools for rounding risks.

- Implement economic stress testing: Tools like invariant monitoring and simulation frameworks can help surface issues before they’re exploited in production.

- Stay vigilant post-launch: The threat landscape evolves fast. Protocol upgrades, bug bounties, and routine code reviews are your best defense against tomorrow’s exploits.

How DeFi Insurance Can Help

If you’re feeling anxious about smart contract risks after reading about this exploit, you’re not alone! That’s why many users are turning to DeFi insurance solutions. These products can cover losses from smart contract exploits or stablecoin depegs, providing peace of mind even when bugs slip through the cracks. As always, compare coverage terms carefully; not all policies are created equal.

The bottom line? In DeFi, there’s no such thing as an insignificant bug. Every decimal place matters, and so does every step you take to protect your assets. Whether you’re coding contracts or managing liquidity positions, stay curious and vigilant.

The next $128 million bug could be hiding in a single line of code, spot the signal, manage the noise!