Stablecoin depegs have become a central concern for DeFi users seeking to preserve capital and maintain liquidity in volatile markets. In 2024, the emergence of advanced DeFi insurance protocols has allowed investors to hedge against these risks with on-chain coverage that is both transparent and automated. This article examines the top five decentralized insurance providers offering stablecoin depeg protection, focusing on their technical mechanisms, governance models, and market performance.

Why Stablecoin Depeg Protection Matters in 2024

Stablecoins are designed to maintain a 1: 1 peg with fiat currencies like the US dollar. However, market shocks, collateral failures, or protocol exploits can cause these assets to deviate from their pegs, sometimes dramatically. Such events can trigger cascading liquidations across lending platforms and DEXs, erasing millions in user funds within hours. As a result, DeFi risk management now demands proactive strategies like stablecoin depeg insurance.

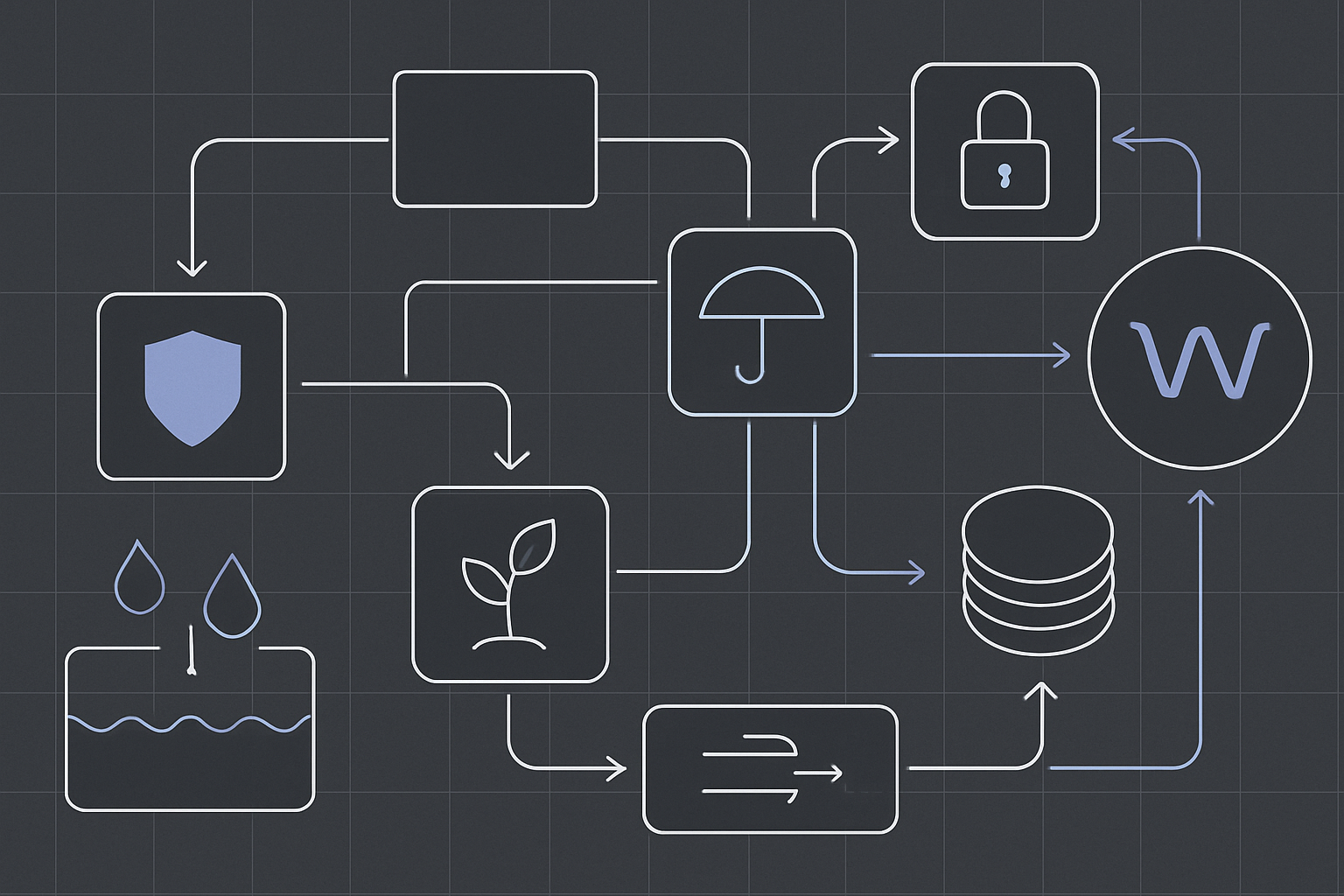

The latest generation of DeFi insurance protocols leverages smart contracts and oracles to detect when a stablecoin trades below (or above) its designated threshold for a specified period. Automated claim settlements ensure swift payouts without intermediaries, a critical feature during periods of high volatility.

The Five Leading DeFi Insurance Protocols for Stablecoin Depegs

The following protocols have emerged as market leaders in providing stablecoin depeg protection. Each brings unique features and governance structures tailored to different user needs:

- InsurAce

- Nexus Mutual

- Unslashed Finance

- Bridge Mutual

- Amulet Protocol

Top 5 DeFi Insurance Protocols for Stablecoin Depeg Protection (2024)

-

Nexus Mutual (NXM): A leading decentralized insurance protocol offering coverage for stablecoin depegging events and smart contract vulnerabilities. Current NXM Price: $83.05. Coverage Highlight: Community-driven claims process and robust track record in processing depeg claims.

-

InsurAce (INSUR): Multi-chain insurance provider supporting Ethereum, BSC, Solana, and more. Coverage Highlight: Portfolio-based insurance, stablecoin depeg protection, and rapid claim settlements across multiple networks.

-

Unslashed Finance: Specializes in staking and DeFi protocol insurance, including stablecoin depeg events. Coverage Highlight: Automated payouts and mutual model governance for transparent, community-led insurance.

-

Bridge Mutual (BMI): Decentralized coverage for stablecoin depegs, smart contract risks, and exchange hacks. Coverage Highlight: Staking-based liquidity pools and decentralized voting for transparent claim approval.

-

Amulet Protocol: Focused on providing DeFi insurance solutions with a particular emphasis on stablecoin depeg protection. Coverage Highlight: Parametric insurance models and multi-chain support for rapid, automated payouts.

Nexus Mutual (NXM): Decentralized Claims Processing With On-Chain Governance

Nexus Mutual stands out for its robust decentralized governance model and proven track record of claim settlements during turbulent periods. At a current price of $83.05 per NXM ( and 0.0271% in the last 24 hours), Nexus Mutual remains one of the most trusted names in crypto asset protection. The protocol enables NXM token holders to participate directly in claims assessment and protocol upgrades, ensuring that decisions are community-driven rather than dictated by centralized entities.

Nexus Mutual’s stablecoin depeg cover automatically triggers payouts when an approved oracle detects that a supported stablecoin trades outside its peg by a predetermined margin over a set time window. This parametric approach guarantees transparency and eliminates delays associated with manual claim reviews.

Nexus Mutual (NXM) Price Prediction 2026-2031

Forecast based on recent market performance, DeFi insurance adoption trends, and evolving crypto regulatory landscape.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $68.00 | $90.00 | $115.00 | +8.4% | DeFi insurance adoption grows, but increased competition and market volatility keep prices in check. |

| 2027 | $77.00 | $102.00 | $135.00 | +13.3% | Bullish scenario as Nexus Mutual expands coverage and regulatory clarity improves; bearish risks include protocol exploits. |

| 2028 | $85.00 | $119.00 | $155.00 | +16.7% | Mainstream DeFi insurance integration boosts NXM demand; some price compression from new entrants. |

| 2029 | $96.00 | $132.00 | $175.00 | +10.9% | Sustained adoption amid broader crypto acceptance; potential price spikes during high-volatility events. |

| 2030 | $110.00 | $145.00 | $195.00 | +9.8% | Nexus Mutual cements leadership in DeFi insurance, but faces pressure from protocol upgrades and regulatory shifts. |

| 2031 | $125.00 | $158.00 | $220.00 | +9.0% | Mature DeFi insurance market with Nexus Mutual as a key player; price stability increases, but speculative swings remain possible. |

Price Prediction Summary

Nexus Mutual (NXM) is projected to experience steady growth through 2031, underpinned by increasing demand for DeFi insurance amid ongoing stablecoin depeg risks and broader crypto adoption. While competition and regulatory uncertainties may cause volatility, NXM’s strong track record and expanding product suite position it for long-term appreciation.

Key Factors Affecting Nexus Mutual Price

- Growing demand for DeFi insurance solutions, especially for stablecoin depeg events and smart contract risks.

- Expansion of Nexus Mutual’s coverage and cross-chain capabilities.

- Entry of new competitors and evolving DeFi insurance landscape.

- Regulatory developments affecting DeFi protocols and insurance products.

- Market cycles, including speculative surges and corrections.

- Technological improvements in automated claims and risk assessment.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

InsurAce: Multi-Chain Coverage With Portfolio-Based Policies

InsurAce distinguishes itself through multi-chain support, covering assets not only on Ethereum but also Binance Smart Chain, Solana, Avalanche, and more. Users can bundle multiple assets under one policy for comprehensive portfolio-level coverage. InsurAce’s architecture supports automated detection of smart contract exploits as well as stablecoin depegs, making it suitable for complex DeFi strategies spanning several blockchains.

The platform’s decentralized underwriting pools allow participants to stake capital in return for premium income while contributing to the protocol’s solvency. Claims are processed using transparent voting mechanisms that balance risk-sharing among stakeholders.

Choosing the Right Protocol For Your Risk Profile

Selecting the optimal provider depends on factors such as chain compatibility, claims history, governance transparency, and payout speed. For detailed comparisons across these protocols, including Unslashed Finance, Bridge Mutual, and Amulet Protocol, see our comprehensive guide: How To Compare DeFi Insurance Providers For Stablecoin Depeg Protection In 2024.

Unslashed Finance: Mutualized Coverage for Stakers and Liquidity Providers

Unslashed Finance has carved a niche in offering insurance for stakers and liquidity providers, with a particular focus on protection against stablecoin depegs across major networks such as Ethereum, Polkadot, and Cosmos. Its mutual model incentivizes participants to provide capital to risk pools in exchange for a share of premiums and governance power. This approach aligns user incentives with protocol security, as pool backers are directly exposed to claim events.

Claims on Unslashed are adjudicated through decentralized voting, ensuring that no single party can unilaterally approve or deny payouts. The protocol’s automated oracle integrations continuously monitor stablecoin price feeds, triggering compensation if a supported asset falls outside its peg for the required duration. This automation is critical for market participants who need immediate recourse during high-volatility periods.

Bridge Mutual: Permissionless Pools and Community-Driven Decisions

Bridge Mutual stands out for its permissionless coverage pools and commitment to community governance. Users can create or join pools covering specific stablecoins or protocols, customizing risk parameters based on market demand. This flexibility allows the ecosystem to rapidly adapt to emerging threats or new types of depeg risk.

The protocol’s claims process is fully decentralized: claimants submit proof of loss, which is then evaluated by BMI token holders through transparent voting. This ensures that legitimate claims are paid out promptly while deterring fraudulent activity. Bridge Mutual’s design encourages active participation from both liquidity providers and policyholders, creating a robust defense against systemic shocks in the DeFi space.

Amulet Protocol: Specialized Stablecoin Depeg Insurance With DAO Oversight

Amulet Protocol is engineered specifically for stablecoin depeg protection, leveraging a DAO-driven governance structure to manage underwriting risk and claims assessment. Its multi-chain compatibility extends coverage across leading blockchains, enabling users to insure assets regardless of where they are deployed.

Amulet employs parametric triggers similar to other leaders in this sector: when an oracle confirms that a supported stablecoin trades outside its peg by the defined margin over the set interval, payouts are executed automatically via smart contract logic. The protocol’s transparent treasury management ensures that sufficient reserves are available for large-scale depeg events, an essential safeguard given the systemic risks posed by collateral failures.

Best Practices For Using DeFi Insurance in 2024

- Diversify Coverage: Consider splitting your insurance exposure across multiple protocols (e. g. , Nexus Mutual and InsurAce) to mitigate provider-specific risks.

- Assess Claims History: Review each protocol’s record of processed claims during recent volatility spikes, reliability matters more than low premiums alone.

- Understand Governance: Favor protocols with transparent DAO structures where policyholders have direct input into claims decisions and product upgrades.

- Monitor Protocol Solvency: Check real-time reserve ratios and liquidity pool health before purchasing cover, especially during periods of elevated market stress.

The evolution of DeFi insurance means users now have access to sophisticated tools for protecting their assets from one of crypto’s most persistent risks: stablecoin depegs. By leveraging automated smart contracts, decentralized governance, and multi-chain support, protocols like InsurAce, Nexus Mutual (trading at $83.05 per NXM), Unslashed Finance, Bridge Mutual, and Amulet Protocol set the standard for crypto asset protection in 2024.

For deeper technical insights into how these platforms respond during real-world depeg events, and practical steps you can take as an investor, see our detailed analysis here: How DeFi Insurance Protocols Respond To Stablecoin Depeg Events A 2024 Case Study.