On November 7,2025, the DeFi community woke up to a jarring reality: USDX, the flagship stablecoin from Stables Labs, was trading at just $0.745878 instead of its intended $1 peg. This sharp deviation is not just a technical hiccup – it’s a real-time stress test for the entire decentralized finance ecosystem. The USDX depeg is a case study in how quickly stability can unravel and why risk management in DeFi must be relentless and proactive.

USDX Depeg at $0.745878: Anatomy of a Breakdown

The numbers are stark: in the last 24 hours, USDX plummeted from a high of $1.00 to as low as $0.3664 before clawing back to $0.745878. This isn’t just an isolated event – it’s the result of failures across multiple fronts:

- Reserve Mismanagement: Confidence in any stablecoin begins with its reserves. When transparency falters or assets are misallocated, panic can set in fast, triggering mass redemptions and further weakening the peg.

- Liquidity Crunches: As users rushed to exit USDX positions, liquidity evaporated. Sudden surges in redemption requests overwhelmed available reserves, causing slippage and accelerating the depeg spiral.

- Market Volatility: Broader crypto market downturns amplify stablecoin fragility. If underlying collateral drops sharply or becomes illiquid, even well-designed pegs can break down.

This is not an isolated phenomenon – recent high-profile depegs like xUSD and USDe have exposed similar design flaws and operational risks across the sector (see detailed analysis here).

Contagion Risks: Why One Stablecoin’s Fall Threatens All of DeFi

A stablecoin depegging doesn’t stay contained for long. In DeFi, everything is interconnected – one collapse can trigger systemic tremors:

- Collateral Liquidations: Many lending protocols use stablecoins like USDX as collateral. When its value drops below $1, borrowers’ positions become undercollateralized, triggering forced liquidations that ripple through lending pools.

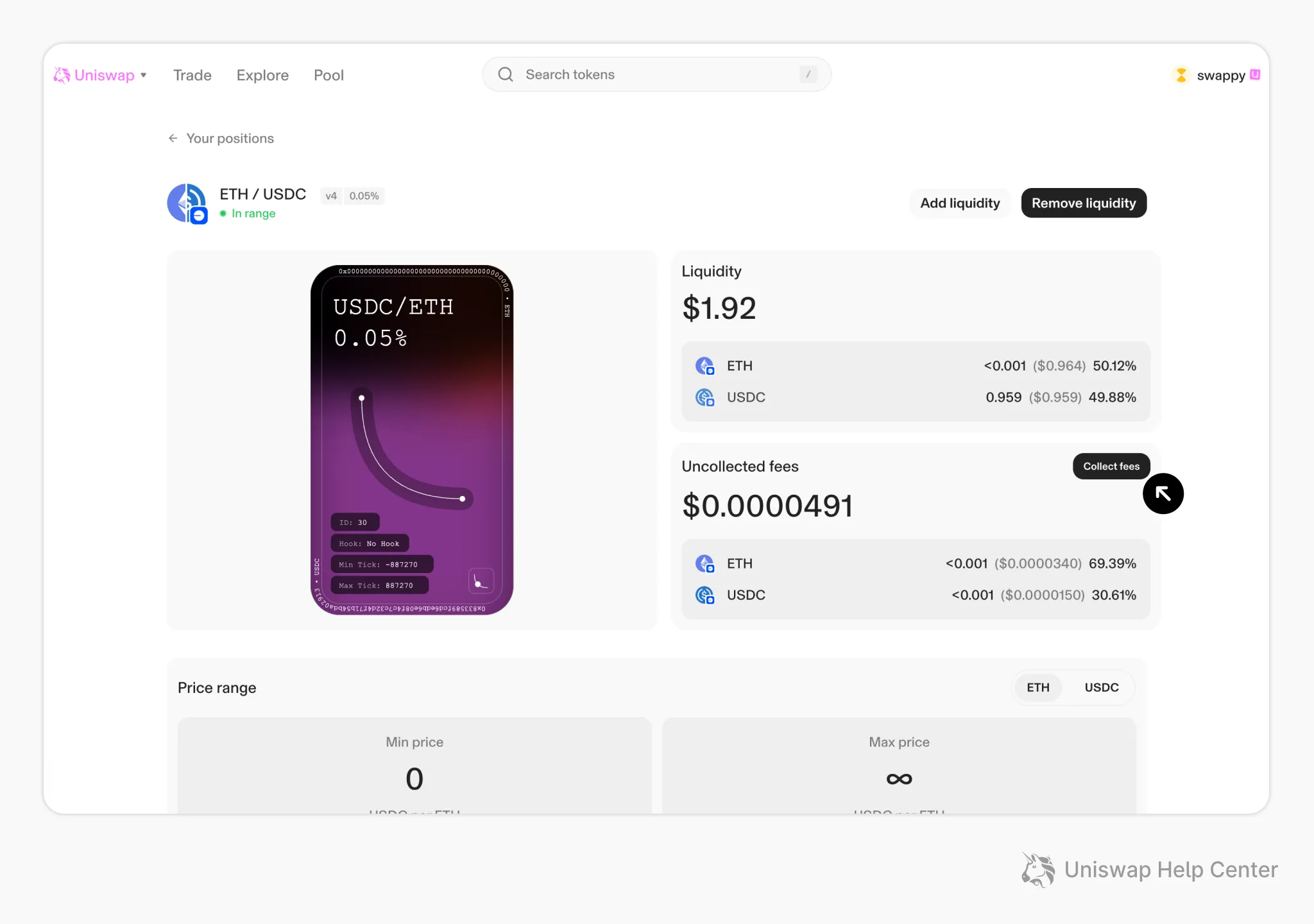

- Pools and LPs Take Hits: Liquidity pools on DEXes holding USDX pairs become imbalanced fast during a depeg event. Arbitrageurs drain pools for profit, leaving remaining liquidity providers exposed to impermanent loss and reduced capital efficiency.

- User Trust Erodes: Every major depeg chips away at user confidence not just in one coin but in all algorithmic and reserve-backed stables – making future runs more likely and recovery harder each time.

The USDX event mirrors past crises like UST and USDe but with fresh urgency given how deeply integrated stables now are into lending protocols, DEXes, yield farms, and derivatives platforms (read more on cascading liquidation risks here). The risk of contagion is real – if you’re exposed to DeFi protocols relying on USDX collateral or liquidity pairs right now, vigilance isn’t optional.

USDX Stablecoin Price Prediction 2026-2031

Forecasts reflect potential recovery scenarios post-2025 depeg, incorporating DeFi market risks, regulatory outlook, and restoration efforts.

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.62 | $0.76 | $0.92 | +1.9% | Gradual recovery as confidence rebuilds; volatility remains high, with ongoing reserve audits and transparency measures. |

| 2027 | $0.58 | $0.81 | $1.05 | +6.6% | Potential for partial re-peg amid DeFi stabilization and improved risk management; regulatory clarity may boost trust. |

| 2028 | $0.55 | $0.85 | $1.10 | +4.9% | Continued ecosystem improvements and insurance adoption help; competition from new stablecoins limits upside. |

| 2029 | $0.52 | $0.88 | $1.15 | +3.5% | Market maturation; slow, steady progress toward restoring the $1 peg, but legacy risk overhang persists. |

| 2030 | $0.50 | $0.91 | $1.20 | +3.4% | Bullish scenario possible with full reserve restoration and successful tech upgrades; bearish risks from further DeFi shocks. |

| 2031 | $0.48 | $0.93 | $1.25 | +2.2% | By now, USDX either regains stablecoin status or is replaced; best-case is full peg restoration, but risk of irrelevance remains. |

Price Prediction Summary

USDX faces a challenging road to recovery following its 2025 depeg, with average prices projected to gradually rise but remain below the $1 peg for several years. Full restoration depends on rebuilding trust, enhancing reserve transparency, and navigating competition and regulation. Upside exists if systemic DeFi risks are addressed and technological improvements succeed, but downside risks from renewed volatility and loss of confidence persist.

Key Factors Affecting USDX Stablecoin Price

- Reserve transparency and effective management

- DeFi ecosystem stability and liquidity

- Regulatory developments and government oversight

- Market competition from new and existing stablecoins

- Technological upgrades and risk mitigation measures

- User confidence and adoption trends

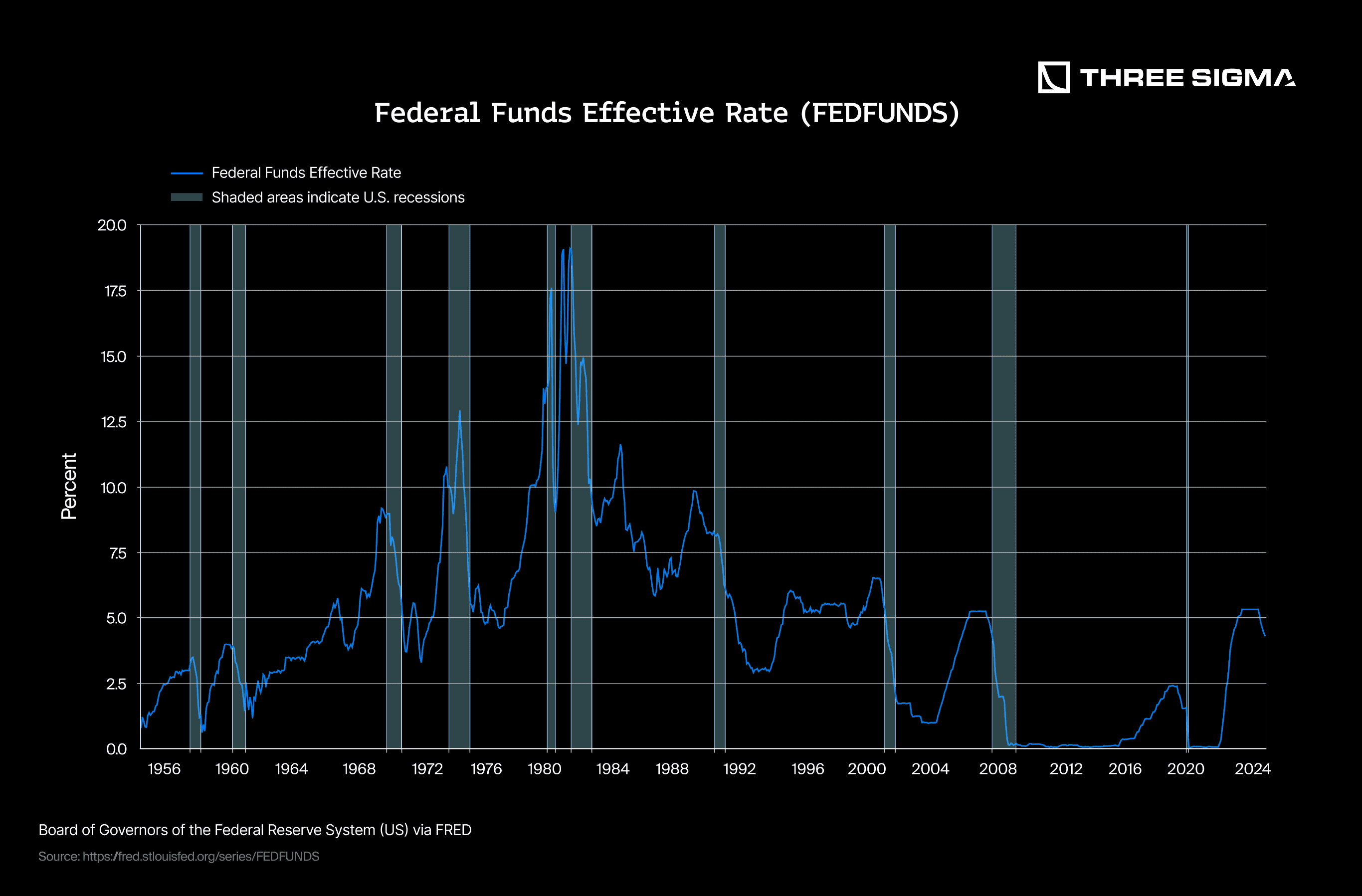

- Macroeconomic factors impacting crypto markets

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Painful Lessons for DeFi Users: How to Survive (and Hedge) Stablecoin Depegs

If you’re holding stablecoins or using them as collateral today, this isn’t just news – it’s your wake-up call to reassess your risk exposure immediately:

- Diversify Stablecoin Holdings: Don’t make the rookie mistake of putting all your dry powder into one stablecoin basket. Even “blue chip” stables can break their pegs under stress; spreading exposure reduces single-point-of-failure risk.

- Know Your Collateral: Take time to understand what backs your stables – whether it’s fiat reserves, crypto collateral or algorithmic mechanisms. Transparency matters; so does real-time monitoring of reserve health.

- Stay Alert (and Insured): Watch price feeds closely during market turbulence; consider hedging with insurance products designed specifically for stablecoin depegs (explore coverage options here). In fast-moving markets like this one, reaction time is everything.

Beyond immediate price action, the USDX depeg underscores a recurring theme: DeFi is only as strong as its weakest stablecoin. When USDX slipped to $0.745878, it didn’t just wipe out confidence in Stables Labs. It shook the foundation of every protocol that had integrated USDX as a core asset, reminding us that composability cuts both ways in decentralized finance.

Protocol devs and risk managers are now scrambling to patch exposure and shore up liquidity buffers. For users, this is a crash course in why stablecoin insurance is no longer optional, especially as more protocols experiment with novel collateral types and automated stabilization mechanisms. If you’re not actively hedging, you’re gambling with your stack.

What’s Next? USDX Recovery or DeFi Fallout?

The path forward for USDX remains uncertain. At $0.745878, the market has priced in severe doubt about reserve sufficiency and governance response. Whether USDX can claw back to par depends on rapid transparency from Stables Labs, credible recapitalization moves, and, critically, a restoration of user trust.

If history is any guide, recovery may be partial or protracted unless decisive action is taken (see previous recoveries and failures here). Meanwhile, protocols that relied on USDX now face tough decisions: halt operations, migrate collateral, or risk further contagion.

This drama isn’t limited to one coin or one protocol. The entire DeFi ecosystem must adapt by:

- Implementing Automated Risk Controls: Protocols should set circuit breakers for sudden stablecoin volatility, freezing affected markets until peg stability returns.

- Prioritizing Real-Time Transparency: On-chain proof of reserves and automated audits are now table stakes for any stablecoin issuer hoping to retain market trust.

- Pushing for Insurance Adoption: Users must demand, and protocols should integrate, coverage options against both exploit-driven losses and depegs. The cost of ignoring this lesson will only rise as DeFi scales.

Key Takeaways for Surviving the Next Depeg

Smart Moves for DeFi Users After a Stablecoin Depeg

-

Check Stablecoin Prices Immediately: Monitor the current value of affected stablecoins (e.g., USDX is now $0.7459) on trusted platforms like CoinMarketCap or CoinGecko. Quick awareness helps you act before further losses.

-

Diversify Your Stablecoin Holdings: Move funds into multiple established stablecoins like USDC, DAI, and Tether (USDT) to spread risk and maintain liquidity.

The bottom line? Every time a peg breaks, and especially at high-profile levels like today’s USDX event, the bar gets raised for risk management across the board. Don’t wait for the next headline-grabbing crash before diversifying your holdings, reviewing your protocol exposures, or securing insurance coverage tailored for volatile markets.

If you’re still treating stablecoins as “risk-free, ” you’re not paying attention in 2025.