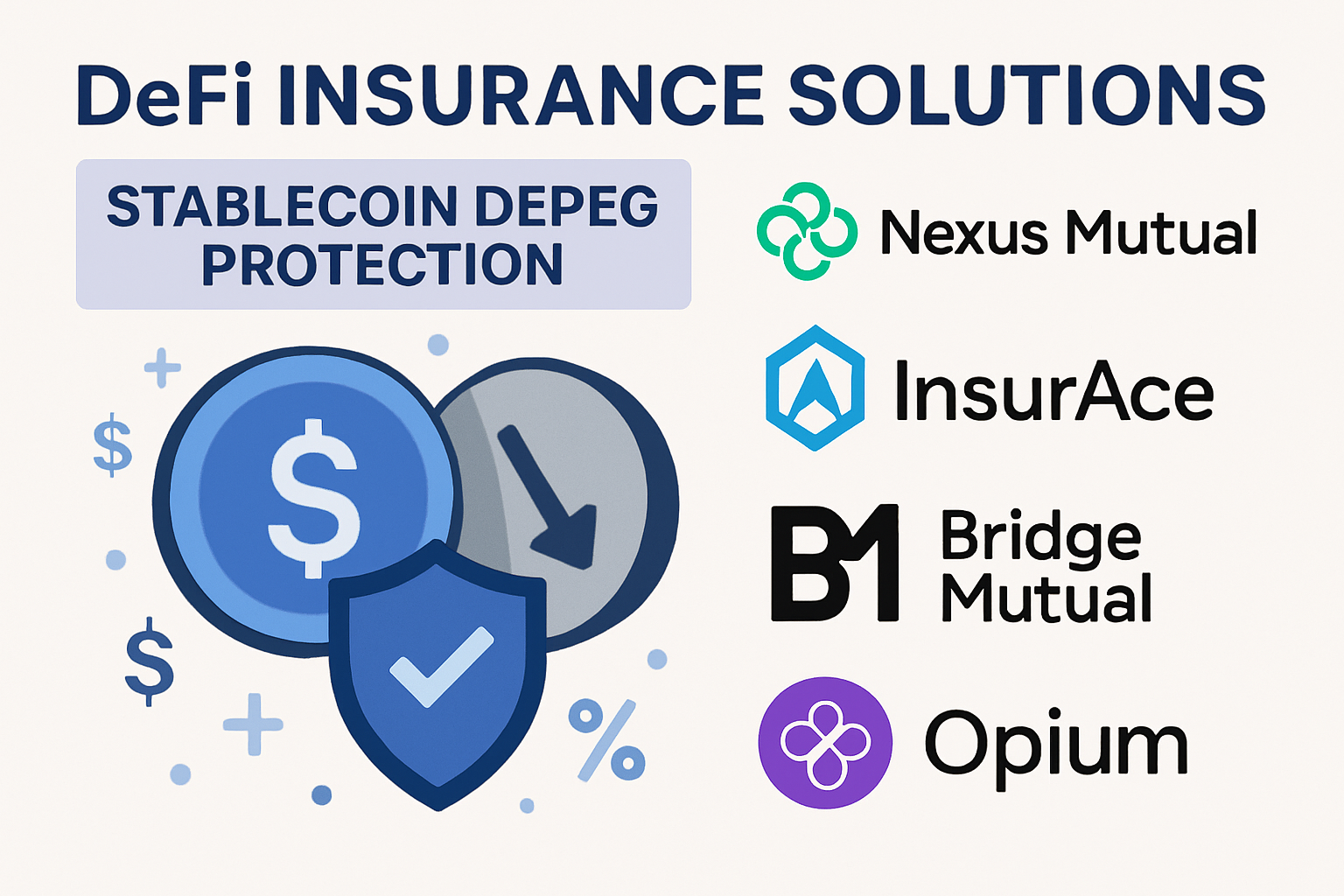

Stablecoins are foundational to the DeFi ecosystem, providing a liquid, dollar-pegged asset for trading, lending, and yield strategies. However, persistent market volatility and operational shocks have made stablecoin depeg insurance a top priority for risk-conscious crypto users. In this article, we’ll examine how leading DeFi insurance protocols help mitigate losses from stablecoin depegs and compare their unique approaches to DeFi asset protection.

Why Stablecoin Depegs Are a Critical Risk in DeFi

Despite their design to maintain a 1: 1 peg with fiat currencies, stablecoins are not immune to price dislocations. Factors like liquidity crunches, regulatory interventions, or smart contract exploits can cause even major stablecoins such as USDC or USDT to trade below $1.00 for sustained periods. These depegging events can trigger cascading liquidations across lending protocols, wipe out leveraged positions, and erode user confidence in DeFi markets.

Recent history shows that even brief depegs can result in millions of dollars in losses. As a result, DeFi insurance comparison has become an essential step for anyone seeking robust stablecoin risk management. Let’s explore how specialized coverage works and which platforms offer the most reliable protection.

Top DeFi Insurance Platforms Offering Stablecoin Depeg Protection

Top DeFi Insurance Solutions for Stablecoin Depegs

-

Nexus Mutual offers decentralized insurance coverage for smart contract bugs and protocol failures. While primarily known for smart contract cover, Nexus Mutual has expanded to include some stablecoin depeg protection, with customizable policies and a member-driven claims process.

-

InsurAce is a multi-chain decentralized insurance protocol providing explicit coverage for stablecoin depegging events. Users can insure their assets against loss of peg incidents, with transparent terms, flexible coverage amounts, and a proven record of processing depeg-related claims.

-

Bridge Mutual delivers decentralized insurance against stablecoin depegs, smart contract exploits, and centralized exchange failures. Claims are verified using oracles, and payouts compensate policyholders if a stablecoin trades below its peg for a defined period.

-

Opium Depeg Insurance provides tokenized, on-chain insurance products specifically designed to hedge against stablecoin depegging. Users can purchase coverage for specific stablecoins, with automated payouts triggered by predefined price thresholds.

The following protocols are at the forefront of crypto insurance for depegs, each bringing distinct mechanisms and governance models:

Nexus Mutual

Nexus Mutual is one of the earliest decentralized mutuals providing on-chain cover against smart contract failures, and more recently, select stablecoin depeg events. Users purchase cover specifying which protocol or asset they want protection for; if a covered depeg occurs (e. g. , USDT trades below $0.98 for over 24 hours), claims can be submitted and are adjudicated by Nexus’s member-driven claims process. Notably, Nexus Mutual’s approach relies on community voting rather than automated triggers, a factor worth considering when evaluating claim speed and reliability.

InsurAce Protocol

InsurAce offers broad-based coverage across smart contract hacks and stablecoin depegs. Its parametric model uses on-chain price oracles to monitor pegged assets continuously; if a supported stablecoin drops below its peg by a predefined threshold (such as $0.97) within the policy window, payouts are automatically triggered, removing subjectivity from the claims process. InsurAce is also notable for its multi-chain support and competitive premiums relative to other decentralized providers.

Bridge Mutual

Bridge Mutual specializes in insuring against stablecoin price instability as well as centralized exchange risks. Users select their desired coverage amount and duration; if the insured stablecoin remains below its peg past a set time frame (e. g. , 24 hours), Bridge’s oracle-based system validates the event and processes compensation directly to policyholders, typically paid out in another stable asset. This makes Bridge Mutual an attractive choice for users prioritizing fast claims resolution during volatile periods.

Opium Depeg Insurance

The Opium protocol brings financial derivatives innovation into the insurance space by offering tokenized contracts specifically designed to hedge against depegging events. Users can buy or sell these contracts depending on their risk appetite; payouts are determined by transparent reference prices from trusted oracles at expiry. Opium’s flexible framework enables both speculators and conservative investors to tailor their exposure precisely, a key advantage as market conditions evolve rapidly.

Selecting the Right Coverage: Key Considerations

No two insurance protocols are identical in terms of coverage scope, premium structure, or claims process. When comparing platforms like Nexus Mutual, InsurAce, Bridge Mutual, and Opium Depeg Insurance:

- Coverage Triggers: Is payout based on objective price feeds or community voting?

- Payout Speed: How quickly do users receive compensation after an eligible event?

- Supported Stablecoins: Does the platform cover all major assets (USDC/USDT/DAI) or only select tokens?

- User Participation: Can you stake capital as an underwriter to earn yield while supporting protocol liquidity?

A nuanced understanding of these variables is essential before purchasing any policy, especially given that exclusions (like only covering USDT but not USDC) may apply depending on provider terms.

Premiums also vary significantly based on the perceived risk profile of each stablecoin and the historical volatility of their respective pegs. For example, insurance for algorithmic stablecoins or those with a history of depegging will generally command higher premiums than asset-backed tokens with robust collateralization and transparent reserves. Users should assess whether the cost of coverage aligns with their risk tolerance and expected exposure.

Another critical factor is the claims transparency. Protocols like InsurAce and Bridge Mutual leverage automated, oracle-driven triggers for most depeg events, ensuring prompt and objective payouts. In contrast, Nexus Mutual’s model, while offering flexibility and community oversight, may involve longer deliberation periods as claims are reviewed by member vote. Opium’s approach stands out for its composability: users can construct custom hedges that fit their portfolio risk profile, but must be comfortable navigating derivatives markets.

Maximizing DeFi Asset Protection with Layered Strategies

Relying solely on one insurance protocol may not be sufficient for comprehensive DeFi asset protection. Advanced users often combine multiple policies or supplement insurance with on-chain hedging strategies. For instance, it is possible to purchase depeg cover from both InsurAce and Bridge Mutual to diversify counterparty risk or use Opium contracts alongside traditional policies for added flexibility.

It’s also important to monitor policy terms regularly; protocols update coverage conditions in response to new exploits or regulatory developments. Staying informed about protocol governance changes, and participating in community votes where applicable, can provide early warning of shifts in available protections or premium adjustments.

Comparative Table: Key Features of Leading Stablecoin Depeg Insurance Providers

Comparison of DeFi Insurance Solutions for Stablecoin Depeg Protection

| Provider | Coverage Trigger | Payout Speed | Supported Stablecoins | Premium Cost |

|---|---|---|---|---|

| Nexus Mutual | Smart contract bugs; limited direct depeg cover | Varies (community claim assessment) | Primarily protocol-specific; limited direct stablecoin depeg cover | Medium to High |

| InsurAce | Stablecoin depeg below peg for set period (oracle-based) | Fast (automated or semi-automated, usually within days) | USDT, USDC, DAI, BUSD, others | Low to Medium |

| Bridge Mutual | Stablecoin price drops below peg for a set period (oracle-verified) | Fast (typically within days after claim) | USDT, USDC, DAI, BUSD, others | Medium |

| Opium Depeg Insurance | Stablecoin price drops below predefined threshold (parametric, oracle-based) | Instant to Fast (automated, parametric payout) | USDT, USDC, DAI, others (depends on vault) | Varies (depends on strike, duration, and volatility) |

If you’re deciding which platform best fits your needs, review our detailed breakdown at How to Compare DeFi Insurance Providers for Stablecoin Depeg Protection. For a technical walkthrough on how these protocols operate under stress scenarios, see How DeFi Insurance Protocols Respond to Stablecoin Depeg Events: A 2024 Case Study.

The landscape for stablecoin depeg insurance is rapidly evolving as protocols refine their models in response to market shocks. By adopting a data-driven approach, comparing triggers, payout mechanisms, costs, and governance, DeFi users can meaningfully reduce exposure to systemic risks while maintaining access to high-yield opportunities across decentralized markets.