Until recently, the world of reinsurance was a fortress: institutional-only, opaque, and out of reach for even the most adventurous DeFi users. But as on-chain reinsurance protocols like OnRe and Re Protocol accelerate their integration with decentralized finance, they’re not just opening new yield streams, they’re fundamentally transforming DeFi insurance yields and risk management models.

Tokenizing Reinsurance: From Institutional Vaults to DeFi Wallets

The reinsurance market is massive, clocking in at $750 billion globally, but historically it’s been closed off to anyone without deep pockets and regulatory clout. That’s changing fast. Platforms like OnRe are taking real-world reinsurance contracts and tokenizing their returns, letting everyday DeFi users tap into a yield source that’s both stable and largely uncorrelated with crypto market swings.

Their ONe token is a prime example: it offers projected returns up to 40.35%, derived from a unique blend of reinsurance performance, collateral yield, and protocol incentives. This isn’t just about speculation, it’s about using blockchain rails to unlock access to an asset class once reserved for institutional giants. For those interested in the mechanics behind this shift, here’s an excellent primer on how on-chain reinsurance protocols use blockchain to provide real-world insurance yields.

Pooled Capital Meets Real-World Risk: How Protocols Like OnRe and Re Work

On-chain reinsurance protocols operate by channeling capital from DeFi users directly into portfolios of real-world insurance contracts. The process is elegantly simple yet powerful: deposit stablecoins into a smart contract, receive yield-bearing tokens (like OnRe’s ONe or Re Protocol’s reUSDe), and let your capital underwrite diversified insurance risk, tracked transparently on-chain.

This structure means every dollar is fully collateralized and accounted for, with all fund flows visible to participants. For instance, OnRe’s reUSD token targets yields based on the higher of the 7-day average SOFR plus 250 basis points or the yield from Ethena’s sUSDe stablecoin, creating a “risk-free” floor for returns while still exposing holders to upside from underwriting profits.

The beauty here lies in composability: these tokens can be plugged into other DeFi protocols as collateral or LP assets, multiplying their utility across Solana or Avalanche ecosystems. If you want more detail on how these pools actually generate yield from real-world premiums, check out this resource: how on-chain reinsurance pools generate yield from real-world insurance premiums.

The Yield Equation: Stability Without Sacrificing Growth

The core appeal of these protocols is simple but powerful: uncorrelated yield. Unlike most DeFi staking or lending products that rely heavily on crypto market cycles (and are thus highly volatile), returns here come from underwriting premiums paid by real businesses in the traditional economy.

This means that even during periods of crypto market stress or sideways action, DeFi investors can enjoy steady income streams, an attractive proposition for anyone seeking resilience without sacrificing growth potential. As platforms like Re Protocol expand their institutional offerings (with products like fully collateralized U. S. insurance lines), they’re also introducing advanced risk tranching models that let users choose between higher-yield/higher-risk slices or safer but steadier returns.

If you’re curious about how risk tranching works in practice and how it fits into broader DeFi portfolio strategies, there’s more insight at how on-chain reinsurance enhances risk management in DeFi protocols.

As capital flows into these collateralized insurance pools, the DeFi landscape is seeing a shift in how risk and reward are balanced. Instead of chasing unsustainable APYs from leverage or reflexive tokenomics, investors can now anchor their portfolios with programmable insurance assets that offer both transparency and real economic backing. The result? A more resilient, diversified source of yield that can weather market volatility.

Top On-Chain Reinsurance Protocols & Yield Innovations

-

OnRe — The world’s first on-chain reinsurance company. OnRe’s ONe token gives investors exposure to real-world reinsurance yields, combining reinsurance premiums, collateral returns, and protocol incentives. Its ONyc stable asset is designed to become the preferred collateral across Solana DeFi, with projected returns of up to 40.35% derived from reinsurance performance and sUSDe yields.

-

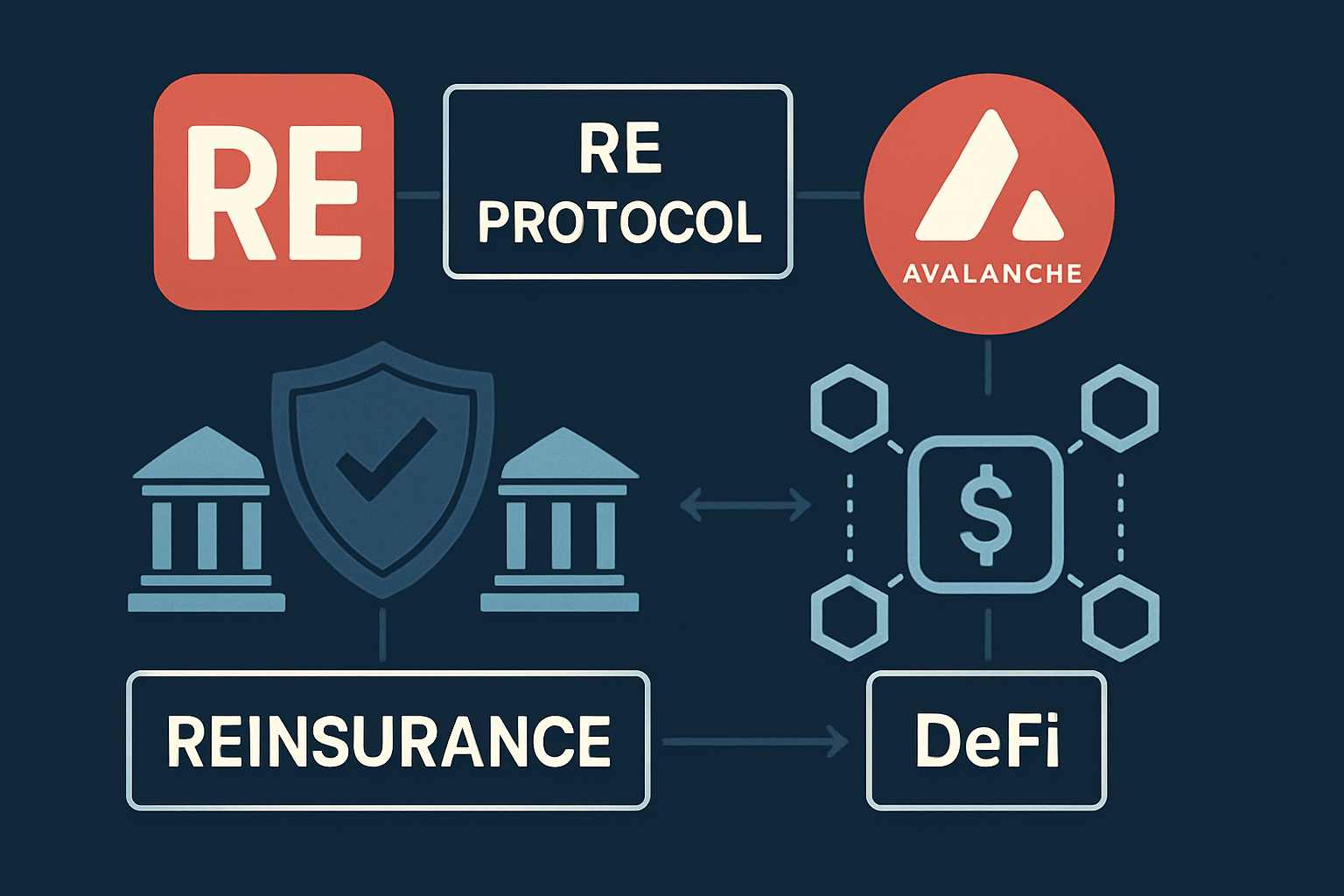

Re Protocol — A decentralized reinsurance protocol operating on Avalanche and Ethereum. Re’s reUSDe token is fully collateralized and backed by U.S. insurance underwriting, offering uncorrelated, stable yields. The protocol emphasizes transparency, on-chain tracking, and built-in liquidity, making institutional-grade reinsurance yields accessible to DeFi users.

-

InsurAce — A multi-chain DeFi insurance protocol that utilizes layered risk pools and reinsurance agreements to diversify yield sources. By integrating on-chain reinsurance, InsurAce enables users to earn yields from both direct insurance underwriting and reinsurance-backed products, enhancing portfolio stability and yield resilience.

-

Etherisc — An open-source insurance protocol that leverages blockchain for transparent, automated risk transfer. Etherisc collaborates with reinsurance partners to back its insurance pools, enabling yield generation from real-world risk diversification and on-chain capital efficiency.

But the innovation doesn’t stop at yield generation. On-chain reinsurance is also unlocking new forms of composability for DeFi builders. By integrating tokens like ONe or reUSDe as collateral layers, lending markets and structured products can tap into stable, uncorrelated returns while giving users more flexibility in how they manage risk. This is especially relevant as multichain capital pool protocols now span Ethereum, Solana, Avalanche, Polygon, and BNB Chain, enabling cross-chain insurance coverage with over $130 million pooled across networks.

Programmable Insurance: Building Blocks for the Next Wave of DeFi

What’s truly transformative is how programmable insurance is becoming a foundational layer for decentralized finance. With smart contracts governing everything from underwriting to claims processing, protocols can automate payouts based on real-world data feeds, eliminating manual bottlenecks and reducing counterparty risk. This opens up possibilities for dynamic coverage products that adjust premiums or exposures based on market conditions in real time.

Tokenized reinsurance yields are also paving the way for new types of structured DeFi products, think tranching by risk appetite, automated hedging strategies against stablecoin depegs or protocol exploits, and even community-driven mutual coverage pools.

The result is an ecosystem where users can fine-tune their exposure to both crypto-native risks and traditional market events, all while enjoying transparent reporting and instant liquidity options. As more institutional capital enters these decentralized reinsurance pools, expect both yields and product sophistication to evolve rapidly.

The Road Ahead: Resilience Through Real-World Integration

The integration of decentralized reinsurance into DeFi isn’t just a technical upgrade, it’s a philosophical leap toward bridging the best of both worlds. By fusing blockchain’s transparency with the proven economics of global insurance markets, protocols like OnRe and Re are setting new standards for what sustainable yield looks like in crypto.

The next wave will likely see even deeper integration between on-chain insurance primitives and broader DeFi infrastructure: think DAOs managing multi-strategy insurance portfolios, automated payouts triggered by oracle-verified events, or programmable tranching that adapts to macroeconomic shocks in real time.

If you’re looking to diversify your yield sources beyond pure speculation, and want exposure to an asset class that’s historically been recession-resistant, on-chain reinsurance deserves your attention. For those ready to explore further or participate directly in these emerging protocols, there are excellent guides available on how on-chain reinsurance protocols open up stable real-world yield to DeFi investors.