Stablecoins are the backbone of DeFi, but in 2024, the reality is clear: even the most trusted stablecoins can lose their peg. When USDC or DAI slip below $1, panic spreads fast and losses mount. For DeFi users, developers, and investors, protecting against these sudden depegs is no longer optional, it’s mission critical.

What Triggers a Stablecoin Depeg, and Why It Matters

Stablecoins are engineered to track fiat currencies like the US dollar. But market shocks, regulatory crackdowns, or smart contract bugs can all trigger a depeg, when a stablecoin trades below its intended value. The risk isn’t theoretical: we’ve seen high-profile events where stablecoins like USDC and UST lost their pegs, wiping out billions in value and shaking confidence across the ecosystem.

The consequences ripple through every corner of DeFi. Lending protocols face mass liquidations, liquidity pools drain rapidly, and users holding depegged coins see instant losses. That’s why DeFi insurance stablecoin depeg coverage has become one of 2024’s hottest risk management tools.

How DeFi Insurance Protocols Safeguard Against Stablecoin Depegs

The new generation of DeFi insurance protocols use smart contracts to automate payouts when a depeg event meets predefined criteria, no centralized claims adjusters required. Four protocols stand out for their robust approach to stablecoin depeg coverage:

Top DeFi Insurance Protocols for Stablecoin Depeg Protection (2024)

-

Nexus Mutual: A member-owned mutual protocol renowned for its robust DeFi insurance products, including stablecoin depeg coverage. Nexus Mutual offers compensation if a covered stablecoin loses its peg below a set threshold, with claims assessed by community governance. Widely trusted for its transparency and claims history.

-

InsurAce: A leading multi-chain DeFi insurance platform, InsurAce provides comprehensive coverage against stablecoin depegging events. Its flexible policies and cross-chain support make it a go-to choice for users seeking protection across various blockchains.

-

Unslashed Finance: Known for its decentralized risk pools, Unslashed Finance offers depeg protection among other crypto insurance products. The protocol emphasizes fast, automated payouts and diversified coverage, making it a popular option for proactive DeFi users.

-

Sherlock: Specializing in smart contract security and insurance, Sherlock has expanded its offerings to include stablecoin depeg protection. Sherlock leverages expert claim assessments and a robust risk management framework to safeguard users against sudden stablecoin price drops.

Nexus Mutual, InsurAce, Unslashed Finance, and Sherlock each bring unique mechanisms to protect users:

- Nexus Mutual: Offers customizable policies that pay out if a covered stablecoin drops below its peg for a set period, users choose terms based on their risk tolerance.

- InsurAce: Provides multi-chain coverage with automated claims processing; supports major stablecoins and lets users tailor coverage amounts.

- Unslashed Finance: Focuses on flexible risk pools that cover both smart contract exploits and depegs; community governance controls policy updates.

- Sherlock: Known for rigorous security audits and rapid response coverage; combines exploit detection with financial protection for depegging incidents.

This diversity gives users options to match their exposure profile, and encourages healthy competition among protocols to offer faster payouts or lower premiums. Want details on how these mechanisms work under real market stress? Check our deep dive on how DeFi insurance protocols respond to stablecoin depeg events.

The Mechanics: Automated Payouts and Decentralized Risk Pools

The heart of these protocols is automation. When an oracle detects that (for example) USDC trades below $0.95 for over 24 hours, smart contracts trigger compensation to policyholders, no paperwork or middlemen involved. This speed is essential in volatile markets where delays mean bigger losses.

Pooled resources are another key advantage. Instead of relying on a single insurer’s balance sheet, these platforms distribute risk across many participants via decentralized pools. If one user claims after a DAI depeg event, it’s the collective pool (not just one company) that pays out, making large-scale protection possible without centralized bottlenecks.

This isn’t theory, it’s already been tested in live fire situations where protocols like Nexus Mutual processed millions in claims after market-wide shocks. Curious about comparing policy terms? Our guide on comparing DeFi insurance providers for stablecoin depeg protection breaks down what to look for in 2024’s top offerings.

Yet, not all depeg insurance is created equal. Each protocol approaches risk and payout calculation differently, so users need to scrutinize terms before committing capital. For example, Nexus Mutual relies on member voting for claim approval, which can introduce slight delays but fosters transparency and community oversight. InsurAce leans into automation with instant payouts when on-chain oracles confirm a depeg event, ideal for traders who can’t afford to wait.

Unslashed Finance stands out with its flexible coverage architecture. Users can stack policies for layered protection, think simultaneous coverage against both stablecoin depegs and smart contract exploits in a single policy bundle. This is especially relevant for DeFi power users running complex yield strategies across multiple chains.

Sherlock, meanwhile, has carved out a niche by pairing insurance with proactive security auditing. Their team works directly with protocols to spot vulnerabilities before they cause catastrophic depegs, then backs up their audits with financial protection if things go south anyway. It’s a hybrid approach that’s gaining traction among developers and institutional DeFi players looking for more than just passive insurance.

What Should You Watch Out For in 2024?

- Payout criteria: Not every dip counts as a depeg event. Most policies require the stablecoin to remain below a set threshold (often $0.95 or lower) for 24 hours or more before triggering compensation.

- Premium volatility: In times of market stress, premiums can spike fast as demand for protection surges, especially if rumors of insolvency or regulatory action hit a major stablecoin.

- Risk pool health: Decentralized pools are only as robust as their funding and risk models. If too many claims hit at once, some protocols may impose limits or delays on payouts.

- Coverage exclusions: Some policies exclude losses from black swan events or technical failures outside the stablecoin’s control (like blockchain outages). Always read the fine print.

If you’re serious about protecting against stablecoin depeg, it pays to stay sharp: monitor protocol updates, check pool solvency metrics, and diversify your coverage across multiple providers when possible. Our resource hub on comparing top depeg insurance providers is updated regularly with protocol health stats and user reviews.

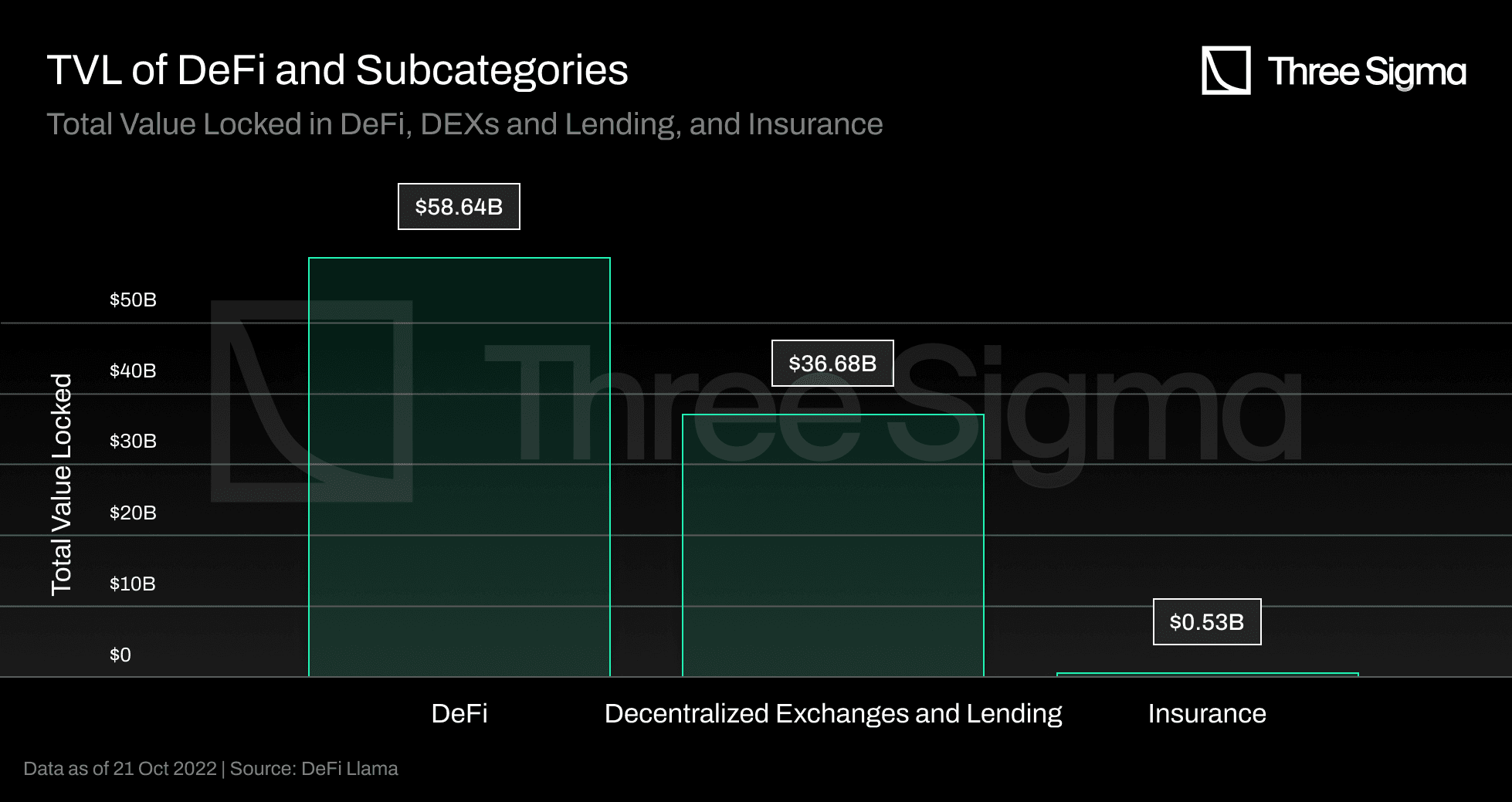

Why DeFi Insurance Is Becoming Table Stakes

The bottom line? In 2024’s high-velocity markets, DeFi risk management isn’t just about picking the right assets, it’s about proactively hedging against systemic shocks like stablecoin depegs. The top protocols, Nexus Mutual, InsurAce, Unslashed Finance, Sherlock, are innovating rapidly to meet this challenge head-on.

The next wave of DeFi adoption will depend on how well these insurance mechanisms scale under pressure. As more institutions enter the space and regulatory scrutiny intensifies, expect new features like cross-chain coverage, dynamic premium adjustment based on real-time risk data, and even bundled protection products covering everything from yield farming exploits to DAO governance attacks.

If you’re navigating these turbulent waters as a trader or long-term investor, don’t treat insurance as an afterthought, it’s your first line of defense when algorithms fail and sentiment turns south overnight.

The landscape is evolving quickly, and so are the risks. Stay alert, compare your options closely, and use DeFi insurance strategically to keep your portfolio resilient no matter what comes next.