The DeFi insurance landscape has evolved rapidly in 2024, with protocols racing to address the challenges posed by stablecoin depegs. As stablecoins become increasingly central to decentralized finance, their failures have outsized impacts on users and protocols alike. Recent events have tested the readiness of DeFi insurance providers, highlighting both the strengths and gaps in current depeg protection mechanisms.

Stablecoin Depegs: A Growing Threat to DeFi Portfolios

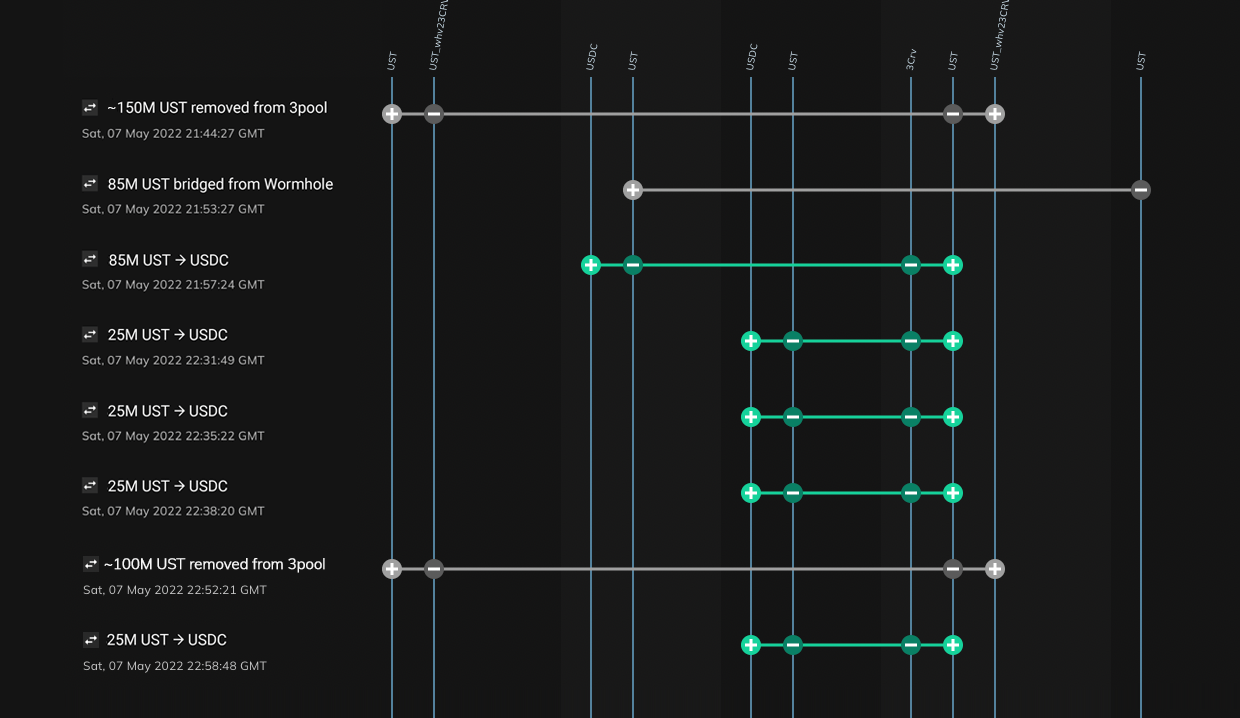

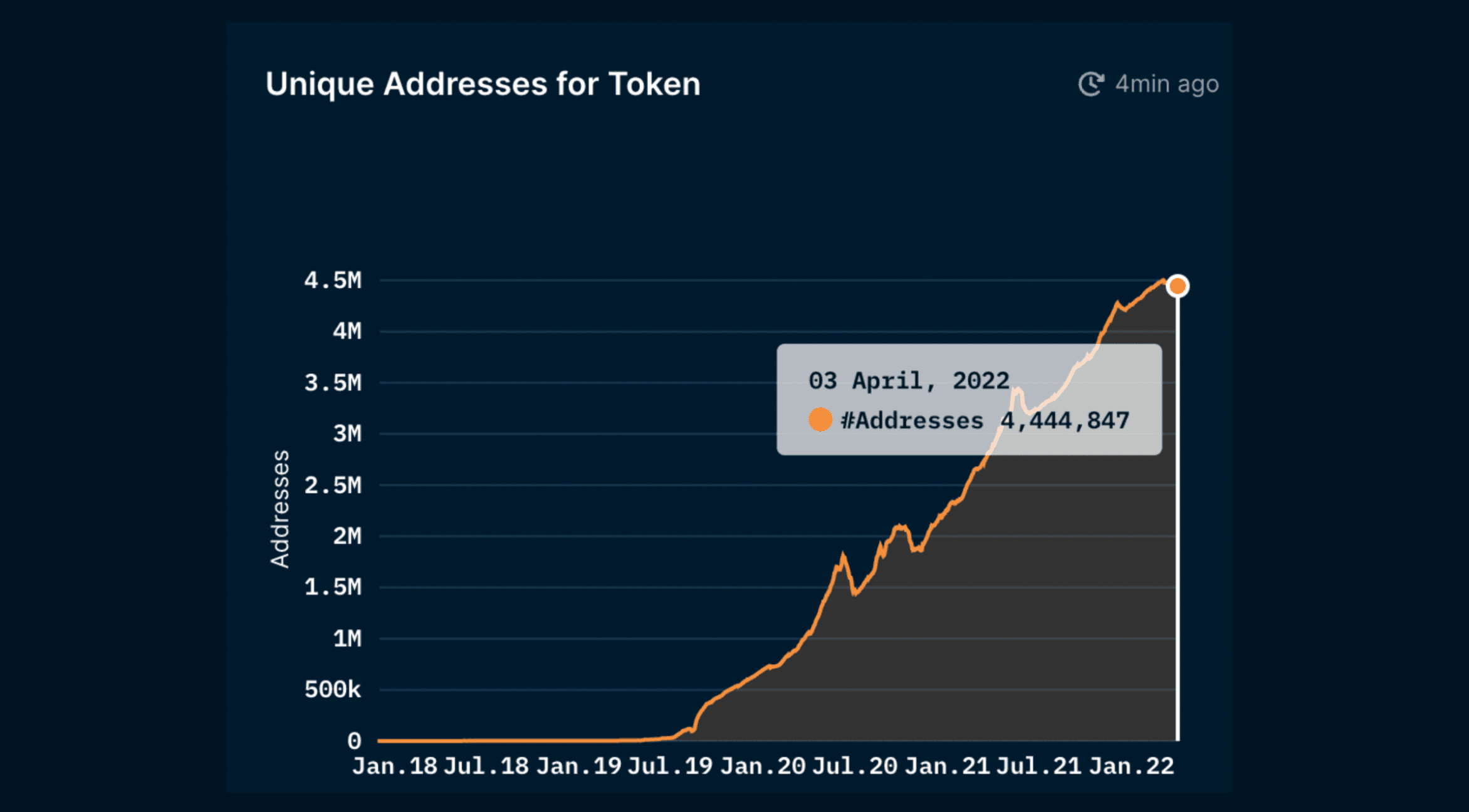

Stablecoins are marketed as safe harbors in crypto’s volatility, pegged 1: 1 to fiat currencies like the US dollar. Yet history shows that pegs can snap, sometimes violently. In May 2022, TerraUSD (UST) collapsed, sending shockwaves across DeFi and prompting insurance payouts exceeding $11.5 million from protocols such as InsurAce, Unslashed, and Risk Harbor. Fast forward to October 2025, and the synthetic stablecoin USDe plummeted to $0.65, triggering $19.35 billion in liquidations within a single day. These events exposed the systemic risks tied to stablecoins and underscored why robust depeg coverage is no longer optional for serious DeFi investors.

Depeg insurance has become one of the most sought-after products in crypto risk management. According to recent market research, the global depeg insurance market stood at $420 million in 2024 and is projected to expand at a staggering 28.7% CAGR through 2033. This explosive growth reflects both user demand and the recognition that traditional risk models struggle to price correlated crypto shocks.

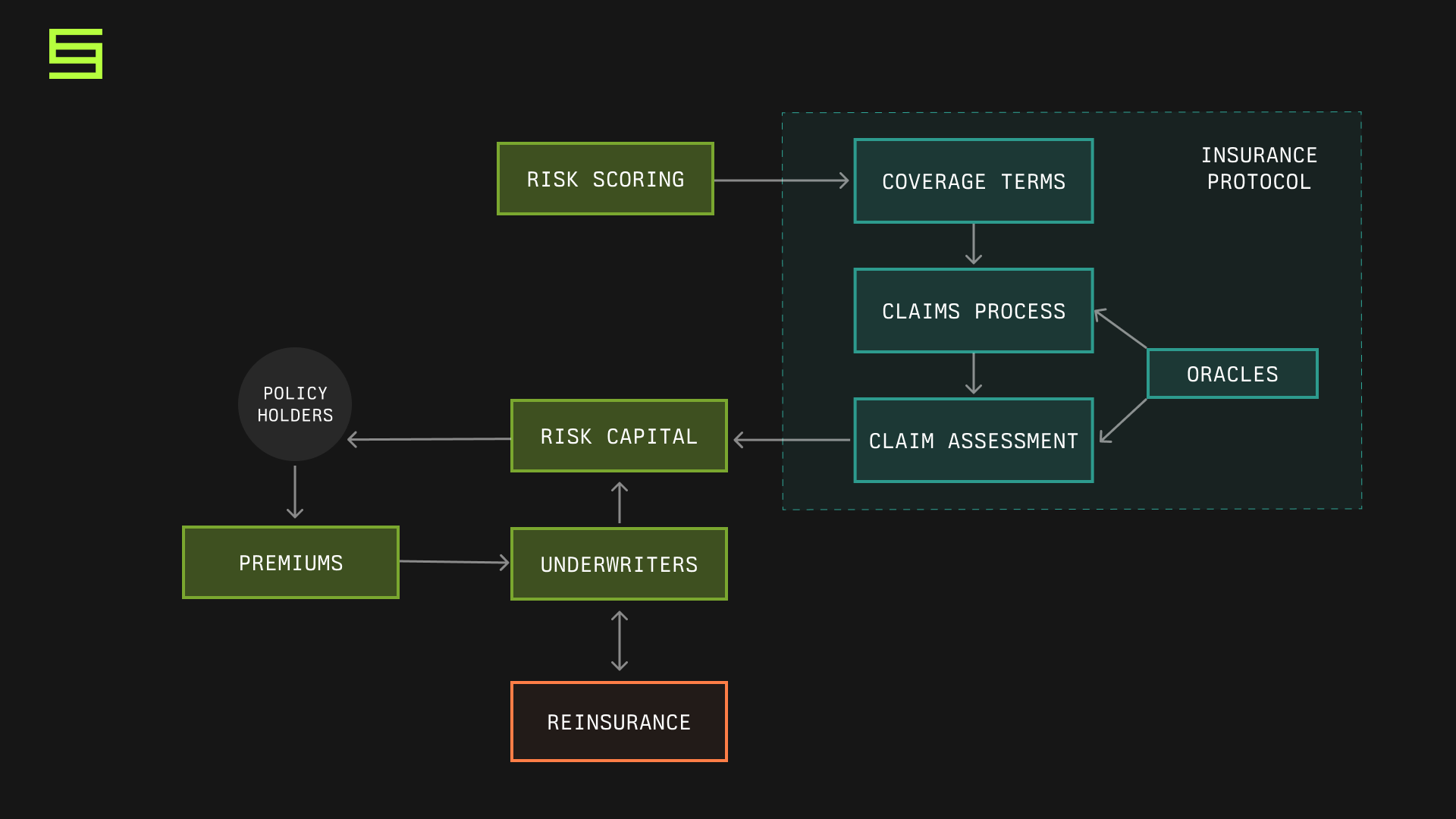

How DeFi Insurance Protocols Structure Depeg Protection

Leading protocols like Nexus Mutual, InsurAce, and Etherisc have rolled out specialized products for stablecoin depeg risk. The mechanics are straightforward: users purchase coverage for a specific stablecoin and duration. If the coin’s price falls below a defined threshold (for example, 5-20% below $1) for a set period (often 24 hours), the protocol triggers an automated payout.

For example, Etherisc’s USDC depeg cover pays out if USDC trades between $0.80 and $0.95 for at least 24 hours. Nexus Mutual has expanded its scope to include multiple stablecoins and allows users to tailor coverage parameters to their risk appetite. These innovations represent a leap forward from earlier insurance models that focused exclusively on smart contract exploits.

However, not all risks are covered equally. Many policies exclude losses from off-chain events, regulatory seizures, or human error, leaving certain vulnerabilities unaddressed. Additionally, because stablecoin failures often coincide with broader market turmoil, insurance pools must maintain significant reserves to honor claims during systemic crises.

Case Study: The USDe Depeg Event of October 2025

The dramatic depegging of USDe in October 2025 serves as a cautionary tale and a stress test for DeFi insurance infrastructure. When USDe slipped from $1 to $0.65, panic ensued across lending protocols, DEXs, and liquidity pools. Within hours, over $19.35 billion in positions were liquidated as collateral values evaporated.

Insurance protocols responded with varying degrees of efficiency. Automated claims processing kicked in for eligible policyholders, while others faced delays due to manual verification or ambiguous policy language. The event exposed two key lessons: first, the necessity of clear, transparent claims processes; second, the importance of ample capital reserves to meet sudden surges in payouts.

To dive deeper into how on-chain insurance protocols work during such crises, see this detailed guide.

Beyond immediate payouts, the USDe incident catalyzed protocol upgrades and renewed scrutiny on stablecoin risk models. Several insurance DAOs initiated community votes to reassess premium structures, expand coverage triggers, and tighten off-chain data feeds for price verification. Some protocols even paused new policy issuance temporarily to protect existing pools from insolvency. This adaptive governance is a hallmark of DeFi insurance, but it also reveals the sector’s growing pains as it scales to meet real-world shocks.

Transparency during the claims process became a flashpoint for user trust. In forums and Discords, affected investors demanded granular breakdowns of payout calculations and reserve sufficiency. Protocols that provided real-time dashboards and published post-mortems saw markedly less reputational damage compared to those that communicated poorly or delayed settlements.

What Users Should Know: Claims, Exclusions, and Risk Mitigation

For users considering stablecoin depeg coverage, understanding the claims process is critical. Most protocols operate on predefined triggers: if a stablecoin remains below a certain price (e. g. , $0.80) for 24 hours, claims can be submitted automatically or semi-automatically via smart contracts. However, review periods, KYC requirements, or ambiguous policy terms can slow things down, especially during large-scale events.

Exclusions are equally important. Losses from regulatory actions, custodial failures, or oracle manipulation are often not covered unless explicitly stated. Always review policy documentation closely and consider diversifying coverage across multiple providers for robust protection.

Key Steps to File a Stablecoin Depeg Insurance Claim (2024)

-

1. Verify Depeg Event and Coverage: Confirm that a stablecoin depeg event has occurred (e.g., USDe dropping to $0.65 from its $1 peg) and that your DeFi insurance policy—such as those from InsurAce, Nexus Mutual, or Etherisc—covers the affected stablecoin and event parameters.

-

2. Connect Wallet to Insurance Protocol: Access the relevant DeFi insurance platform and securely connect your crypto wallet (e.g., MetaMask, WalletConnect) that holds the insured assets.

-

3. Initiate the Claim Process: Navigate to the claims section of the protocol (e.g., InsurAce, Etherisc, Nexus Mutual) and select the policy tied to the depegged stablecoin. Start a new claim submission.

-

4. Submit Required Evidence: Provide on-chain proof of loss, such as transaction hashes, wallet addresses, and screenshots showing the stablecoin’s value during the depeg period (e.g., USDe at $0.65). Some protocols, like Etherisc, may automate evidence collection via smart contracts.

-

5. Undergo Claim Assessment: The protocol’s automated or community-driven assessment process will review your claim. For example, Nexus Mutual uses member voting, while Etherisc may rely on smart contract triggers for payout eligibility.

-

6. Receive Payout in Approved Cases: If your claim is validated, the protocol will process the payout—often directly to your connected wallet—in the covered asset or protocol token. For instance, Etherisc automates payouts for USDC depeg events between 5% and 20% over 24 hours.

As the market matures, expect more customizable policies and dynamic pricing tied to real-time risk analytics. Newer entrants like Etherisc and Risk Harbor are experimenting with parametric triggers and transparent on-chain audits to address past shortcomings.

Market Outlook: DeFi Insurance Poised for Mainstream Adoption

The explosive growth of the depeg insurance market, from $420 million in 2024 with a projected CAGR of 28.7%: signals strong institutional interest. As regulatory clarity improves and protocols refine their underwriting models, expect broader adoption not just by crypto natives but also by traditional asset managers exploring tokenized money market funds and RWAs.

For an in-depth look at comparing top providers and understanding policy nuances, see our comparison guide.

If you’re active in DeFi or holding substantial stablecoin balances, now is the time to reevaluate your risk management stack. The lessons from UST and USDe are clear: depeg events can be sudden and severe, but proactive insurance coverage remains one of the most effective tools for protecting your portfolio against systemic shocks.