For decades, reinsurance has operated behind closed doors, with capital flows and risk assessments shrouded in opacity. The emergence of Re Protocol is now upending this paradigm, channeling on-chain capital directly into real-world reinsurance treaties via a blockchain-native workflow. This strategic leap doesn’t just modernize insurance infrastructure – it unlocks transparent, tokenized insurance yields for DeFi participants seeking both security and uncorrelated returns.

Re Protocol’s Capital Stack: Where Stablecoins Meet Real-World Insurance Premiums

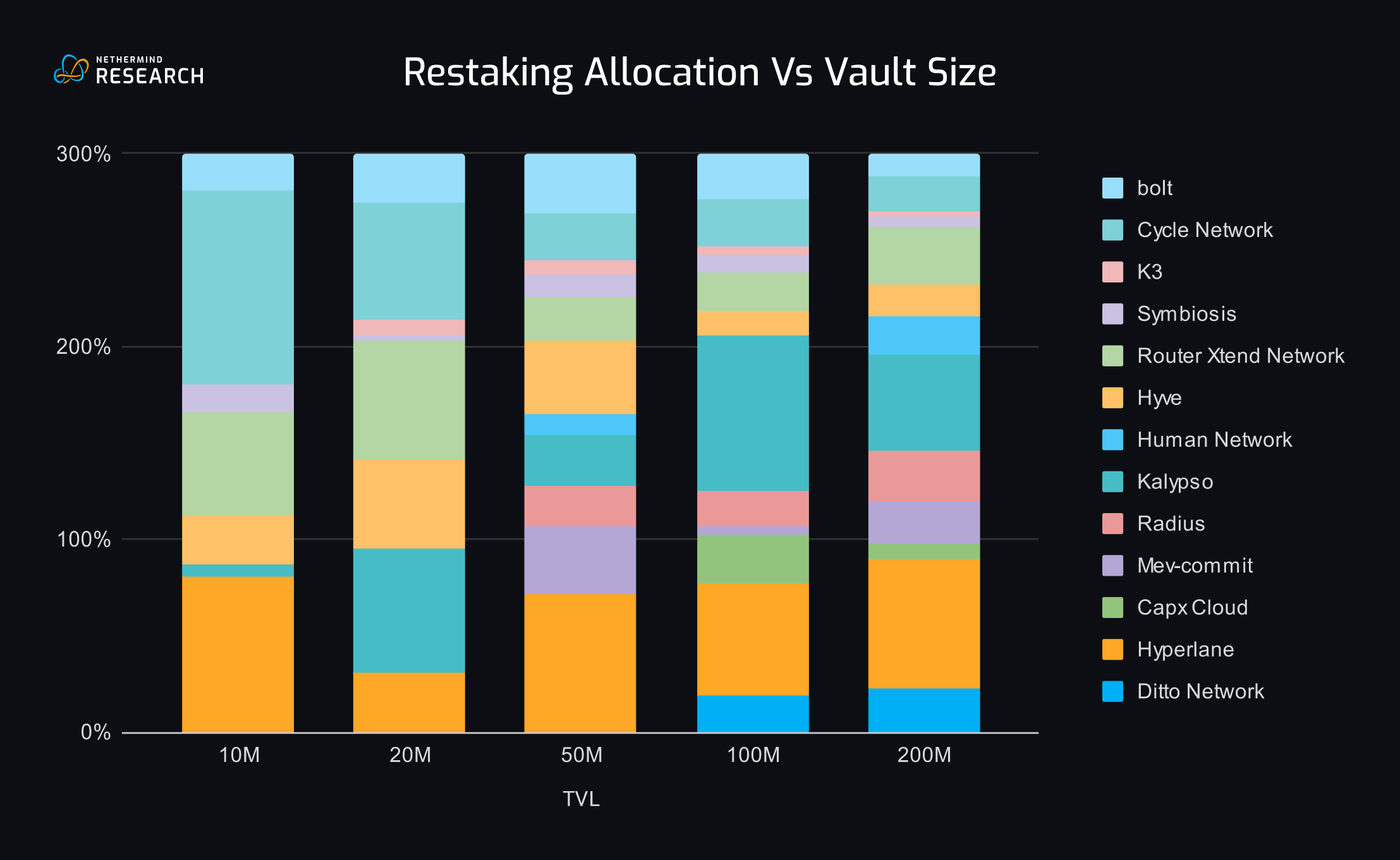

The foundation of DeFi reinsurance through Re Protocol is the ability for users to stake stablecoins such as USDC, DAI, USDe, or sUSDe into Insurance Capital Layers (ICLs). In return, participants mint yield-bearing tokens that represent exposure to fully collateralized reinsurance contracts. This mechanism bridges the gap between crypto-native liquidity and the global insurance sector, a market historically inaccessible to retail and even most institutional investors.

At the core are two innovative ERC-20 assets:

- reUSD (Basis-Plus): A principal-protected token tracking the greater of the risk-free rate plus 250 basis points or Ethena’s basis-trade yield plus 250 basis points. It accrues yield daily and offers a stable USD-denominated asset for conservative DeFi users.

- reUSDe (Insurance Alpha): A first-loss, profit-sharing token for those with more risk appetite. Holders absorb any portfolio losses but also capture surplus profits, historically yielding an impressive 16, 25% IRR after fees. This aligns incentives with real underwriting performance and market-driven premium flows.

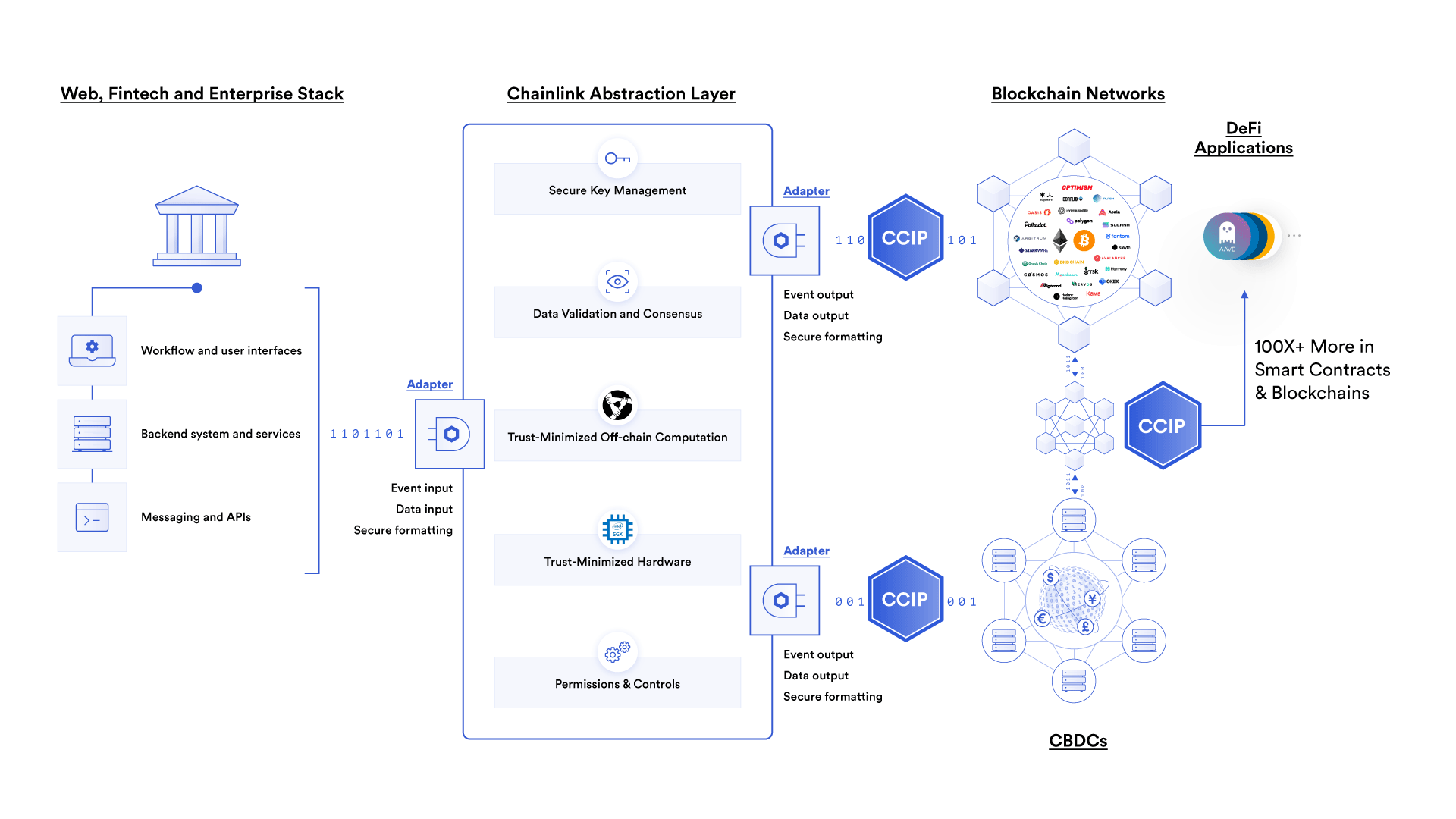

The process is fully transparent: idle funds are held securely in smart contracts, with balances published daily to a Chainlink oracle. This creates ironclad proof-of-reserves and removes the trust assumptions that have plagued both TradFi insurers and early DeFi coverage protocols.

How On-Chain Reinsurance Actually Works: Legal Trusts Meet Smart Contracts

The operational magic of Re Protocol lies in its use of Surplus Notes. When capital is staked into ICLs, it is lent under legally binding surplus notes to vetted reinsurers. These funds are then deposited into U. S. -domiciled trust accounts, providing admitted collateral for insurance policies written by regulated carriers. Every inflow (premiums) and outflow (claims) is hashed on-chain via Chainlink oracles, ensuring 24/7 auditable proof-of-funds for participants worldwide.

This structure does not sacrifice safety for yield: pools are deliberately overcollateralized, and redemptions are governed by daily solvency checks. Programmatic controls ensure that liquidity remains available without undermining portfolio health, a critical advancement over legacy models where capital can be locked up or misallocated without recourse.

Key Benefits of Tokenized Reinsurance Yields

-

Transparency and On-Chain Proof of Funds: Every transaction, trust account balance, premium inflow, and claim outflow is published on-chain and verified by Chainlink oracles, offering unmatched transparency compared to opaque traditional insurance investments.

-

Fully Collateralized, Principal-Protected Yields: With products like reUSD (Basis-Plus), investors receive a principal-protected, yield-accruing token backed by overcollateralized pools and U.S.-domiciled trust accounts, reducing counterparty risk.

-

Attractive, Uncorrelated Returns: Tokenized reinsurance yields, such as those from reUSDe (Insurance Alpha), historically offer 16–25% IRR, providing exposure to an asset class uncorrelated with traditional markets and shielding investors from broader financial volatility.

-

Daily Liquidity and Programmatic Redemptions: Unlike traditional insurance investments with long lock-ups, Re Protocol enables daily redemptions and liquidity through smart contracts, balancing investor freedom with solvency safeguards.

-

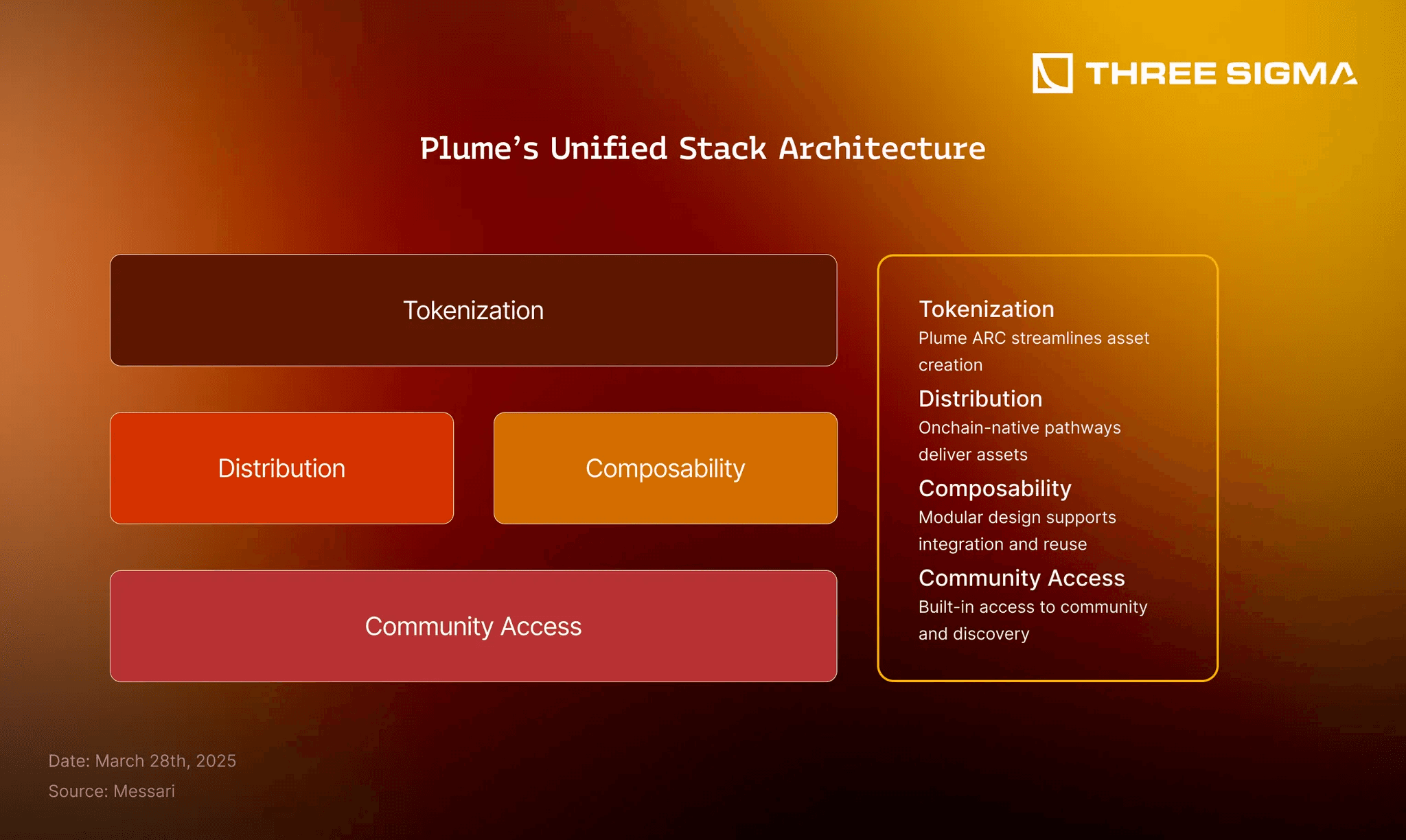

Seamless DeFi Integration and Composability: As ERC-20 tokens, reUSD and reUSDe can be used across leading DeFi platforms for lending, borrowing, and yield farming, unlocking new strategies not possible in legacy insurance markets.

A New Era of Insurance Yields: Composability and Real-World Alpha

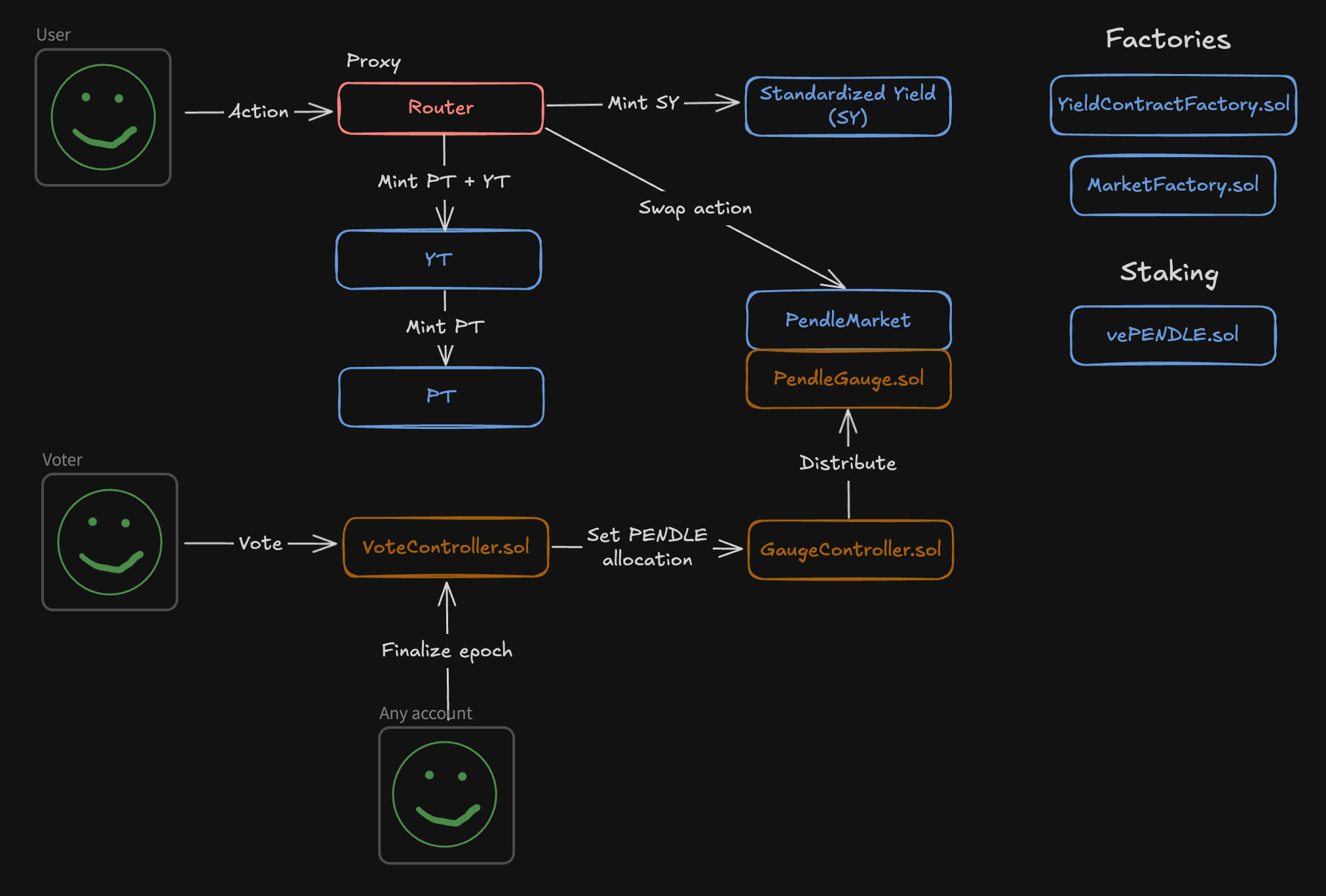

The composability of Re Protocol’s ERC-20 tokens means they slot seamlessly into existing DeFi infrastructure, enabling lending, borrowing, staking, and even innovative structured products built atop uncorrelated insurance yields. With deployment across Ethereum, Avalanche, and Arbitrum, accessibility is global and frictionless.

This model has already attracted attention from major DeFi platforms. For example, Pendle Finance’s July 2025 partnership with Ethena Labs and Re Protocol enabled new reUSD/reUSDe vaults offering a current yield of 16% APY, uncorrelated with broader crypto market volatility, a compelling proposition amid macro uncertainty.

If you want a deeper dive into how these mechanisms generate sustainable real yield from actual insurance premiums rather than speculative trading fees or inflationary tokenomics, see this dedicated breakdown.

What sets Re Protocol apart is its ability to bring real-world insurance risk on-chain while maintaining ironclad transparency. Unlike opaque reinsurance syndicates or black-box DeFi insurance pools, every dollar staked, premium received, and claim paid is verifiable on public ledgers and independently attested by Chainlink oracles. This level of openness is not just a technical upgrade, it’s a paradigm shift for risk management in decentralized finance.

For investors, the implications are significant. Exposure to tokenized reinsurance yields means access to a multi-trillion dollar asset class that has historically been uncorrelated with equities, bonds, or crypto cycles. Insurance premiums are sticky, predictable cash flows, especially in property-casualty lines, and the ability to tap them via composable ERC-20 tokens unlocks new possibilities for portfolio construction and hedging within the DeFi ecosystem.

Risk Controls and Transparency: Why Institutional Capital Is Taking Notice

The protocol’s deliberate overcollateralization and programmatic redemption logic serve as institutional-grade safeguards. Redemptions are processed daily but always subordinate to solvency checks, liquidity is never prioritized over the health of the underlying pool. This is a critical differentiator for allocators wary of the rug pulls and insolvencies that have haunted earlier DeFi coverage experiments.

Moreover, Re Protocol’s legal architecture, pairing surplus notes with U. S. -domiciled trust accounts, ensures regulatory compliance and enforceability, further de-risking participation for both accredited investors and forward-thinking DAOs. The result is a capital stack that can withstand black swan events without sacrificing yield or flexibility.

Key Use Cases for DeFi Users Leveraging Tokenized Reinsurance Yields

-

Stable, Uncorrelated Yield Generation: DeFi users can earn yield by staking stablecoins (such as USDC, DAI, USDe, or sUSDe) into Re Protocol’s Insurance Capital Layers (ICLs), receiving reUSD or reUSDe tokens. These yields are derived from real-world reinsurance premiums and are uncorrelated with traditional crypto or equity market volatility.

-

Portfolio Diversification with Real-World Assets: By holding reUSD or reUSDe, users gain exposure to the global insurance market—a massive, historically resilient asset class—without leaving the DeFi ecosystem. This diversification can help mitigate risk during periods of crypto market instability.

-

Composability with DeFi Protocols: As ERC-20 tokens, reUSD and reUSDe can be integrated into lending, borrowing, and yield farming platforms like Pendle Finance, enabling users to maximize returns and participate in advanced DeFi strategies.

-

Access to Principal-Protected and Alpha-Driven Products: Users can choose between reUSD (principal-protected, stable yield) and reUSDe (higher-risk, profit-sharing with historical IRR of 16–25%), tailoring risk and return profiles to individual preferences.

-

On-Chain Transparency and Proof of Funds: All capital flows, trust balances, and claim events are published to Chainlink oracles, giving users real-time, verifiable proof of collateralization and fund safety—an unprecedented level of transparency for insurance-linked investments.

-

Participation in Points and Rewards Programs: With the launch of the Re Points Program on Avalanche, users can earn additional incentives by holding or using reUSD and reUSDe, enhancing overall yield and engagement within the ecosystem.

Looking Ahead: The Future of On-Chain Insurance Coverage

The expansion of Re Protocol’s offerings on Avalanche in August 2025, and integrations with platforms like Pendle Finance, signal a maturation of the on-chain insurance yield market. As more protocols seek sustainable, non-correlation sources of return, tokenized reinsurance stands poised to become a foundational primitive in DeFi’s next growth cycle.

For developers and DAOs building risk-managed vaults or stablecoin products, incorporating reUSD or reUSDe can provide both robust yield and much-needed diversification away from endogenous protocol risks. For investors seeking real-world alpha without sacrificing transparency or composability, Re Protocol offers an institutional-grade solution built natively for the blockchain era.

The convergence of blockchain transparency with centuries-old insurance economics is no longer hypothetical, it’s live, auditable, and already delivering value for early adopters. As capital continues to flow into this emerging sector, expect on-chain reinsurance to redefine what it means to manage risk, and earn sustainable returns, in decentralized finance.