Yield-separated stablecoins are rapidly redefining the compliance and risk landscape in decentralized finance (DeFi). As regulatory scrutiny intensifies globally, especially with frameworks like MiCA in the EU and the U. S. GENIUS Act, DeFi protocols are innovating to remain both compliant and competitive. The STBL protocol is at the forefront of this evolution, leveraging a model that splits principal value from yield – a structural shift that could set the new standard for stablecoin design.

Why Yield-Separated Stablecoins Are Gaining Momentum

Traditional stablecoins, such as USDC or USDT, maintain a 1: 1 peg to fiat currency and are typically backed by cash or short-term government securities. The yield generated from these reserves is usually retained by the issuer, not passed on to users. However, regulatory developments are changing this paradigm. Under MiCA and the GENIUS Act, offering direct yield on stablecoins risks classifying them as securities – a nonstarter for many issuers.

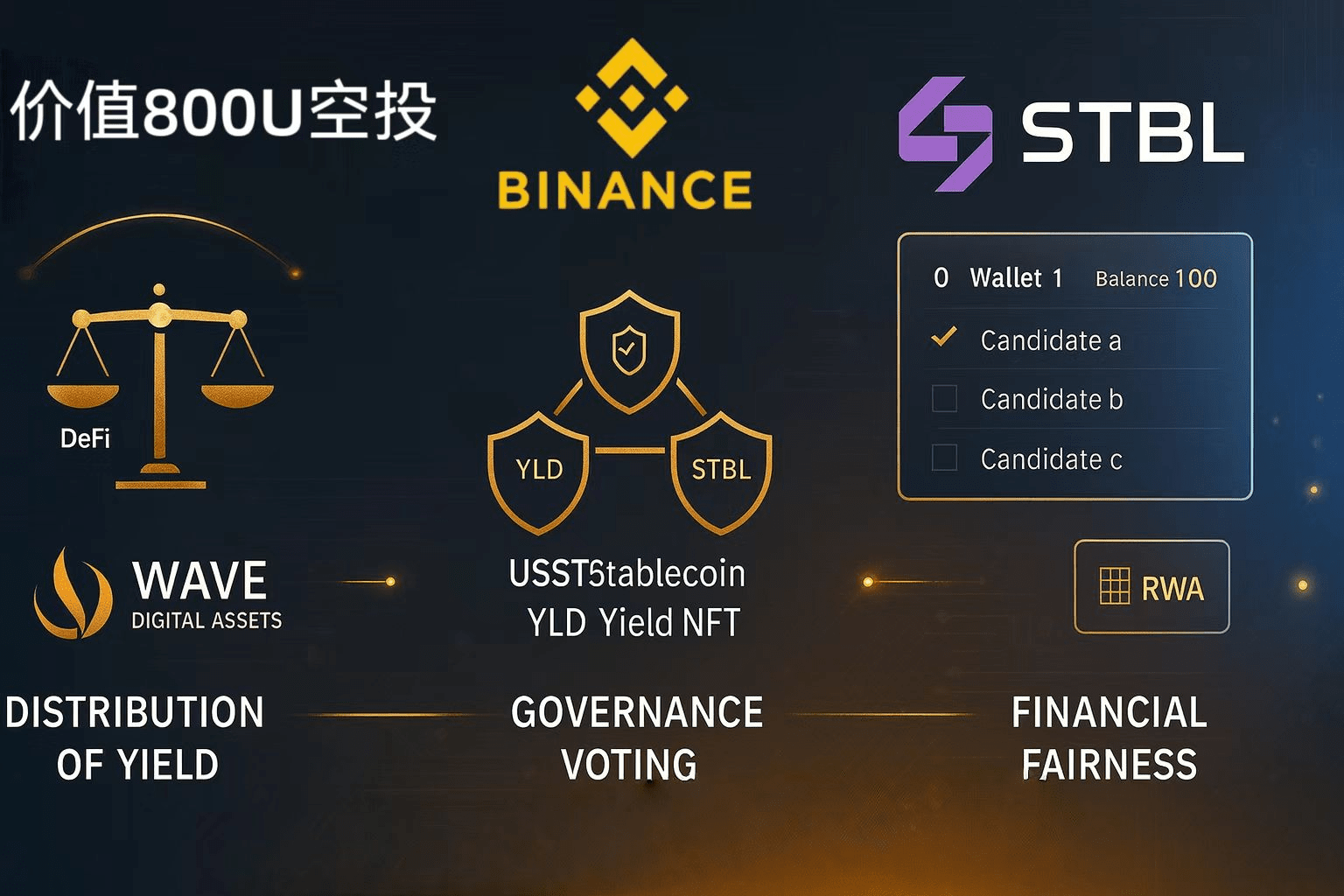

Enter yield-separated stablecoins like STBL. By decoupling the principal (the spendable stablecoin) from its yield component (often represented as an NFT or separate token), protocols can maintain compliance while still distributing returns to users. This architecture allows for:

- Regulatory alignment: The principal token remains non-yielding and thus outside security definitions.

- User empowerment: Yield rights become transferable assets, enabling secondary markets and novel DeFi strategies.

- Improved transparency: On-chain separation enhances auditability and risk assessment.

This model is not just theoretical: according to CoinMarketCap’s analysis of STBL, it’s already live with active adoption across major DeFi platforms.

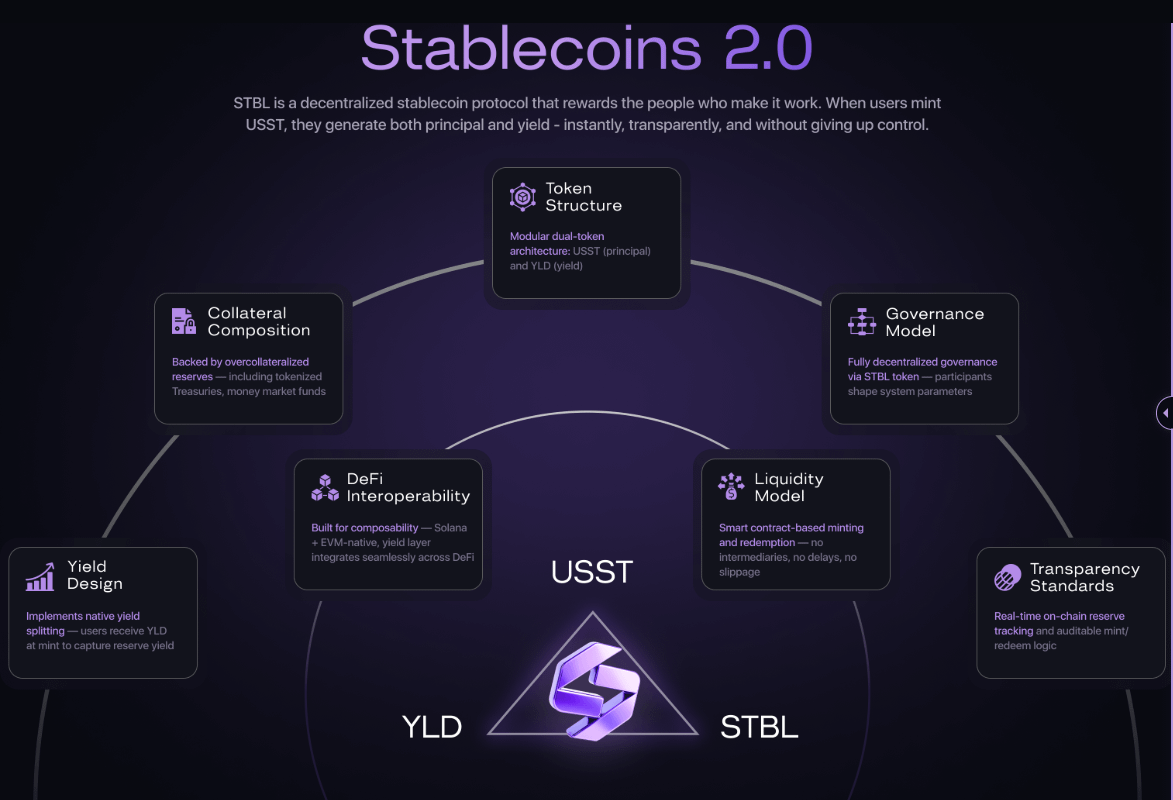

The STBL Model: Principal vs. Yield Tokenization

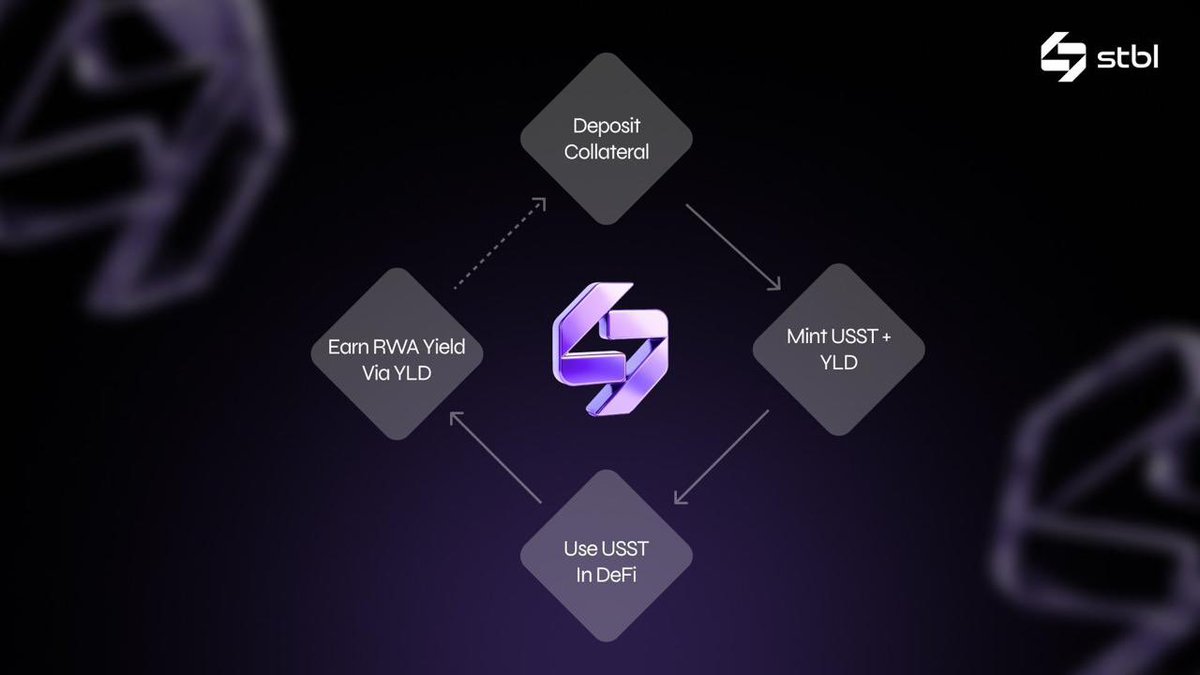

The core innovation of STBL lies in its dual-token system:

- USST: A USD-pegged stablecoin designed for payments and liquidity across DeFi applications.

- YLD NFT: An NFT that represents the right to claim yield generated by underlying collateral (such as tokenized Treasury bills or RWA-backed assets).

This structure means users can hold USST for everyday transactions while selling or staking their YLD NFTs elsewhere – maximizing capital efficiency without running afoul of new rules on interest-bearing stablecoins. For protocols seeking regulatory clarity, this model also enables them to demonstrate clear separation between payment instruments and investment products (source).

Compliance Advantages: Surviving MiCA and GENIUS Act Crackdowns

The push toward regulatory-compliant DeFi has never been more urgent. With regulators drawing a hard line against yielding stablecoins (source), projects like STBL offer a path forward. By ensuring only the YLD NFT receives returns – not the USST itself – STBL aligns with both European MiCA requirements and American GENIUS Act provisions.

This separation is more than legal window dressing; it fundamentally alters how risk is managed within DeFi protocols:

- No commingling of user funds with protocol treasuries;

- Easier auditing of reserve backing;

- Simplified KYC/AML processes for yield recipients vs. spenders.

The result is a more robust compliance posture without sacrificing user choice or ecosystem liquidity.

Risk Management Innovations Backed by On-Chain Transparency

The technical architecture of yield-separated stablecoins also brings substantial risk management improvements. All collateral backing USST is transparently held on-chain, allowing real-time audits by both regulators and users (source). Over-collateralization further cushions against market volatility or unexpected depegs – critical as RWA-backed models proliferate in response to demand for real-world yields (CertiK report).

STBL (STBL) Price Prediction 2026-2031

Forecast based on current price ($0.2816), yield-separated stablecoin market trends, and regulatory landscape as of October 2025.

| Year | Min Price | Avg Price | Max Price | % Change (Avg) vs. 2025 | Market Scenario Highlights |

|---|---|---|---|---|---|

| 2026 | $0.26 | $0.31 | $0.38 | +10% | Initial post-MiCA/GENIUS compliance boost; stable adoption in DeFi, but capped upside due to regulatory yield limits. |

| 2027 | $0.25 | $0.34 | $0.44 | +21% | Growth in tokenized funds integration; increased RWA adoption; potential for volatility if new entrants disrupt market. |

| 2028 | $0.24 | $0.37 | $0.49 | +31% | Wider DeFi ecosystem integration; competition from other compliant stablecoin protocols; improved transparency attracts institutional users. |

| 2029 | $0.23 | $0.40 | $0.54 | +42% | Potential for global regulatory harmonization; STBL benefits from on-chain auditability and risk management. |

| 2030 | $0.22 | $0.44 | $0.60 | +56% | Possible expansion to cross-border payments; DeFi user base broadens, but profit-taking and new tech may cause volatility. |

| 2031 | $0.20 | $0.48 | $0.67 | +70% | Matured DeFi compliance infrastructure; STBL seen as a reserve-grade stablecoin, but faces stiff competition and innovation cycles. |

Price Prediction Summary

STBL is positioned to grow steadily as yield-separated stablecoins gain traction in compliant DeFi markets. Regulatory clarity (MiCA, GENIUS Act) and transparent, over-collateralized models support price appreciation, though upside is constrained by competition and regulatory yield restrictions. The price range reflects both bullish (wider adoption, institutional use) and bearish (regulatory tightening, market competition) scenarios. Progressive year-over-year growth is expected, but with moderate volatility due to evolving market structure.

Key Factors Affecting STBL Price

- Regulatory developments in the US (GENIUS Act) and EU (MiCA) affecting stablecoin yield structures.

- Adoption of yield-separated stablecoin models across DeFi protocols and payment infrastructures.

- Security and transparency improvements (on-chain audits, over-collateralization).

- Competition from traditional and next-generation stablecoins, including tokenized money market funds.

- Potential for real-world asset (RWA) integration and institutional adoption.

- Broader crypto market cycles and macroeconomic conditions affecting demand for stable assets.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The combination of transparent audits, decentralized governance through protocol tokens, and programmable insurance mechanisms creates an environment where systemic risks can be identified early and mitigated proactively – making these next-generation stablecoins attractive not only for individual users but also institutional players seeking secure exposure to DeFi yields.

Institutional adoption is further catalyzed by the ability to meet stringent compliance requirements without sacrificing access to yield. Tokenized money market funds and real-world asset (RWA) integrations, as seen in STBL’s collateral pools, are driving a new wave of DeFi products that can coexist with traditional finance while remaining natively digital and composable. The USST-YLD NFT model exemplifies how DeFi risk management can be strengthened through clear asset segregation and programmable oversight.

For users, this means more granular control over risk exposure. You can hold USST for its stability or trade YLD NFTs for speculative yield, each with distinct risk profiles. This modular approach is especially relevant as regulatory regimes evolve: should rules around yield change, protocols can adapt by modifying only the yield token layer, preserving the utility of the principal stablecoin.

Key Benefits of Yield-Separated Stablecoins for DeFi Users

Key User Benefits of STBL’s Dual-Token Model

-

Regulatory Compliance: By separating the stablecoin (USST) from the yield token (YLD), STBL aligns with frameworks like the U.S. GENIUS Act and MiCA, ensuring the stablecoin remains a non-security and facilitating broader adoption in regulated markets.

-

Direct Yield Access: Users can claim yield directly via the YLD token, rather than relying on the issuer to distribute returns, providing transparent, on-chain access to real-world asset yields.

-

Enhanced Transparency: All collateral backing STBL is tokenized and stored on-chain, allowing users to independently verify reserves and monitor protocol health in real time.

-

Improved Risk Segmentation: The dual-token structure allows users to choose between holding stable liquidity (USST) or yield exposure (YLD), enabling tailored risk management strategies.

-

Decentralized Governance: STBL holders can participate in protocol governance, voting on risk parameters, collateral types, and policy changes, fostering community-driven oversight.

Security remains paramount. According to CertiK’s Skynet Stablecoin Spotlight Report, as RWA-backed and yield-bearing models proliferate, their attack surface expands. However, protocols like STBL counterbalance this with on-chain proof-of-reserves, open-source smart contracts, and community-driven governance, all critical features for robust stablecoin audits.

Market data underscores this trend:

| Token | Current Price | 24h High | 24h Low |

|---|---|---|---|

| STBL | $0.28161 | $0.3093 | $0.2789 |

This real-time transparency not only builds trust but also enables rapid response to emerging threats, an essential capability in a sector where exploits and depegs can cascade rapidly across interconnected protocols.

The Future: Insurance Layer and Beyond

The next frontier for yield-separated stablecoins is native insurance integration. By embedding coverage against smart contract exploits or stablecoin depegs directly into the protocol layer, users gain an additional line of defense, further aligning incentives between issuers, holders, and liquidity providers.

This layered approach could ultimately make products like STBL foundational components for compliant DeFi infrastructure worldwide. As regulatory clarity increases and technical standards mature, expect to see broader adoption by both retail users seeking safer yields and institutions demanding transparent, auditable exposure to digital dollars.