Stablecoins like USDC, DAI, and USDT are the backbone of DeFi, promising 1: 1 stability with the US dollar. But as recent events have shown, even the most trusted stablecoins can lose their peg, sometimes dramatically and unexpectedly. When a stablecoin trades below $1, users can face major losses, especially if they’re relying on that value for lending, trading, or payroll. That’s where on-chain insurance for stablecoin depeg events comes in: providing automated protection and peace of mind for DeFi users.

Why Stablecoin Depegs Matter in 2025

Depegging is no longer a hypothetical risk. Just look at the current price of Multichain Bridged USDC (Fantom): $0.0590. This is far from its intended $1 peg, a stark reminder that market shocks or technical failures can send even top stablecoins spiraling downward. For anyone holding large amounts of stablecoins or using them as collateral, a depeg event can quickly snowball into significant losses.

The good news? On-chain insurance protocols have stepped up to offer auto-payouts when depegs occur. Unlike traditional insurance, which often involves paperwork and delays, these DeFi-native solutions use smart contracts to monitor prices and trigger instant compensation once set criteria are met.

How On-Chain Insurance Works: Automation Meets Transparency

The core innovation is parametric insurance: instead of requiring proof of loss or human intervention, smart contracts automatically pay out when a stablecoin crosses a predefined threshold and stays there for a set time. For example:

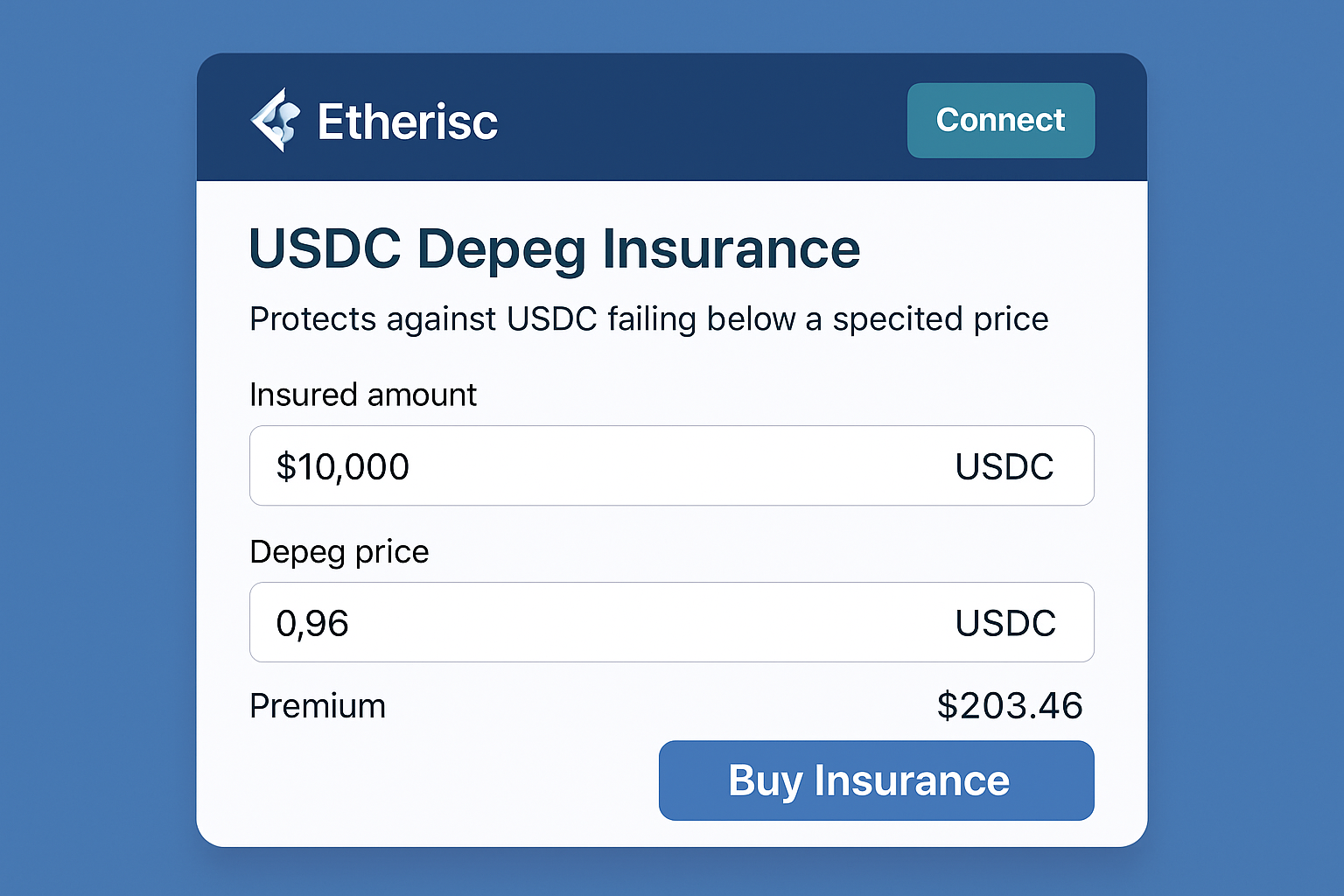

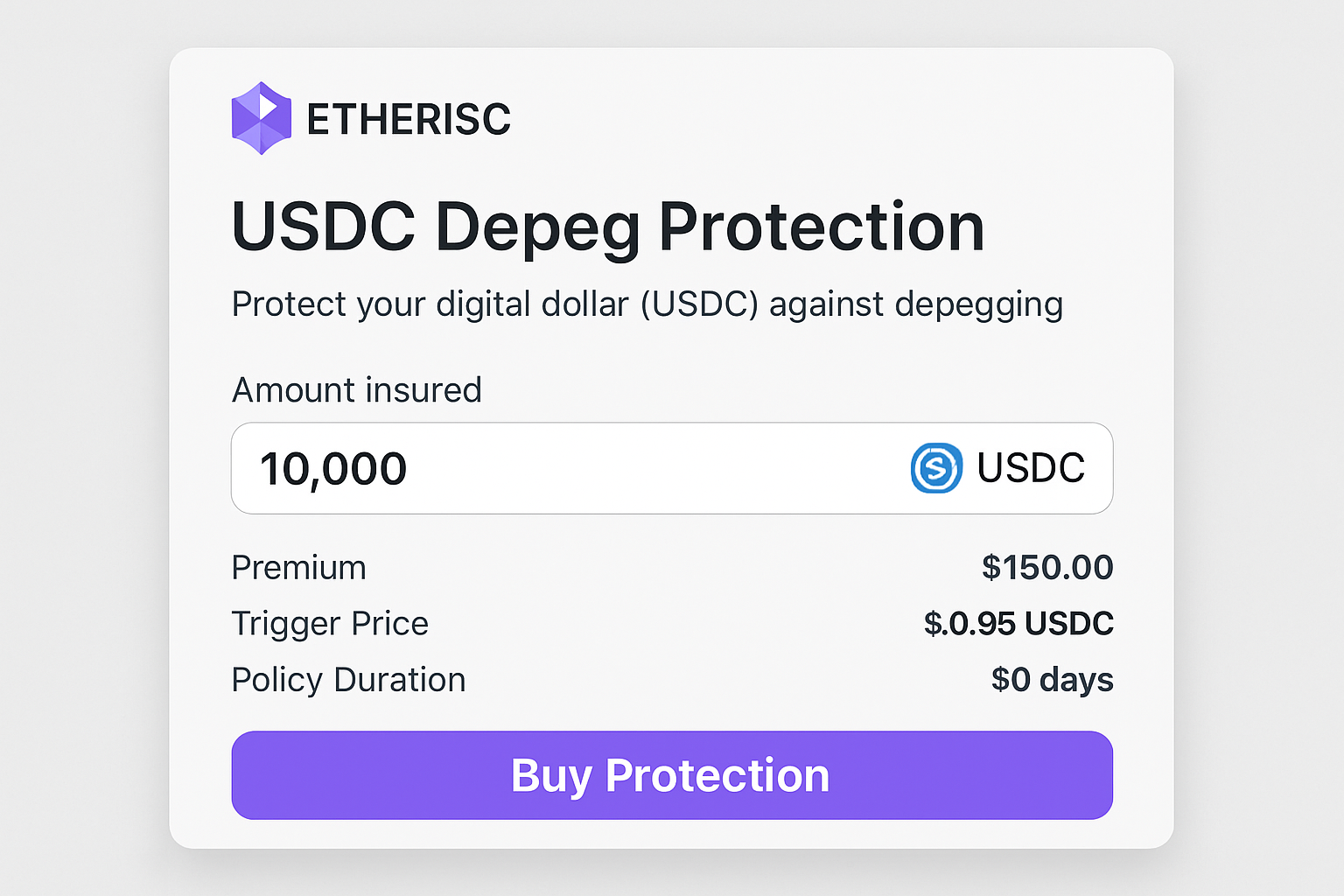

- Etherisc’s USDC Depeg Protection: If USDC drops below $0.995 and doesn’t recover within 24 hours, policyholders receive an automatic payout, no claims process needed. Powered by Chainlink’s decentralized price oracle, this system ensures accurate detection and prompt settlement. (prnewswire.com)

- StableShield: Users wrap their tokens into insured versions (like iUSDC), backed by deep institutional liquidity. If USDC falls below $0.95, the protocol settles instantly at full dollar value, making it easy to claim your funds without delay.

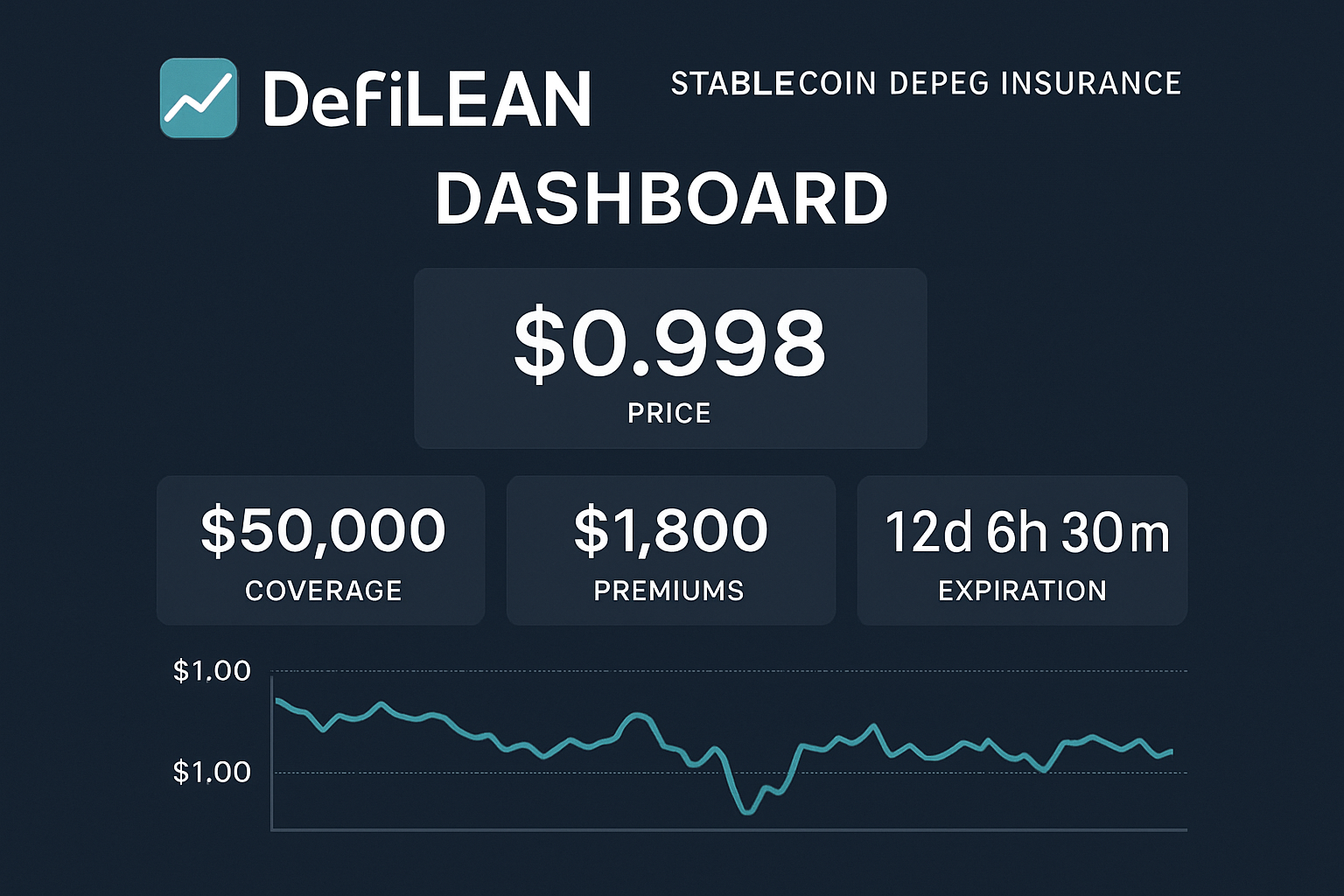

- DefiLean: Customizable policies let users choose which coins to insure (USDC, DAI, USDT), select trigger prices, and set durations, all with premiums based on real volatility data.

This approach is gaining traction because it’s fast, transparent, and removes human bias from the equation. With historical volatility baked into pricing models, and payouts executed directly on-chain, users get reliable risk mitigation tailored to today’s volatile crypto markets.

The Market Response: Auto-Payouts Become Table Stakes

The demand for stablecoin depeg insurance has never been higher:

- Nexus Mutual, InsurAce, Etherisc, StableShield, all report growing interest in depeg cover products as more users seek ways to safeguard their assets from black swan events.

- OpenCover explains that these covers are now seen as essential tools in any DeFi risk management strategy, not just nice-to-haves.

-

USD Coin (USDC), DAI, and USDT Price Prediction 2026-2031

Professional outlook based on on-chain insurance adoption, regulatory trends, and market stability

Year Minimum Price Average Price Maximum Price % Change (Avg, YoY) Market Scenario Insights 2026 $0.97 $1.00 $1.03 0% On-chain insurance adoption improves confidence, reducing depeg volatility. Stablecoin peg holds near $1.00. 2027 $0.97 $1.00 $1.04 0% Regulatory clarity supports stablecoin use in TradFi and DeFi; insured stablecoins (iUSDC, etc.) gain traction. 2028 $0.96 $1.00 $1.05 0% Competition from CBDCs and new stablecoins increases, but technology upgrades keep depeg risk minimal. 2029 $0.95 $0.99 $1.06 -1% Potential macroeconomic shocks test pegs; robust insurance mitigates losses, but minor depegs possible. 2030 $0.94 $0.99 $1.07 0% Decentralized insurance becomes standard; stablecoins widely integrated in global payments, keeping peg strong. 2031 $0.94 $0.98 $1.08 -1% Maturing market and regulation lead to slight compression in premiums; minor depegs rare but possible in extreme scenarios. Price Prediction Summary

USDC, DAI, and USDT are expected to maintain strong pegs to the US dollar, especially as on-chain insurance protocols become industry standard. Minor depegs may occur during periods of high market stress, but automated insurance payouts and improved transparency will help restore confidence quickly. Overall, stablecoins are projected to remain close to $1.00, with limited downside in extreme scenarios and modest upside if demand spikes or supply tightens.

Key Factors Affecting USD Coin Price

- Adoption and integration of on-chain depeg insurance protocols (e.g., Etherisc, StableShield, InsureDAO)

- Regulatory developments affecting stablecoin issuance and backing

- Competition from central bank digital currencies (CBDCs) and new algorithmic stablecoins

- Advancements in oracle technology and decentralized finance infrastructure

- Market sentiment, risk appetite, and global macroeconomic events

- Insurance premium costs and availability of liquidity for coverage

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This shift is also reshaping how protocols approach liquidity management; many now keep reserves specifically earmarked for instant depeg settlements.

A Closer Look at Current Insurance Protocols

Comparing Top Stablecoin Depeg Cover Protocols

-

Etherisc: Offers parametric depeg protection for USDC. If USDC falls below $0.995 and does not recover within 24 hours, users receive automatic payouts—no claims process required. Powered by Chainlink price feeds for reliable depeg detection.

-

StableShield: Provides insured stablecoins (e.g., iUSDC) by wrapping assets, backed by $500 million+ in institutional liquidity. If USDC drops below $0.95, users can instantly claim their full dollar value. Integrates with DeFi protocols like Aave and Ethena. Premium: 1.5% per year.

-

DefiLean: Features customizable depeg insurance for USDC, DAI, and USDT. Users set their own depeg thresholds and coverage durations. Premiums are based on volatility and chosen parameters. Automatic payouts are triggered by smart contracts in the event of a depeg.

-

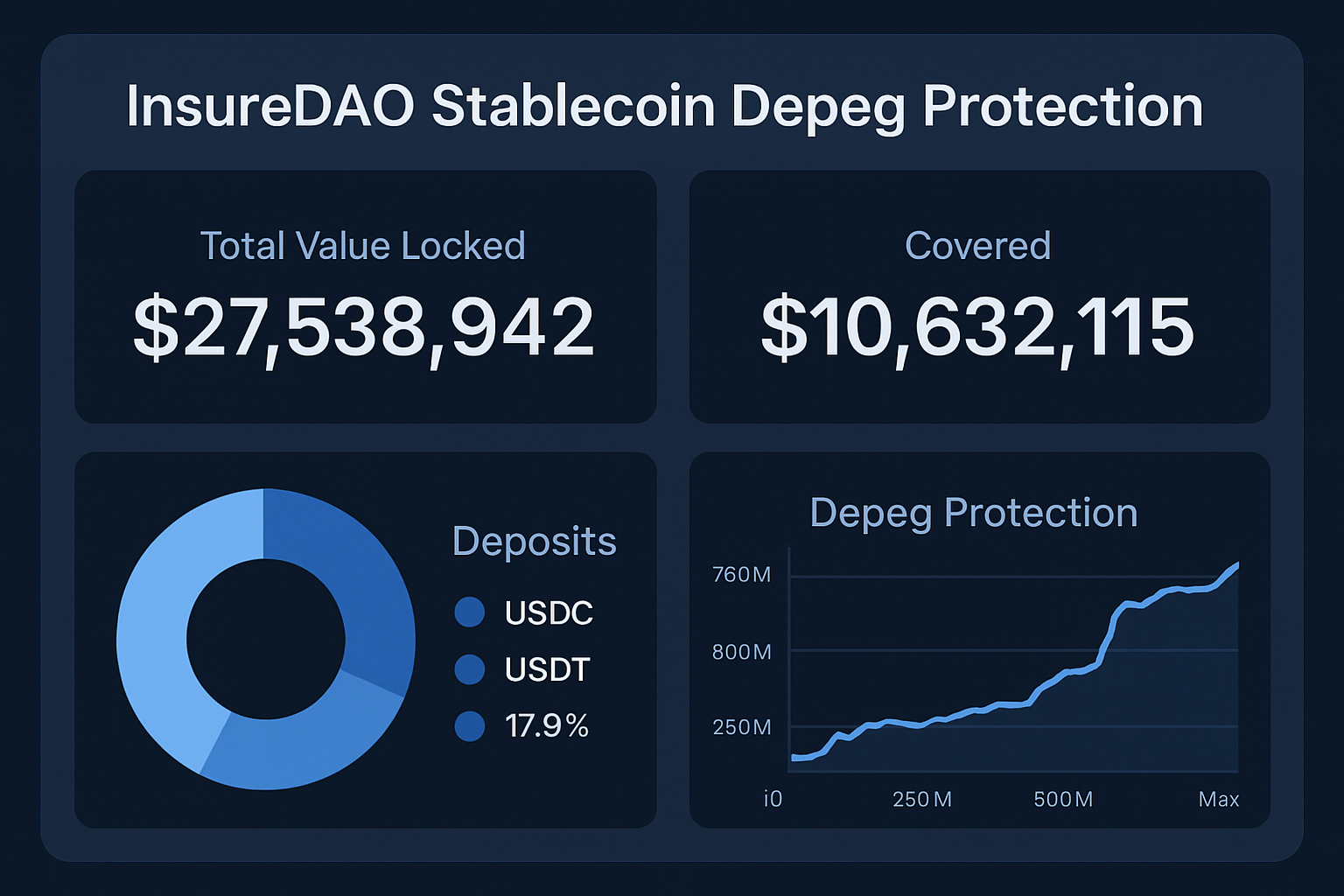

InsureDAO: Delivers depeg risk protection with instant payouts (within two days) and no proof of loss required. Utilizes Chainlink Oracles for automated claim assessment and offers hedging strategies for liquidity providers.

If you’re considering adding depeg protection to your toolbox, or just want to understand how these systems work under the hood, the next section will break down real-world use cases and walk you through how to get covered step by step.

Choosing the right on-chain insurance stablecoin depeg solution depends on your risk profile, preferred stablecoins, and how you interact with DeFi protocols. For example, if you’re an active liquidity provider on Aave or Ethena, StableShield’s insured tokens (like iUSDC) can integrate directly into your workflow, offering seamless protection without the need to move funds between platforms. Meanwhile, DefiLean’s customizable coverage may appeal to those who want granular control over their depeg thresholds and policy durations.

InsureDAO stands out for its rapid two-day payout window and zero requirement for proof of loss. This is particularly valuable during volatile periods when price swings can happen fast and users need immediate compensation to avoid cascading liquidations or missed obligations. By leveraging Chainlink oracles for real-time price feeds, InsureDAO and Etherisc both ensure that payouts are triggered only when objective, transparent criteria are met, removing ambiguity from the claims process.

Real-World Impact: From Payroll to Protocol Safety Nets

The implications of these innovations stretch far beyond individual traders. DAOs paying contributors in USDC or DAI can now protect their payroll against sudden drops below $1, ensuring employees receive full value regardless of market turbulence. Treasury managers for protocols can hedge reserve assets against systemic shocks, no more sleepless nights watching charts when a depeg event looms.

This is especially critical given the current market data: Multichain Bridged USDC (Fantom) sits at $0.0590, a figure that would have triggered every major depeg insurance protocol’s auto-payout mechanism had it been covered. The speed at which these tools operate means users aren’t left holding the bag during black swan events; instead, they get compensated almost instantly as soon as the smart contract criteria are fulfilled.

Getting Covered: How to Buy Depeg Insurance in Minutes

Most leading platforms make it easy: connect your wallet, select which stablecoins to protect (USDC, DAI, USDT), choose your coverage parameters (thresholds and duration), review the premium (which is often under 2% per year), and confirm. Once active, your policy sits on-chain, no paperwork required, and you’re protected from the moment coverage starts.

- No claims forms: Smart contracts monitor prices 24/7 via decentralized oracles

- No waiting period: Payouts are instant or within hours once conditions are met

- No centralized gatekeepers: Everything happens transparently and autonomously on-chain

Why On-Chain Depeg Insurance Matters Now More Than Ever

The collapse of Multichain Bridged USDC (Fantom) down to $0.0590 is a wake-up call for anyone still assuming stablecoins always hold their peg. As DeFi matures and institutional money flows in, robust risk management isn’t optional, it’s essential infrastructure. On-chain insurance protocols like Etherisc, StableShield, DefiLean, and InsureDAO are setting new standards by making auto-payouts for USDC depegs, DAI volatility spikes, or USDT slippage not just possible but practical.

Top Benefits of On-Chain Insurance for Stablecoin Depegs

-

Automatic, Fast Payouts: On-chain insurance protocols like Etherisc and StableShield use smart contracts to trigger instant payouts when stablecoins like USDC or USDT depeg below set thresholds (e.g., USDC below $0.995 for 24 hours). No manual claims process is needed.

-

Customizable Coverage: Platforms such as DefiLean let users tailor their depeg insurance by choosing which stablecoins to protect, setting depeg thresholds, and selecting coverage periods, offering flexibility to match individual risk profiles.

-

Transparent, Decentralized Operation: On-chain insurance leverages decentralized oracles (like Chainlink) and open-source smart contracts, ensuring transparent monitoring of stablecoin prices and clear, auditable payout logic.

-

Protection Across Major Stablecoins: Leading protocols provide depeg cover for popular stablecoins including USDC, DAI, and USDT, helping users safeguard their assets against the most common depegging risks in DeFi.

-

Boosts Confidence and Stability in DeFi: By mitigating depeg risks, on-chain insurance solutions help maintain user trust and stability within the crypto ecosystem, encouraging broader adoption of stablecoins for trading, saving, and DeFi applications.

If you’re serious about protecting your assets in DeFi, whether you’re an investor, developer, DAO treasurer or everyday user, it’s time to add stablecoin insurance protocols to your toolkit. Because in crypto as in life: knowledge is your best coverage.