Security remains the defining challenge for decentralized finance, and 2024 has seen a new wave of innovative insurance protocols step up to address smart contract exploit risk. As capital flows into DeFi, users demand robust protection against protocol vulnerabilities, flash loan attacks, and governance exploits. Selecting the right DeFi insurance provider is now a strategic imperative for investors, developers, and DAOs alike.

Navigating DeFi Insurance: Why Smart Contract Exploit Coverage Matters

With billions of dollars lost to exploits each year, smart contract insurance is no longer a niche product – it’s a critical layer in any risk management stack. The following platforms have emerged as leaders in providing on-chain coverage against contract failures and malicious attacks. Each offers distinct models for underwriting risk, processing claims, and incentivizing security research.

Top 11 DeFi Insurance Providers for Smart Contract Exploit Coverage (2024)

Top 11 DeFi Insurance Providers in 2024

-

Nexus Mutual: A member-owned mutual on Ethereum, Nexus Mutual offers decentralized coverage against smart contract failures, exchange hacks, and governance attacks. The protocol features transparent claims, community governance, and multiple cover products. Current NXM Price: $104.54 (as of October 4, 2025)

-

InsurAce: This multi-chain platform provides insurance for smart contract exploits, stablecoin de-pegging, and centralized exchange risks. InsurAce is known for its capital efficiency and portfolio-based underwriting, making DeFi protection more affordable.

-

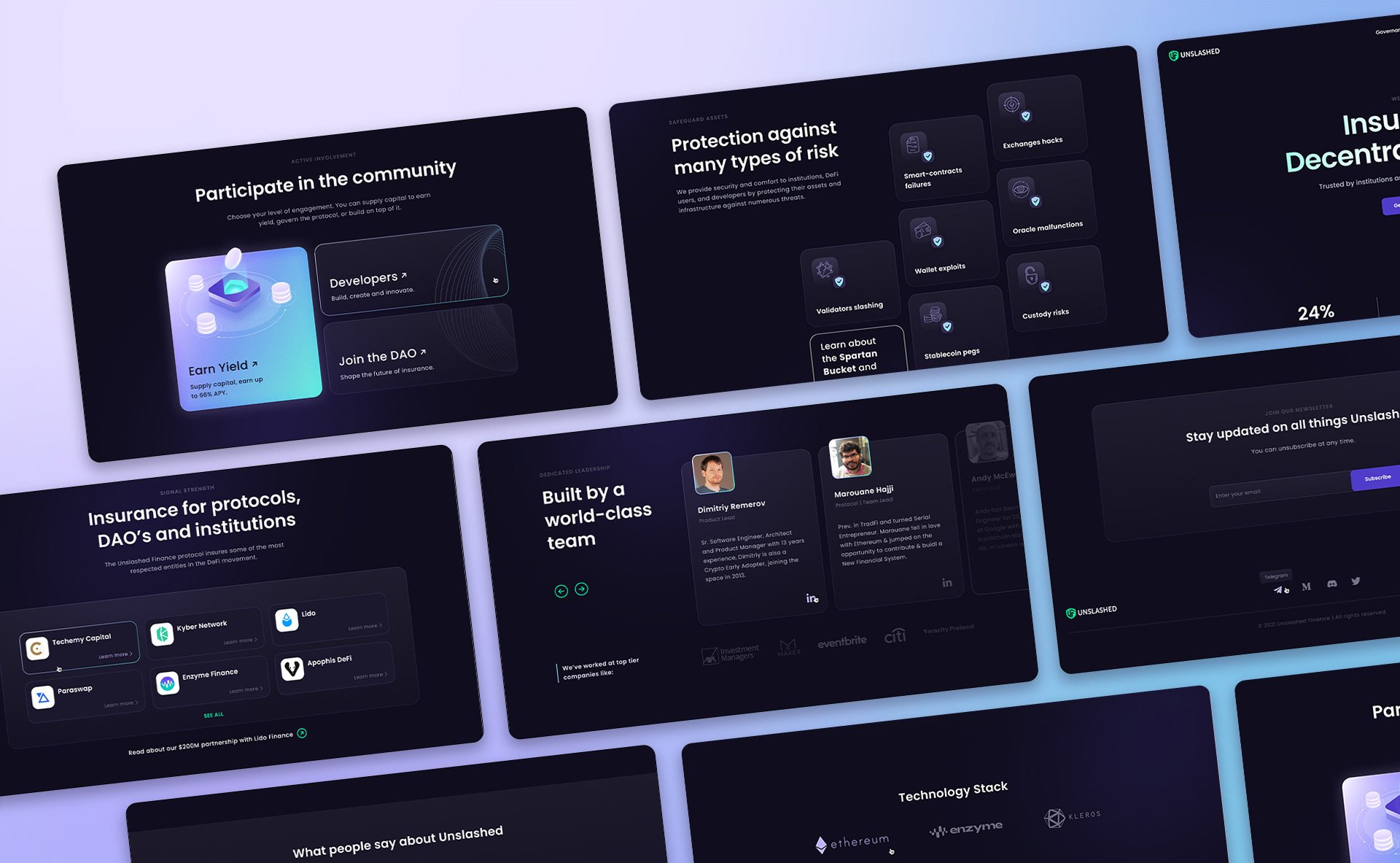

Unslashed Finance: Unslashed delivers instant-liquidity coverage with decentralized claims arbitration. It supports tokenized, flexible insurance for protocol exploits, validator slashing, and more, emphasizing capital efficiency and Web3 alignment.

-

Sherlock: Sherlock specializes in smart contract exploit coverage with a focus on protocol security. It combines insurance pools with expert security reviews and on-chain risk assessment to protect DeFi protocols and users.

-

Etherisc: Etherisc is a decentralized insurance protocol that enables the creation of customized insurance products. It supports coverage for smart contract risks and aims to make insurance more transparent and accessible via open-source infrastructure.

-

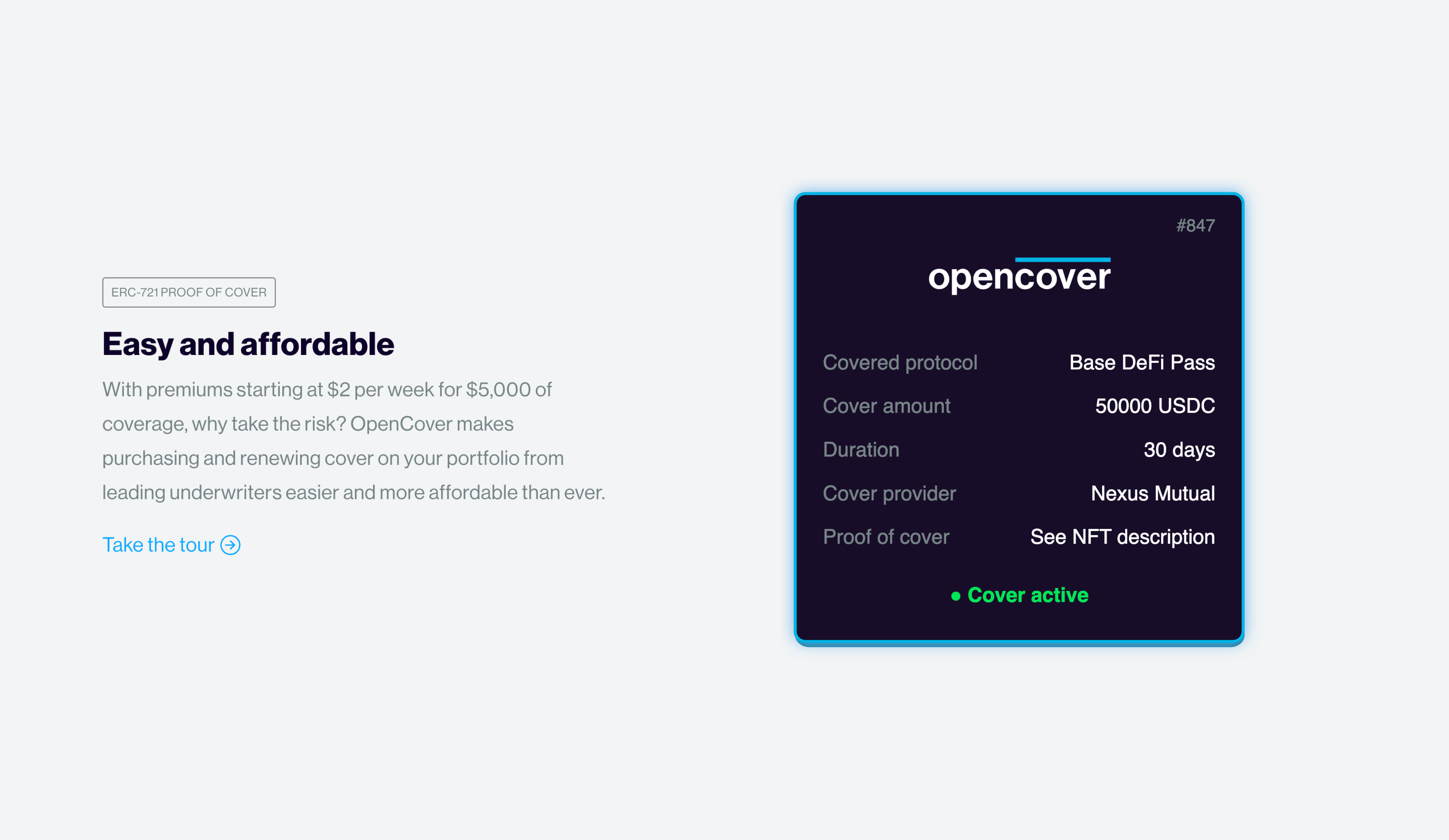

OpenCover: OpenCover simplifies DeFi insurance by offering easy-to-purchase, affordable coverage for portfolios. It streamlines the user experience and provides protection against protocol exploits and DeFi-specific risks.

-

Bridge Mutual: Bridge Mutual operates a peer-to-peer insurance protocol covering smart contract risks, stablecoin failures, and exchange hacks. Users can stake, govern, and earn rewards while benefiting from efficient claims processing.

-

Solace: Solace provides automated, pay-as-you-go coverage for DeFi users. Its protocol dynamically adjusts insurance based on wallet assets, ensuring users only pay for what they need while staying protected from smart contract risks.

-

Y2K Finance: Y2K Finance offers market-driven insurance solutions for DeFi, focusing on de-pegging events and protocol failures. Its products allow users to hedge against specific systemic risks within the crypto ecosystem.

-

Amulet Protocol: Amulet Protocol delivers multi-chain, modular insurance with a focus on smart contract and yield protocol coverage. It features a transparent claims process and incentivizes risk assessors for accurate underwriting.

-

Neptune Mutual: Neptune Mutual specializes in parametric insurance for DeFi protocols, offering rapid payouts based on predefined event triggers. Its platform covers smart contract exploits and exchange risks, ensuring swift compensation for affected users.

Let’s break down what sets these platforms apart in the current market:

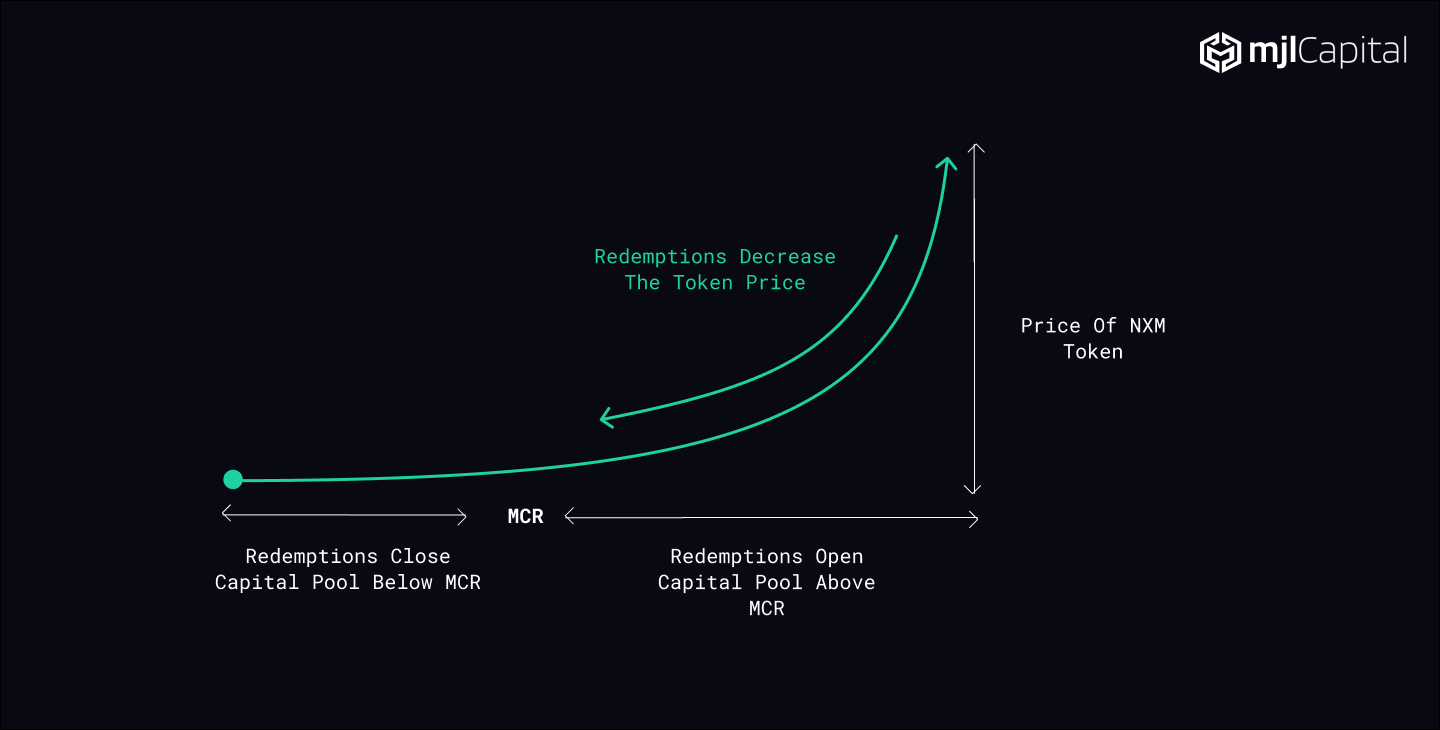

Nexus Mutual: Market Leader with Community-Driven Claims

Nexus Mutual continues to anchor the sector with its member-owned mutual model. As of October 4th, 2025, NXM trades at $104.54, reflecting steady demand for its Ethereum-based cover products. Nexus Mutual provides extensive protection against smart contract exploits across major protocols and exchanges. The community votes on claims – ensuring transparency but requiring active participation from stakeholders. With additional options like depeg cover and exchange hack protection now live, Nexus Mutual remains the most comprehensive solution for institutional-grade risk mitigation.

InsurAce and Unslashed Finance: Multi-Chain Reach and Instant Liquidity

InsurAce has carved out a strong position by offering multi-chain coverage across Ethereum, BNB Chain, Polygon and more. Its portfolio-based underwriting keeps premiums competitive while enabling users to bundle multiple policies in one transaction – ideal for diversified DeFi portfolios.

Unslashed Finance, meanwhile, distinguishes itself through capital efficiency and instant liquidity for policyholders. Its tokenized cover positions are tradable at any time – a Web3-native approach that appeals to sophisticated yield farmers and DAOs seeking flexibility without sacrificing security.

The Next Generation: Sherlock, Etherisc and OpenCover

Sherlock brings a new paradigm by combining insurance with proactive security auditing. Their protocol leverages expert auditors (“Sherlocks”) who are financially incentivized to detect vulnerabilities before attackers do – aligning interests between security researchers and end users.

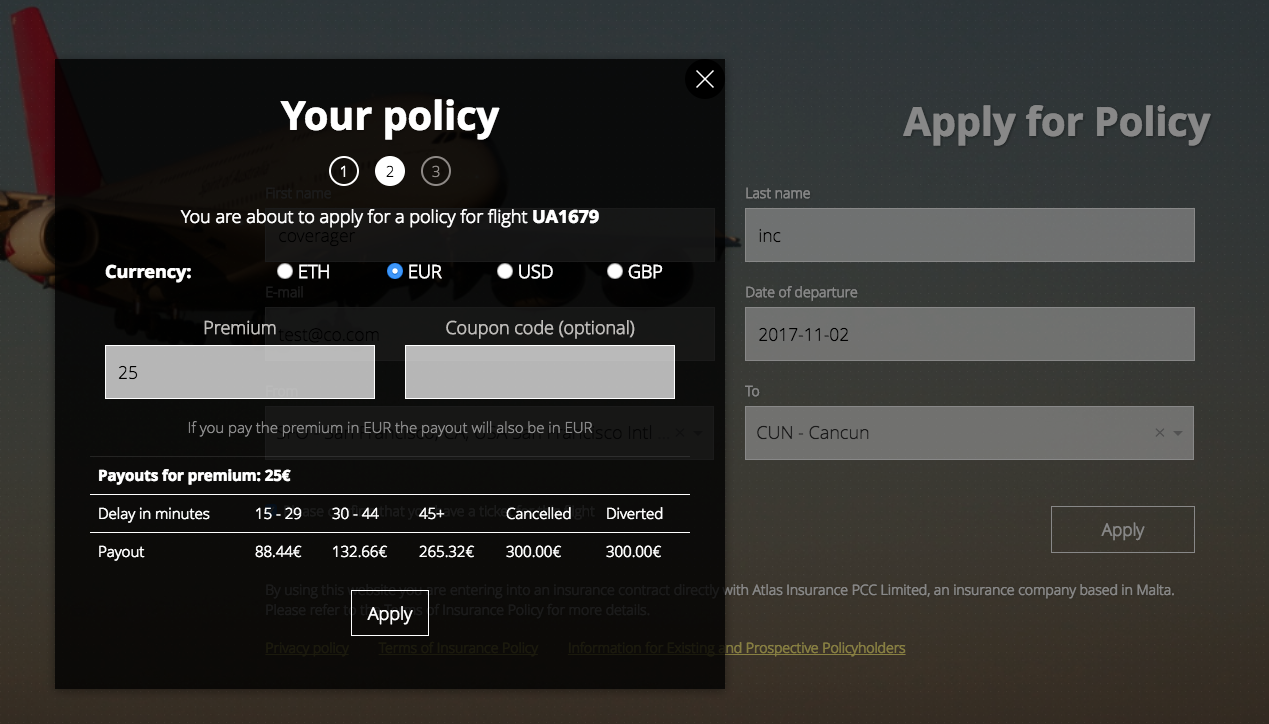

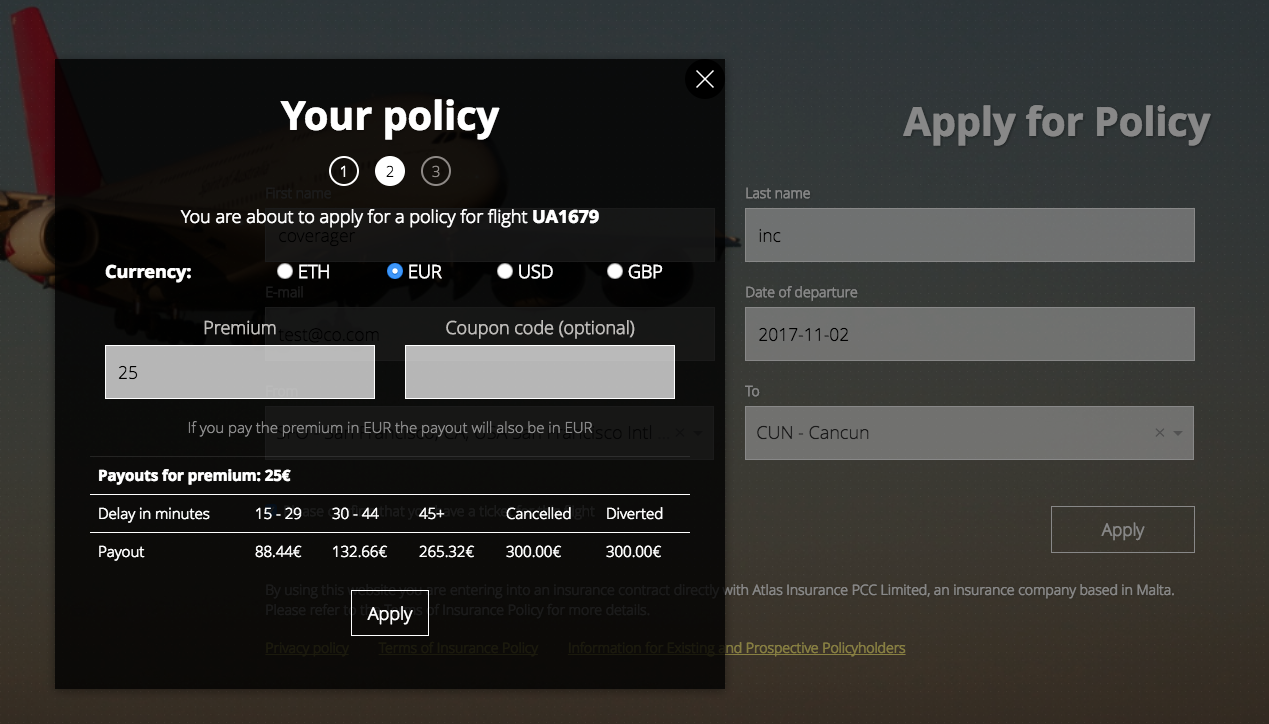

Etherisc, one of the earliest decentralized insurance frameworks, continues to expand its modular infrastructure for custom risk products. While best known for parametric weather insurance and flight delay coverages outside DeFi proper, Etherisc’s open architecture is increasingly being adopted by DAOs looking to build bespoke exploit protection products tailored to their needs.

OpenCover makes portfolio-level DeFi protection accessible via simple interfaces and affordable premiums. By aggregating policies from multiple underwriters into a single dashboard experience, OpenCover lowers barriers for new entrants while still offering credible recourse in the event of an exploit.

Beyond the major players, several agile protocols are redefining how smart contract exploit coverage is delivered across the DeFi landscape. Their approaches reflect a maturing market, with sharper focus on user experience, capital efficiency, and claims transparency.

Bridge Mutual, Solace and Y2K Finance: Peer-to-Peer Innovation and Specialized Risk

Bridge Mutual stands out with its peer-to-peer risk-sharing model. Users stake tokens to underwrite coverage for smart contract exploits, stablecoin depegs, and exchange hacks, earning rewards while actively participating in decentralized governance. Bridge Mutual’s streamlined claims process and flexible staking pools make it attractive for both passive investors and active risk managers seeking diversified exposure.

Solace takes a modular approach by enabling users to purchase insurance on a per-protocol basis. Its pay-as-you-go structure means users only pay premiums when their funds are actually at risk, an appealing proposition in volatile markets where capital efficiency is paramount. Solace’s focus on automation and seamless UX lowers friction for retail DeFi participants without sacrificing security standards.

Y2K Finance addresses a critical gap by specializing in tail-risk protection for exotic DeFi events, such as extreme market volatility or protocol-specific black swan incidents. By tokenizing insurance positions and facilitating secondary trading, Y2K enables sophisticated hedging strategies that appeal to both institutional traders and advanced retail users navigating unpredictable markets.

Amulet Protocol and Neptune Mutual: Emerging Standards in Claims Transparency

Amulet Protocol brings robust actuarial modeling to the DeFi insurance space. Its risk assessment engine dynamically prices coverage based on real-time protocol metrics and historical exploit data, offering fairer premiums without compromising solvency. Amulet’s transparent claims adjudication process is governed by both oracles and DAO voting, ensuring that payouts remain consistent with community standards.

Neptune Mutual, meanwhile, targets enterprise-grade protocols with parametric insurance solutions that trigger automatic payouts upon predefined exploit events. This eliminates lengthy claims processes and builds trust among institutional partners who require rapid recourse after an incident. Neptune’s integrations with leading DeFi protocols signal a new era of programmable insurance products tailored for large-scale deployments.

Comparing Coverage: What Matters Most in 2024?

The competitive edge among these top 11 DeFi insurance providers of 2024 lies in their ability to balance three core pillars: coverage breadth, capital efficiency, and claims transparency. As the sector matures, users are demanding more than just compensation, they want proactive threat monitoring, flexible policy structures, and clear communication throughout the claims cycle.

DeFi Insurance Platforms: Feature Comparison Checklist

-

Nexus Mutual: Member-owned mutual on Ethereum offering coverage for smart contract failures, exchange hacks, and governance attacks. Claim Speed: Community-voted, typically within days. Multi-Chain Support: Primarily Ethereum. Capital Efficiency: Pooled capital model. Community Governance: Yes, members vote on claims and protocol changes. Latest NXM Price: $104.54 (as of Oct 4, 2025).

-

InsurAce: Provides multi-chain coverage (Ethereum, BSC, Polygon) for smart contracts, stablecoins, and exchanges. Claim Speed: Decentralized voting, typically 7-14 days. Multi-Chain Support: Yes. Capital Efficiency: Portfolio-based underwriting reduces premiums. Community Governance: Yes, token holders participate in claims and decisions.

-

Unslashed Finance: Offers capital-efficient, instant-liquidity insurance with decentralized claims arbitration. Claim Speed: Fast, with decentralized arbitration. Multi-Chain Support: Focused on Ethereum. Capital Efficiency: High, with pooled capital and tokenized coverage. Community Governance: Yes, via token-holder participation.

-

Sherlock: Specializes in smart contract exploit coverage with a focus on protocol security through audits and monitoring. Claim Speed: Rapid, audit-driven process. Multi-Chain Support: Primarily Ethereum. Capital Efficiency: Uses staking pools. Community Governance: Yes, stakers participate in protocol direction.

-

Etherisc: A decentralized insurance protocol supporting customizable products (e.g., flight delay, crop, smart contract risk). Claim Speed: Automated, event-driven. Multi-Chain Support: Expanding beyond Ethereum. Capital Efficiency: Risk pools. Community Governance: Yes, open-source and community-driven.

-

OpenCover: Aggregates DeFi insurance products for easy, affordable portfolio protection. Claim Speed: Depends on underlying provider. Multi-Chain Support: Yes, covers multiple chains. Capital Efficiency: Aggregator, leverages best rates. Community Governance: No direct governance, relies on providers.

-

Bridge Mutual: P2P insurance protocol for smart contracts, stablecoins, and exchanges. Claim Speed: Efficient, peer-reviewed process. Multi-Chain Support: Expanding beyond Ethereum. Capital Efficiency: Staking-based pools. Community Governance: Yes, users vote on claims and upgrades.

-

Solace: Offers pay-as-you-go DeFi insurance with automatic wallet coverage. Claim Speed: Automated, typically fast. Multi-Chain Support: Yes, supports several EVM chains. Capital Efficiency: Dynamic pricing and pooled risk. Community Governance: Yes, DAO-driven decisions.

-

Y2K Finance: Focuses on depeg risk coverage for stablecoins and protocols. Claim Speed: Automated, event-based triggers. Multi-Chain Support: Supports multiple chains. Capital Efficiency: Market-based, with vaults. Community Governance: Yes, governance token holders vote.

-

Amulet Protocol: DeFi risk protection platform with a modular, multi-chain approach. Claim Speed: Automated and community-reviewed. Multi-Chain Support: Yes, built for cross-chain. Capital Efficiency: Uses risk-sharing pools. Community Governance: Yes, via AMT token.

-

Neptune Mutual: Specializes in parametric insurance for smart contract exploits and protocol hacks. Claim Speed: Fast, event-based payouts. Multi-Chain Support: Yes, covers multiple blockchains. Capital Efficiency: Parametric pools optimize capital use. Community Governance: Yes, community-driven via NPM token.

The right choice depends on your portfolio composition and risk appetite:

- If you prioritize community-driven governance, Nexus Mutual or Bridge Mutual should be top contenders.

- If multi-chain exposure is key to your strategy, InsurAce or OpenCover provide broad protocol support.

- If you demand real-time liquidity or tradable policies, Unslashed Finance or Y2K Finance offer unique advantages.

- If you need bespoke or parametric coverages, Etherisc or Neptune Mutual may fit specialized requirements.

Strategic Takeaway: Smart Contract Exploit Insurance Is Non-Negotiable

The era of “trustless” finance has proven that code risk is real, and costly. Integrating smart contract exploit coverage from one (or more) of these leading providers isn’t just prudent; it’s essential for any serious participant in today’s DeFi ecosystem. As new exploits emerge and regulatory scrutiny intensifies through 2025-2026, expect further innovation at the intersection of security research and decentralized insurance design.

If you’re evaluating which platform best fits your needs, or want deeper analysis of evolving coverage models, see our expert guide: How to Choose the Best DeFi Insurance for Smart Contract Exploit Protection in 2024.