Stablecoins have long promised to bridge the gap between traditional finance and decentralized networks, but until now, their infrastructure has lagged behind their ambition. Today, a new breed of Layer 1 blockchains purpose-built for stablecoins is reshaping the DeFi payments landscape. Among them, Stablechain stands out as the first USDT-focused Layer 1 blockchain, engineered to eliminate many of the pain points that have hampered global stablecoin adoption.

Why Stablecoin Infrastructure Needed a Rethink

General-purpose blockchains like Ethereum and Solana were never designed with stablecoins as their core use case. Users typically pay gas fees in volatile native tokens (ETH or SOL), which can introduce unpredictable costs and operational headaches for both retail users and enterprises. Worse still, high network congestion can push fees to unmanageable levels, undermining the promise of frictionless digital payments.

This is where Stablechain’s approach is fundamentally different. Instead of layering stablecoins atop a blockchain built for speculation, Stablechain has reimagined the stack from the ground up: USDT is not just an asset on the network, it’s the fuel that powers every transaction.

“By using USDT directly as gas and settlement currency, Stablechain removes unnecessary complexity and volatility from DeFi payments. ”

The Core Innovations: USDT as Gas Token and Zero-Fee Transfers

The headline feature of Stablechain is simple but revolutionary: users pay all transaction fees in USDT, not some secondary token subject to wild price swings. This alone makes fee estimation predictable and removes a major onboarding barrier for non-crypto natives. For businesses seeking stablecoin-based payroll or cross-border settlements, it means no more treasury management headaches juggling multiple volatile assets.

The innovation doesn’t stop there. Through integration with LayerZero’s messaging protocol, Stablechain supports zero-gas peer-to-peer transfers using USDT0, a decentralized version of Tether designed for seamless movement across chains. This unlocks true microtransactions and borderless remittances without hidden costs or technical hurdles, a breakthrough for both emerging markets and institutional-grade payment rails.

Key Benefits of Stablechain for Enterprise Stablecoin Payments

-

USDT as Native Gas Token: Enterprises can pay transaction fees directly in USDT, eliminating the need to manage volatile cryptocurrencies and streamlining treasury operations.

-

Sub-Second Transaction Finality: Stablechain confirms payments almost instantly, enabling real-time settlement for cross-border and high-volume transactions.

-

Zero-Gas Transfers with USDT0: Through LayerZero integration, enterprises can execute gas-free peer-to-peer transfers using USDT0, reducing operational costs for frequent payments.

-

Predictable and Low Fees: Using USDT for gas ensures consistent, minimal transaction costs, making budgeting and forecasting easier for enterprise finance teams.

-

Enhanced Scalability: Stablechain is engineered to process thousands of transactions per second without congestion, supporting enterprise-grade payment volumes.

-

EVM Compatibility for Seamless Integration: Enterprises can leverage Ethereum Virtual Machine (EVM) compatibility to deploy or migrate dApps using familiar tools, accelerating innovation and reducing integration friction.

-

Improved User Experience: By removing the need for multiple tokens and simplifying transaction processes, Stablechain lowers onboarding barriers for enterprise clients and their partners.

-

Robust Industry Support and Partnerships: Backed by Bitfinex, Hack VC, Franklin Templeton, and PayPal Ventures, Stablechain offers enterprises confidence in long-term stability and ecosystem growth.

EVM Compatibility: Lowering Barriers for Developers

A blockchain is only as useful as its developer ecosystem. Recognizing this, Stablechain offers full Ethereum Virtual Machine (EVM) compatibility, allowing teams to deploy dApps using familiar Solidity codebases and developer tools. This means existing DeFi protocols can port over with minimal friction while taking advantage of instant finality and cost-efficient settlement in USDT.

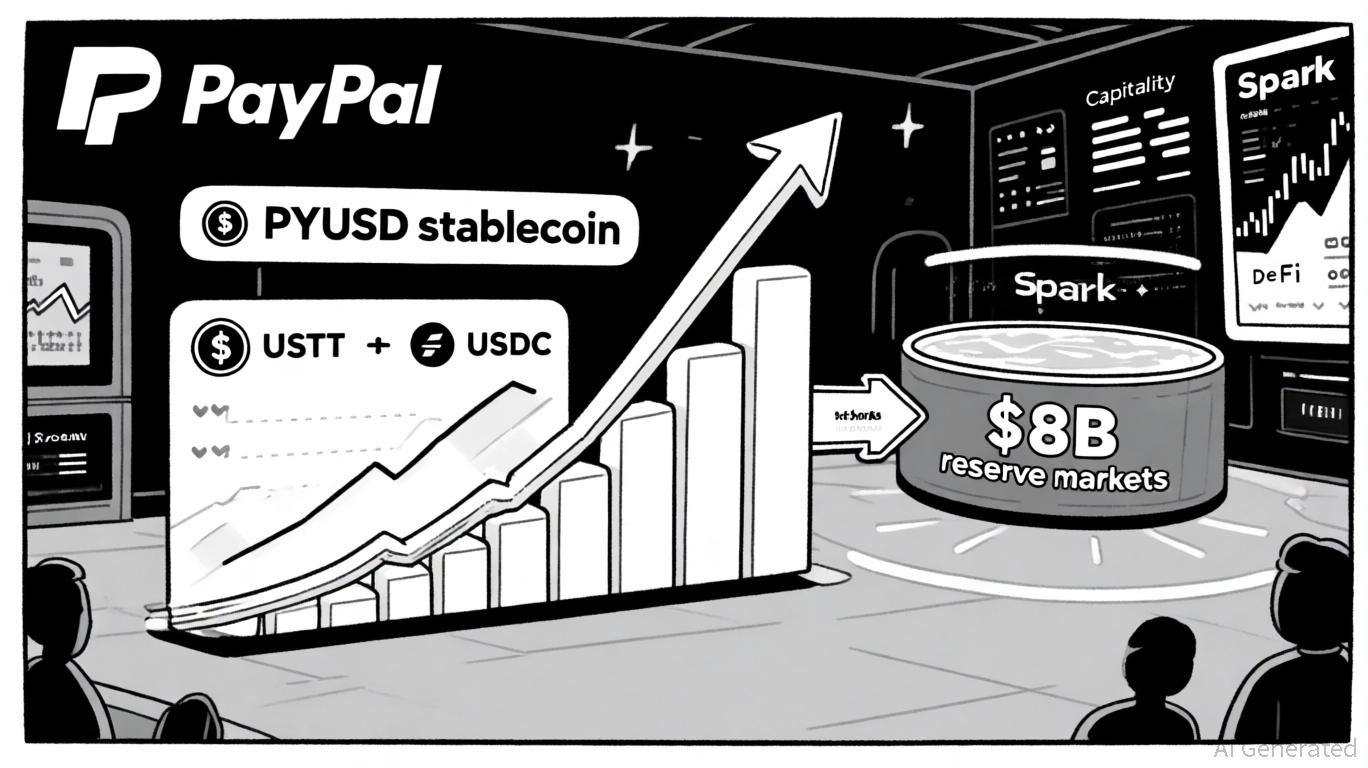

Industry Backing and Strategic Funding Moves

The market has taken notice in a big way. In July 2025, Stablechain closed a $28 million seed funding round led by Bitfinex and Hack VC, drawing participation from Franklin Templeton, Castle Island Ventures, KuCoin Ventures, and other heavyweights in global finance. Shortly after, PayPal Ventures announced a strategic investment to integrate PayPal USD (PYUSD) into Stablechain, an endorsement that underscores how seriously legacy fintech players are betting on stablecoin-native infrastructure.

This wave of institutional support signals that enterprise-grade stablecoin payments are not just possible, they’re inevitable.

The User Experience Revolution: Simplicity Meets Scale

No matter how advanced the technology under the hood, mass adoption hinges on user experience. By eliminating multi-token complexity and offering sub-second finality even during peak demand periods (see documentation here), Stablechain delivers a frictionless experience that appeals to both crypto veterans and newcomers alike. The days when users had to worry about keeping small balances of volatile tokens just to make transactions are numbered; on Stablechain, if you have USDT, you’re good to go.

This paradigm shift is more than just a technical upgrade; it’s a reimagining of what digital money can achieve at scale. As payment rails become indistinguishable from the stablecoins themselves, Stablechain is setting a new benchmark for how value moves across borders, industries, and user demographics. The implications for DeFi are profound: predictable costs, immediate settlement, and seamless onboarding are no longer aspirational, they’re the new normal.

Enterprise Impact: Stablecoin Payments Without Friction

For enterprises, the ability to move large sums globally without exposure to volatile assets is a game-changer. Stablechain’s architecture enables payroll, B2B transfers, and supply chain settlements using only USDT, no ETH or alternative tokens required. This removes operational overhead and regulatory ambiguity, making it far easier for traditional businesses to tap into blockchain-based finance.

Moreover, with zero-gas USDT0 transfers via LayerZero integration, companies can execute high-frequency payments or micro-incentives at scale, an impossibility on legacy blockchains where gas fees would quickly render such models uneconomical. Whether you’re an SME paying freelancers in multiple countries or a multinational managing global liquidity, Stablechain’s infrastructure promises both speed and certainty.

Enterprise Use Cases for Stablechain Stablecoin Payments

-

Cross-Border Payroll for Global Enterprises: Stablechain enables real-time, gas-free salary payments in USDT directly to employees worldwide, eliminating delays and currency conversion fees associated with traditional banking. Enterprises can leverage USDT0 zero-gas transfers for seamless, cost-effective payroll distribution.

-

Instant B2B Settlements: With sub-second transaction finality and predictable USDT fees, Stablechain allows businesses to settle large-value invoices and supplier payments instantly, improving cash flow and reducing reconciliation times across borders.

-

Automated Treasury Management: Enterprises can use Stablechain’s EVM-compatible smart contracts to automate treasury operations, such as real-time fund allocation, liquidity management, and on-chain auditing, all denominated in stable USDT for reduced volatility risk.

-

Seamless Integration with PayPal USD (PYUSD): Following PayPal Ventures’ investment, enterprises can integrate PYUSD on Stablechain for business payments, expanding their reach to customers and partners who prefer PayPal’s stablecoin ecosystem.

-

Global Micropayments for Digital Services: Stablechain’s low, predictable USDT fees make it ideal for high-frequency, low-value transactions in digital content, SaaS, and IoT platforms, enabling new business models and revenue streams for enterprises.

DeFi Ecosystem Effects: Liquidity and Security

Stablechain’s EVM compatibility means DeFi protocols can migrate or launch natively with minimal friction. Liquidity pools denominated in USDT inherit the network’s predictability and sub-second finality while avoiding impermanent loss risks tied to volatile gas tokens. For lending markets and DEXs, this translates into tighter spreads and more reliable settlement, key ingredients for institutional adoption.

Security is another area where purpose-built stablecoin infrastructure shines. By eliminating unnecessary token swaps and reducing attack surfaces associated with multi-token fee models, Stablechain reduces vectors for smart contract exploits, a critical concern for users seeking robust DeFi coverage. As stablecoins continue to underpin the majority of on-chain value transfer, their native chains must be engineered with both scalability and risk mitigation in mind.

What Comes Next for Stablecoin-Native Blockchains?

The rapid pace of industry support, highlighted by PayPal Ventures’ integration of PYUSD (see PayPal’s announcement): suggests that we’re witnessing the early innings of an enterprise-grade stablecoin revolution. As more payment providers and fintech giants join the ecosystem, expect further enhancements in cross-chain interoperability, compliance tooling, and insurance solutions tailored specifically for stablecoin transactions.

Ultimately, what makes Stablechain so compelling isn’t just its technical prowess, it’s the way it abstracts complexity so that users (and businesses) can focus on outcomes rather than infrastructure. The ability to transact instantly with predictable costs using a globally recognized digital dollar is not just an incremental improvement; it’s a leap forward for financial inclusion and capital efficiency worldwide.