Stablecoin payments are rapidly evolving, with new Layer 1 blockchains emerging to address the unique needs of digital dollar transfers. While Circle’s Arc and Stripe’s Tempo have captured headlines for their USDC-focused payment rails, Stablechain is quietly redefining the landscape by building a dedicated, high-performance network optimized for Tether’s USDT. As businesses and users demand faster, simpler, and more predictable stablecoin transactions, Stablechain’s USDT-native approach stands out from legacy infrastructures that still rely on volatile native tokens or complex fee structures.

Rethinking Stablecoin Payments: Why Native Matters

The core innovation behind Stablechain is its use of USDT as the native gas token. Unlike most blockchains that require users to manage a separate utility token (often subject to price swings), Stablechain lets you pay transaction fees directly in the same stablecoin you’re sending, USDT. For peer-to-peer transfers, there are no gas fees at all, making microtransactions and remittances not just feasible but frictionless.

This model is a radical departure from chains like Ethereum or even EVM-compatible sidechains where gas fees can spike unpredictably and must be paid in ETH or another volatile asset. By eliminating this barrier, Stablechain removes a persistent source of user confusion and cost unpredictability that has long plagued mainstream adoption of blockchain-based payments.

Performance at Scale: Sub-Second Finality and Enterprise Blockspace

Speed and reliability are paramount for payment networks. Stablechain delivers sub-second block finality, ensuring that transactions settle almost instantly, even during periods of peak network activity. With capacity for thousands of transactions per second, it can support everything from high-frequency retail payments to large-scale enterprise settlements.

A standout feature for business users is the option to apply for dedicated block space. This guarantees predictable speeds and fees regardless of broader network congestion, a critical advantage for enterprises integrating stablecoins into their core operations or offering real-time settlement services.

How Stablechain Improves Stablecoin Payments

-

USDT as the Native Gas Token: Stablechain enables users to pay transaction fees directly in USDT, eliminating the need for volatile native tokens and simplifying stablecoin payments. Peer-to-peer USDT transfers are gas-free, making small transactions like remittances and micropayments more practical.

-

Sub-Second Settlement and High Throughput: The network delivers sub-second block finality and supports thousands of transactions per second, ensuring fast, reliable, and scalable stablecoin payments even during periods of high demand.

-

Enterprise-Grade Scalability: Stablechain offers dedicated block space for businesses, enabling predictable transaction speeds and fees. This is ideal for enterprises requiring consistent performance for high-volume payment processing.

-

EVM Compatibility for Developers: Fully compatible with the Ethereum Virtual Machine (EVM), Stablechain allows developers to use existing Ethereum tools and smart contracts, reducing barriers to migration and dApp development.

-

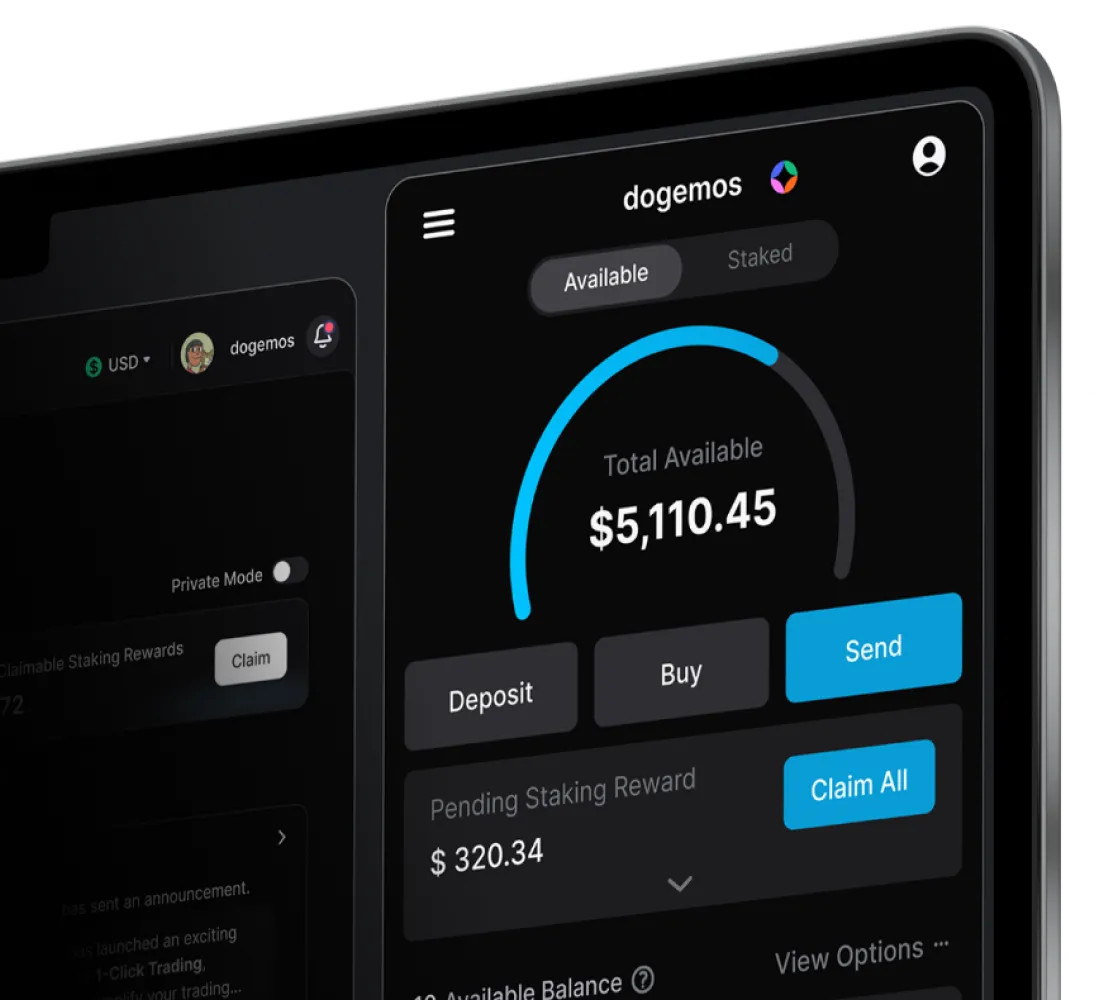

User-Friendly Wallet Experience: The Stable Wallet supports social logins, debit/credit card integration, and human-readable wallet aliases, making stablecoin payments accessible to a broader audience.

EVM Compatibility and Developer Onboarding

One challenge facing any new blockchain is attracting developers. Here, too, Stablechain takes a pragmatic approach: it is fully EVM-compatible, meaning developers can deploy existing Ethereum smart contracts on Stablechain without rewriting code or learning new tools. This compatibility accelerates dApp development while opening doors for DeFi protocols, wallets, and fintech platforms to integrate USDT-native payment rails quickly.

The roadmap also includes robust developer resources and toolkits aimed at lowering onboarding friction further, a move likely to foster rapid ecosystem growth as more teams seek stablecoin-first infrastructure.

User Experience: Wallets Designed for Real People

No discussion of mainstream adoption would be complete without addressing usability. The official Stable Wallet integrates social logins (think Google or Apple ID), supports debit/credit card onboarding, and features human-readable wallet aliases instead of cryptic addresses. These enhancements lower technical barriers for everyday users while supporting compliance needs for regulated businesses.

Stablechain’s focus on user-centric design is a strategic move to bridge the gap between crypto-native users and mainstream consumers. By offering familiar onboarding flows and intuitive wallet features, Stablechain effectively removes many of the hurdles that have historically limited stablecoin adoption for payments and remittances. The ability to send USDT instantly, without worrying about gas fees or complex address formats, is a game-changer for both individuals and businesses seeking efficient global transfers.

Security, Backing, and Industry Support

While performance and usability are crucial, security remains paramount. Stablechain leverages proven consensus mechanisms and benefits from EVM compatibility, allowing developers to use audited smart contracts from the Ethereum ecosystem. The network’s architecture is designed to minimize attack vectors common in traditional Layer 1s, while regular audits and bug bounty programs provide additional layers of protection.

The project’s credibility is further enhanced by backing from major industry players such as Bitfinex and Hack VC. This institutional support not only provides financial stability but also signals confidence in Stablechain’s technical vision. As Tether (USDT) continues to be the world’s most widely used stablecoin by volume, having a dedicated Layer 1 infrastructure purpose-built for its unique requirements positions Stablechain as a foundational pillar for the next wave of DeFi payments innovation.

How Stablechain Stacks Up: Key Features at a Glance

Stablechain vs Arc (USDC), Tempo (Stripe), and Legacy EVM Chains: Key Feature Comparison

| Feature | Stablechain (USDT-Native) | Arc (USDC / Circle) | Tempo (Stripe) | Legacy EVM Chains |

|---|---|---|---|---|

| Native Stablecoin Gas | USDT as native gas token 💸 (no volatile token needed) | USDC as native gas token 💵 | USDC as native gas token 💳 | ETH or other volatile tokens (e.g., ETH, BNB) ⚡ |

| Gas-Free Peer-to-Peer Transfers | Yes ✅ (USDT P2P transfers are gas-free) | No ❌ | No ❌ | No ❌ |

| Block Finality | Sub-second ⚡ | Sub-second ⚡ | Likely sub-second (Stripe-grade) ⚡ | ~12-60 seconds ⏳ |

| Enterprise Blockspace | Dedicated blockspace for businesses 🏢 | Guaranteed blockspace for enterprises 🏢 | Not specified | Not available |

| EVM Compatibility | Full EVM support 🛠️ | EVM-compatible 🛠️ | Not specified | Yes 🛠️ |

| User-Friendly Wallet | Social login, debit/credit card support, aliases 🧑💻 | Not specified | Not specified | Depends on third-party wallets |

| Developer Tools | Ethereum tools and smart contracts work out-of-the-box 👨💻 | Ethereum tools supported 👨💻 | Not specified | Ethereum tools supported 👨💻 |

| Target Use Case | Optimized for USDT payments and remittances 🌍 | Stablecoin payments, FX, capital markets 💼 | Payments infrastructure for Stripe ecosystem 💳 | General-purpose smart contracts |

The Road Ahead: Enterprise-Grade Payments and Ecosystem Growth

Looking forward, Stablechain’s phased roadmap demonstrates a commitment to both immediate utility and long-term scalability. The current phase has already delivered USDT-native gas fees, sub-second finality, and gas-free peer-to-peer transfers. In upcoming phases, features like transfer aggregators and enterprise-guaranteed blockspace will further streamline high-volume processing, a critical need for payment processors, payroll providers, and cross-border fintechs.

The future vision also includes comprehensive developer toolkits to accelerate dApp innovation on top of this stablecoin-first infrastructure. As more projects seek predictable costs and seamless user experiences for their customers, EVM compatibility will make migration straightforward while preserving access to Ethereum’s robust ecosystem of tools.

Ultimately, Stablechain’s USDT-native Layer 1 approach isn’t just an incremental upgrade, it represents a foundational shift in how digital dollars can be moved globally with speed, security, and simplicity. As the stablecoin payments sector matures amidst growing regulatory scrutiny and enterprise adoption, purpose-built solutions like Stablechain will likely set new standards for efficiency and reliability in decentralized finance.