Insurance in decentralized finance has long suffered from a fundamental tradeoff: either protocols lock up enormous capital to back risk pools, or they leave users exposed to unpredictable black swan events. Yet, as DeFi matures and institutional participants demand more robust risk management, the market is witnessing a paradigm shift. Symbiotic and SAFU are at the forefront of this movement, leveraging shared security and restaking innovations to deliver capital-efficient, transparent, and user-friendly DeFi insurance solutions.

Symbiotic’s Universal Staking: The Engine for Capital-Efficient DeFi Insurance

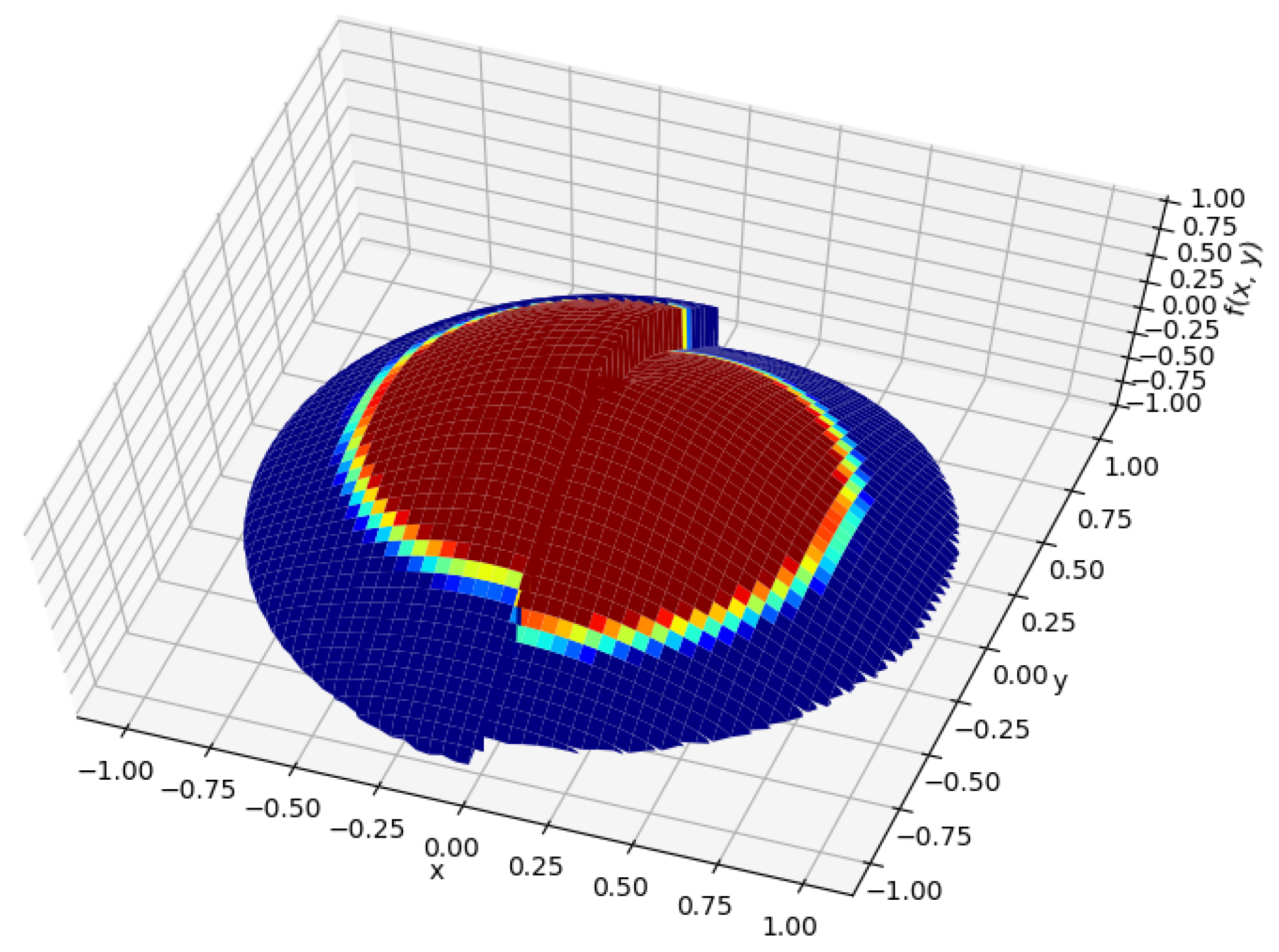

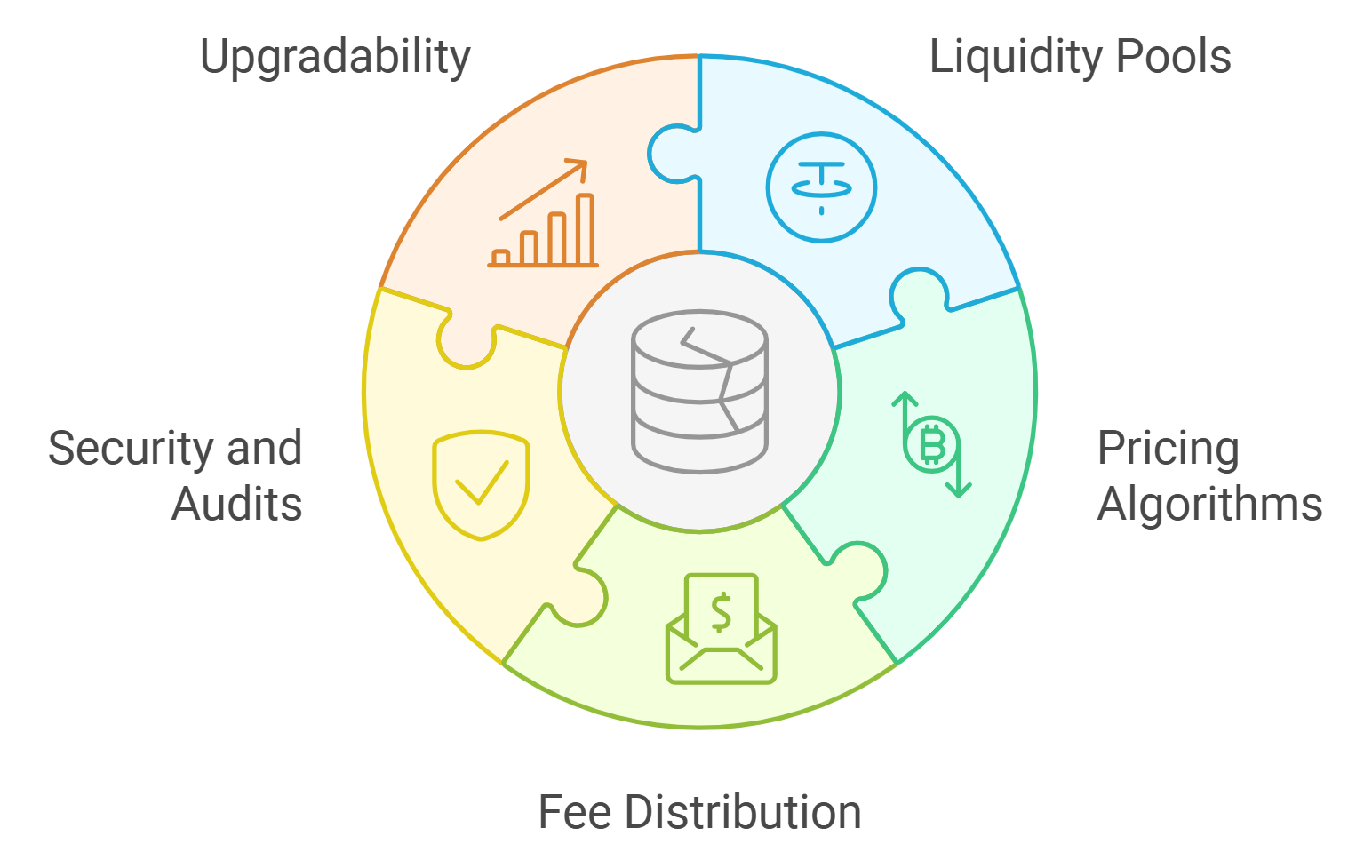

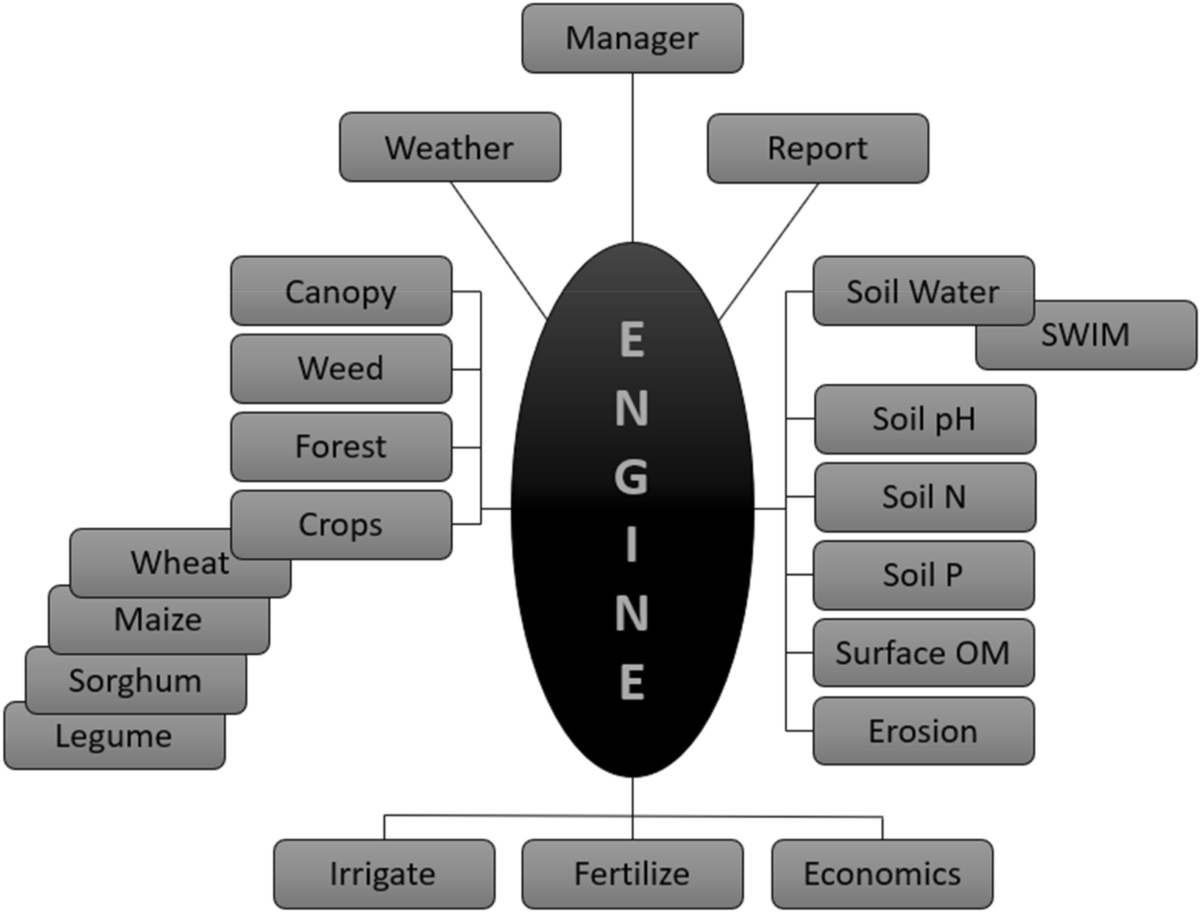

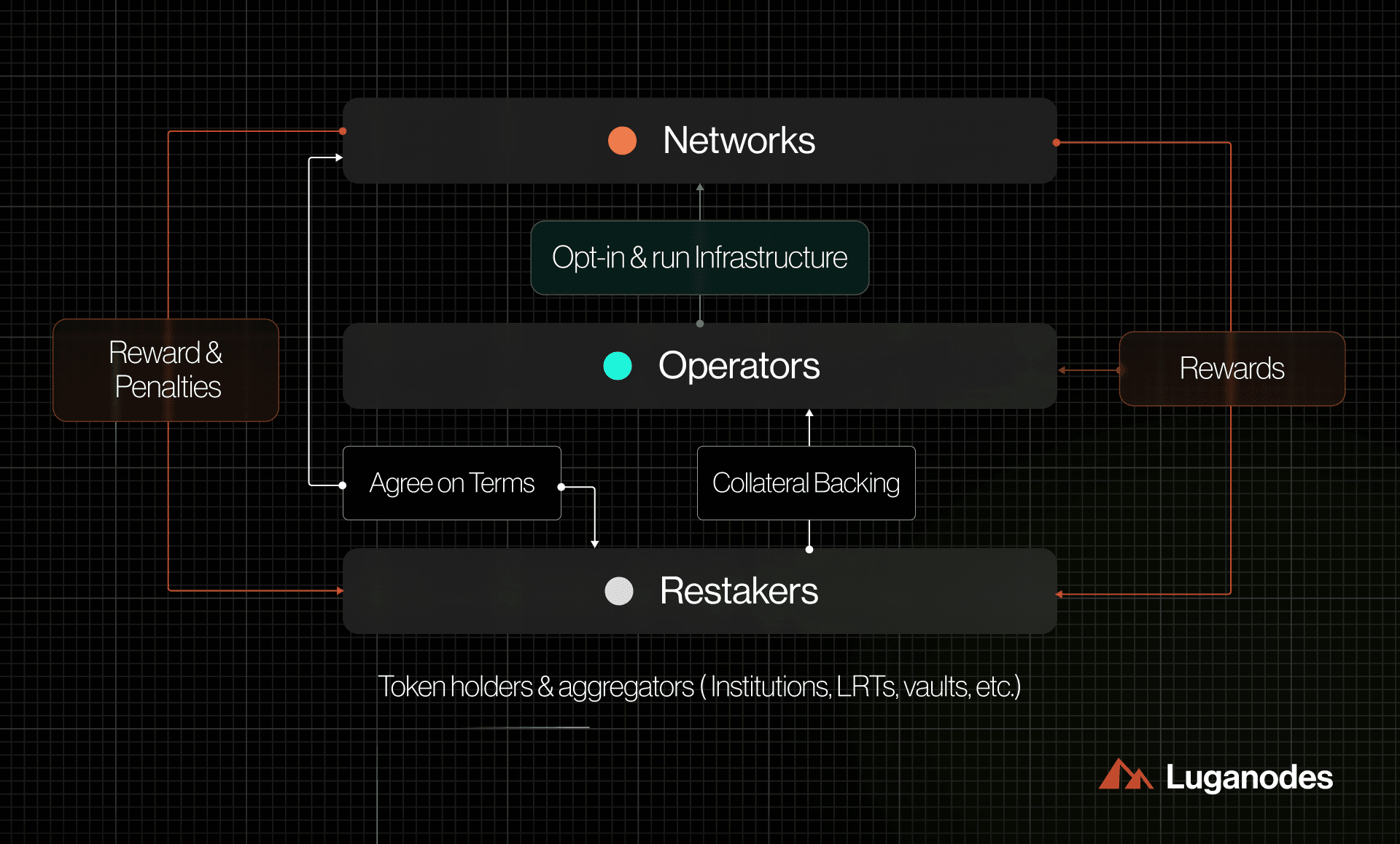

The Symbiotic protocol introduces a powerful new primitive for on-chain security: Universal Staking. Rather than siloing staked assets within individual blockchains or insurance pools, Symbiotic enables network builders to design custom staking implementations that flexibly allocate capital across multiple protocols and risk pools. This approach directly addresses the inefficiencies plaguing earlier insurance models, where idle capital sat dormant or was overcommitted to a single protocol.

With Symbiotic’s shared security layer, stakers can participate in diverse opportunities simultaneously. For example, a single ETH stake can secure multiple networks or insurance products at once, optimizing yield while distributing risk. This not only enhances returns but also makes it feasible for insurance underwriters to support coverage for niche risks – such as smart contract exploits or validator slashing – without requiring massive upfront reserves. The result is a system where one stake enables many outcomes, driving true capital efficiency into DeFi coverage.

This architecture is already attracting attention from major players. As noted in recent coverage by cryptodamus.io, Symbiotic’s model allows for the creation of tailored insurance products that dynamically adapt to protocol-specific risks – all without fragmenting liquidity or compromising on transparency.

SAFU’s Self-Repaying Insurance: Seamless Coverage Without Upfront Premiums

If Symbiotic provides the infrastructure for efficient risk pooling, SAFU brings innovation directly to end users with its self-repaying insurance model. Traditionally, purchasing DeFi insurance meant paying an upfront premium out-of-pocket – a friction point that limited adoption among retail and institutional users alike.

SAFU sidesteps this barrier by allowing depositors to place yield-bearing tokens (such as Ethena’s USDe) into its protocol. In return, they receive an insured version of their asset (e. g. , safuUSDe), which continues to earn yield but at a slightly reduced rate. The difference in yield is redirected to restakers who provide the actual coverage capacity. In effect, users obtain robust protection against depegs or insolvency events without ever committing additional capital beyond what they’ve already deposited – a game-changer for accessibility and adoption.

This mechanism is further enhanced by SAFU’s Dynamic Yield Distribution Framework (vYDF), which intelligently calibrates how much yield is sacrificed based on real-time risk exposure and optimal coverage levels for each asset class. Risk curators act as circuit breakers: if an asset becomes underinsured relative to its target level, vYDF increases the required yield sacrifice until adequate protection is restored; when overinsured, it dials sacrifice down to maximize depositor returns.

The New Standard: Embedded Guarantees and Customizable Risk Pools

The synergy between these two models points toward a future where DeFi insurance is not just more secure but also vastly more flexible and scalable. By embedding automated guarantees at the protocol level via universal staking primitives – rather than relying solely on opt-in products – networks can offer seamless protection as part of their core infrastructure.

Key Advantages of Capital-Efficient DeFi Coverage via Symbiotic & SAFU

-

Universal Staking for Flexible Capital Allocation: Symbiotic’s universal staking framework enables assets to be staked across multiple networks simultaneously, optimizing capital use and allowing stakers to earn yield from diverse sources while supporting various DeFi protocols.

-

Self-Repaying Insurance Model: SAFU introduces a groundbreaking insurance mechanism where users deposit yield-bearing tokens and receive insured versions, sacrificing only a portion of their yield for coverage—removing the need for upfront capital and making insurance more accessible.

-

Dynamic Yield Distribution for Optimal Coverage: SAFU’s Dynamic Yield Distribution Framework (vYDF) automatically adjusts the yield sacrificed by depositors based on real-time insurance needs, ensuring efficient use of capital and maintaining adequate protection levels for each asset.

-

Customizable, Permissionless Security Solutions: Symbiotic empowers network builders to design tailored staking and insurance solutions in a permissionless environment, supporting a wide range of risk profiles and use cases without compromising capital efficiency.

-

Automated, Transparent Guarantees: Through embedded, automated guarantees enforced by smart contracts, Symbiotic and SAFU reduce reliance on manual intervention, increasing transparency and trust in DeFi insurance processes.

This evolution has profound implications for both users and protocol designers:

- No more idle capital: Restaked assets do double (or triple) duty across multiple protocols.

- User experience streamlined: Getting insured becomes as simple as wrapping your token; no separate signups or upfront premiums.

- Dynamically managed risk: Yield sacrifice adjusts automatically based on real-time market conditions and curated targets.

- Bespoke coverage: Protocols can design custom risk pools tailored precisely to their needs without fragmenting liquidity.

These advances are not just theoretical. SAFU’s integration with Symbiotic’s universal staking is already demonstrating how on-chain insurance can be both institutional-grade and accessible to everyday DeFi users. The result: a more resilient ecosystem where risk is shared, capital works harder, and protection becomes a native feature rather than an afterthought.

Challenges Ahead: Prudence, Transparency, and Adoption

Despite these breakthroughs, the path to widespread adoption of capital-efficient DeFi insurance is not without obstacles. Risk assessment remains a moving target in decentralized markets. Protocols must maintain rigorous standards for onboarding new assets and calibrating risk parameters, especially as new attack vectors and market dynamics emerge. The transparent, permissionless nature of Symbiotic’s framework helps, but it also places the onus on network participants to act prudently and avoid adverse selection.

Another critical factor is transparency. While embedded guarantees make insurance seamless for users, they also demand robust reporting and auditability at every layer. Users and institutions alike will expect clear disclosures about how coverage levels are set, how claims are processed, and what triggers payouts in the event of an exploit or depeg. Both Symbiotic and SAFU have made strides here by making their mechanisms open-source and subject to community governance, a crucial step toward earning long-term trust.

What’s Next: Toward Embedded DeFi Protection at Scale

The vision of capital efficient DeFi coverage is quickly moving from concept to reality. As more protocols adopt universal staking models like Symbiotic’s, and as user-facing products like SAFU’s insured tokens proliferate, the industry could see a shift away from siloed risk pools toward embedded guarantees. This would mean that every interaction with a supported asset or protocol comes with built-in protection: no extra steps, no friction, just peace of mind as standard.

This transformation won’t happen overnight. It will require ongoing collaboration between risk curators, protocol developers, stakers, and end users. But the blueprint is now clear: by leveraging restaking primitives for shared security and dynamic yield frameworks for responsive pricing, DeFi can finally offer insurance that matches the composability and openness of its underlying infrastructure.

Key Advantages of Capital-Efficient DeFi Coverage by Symbiotic and SAFU

-

Universal Staking for Enhanced Capital Efficiency: Symbiotic’s universal staking framework enables staked assets to be flexibly allocated across multiple networks, maximizing yield opportunities and reducing risk concentration. This shared security protocol empowers stakers to participate in diverse insurance pools without locking capital into a single protocol.

-

Self-Repaying Insurance Model: SAFU pioneers on-chain insurance by allowing users to deposit yield-bearing tokens and receive insured versions of their assets. The insurance is funded by a portion of the yield, eliminating the need for upfront capital and making coverage seamless and accessible for DeFi participants.

-

Dynamic Yield Distribution Framework (YDF): SAFU’s vYDF dynamically adjusts the yield sacrificed by depositors based on real-time insurance needs. This mechanism ensures optimal coverage for each asset while enhancing capital efficiency by reducing unnecessary yield sacrifice when coverage exceeds the required threshold.

-

Customizable and Automated Risk Coverage: Through Symbiotic’s permissionless staking architecture, networks and protocols can implement tailored insurance products that address specific risks such as smart contract vulnerabilities and validator failures, supporting a wide range of DeFi applications.

-

Transparent, Scalable, and Trustless Protection: The integration of Symbiotic and SAFU delivers scalable, on-chain insurance solutions with transparent mechanisms. This fosters greater trust in DeFi by providing verifiable, automated protection without reliance on centralized intermediaries.

The implications go beyond just insurance:

- Sustainable yield generation: Restakers earn competitive returns while supporting network security.

- Broad-based trust: Transparent mechanisms foster confidence among retail users, DAOs, and institutional allocators alike.

- Customizable DeFi risk pools: Protocols can fine-tune coverage parameters to suit evolving threats, without locking up excess capital.

- No upfront premium barriers: Insurance becomes opt-out rather than opt-in, driving adoption across the entire ecosystem.

The bottom line? By combining Symbiotic’s universal staking foundation with SAFU’s seamless self-repaying model, DeFi insurance is finally catching up with the promise of decentralized finance itself: efficient markets where risks are managed collectively, and capital always finds its highest use.