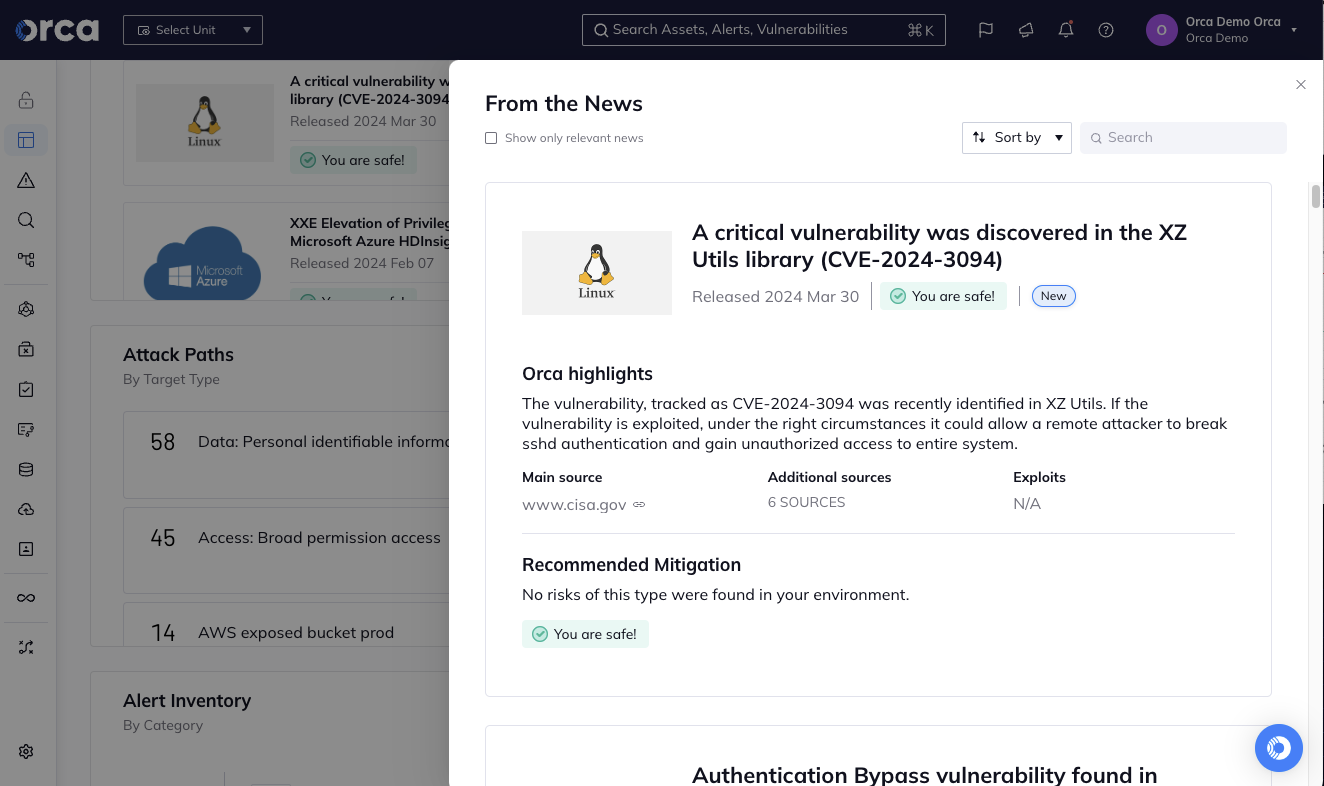

Smart contract audits have become a bedrock of DeFi security, with protocols touting audit reports as badges of trust. Yet, headline-grabbing exploits persist, draining millions from audited projects and shaking user confidence. If audits are so prevalent, why do DeFi smart contract exploits keep happening? The answer lies in the nuanced realities of code review, evolving threats, and the unique economic landscape of decentralized finance.

![]()

Why Audited Smart Contracts Still Get Exploited

Audits are indispensable for identifying bugs and vulnerabilities before launch. However, they’re not silver bullets. Let’s break down five recurring pitfalls that explain why even thoroughly audited DeFi protocols remain vulnerable:

5 Key Pitfalls Behind Audited DeFi Exploits

-

Incomplete Audit Coverage: Audits often focus on core contracts but may overlook auxiliary modules, upgradeable proxies, or third-party integrations. The 2024 Prisma Finance exploit exemplifies this, where an overlooked module enabled attackers to steal $10 million.

-

Rapid Post-Audit Code Changes: Protocols frequently deploy new features or bug fixes after audits, introducing fresh vulnerabilities that were not reviewed. This was seen in the 2023 Yearn Finance v2 vault exploit, which occurred after unaudited updates were pushed to production.

-

Economic and Oracle Attack Vectors: Audits primarily assess code logic, but many exploits target economic mechanisms or oracle manipulation. A notable case is the Mango Markets $100 million oracle price manipulation in late 2022, which exploited weaknesses beyond the scope of static code reviews.

-

Audit Fatigue and Over-Reliance: Teams may treat passing an audit as a guarantee of safety, leading to complacency and neglecting ongoing monitoring or layered security. The Euler Finance hack in 2023 is a prime example, where attackers exploited vulnerabilities despite multiple prior audits.

-

Emergence of Zero-Day Vulnerabilities: New attack techniques and previously unknown bugs (zero-days) can bypass even thorough audits. The Curve Finance reentrancy exploit in 2023 leveraged an unanticipated vector, resulting in significant losses despite prior security assessments.

Incomplete Audit Coverage: The Blind Spots in Protocol Security

Most audits focus on core contracts but may neglect auxiliary modules, upgradeable proxies, or third-party integrations. This leaves critical attack surfaces unchecked. A stark example is the 2024 Prisma Finance exploit, where an overlooked module allowed attackers to siphon $10M in assets despite the main contracts being audited. Such incidents underscore that security is only as strong as your least-reviewed component.

“The most dangerous code is often the code nobody is looking at. ”

Rapid Post-Audit Code Changes: Security Debt in Fast-Moving Markets

The pace of DeFi innovation is relentless. Protocols frequently push new features or bug fixes after an audit, often under pressure to capture market share or respond to competitors. These unaudited changes can introduce fresh vulnerabilities that escape scrutiny until it’s too late. The 2023 Yearn Finance v2 vault exploit is a textbook case: after deploying unaudited updates post-audit, Yearn suffered a significant loss when attackers found a new weakness in the changed logic.

Economic and Oracle Attack Vectors: Beyond Code Logic

Traditional audits excel at catching code-level bugs but often miss vulnerabilities tied to protocol economics or external data feeds (oracles). Attackers increasingly target these soft spots with sophisticated strategies that static review processes struggle to anticipate. Consider the late 2022 Mango Markets exploit: by manipulating oracle prices through large trades, attackers drained $100M, without ever breaching core contract logic. This kind of economic manipulation demonstrates why risk management must extend beyond just reviewing Solidity code.

The bottom line? Even the best audits are just one layer in a multi-faceted defense strategy against ever-evolving threats in DeFi.

Audit Fatigue and Over-Reliance: The Danger of Complacency

Passing a smart contract audit is often treated as a finish line rather than a checkpoint. Teams may become complacent, neglecting the need for ongoing monitoring, layered security controls, and regular reassessments. This mindset, known as audit fatigue, can be disastrous. The 2023 Euler Finance hack is a cautionary tale: despite multiple prior audits, the protocol fell victim to an exploit that drained $197 million. The incident highlighted how over-reliance on static audits, without continuous threat modeling or real-time monitoring, leaves even well-reviewed protocols exposed to emerging risks.

Emergence of Zero-Day Vulnerabilities: When the Unknown Strikes

No audit can anticipate every possible attack vector, especially when adversaries are constantly innovating. Zero-day vulnerabilities are previously unknown bugs or techniques that surface only when exploited in the wild. In 2023, Curve Finance suffered a reentrancy exploit that leveraged an unanticipated flaw, resulting in significant asset losses despite rigorous prior reviews. This episode underscores that DeFi’s adversarial landscape is always evolving; static analysis and code review are necessary but not sufficient.

“Security is not a product but a process, a culture of vigilance that adapts as fast as attackers do. ”

Building Resilience: Best Practices for DeFi Risk Management

The persistent gap between audit completion and actual protocol safety calls for a new approach to DeFi risk management. Here’s how projects and users can adapt:

- Continuous Security Monitoring: Employ on-chain analytics and real-time alert systems to detect abnormal activity before it escalates.

- Layered Security: Combine audits with formal verification, bug bounties, insurance solutions, and circuit breakers.

- Comprehensive Coverage: Ensure all modules, including proxies and third-party integrations, are included in security reviews.

- Post-Deployment Discipline: Treat every code change as an opportunity for new risk; mandate incremental audits or peer reviews after updates.

- User Education and Insurance: Empower users with knowledge about protocol risks and available DeFi insurance options for smart contract exploits and stablecoin depegs.

Do you trust audited DeFi smart contracts, or do you prefer additional risk mitigation tools?

Despite thorough audits, DeFi smart contracts are still being exploited due to overlooked modules, rapid code changes, oracle attacks, audit fatigue, and emerging zero-day vulnerabilities. Which approach best reflects your stance on managing DeFi risks?

The Future of DeFi Security: Adaptive Defense and Insurance

The reality is clear: even the most comprehensive audit cannot provide absolute protection against DeFi smart contract exploits. As protocols grow more complex and attackers more sophisticated, risk mitigation must evolve from one-off assessments to continuous defense strategies. Integrating robust insurance solutions for both smart contract exploits and stablecoin depegs can offer another critical layer of protection, empowering users to participate confidently in decentralized finance while acknowledging its inherent risks.

This adaptive mindset, where audits are one tool among many, will define resilient protocols in the years ahead. For those navigating today’s volatile landscape, combining technical best practices with informed risk management is no longer optional; it’s essential.