On September 14,2025, the Bitcoin-backed Yala (YU) stablecoin suffered a catastrophic depeg event that sent shockwaves through the DeFi ecosystem. YU, once designed to maintain a steady $1 value, is currently trading at $0.1503 – a stark reminder of the risks inherent in multi-chain stablecoin protocols. The exploit that triggered this collapse is now a pivotal case study in DeFi cross-chain attack risk and the urgent need for robust risk management frameworks.

How the Yala Stablecoin Depeg Unfolded: Timeline of a Multi-Chain Exploit

The sequence of events that led to YU’s depegging was both complex and emblematic of emerging vulnerabilities in decentralized finance:

Key Moments in the Yala Stablecoin Depeg Exploit

-

September 14, 2025: Yala YU Stablecoin Depegs — Yala’s Bitcoin-backed YU stablecoin loses its $1 peg, plunging to as low as $0.1503 following a major protocol exploit.

-

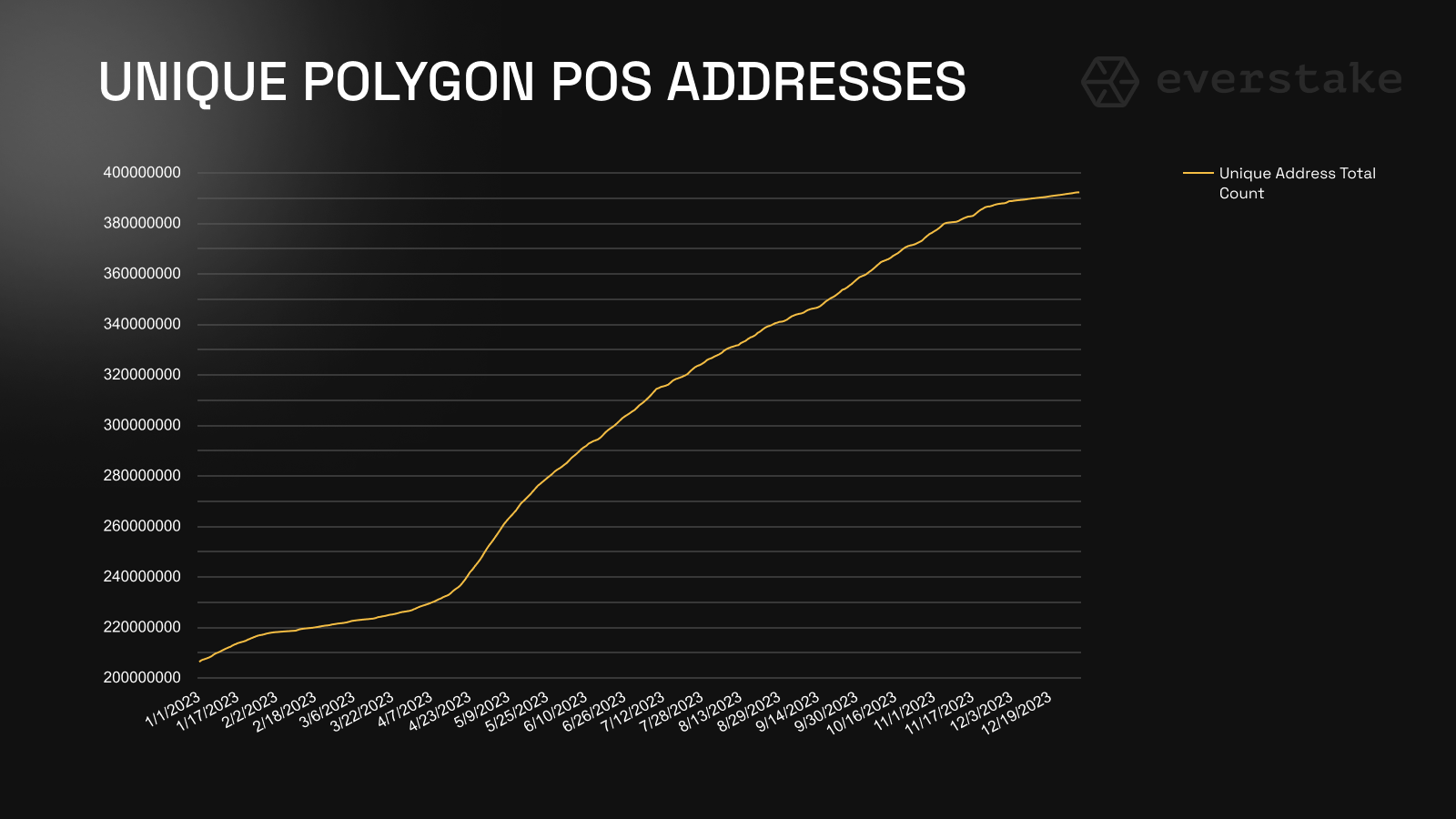

Unauthorized Minting of 120 Million YU on Polygon — Attackers exploit a vulnerability to mint 120 million YU tokens on the Polygon network, far exceeding the protocol’s intended supply.

-

Cross-Chain Bridge Exploitation — 7.71 million YU tokens are bridged to Ethereum and Solana, where they are rapidly swapped for 7.7 million USDC, exposing risks in multi-chain bridge infrastructure.

-

Attacker Launders Proceeds — The attacker converts the stolen funds into 1,501 ETH and disperses them across multiple wallets, complicating recovery efforts.

-

Yala Disables Convert and Bridge Features — In response to the exploit, Yala disables its Convert and Bridge functions to prevent further instability and unauthorized token movement.

-

Ongoing Investigation with SlowMist — Yala partners with blockchain security firm SlowMist to investigate the breach, assuring users that all Bitcoin collateral remains secure.

The attacker exploited flaws in Yala’s protocol on Polygon, managing to mint 120 million unauthorized YU tokens. Of these, 7.71 million tokens were swiftly bridged to Ethereum and Solana, then exchanged for $7.7 million USDC. The proceeds were converted into 1,501 ETH and distributed across multiple wallets – classic laundering tactics seen in high-profile DeFi breaches.

At present, the attacker still controls 22.29 million YU on Ethereum and Solana, with another 90 million unbridged on Polygon. Meanwhile, everyday users are left holding a token whose market value has cratered by over 80% from its intended peg.

Dissecting the Attack: Where Did Security Fail?

The anatomy of this exploit provides a sobering lesson for protocol designers and investors alike:

- Cross-Chain Complexity: Bridging assets across Polygon, Ethereum, and Solana created an expanded attack surface. As seen here, multi-chain protocols are only as secure as their weakest link.

- Poor Mint Controls: The attacker’s ability to mint such an enormous volume of tokens points to insufficient checks within smart contract logic – an avoidable oversight with better audit rigor.

- Lack of Real-Time Monitoring: The window between exploit initiation and mitigation allowed millions to be siphoned off before any emergency measures could be enacted.

The aftermath saw Yala’s team disabling Convert and Bridge features to prevent further outflows. They also engaged blockchain security firm SlowMist for forensic investigation and reassured users that all Bitcoin collateral remains secure – but trust has been severely damaged.

Market Fallout: Price Action Reflects Fragile Confidence

The immediate impact was brutal: within hours of the breach, YU crashed from $1 down to $0.2046 before staging a partial recovery. As of now, it trades at $0.1503, reflecting persistent uncertainty about both protocol solvency and user recourse (source). This episode has reignited debate around algorithmic versus overcollateralized stablecoins – especially those reliant on cross-chain infrastructure.

Yala (YU) Stablecoin Price Prediction 2026-2031

Professional Outlook for YU Price Recovery Post-2025 Exploit

| Year | Minimum Price | Average Price | Maximum Price | Potential % Change (from 2025 close) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.08 | $0.22 | $0.40 | -47% to +166% | Volatility persists as confidence rebuilds; regulatory scrutiny may impact recovery. YU struggles to regain peg, but partial restoration possible if team executes robust recovery plan. |

| 2027 | $0.10 | $0.35 | $0.65 | +0% to +333% | If security upgrades and governance reforms succeed, price may approach $0.50+; otherwise, stagnation near $0.20 likely. Possible relaunch or rebranding could boost sentiment. |

| 2028 | $0.12 | $0.52 | $0.90 | +20% to +500% | Broader DeFi adoption and improved cross-chain infrastructure could drive demand. Regulatory approvals or institutional partnerships may accelerate price recovery. |

| 2029 | $0.18 | $0.70 | $1.10 | +60% to +633% | In a bullish scenario, YU could regain or even exceed $1 peg if trust and liquidity are restored. Bearish case: price remains capped under $0.50 amid lingering doubts. |

| 2030 | $0.25 | $0.85 | $1.25 | +67% to +733% | If YU achieves full peg restoration and market confidence, price stabilizes above $1. Otherwise, it may oscillate in the $0.50-$1.00 range depending on competition. |

| 2031 | $0.30 | $1.00 | $1.40 | +100% to +833% | Sustained ecosystem growth and regulatory clarity could see YU solidify as a leading BTC-backed stablecoin. Risk of new exploits or DeFi downturn remains a concern. |

Price Prediction Summary

Yala’s YU stablecoin faces a challenging path to recovery following the 2025 exploit. Short-term volatility and persistent discount to the $1 peg are expected, but with effective protocol upgrades, security reforms, and market adoption, gradual price restoration is plausible. Full re-pegging may be achieved by 2030-2031 in the most optimistic scenario, though downside risks remain significant.

Key Factors Affecting Yala Price

- Successful completion of independent security audits and protocol upgrades.

- Restoration of user and investor confidence post-exploit.

- Regulatory responses to stablecoin risks and DeFi protocols.

- Market demand for BTC-backed stablecoins and overall DeFi sector growth.

- Competition from more established or newly launched stablecoins.

- Ability to recover or burn exploited tokens and rebalance supply.

- Broader trends in Bitcoin price and crypto market cycles.

- Development of robust cross-chain infrastructure and risk management practices.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This is not just about one project’s failure; it exposes systemic gaps in multi-chain stablecoin vulnerabilities, governance transparency, and crisis response preparedness across DeFi as a whole.

For users, the Yala event is a harsh reminder that even Bitcoin-backed stablecoins are not immune to cascading technical failures and governance shortfalls. The fact that YU sits at $0.1503 – with no clear path back to its $1 peg – signals lasting reputational damage and sets a precedent for market skepticism toward similar projects.

Risk Mitigation: What DeFi Users and Builders Can Learn

The Yala depeg has prompted a wave of introspection among DeFi developers, auditors, and risk managers. Here are actionable lessons drawn from this stablecoin exploit case study:

Key Risk Management Steps for Multi-Chain Stablecoins

-

Conduct Comprehensive Smart Contract Audits with reputable firms like SlowMist or Trail of Bits to identify and mitigate vulnerabilities before deployment across chains.

-

Implement Real-Time On-Chain Monitoring using platforms such as Chainalysis or Forta to detect suspicious activity and exploits as they occur.

-

Secure Cross-Chain Bridges by leveraging established solutions like LayerZero or Wormhole, and regularly updating bridge contracts to patch known vulnerabilities.

-

Establish Emergency Response Protocols including rapid feature disabling (as Yala did with Convert and Bridge) and pre-coordinated incident response with firms like CertiK or OpenZeppelin.

-

Maintain Transparent and Timely Communication with users through official channels such as Discord, Telegram, and Twitter to provide updates, reassure the community, and combat misinformation during crises.

-

Regularly Review and Upgrade Governance Mechanisms using robust frameworks like Snapshot or Aragon to ensure decentralized yet responsive decision-making during emergencies.

-

Collaborate with Blockchain Analytics Firms such as Elliptic or TRM Labs for post-incident investigation and asset tracking across multiple chains.

- Audit Depth Over Speed: Rushed launches and shallow audits increase exposure to overlooked vulnerabilities. Comprehensive, iterative reviews are critical – especially when deploying cross-chain bridges or minting mechanisms.

- Real-Time Monitoring and Kill Switches: Automated alerts and circuit breakers can prevent millions in losses by halting suspicious activity instantly. Post-mortems consistently show that minutes matter in exploit scenarios.

- Transparent Incident Response: Open communication about attack vectors, collateral status, and recovery plans is essential for retaining user trust during crises.

The demand for DeFi insurance for depegs is likely to surge as users seek ways to hedge against both protocol-level exploits and systemic market shocks. However, coverage terms must evolve to account for the unique risks of multi-chain designs, especially when it comes to claims triggered by smart contract failures versus broader market movements.

Looking Ahead: Redefining Stablecoin Security Standards

The Yala hack will shape future best practices in stablecoin security risks. Expect renewed focus on:

- Upgradable Contracts with Caution: While upgradability can patch vulnerabilities post-launch, it also introduces governance risk if not tightly controlled.

- Diversified Collateral Management: Reliance on a single asset, even Bitcoin, can amplify contagion risk if protocol controls fail.

- User Education and Insurance Adoption: As more retail users enter DeFi, understanding the limits of algorithmic pegs and available insurance protections becomes non-negotiable.

No protocol is too big or too well-capitalized to fail unexpectedly. For teams building the next generation of decentralized money, and for everyday users, the Yala incident is a call to demand more from audits, response plans, and coverage products alike. Only by learning from these high-profile failures can DeFi mature into a truly resilient financial ecosystem.