Decentralized Finance (DeFi) insurance is rapidly reshaping the landscape of risk management in crypto, introducing new paradigms for both underwriters and policyholders. Unlike traditional insurance, where actuarial data and long-standing models drive decisions, DeFi insurance risk assessment relies on a blend of smart contract analysis, community-driven evaluation, and real-time market dynamics. This shift demands a nuanced understanding of how underwriters approach risk in an environment defined by transparency, automation, and volatility.

Key Pillars of DeFi Insurance Underwriting

At its core, DeFi insurance underwriting is about meticulously evaluating the unique vulnerabilities that decentralized protocols face. Let’s break down the primary areas that underwriters scrutinize:

Key Factors DeFi Underwriters Assess

-

Smart Contract Security: Underwriters rigorously evaluate the protocol’s smart contract code for vulnerabilities, ensuring it has undergone independent audits and stress testing to prevent exploits and financial losses.

-

Protocol Governance: The governance structure is scrutinized for transparency, decentralization, and effectiveness, as robust governance mechanisms help protocols adapt to new risks and regulatory changes.

-

Liquidity Management: Underwriters analyze liquidity pools for sufficient depth, diversity, and risk controls to ensure the protocol can withstand large withdrawals and volatile market conditions.

-

Market Risk Exposure: The protocol’s exposure to crypto market volatility, impermanent loss, and external economic factors is assessed to determine the potential impact on asset values and insurance claims.

-

Regulatory Compliance: Adherence to Anti-Money Laundering (AML), Countering the Financing of Terrorism (CFT), and other regulatory standards is evaluated to mitigate legal and operational risks.

-

Counterparty Risk: The reliability and creditworthiness of counterparties involved in protocol transactions are examined, considering their financial health and track record to prevent defaults.

-

Incident Response and Recovery Plans: Underwriters look for comprehensive procedures for detecting, containing, and recovering from security breaches or operational failures to minimize disruption and losses.

Smart Contract Security: The First Line of Defense

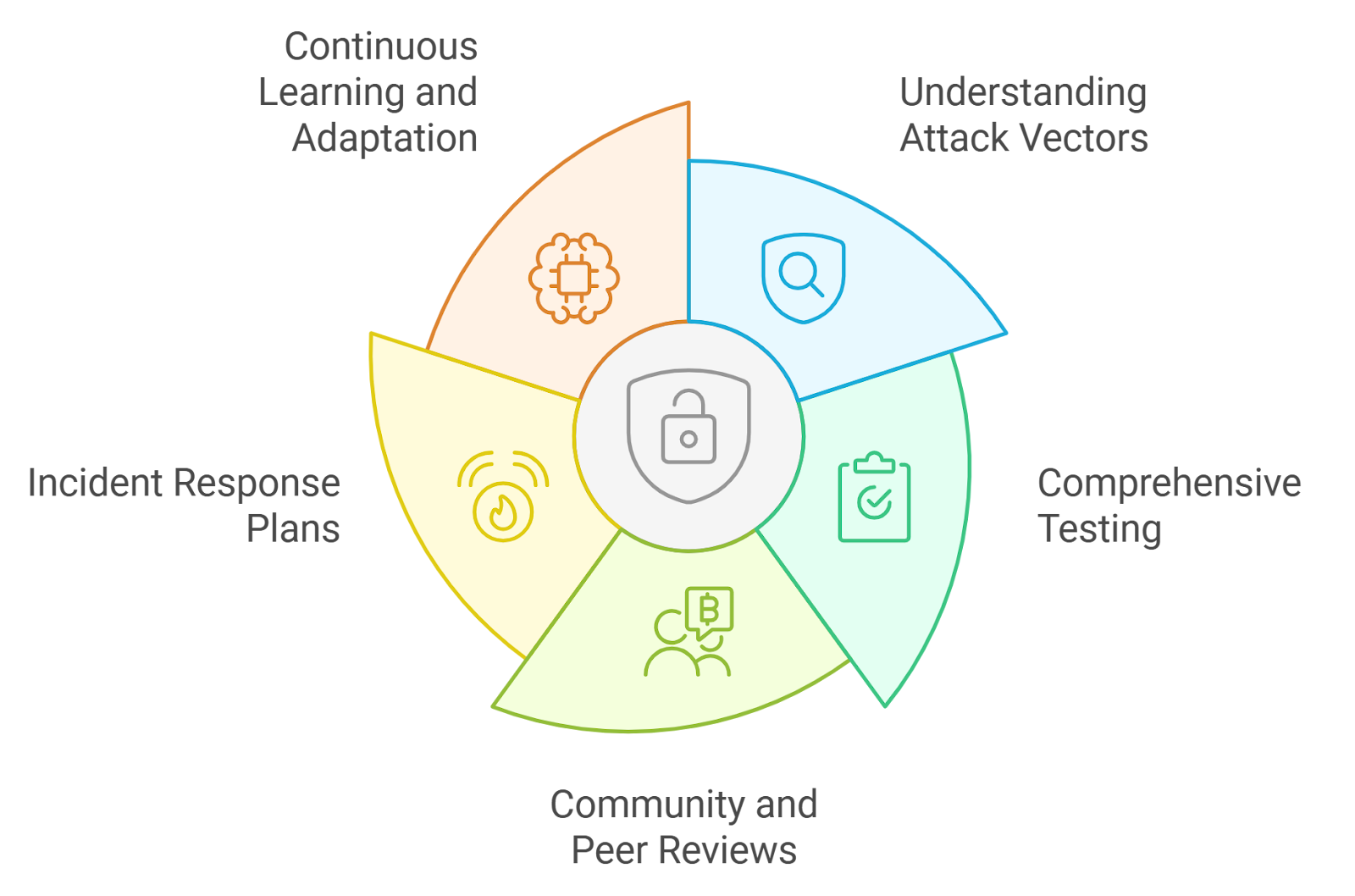

No aspect is more critical in exploit risk DeFi assessment than the security of smart contracts. Underwriters demand evidence of comprehensive audits from reputable firms and look for open-source code that’s been battle-tested by the community. They analyze for known vulnerabilities such as reentrancy attacks or oracle manipulation, issues that have led to some of the most significant losses in DeFi history.

The evaluation doesn’t stop at technical audits. Underwriters probe into how quickly a protocol patches discovered bugs and whether there are bug bounty programs incentivizing white-hat disclosures. This proactive stance is essential because even minor oversights can result in multi-million dollar exploits.

Governance and Liquidity Management: Beyond Code

The resilience of a DeFi protocol also depends on its governance structure. Underwriters gauge how decentralized decision-making is, are changes voted on by a broad DAO or controlled by a small team? Transparent governance reduces susceptibility to malicious upgrades or rushed proposals that could introduce new risks (source).

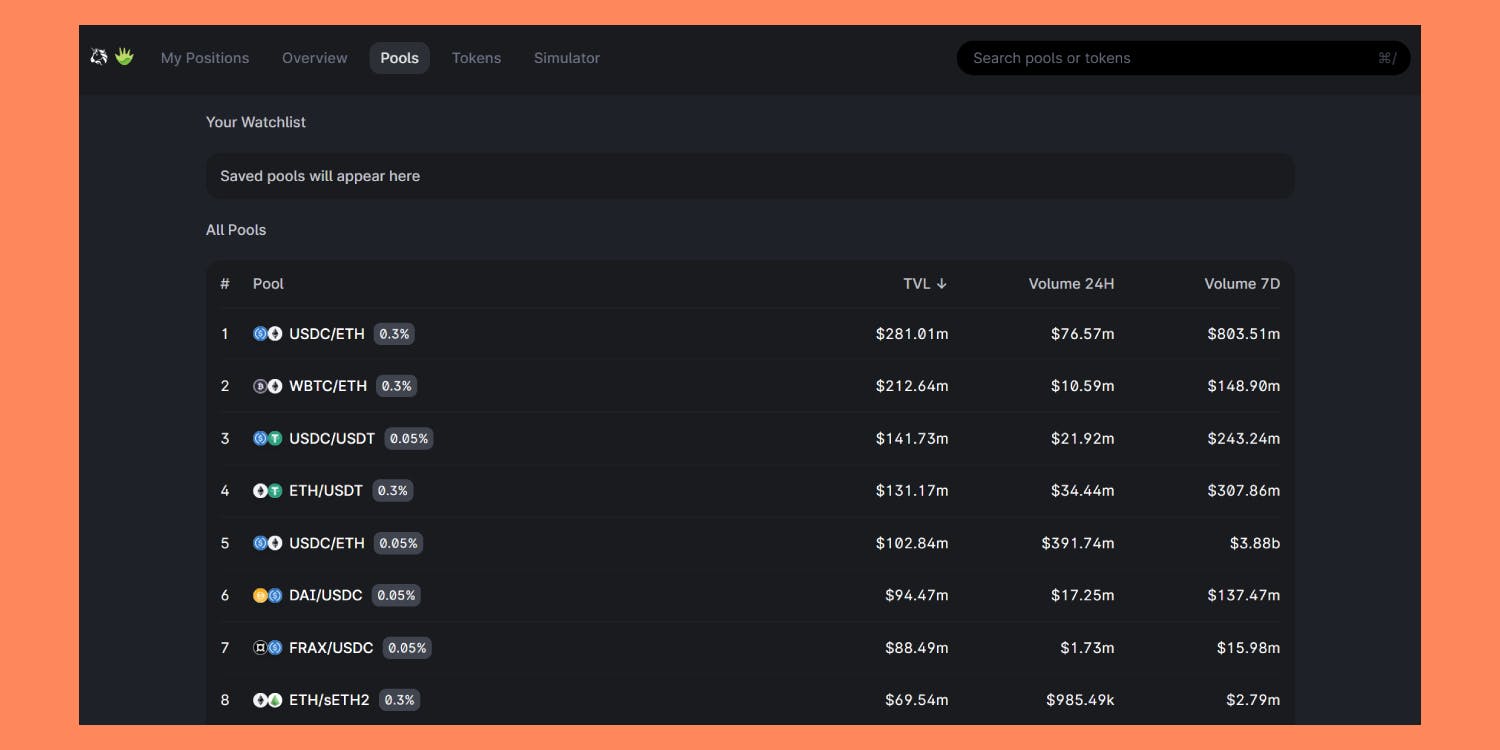

Liquidity management is another focal point. Sufficient liquidity ensures claims can be paid out during adverse events like stablecoin depegs or flash crashes. Underwriters examine pool depth, diversity across assets, and mechanisms such as dynamic withdrawal fees designed to prevent bank-run scenarios (source). Inadequate liquidity can turn a manageable exploit into an existential threat for policyholders.

Market Risk Exposure and Regulatory Compliance

The extreme volatility inherent in crypto markets introduces layers of complexity absent from traditional finance. Underwriters must model potential losses from impermanent loss events or sudden price swings impacting collateralized positions, a core concern for depeg risk assessment. Tools like on-chain analytics platforms help quantify these exposures in real time.

Finally, compliance with evolving regulations is non-negotiable for sustainable growth. Adherence to AML/CFT standards not only protects users but also future-proofs protocols against regulatory shocks (source). Underwriters look for robust KYC procedures where applicable and monitor how protocols adapt to new legal requirements.

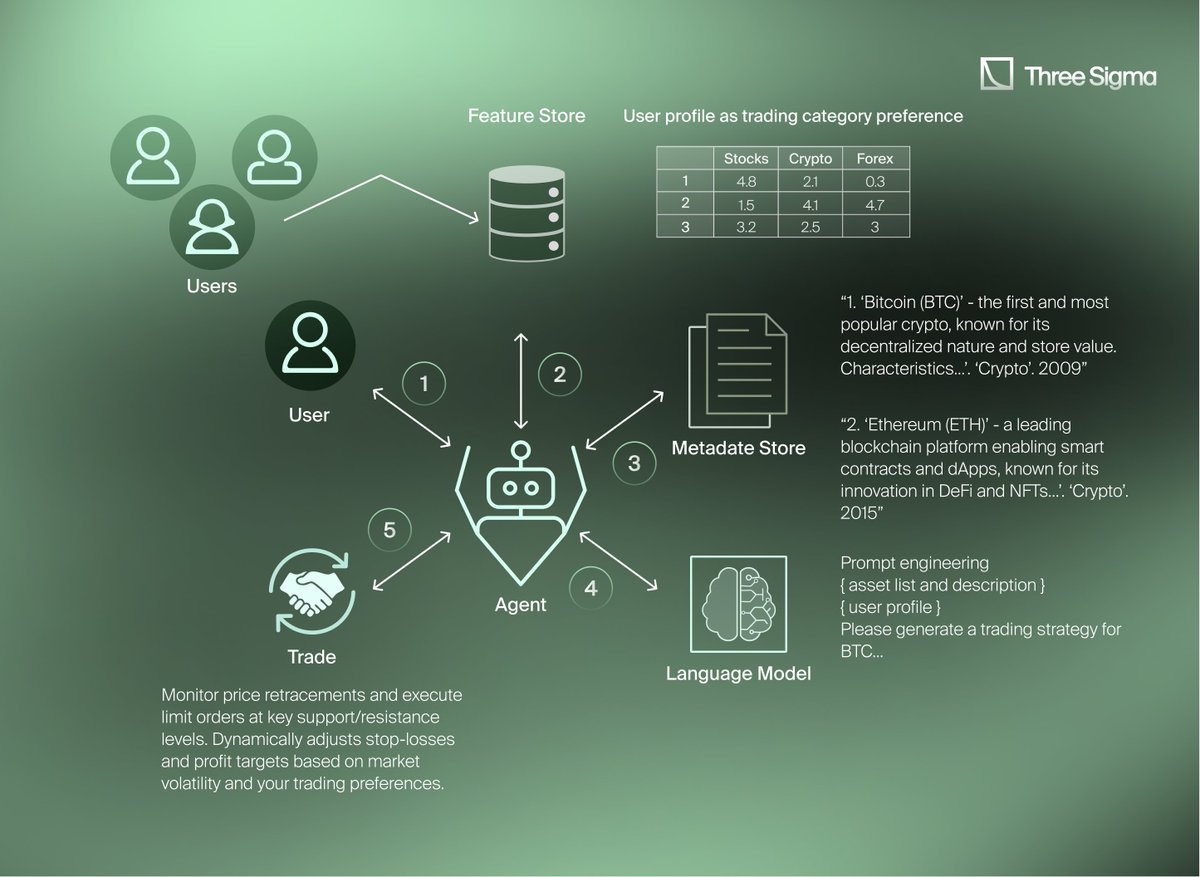

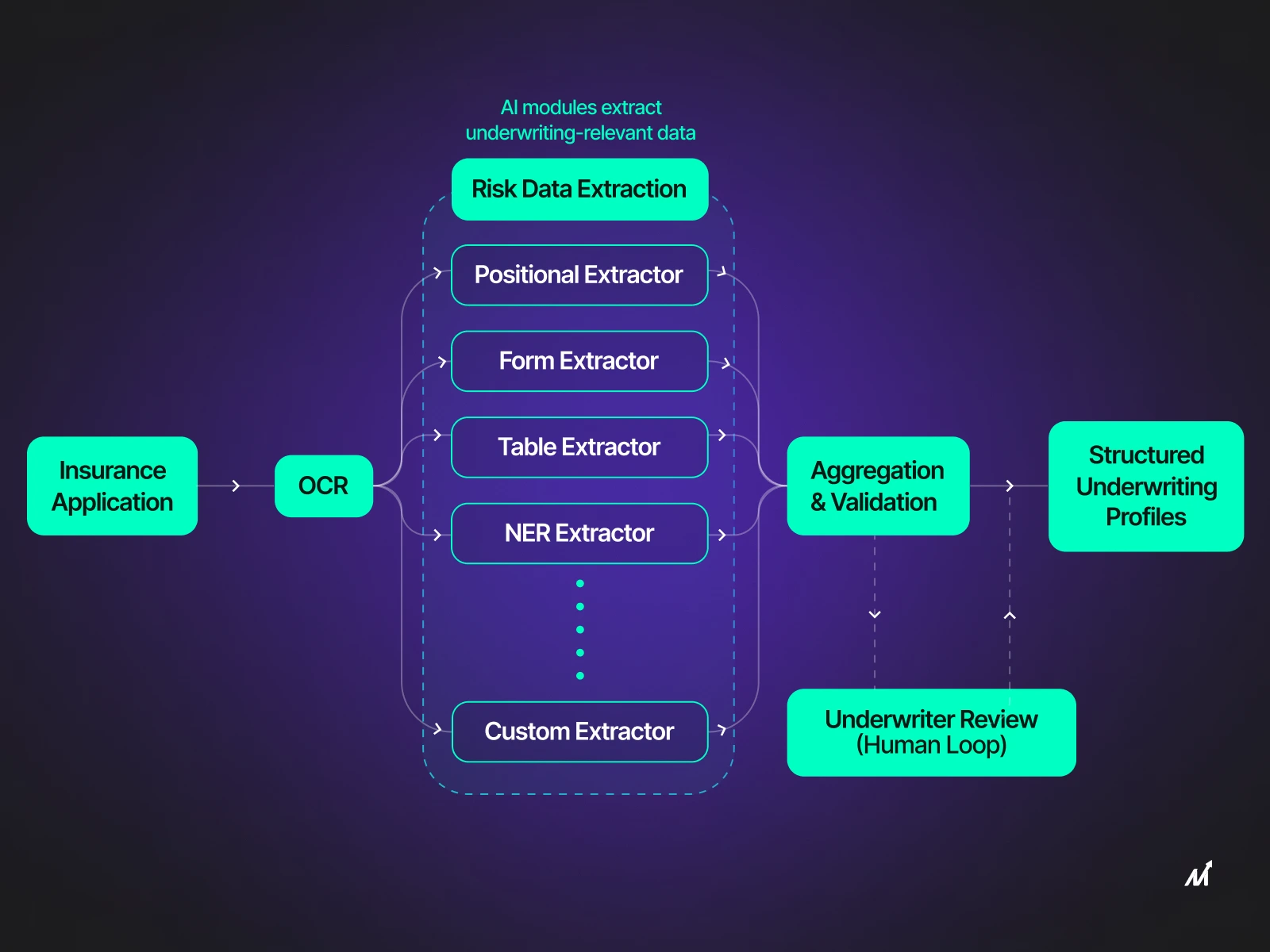

As the DeFi sector matures, underwriters are also increasingly leveraging AI-driven analytics and community-sourced intelligence to inform their decisions. These tools enable faster identification of emerging threats and help quantify risks that were previously opaque. However, the challenge remains: pricing risk in DeFi is a moving target. New attack vectors, governance exploits, or liquidity shocks can emerge overnight, requiring underwriters to remain vigilant and adaptive.

Counterparty Risk and Incident Response: The Human Factor

While smart contracts automate much of DeFi’s infrastructure, people are still at the heart of every protocol, whether as developers, DAO members, or liquidity providers. Counterparty risk in this context refers to the reliability of all these actors. Underwriters assess not only a protocol’s code but also its team’s track record, transparency with the community, and history of honoring claims or bug bounties (source).

Equally critical is a protocol’s incident response plan. Does it have clear procedures for freezing contracts or halting withdrawals during an exploit? Are there predefined communication channels for alerting users? The speed and clarity with which a team can respond to crises often determines whether losses are contained or spiral out of control.

What Sets Top DeFi Insurance Underwriters Apart?

The best underwriters distinguish themselves through rigorous due diligence and ongoing monitoring. They don’t just review protocols at onboarding, they continuously track on-chain activity, governance proposals, market conditions, and developer communications for red flags. This dynamic approach is essential in an ecosystem where yesterday’s safe harbor can become today’s cautionary tale.

Key Practices of Leading DeFi Insurance Underwriters

-

Continuous Protocol Monitoring: Top underwriters like Nexus Mutual and InsurAce employ real-time surveillance tools to track smart contract health, liquidity movements, and protocol governance changes, enabling rapid detection of emerging risks.

-

Advanced AI and Analytics: Platforms such as Bridge Mutual and Unslashed Finance leverage AI-driven analytics to assess smart contract vulnerabilities, analyze transaction patterns, and predict risk exposures with greater precision.

-

Transparent Risk Disclosures: Leading underwriters provide detailed, public risk assessments and audit reports. For example, Nexus Mutual publishes regular smart contract audit summaries and risk factor breakdowns, fostering trust and informed decision-making.

-

Proactive Claims Management: Modern DeFi insurers like InsurAce implement streamlined, on-chain claims processes with community voting and automated triggers, ensuring timely and transparent resolution of claims.

Another hallmark is transparency in risk disclosures. Leading platforms publish detailed criteria for what constitutes covered events (e. g. , smart contract exploits vs. governance failures) and provide regular updates on pool solvency and exposure limits. This empowers policyholders to make informed choices about coverage scope and pricing.

Navigating the Future: Evolving Standards in DeFi Insurance Risk Assessment

The future of DeFi insurance underwriting will likely be defined by greater standardization, both in how risks are assessed and how claims are processed. Industry groups are already releasing guidelines on best practices for evaluating smart contract security, governance structures, and liquidity management (source). As these frameworks gain traction, expect more consistent pricing models and clearer definitions around covered perils.

This evolution will benefit both underwriters, who can better manage aggregate exposures, and users seeking reliable protection against the sector’s most pressing threats: exploit risk DeFi, stablecoin depegs, oracle failures, and more.

The bottom line? Effective DeFi insurance risk assessment is as much about agility as it is about rigor. By understanding what top underwriters look for, from code audits to crisis playbooks, users can select coverage that truly aligns with their needs in this fast-moving landscape.