DeFi insurance has rapidly evolved to address the unique risks inherent in decentralized finance, from smart contract exploits to stablecoin depegs. At the heart of this protection sits a critical but often overlooked component: oracles. Oracles serve as the bridge between real-world data and on-chain logic, enabling smart contracts to respond to external events with precision. In DeFi insurance, their role is especially vital, accurate oracle feeds determine when coverage triggers for losses due to depegs or exploits, impacting whether users receive timely payouts or face financial setbacks.

Why Oracles Are Essential for DeFi Insurance

Insurance protocols in DeFi rely on objective, verifiable data to automate claim processing. For example, if a stablecoin like USDe loses its peg or a protocol suffers an exploit, the insurance contract must detect this event based on clear criteria, often tied directly to price feeds or incident reports provided by oracles. Without reliable oracles, these automated systems are blind: they can’t distinguish between a genuine loss event and market noise.

Oracles underpin several core processes:

- Depeg trigger detection: Monitoring stablecoin prices across multiple exchanges and reporting when a token falls below a defined threshold.

- Smart contract exploit detection: Reporting abnormal fund movements or protocol state changes that indicate an attack.

- Payout automation: Enabling claims processing without manual intervention, reducing delays and disputes.

This makes oracle reliability not just a technical concern but a foundational element of user trust in DeFi insurance products.

The Risks: Oracle Manipulation and Exploits

The power of oracles comes with significant risk. If an attacker can manipulate oracle inputs, by distorting price feeds or injecting false data, they can force protocols into making erroneous decisions. Recent history is full of cautionary tales. In 2024, Polter Finance suffered a $12 million loss when its price oracle was manipulated via liquidity pools, resulting in excessive borrowing against artificially inflated collateral values (source). Similarly, flash loan attacks have leveraged oracle vulnerabilities for rapid-fire exploits; in 2025, the Avalanche-based Euler market lost over $500,000 after a Chainlink oracle mishap triggered mass liquidations (source).

The consequences are clear: inaccurate data leads directly to financial loss, not only for protocols but also for users who depend on insurance coverage to work as promised. This highlights why oracle reliability in DeFi is under constant scrutiny by both developers and risk managers.

Strengthening Oracle Security: Best Practices Emerging in 2025

The industry isn’t standing still. To defend against manipulation and ensure accurate triggers for depeg and exploit events, leading DeFi insurance providers are adopting robust strategies:

Best Practices for Securing Oracles in DeFi Insurance

-

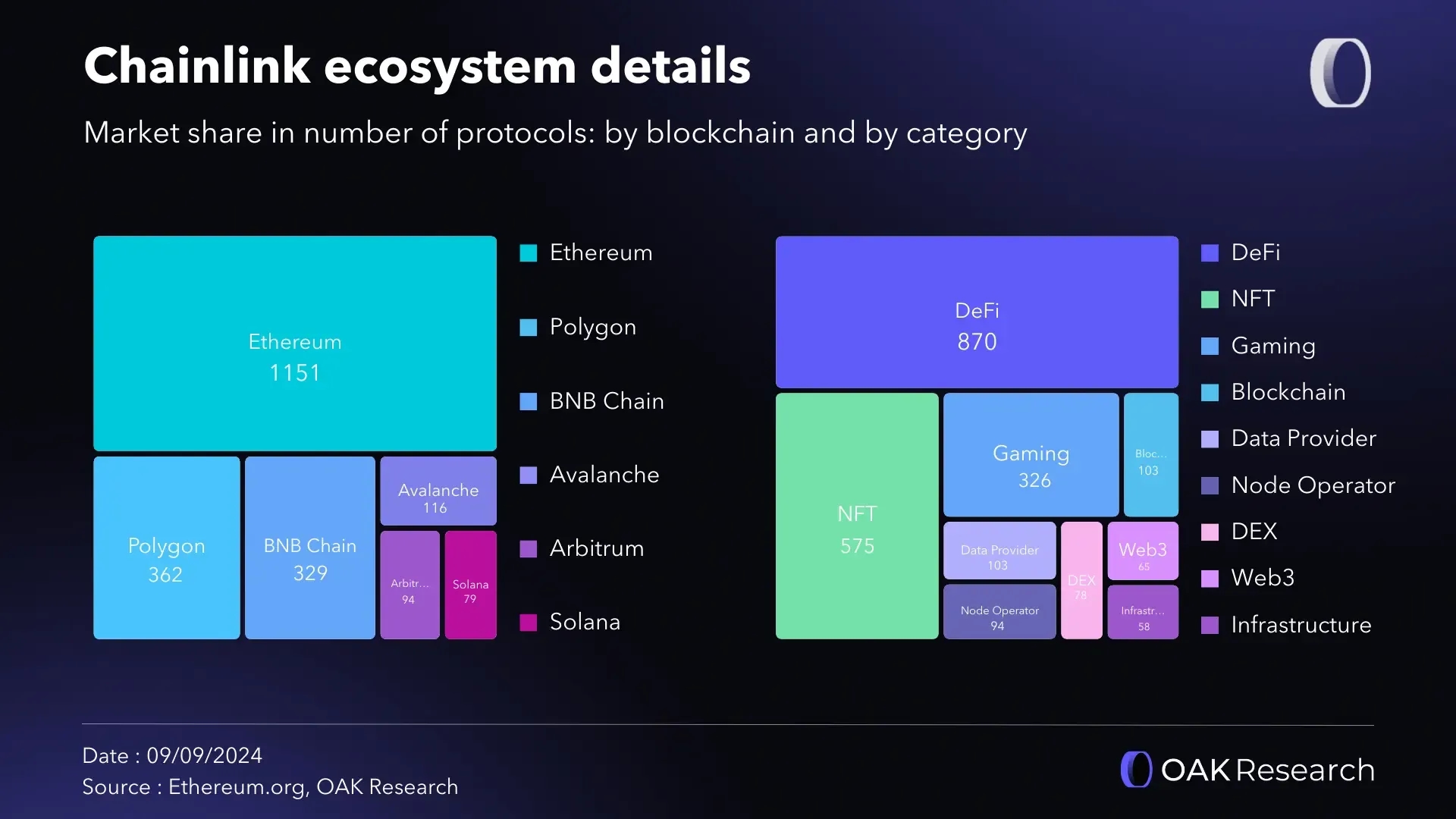

Aggregate Multiple Data Sources: Combine price feeds from several independent oracles to minimize reliance on any single source and reduce manipulation risks. (Example: Chainlink, Band Protocol)

-

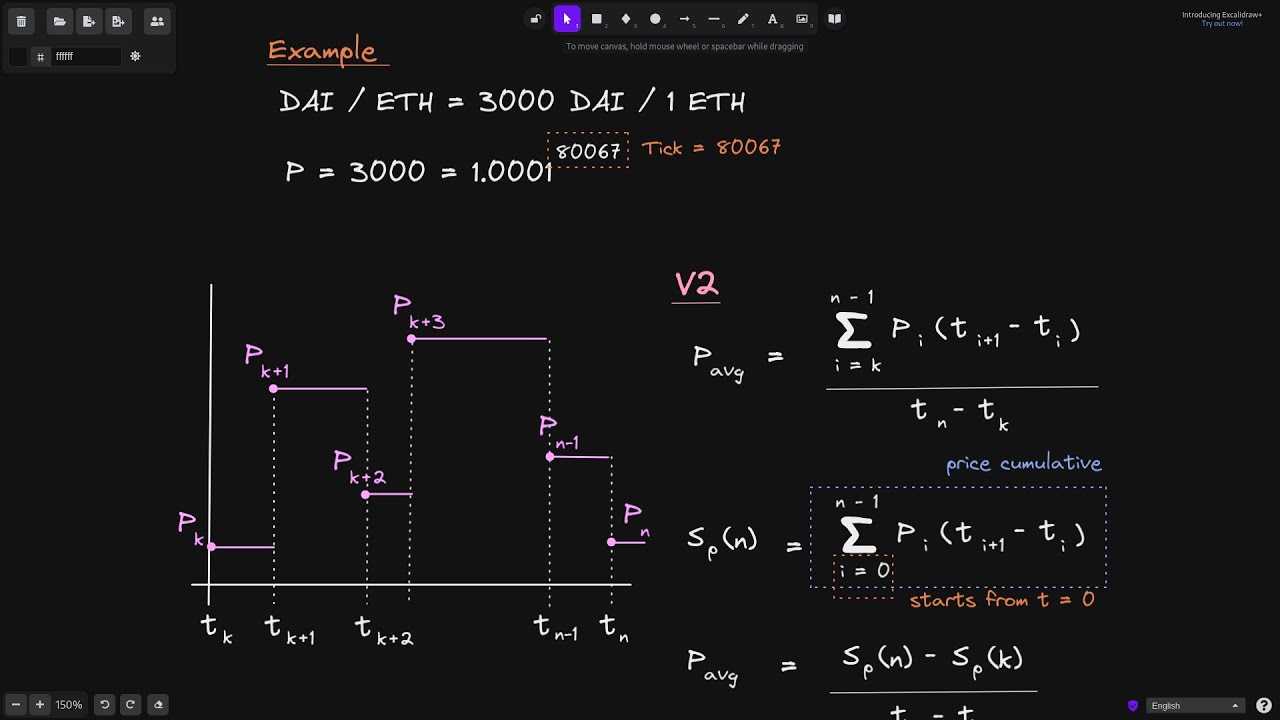

Implement Time-Weighted Average Price (TWAP): Use TWAP oracles to average asset prices over a set period, smoothing out short-term volatility and making price manipulation more difficult. (Example: Uniswap TWAP Oracles)

-

Adopt Decentralized Oracle Networks: Leverage decentralized networks where multiple nodes provide and verify data, enhancing resilience against single-point failures or attacks. (Example: Chainlink Decentralized Oracle Network)

-

Conduct Regular Audits & Real-Time Monitoring: Schedule ongoing security audits and implement continuous monitoring to promptly detect and address vulnerabilities. (Example: CertiK security audit for DeFi protocols)

-

Integrate Proof of Reserves Solutions: Use independent proof of reserves oracles to verify collateral backing in real-time, ensuring transparency and trust. (Example: Chaos Labs Edge Proof of Reserves with Ethena Labs)

- Diversified Data Sources: Aggregating prices from multiple independent sources helps neutralize outlier manipulation attempts (source).

- Time-Weighted Average Price (TWAP): Smoothing out short-term volatility by averaging prices over time makes it harder for attackers to move the needle with quick trades (source).

- Decentralized Oracle Networks: Distributing trust across many nodes reduces single points of failure and increases resilience (source).

- Aggressive Auditing and Real-Time Monitoring: Frequent reviews and active monitoring catch issues before they escalate (source).

A recent example is Ethena Labs’ integration with Chaos Labs’ Edge Proof of Reserves Oracles for its synthetic dollar token USDe, this partnership ensures continuous verification of reserves and boosts transparency for users (source). As more protocols follow suit, we’re seeing the emergence of new standards that put reliability front and center.

Innovative risk frameworks are also gaining traction, with protocols leveraging oracles for real-time risk parameter adjustments. This means insurance products can dynamically adapt to changing market conditions, tightening thresholds during volatility or widening coverage when markets stabilize. The end goal is clear: ensure that insurance triggers fire only when truly warranted, protecting both the protocol’s solvency and user confidence.

“The future of DeFi insurance depends on oracle transparency and resilience. Without robust data integrity, even the most sophisticated coverage products are vulnerable. ”

What Users Should Know About Oracle Risks

If you’re a DeFi participant considering insurance for smart contract exploits or stablecoin depegs, it pays to look under the hood. Not all oracle setups are created equal. Ask these questions before committing:

- How many independent sources does the protocol use for price or event data?

- Is there a history of regular security audits on the oracle infrastructure?

- Does the protocol employ TWAP or similar smoothing mechanisms?

- Can users independently verify reserve data for covered assets?

The answers will reveal whether a provider is serious about minimizing false positives and negatives in claim processing.

Case Study: Lessons from Recent Oracle Exploits

The Polter Finance and Avalanche-based Euler incidents offer sobering lessons. In both cases, attackers exploited weaknesses in oracle design, either by manipulating low-liquidity pools or taking advantage of insufficient aggregation across exchanges. Insurance protocols using similar architectures faced tough questions about their ability to detect and respond to such events accurately.

This has spurred a wave of upgrades across the sector, with more protocols shifting toward decentralized networks and continuous monitoring. Users now expect, and demand, transparency about how depeg trigger detection and smart contract exploit detection work behind the scenes.

The Road Ahead for Oracles in DeFi Insurance

The next generation of DeFi insurance will be shaped by innovations in oracle reliability and transparency. As protocols continue to refine their data pipelines, combining multiple price feeds, implementing time-weighted averages, and distributing trust across decentralized networks, the ecosystem becomes more resilient against manipulation.

For users, this means fewer unexpected losses due to false triggers and greater confidence that their coverage will respond as designed when disaster strikes. For developers and investors, it’s a call to prioritize robust oracle integration as much as any other layer of security.

Checklist: Evaluating Oracle Reliability for DeFi Insurance

-

Verify Use of Multiple Data Sources: Ensure the protocol aggregates price and event data from several independent sources to reduce single-point-of-failure risks. This approach helps minimize manipulation, as seen in best practices recommended by CertiK.

-

Check for Time-Weighted Average Price (TWAP) Oracles: Look for protocols that use TWAP oracles, which average prices over set intervals. This method helps defend against flash loan attacks and price manipulation, as highlighted by Chainlink.

-

Assess Decentralization of Oracle Network: Confirm the protocol employs a decentralized oracle network (e.g., Chainlink), distributing data validation across multiple nodes to enhance resilience against exploits.

-

Review Audit and Monitoring Practices: Check that the protocol undergoes regular security audits and implements real-time monitoring to detect anomalies or vulnerabilities, as recommended by CertiK.

-

Investigate Proof of Reserves Integrations: Look for integrations with independent proof-of-reserves solutions, such as Chaos Labs Edge Proof of Reserves, which provide ongoing, transparent verification of collateral (e.g., as implemented by Ethena Labs for USDe).

-

Research Incident History: Review the protocol’s history for past oracle-related incidents (e.g., the 2024 Polter Finance exploit or the 2025 Chainlink mishap) to assess responsiveness and improvements made after attacks.

The message is simple but powerful: DeFi insurance is only as strong as its weakest data feed. By demanding best-in-class oracle solutions today, we set the stage for a safer, more trustworthy decentralized future tomorrow.