Decentralized Finance (DeFi) insurance is rapidly transforming how crypto users protect their assets, but the legal landscape surrounding it remains a labyrinth of uncertainty. As capital continues to flow into DeFi protocols, the need for robust insurance solutions grows – yet so does regulatory scrutiny. For founders, investors, and users alike, understanding the evolving compliance requirements isn’t just prudent; it’s essential for survival in this volatile ecosystem.

Regulatory Uncertainty: The Core Challenge for DeFi Insurance

The decentralized nature of DeFi insurance platforms means they often operate across multiple jurisdictions simultaneously. This creates a patchwork of regulatory obligations, with no single set of rules to follow. The lack of uniformity leads to ambiguity in compliance responsibilities – a fact highlighted by industry experts and legal analysts alike. For example, what constitutes an “insurance product” in one country may be classified as an unregulated financial instrument in another.

This regulatory fog is more than an academic concern. Platforms that fail to anticipate local laws risk enforcement actions or complete shutdowns. Some projects have already faced legal challenges due to non-compliance, underlining the importance of rigorous jurisdictional analysis before launching or expanding operations.

KYC, AML, and the Privacy Paradox

Traditional insurers must adhere to strict Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. In contrast, DeFi insurance platforms thrive on pseudonymity and permissionless participation – values that clash directly with conventional compliance frameworks. Integrating KYC/AML without alienating privacy-focused users is a persistent dilemma.

The challenge isn’t just technical; it’s philosophical. Some platforms are experimenting with on-chain identity solutions or zero-knowledge proofs as potential middle grounds, but these remain early-stage innovations. Until scalable solutions emerge, the sector will continue to walk a tightrope between regulatory demands and user expectations.

Key Legal Risks for DeFi Insurance Providers

-

Regulatory Uncertainty: DeFi insurance platforms face ambiguous legal obligations due to inconsistent regulations across jurisdictions, making compliance complex and unpredictable.

-

KYC and AML Compliance Challenges: Enforcing Know Your Customer (KYC) and Anti-Money Laundering (AML) standards is difficult in decentralized systems, increasing the risk of regulatory breaches and illicit activity.

-

Smart Contract Vulnerabilities: Reliance on smart contracts exposes DeFi insurance to coding flaws and exploits, which can result in significant financial losses and potential legal liabilities.

-

Evolving Regulatory Landscape: Regulatory bodies, such as the U.S. Department of Justice, are rapidly updating policies around DeFi, requiring providers to continuously adapt to new legal interpretations and requirements.

-

Consumer Protection and Legal Compliance: The lack of centralized oversight in DeFi raises challenges in ensuring user protection and adherence to legal standards, which can undermine trust and sustainability.

-

Integration of RegTech Solutions: Implementing regulatory technology (RegTech) like blockchain analytics is essential for monitoring compliance, but balancing these tools with DeFi’s decentralized ethos remains a complex legal risk.

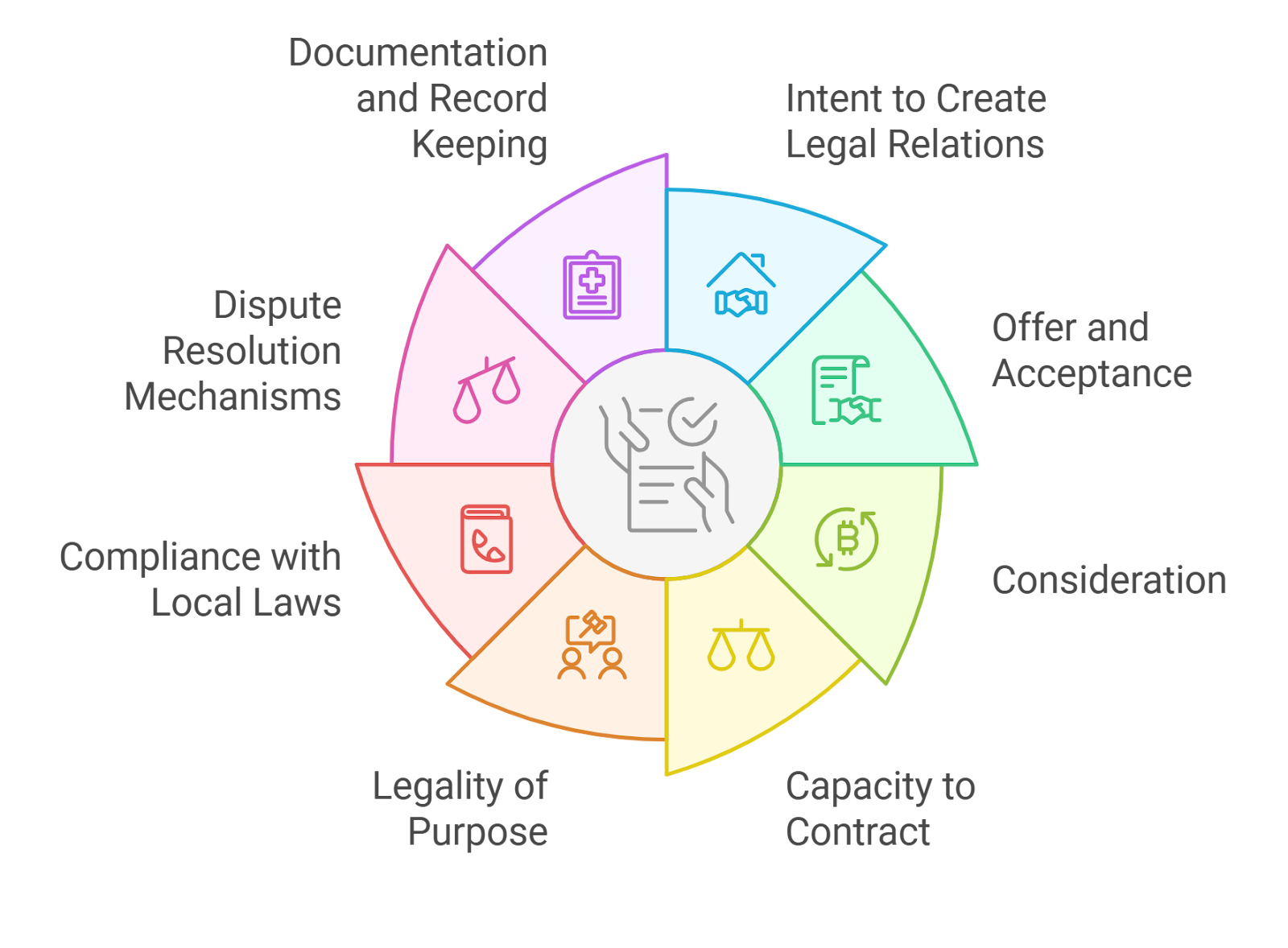

Smart Contract Vulnerabilities and Legal Liability

At the heart of every DeFi insurance product lies a smart contract – transparent but not infallible. Coding errors or exploits can trigger massive losses for both users and protocol treasuries. These incidents raise thorny questions about liability: Who is responsible when code fails? Is it the developer, the DAO governing body, or end-users themselves?

The recent shift by the U. S. Department of Justice towards focusing on criminal intent over unintended outcomes offers some relief for developers (source). However, this evolving stance is far from universal globally – meaning that teams must stay vigilant as new precedents are set in different regions.

Evolving Compliance Tech: RegTech Meets Crypto Insurance

The complexity of DeFi insurance regulation has spurred innovation in compliance technology (RegTech). Blockchain analytics tools can now track suspicious activity patterns in real-time, while on-chain monitoring systems help identify potential AML violations before they escalate (details here). Early adopters of these technologies may gain an edge by demonstrating proactive risk management to both regulators and users.

Yet, RegTech is not a silver bullet. The effectiveness of these tools depends on thoughtful integration with protocol design and governance. Overzealous surveillance can undermine the core value proposition of DeFi, permissionless, borderless participation, while lax controls invite regulatory backlash. Striking the right balance is an ongoing process, requiring collaboration between technologists, legal experts, and community stakeholders.

Consumer Protection and Litigation Trends

Consumer protection remains one of the most hotly debated topics in DeFi insurance regulation. Without centralized oversight, users often lack clear recourse in the event of failed claims or protocol insolvency. Recent litigation trends suggest that courts are still grappling with how to assign responsibility when things go wrong, a dynamic explored in depth by legal commentators (source).

Some jurisdictions are beginning to experiment with sandbox regimes or bespoke licensing frameworks for crypto insurance providers. While these efforts offer hope for clarity, they also introduce new layers of complexity for global projects seeking cross-border scale. As such, many protocols are investing in legal counsel and compliance teams at earlier stages than ever before.

Key Legal Risks for DeFi Insurance Providers

The matrix of risks facing DeFi insurance teams goes well beyond smart contract exploits or regulatory fines. Teams must navigate:

Key Compliance Pitfalls in DeFi Insurance

-

Regulatory Uncertainty Across Jurisdictions: DeFi insurance projects often operate globally, facing inconsistent or unclear regulations in different countries, which complicates compliance and increases legal risk.

-

Challenges with KYC and AML Enforcement: The decentralized and pseudonymous nature of DeFi makes it difficult to implement robust KYC (Know Your Customer) and AML (Anti-Money Laundering) checks, exposing platforms to regulatory scrutiny and potential misuse.

-

Smart Contract Vulnerabilities: Insurance protocols in DeFi rely on smart contracts, which are susceptible to bugs and exploits. Security breaches can result in significant financial losses and legal liabilities for platforms and users.

-

Rapidly Evolving Regulatory Landscape: Regulatory bodies like the U.S. Department of Justice are shifting policies, such as focusing on criminal intent in DeFi code misuse cases. DeFi insurance projects must stay agile to adapt to these changes.

-

Consumer Protection Gaps: The lack of centralized oversight in DeFi can leave users vulnerable to fraud and insufficient recourse, making it challenging for insurance projects to ensure legal compliance and build user trust.

-

Complexity of Integrating RegTech Solutions: Implementing advanced RegTech tools—like blockchain analytics and on-chain monitoring—can help with compliance, but balancing these with DeFi’s decentralization ethos remains a significant hurdle.

Each risk area demands its own mitigation strategy, from robust code audits and bug bounties to transparent governance structures and comprehensive disclosures.

Staying Ahead: Best Practices for Navigating Regulatory Headwinds

So what does it take to thrive as a DeFi insurance provider amid this shifting landscape? The most resilient teams are those that treat compliance as an ongoing function, not a box-ticking exercise. This means:

- Maintaining active monitoring of evolving global regulations

- Engaging proactively with legal advisors across key jurisdictions

- Piloting RegTech integrations that enhance transparency without sacrificing user autonomy

- Building adaptable governance models capable of responding to new compliance requirements

The rewards for getting it right are substantial: increased user trust, smoother institutional onboarding, and a stronger foundation for sustainable growth.

The Road Ahead: Regulatory Evolution as Opportunity

The next wave of innovation in DeFi insurance will likely be shaped by those who can anticipate, not just react to, regulatory shifts. Whether it’s leveraging zero-knowledge proofs for privacy-preserving compliance or participating in industry working groups shaping future standards, forward-thinking teams have an opportunity to help define the rules of engagement.

The bottom line? In the world of crypto insurance legal trends, agility is everything. By staying plugged into policy debates, investing in smart compliance infrastructure, and fostering open dialogue with regulators and users alike, DeFi insurance platforms can turn legal risk into strategic advantage.