Decentralized finance (DeFi) has rapidly evolved, introducing new opportunities for yield and innovation – but also new risks. As protocols grow in value and complexity, users are increasingly turning to DeFi insurance to protect themselves from smart contract exploits and stablecoin depegs. Yet, one of the most common questions remains: How are DeFi insurance premiums calculated? Understanding the mechanics behind these rates is essential for anyone seeking sustainable risk management in the crypto space.

What Drives DeFi Insurance Premiums?

The cost of coverage in DeFi isn’t arbitrary. Instead, it’s determined by a blend of quantitative risk modeling, protocol-specific data, and market dynamics. Here are the core factors influencing premium rates:

Key Factors Influencing DeFi Insurance Premiums

-

Coverage Amount and Duration: The total value insured and the length of time you want coverage directly raise or lower your premium. Higher coverage amounts and longer durations typically mean higher costs.

-

Protocol or Asset Risk Assessment: Insurers analyze the security and stability history of the protocol or asset. Protocols with past exploits or unstable assets (such as stablecoins that have previously depegged) generally incur higher premiums.

-

Depeg Threshold Selection: For depeg coverage, the chosen trigger threshold (e.g., $0.95 vs. $0.80) affects the premium. Lower thresholds that are more likely to be reached result in higher premiums.

-

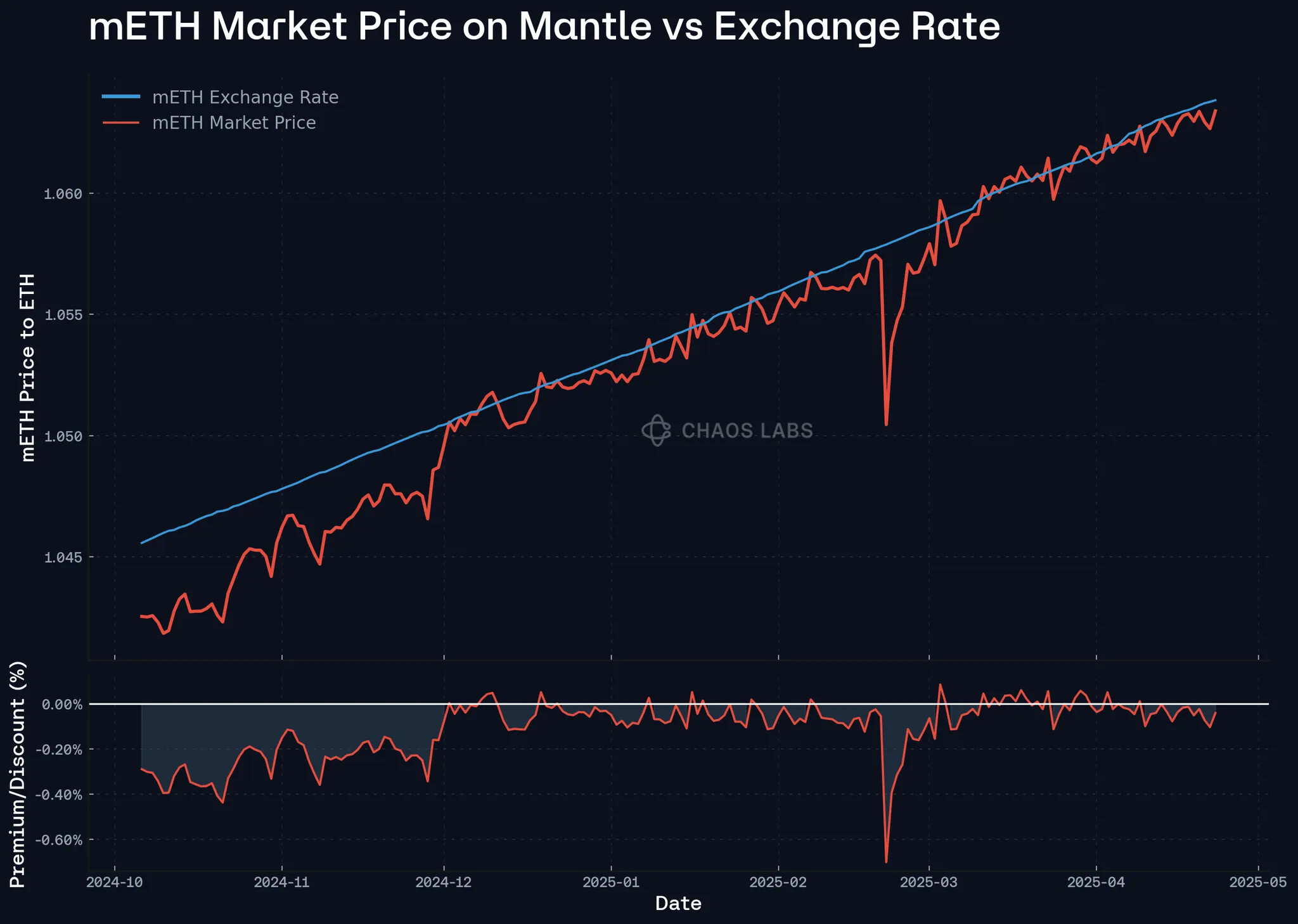

Market Conditions and Volatility: Premiums reflect the current and historical volatility of the covered asset. Assets with frequent or significant price swings are riskier to insure, leading to increased premiums.

-

Observation Periods: The required time an asset must remain below a depeg threshold before a payout is made impacts the premium. Shorter observation periods increase the likelihood of a claim, thus raising premiums.

-

Protocol-Specific Pricing Models: Each DeFi insurance protocol (such as Nexus Mutual, InsurAce, or Unslashed) uses its own pricing models—ranging from parametric triggers to mutual pool mechanisms—which can significantly influence premium rates.

Coverage Amount and Duration: Higher coverage amounts or longer policy durations will naturally increase your premium. This is because insurers take on more potential liability over a longer period.

Protocol or Asset Risk Profile: Insurers assess the historical security and stability of each protocol or asset. For example, a stablecoin with a consistent peg history will usually have a lower premium than one that has experienced frequent volatility or depegging events. Similarly, protocols with prior exploit incidents may face higher rates due to perceived risk.

Depeg Thresholds and Observation Periods: In depeg insurance, your chosen trigger threshold (such as $0.95 vs $0.80) significantly impacts pricing. Lower thresholds increase the likelihood of a payout, so expect higher premiums if you want protection at less severe depegs. The observation period – how long the price must stay below the threshold before triggering a claim – also matters; shorter periods mean higher premiums due to increased payout probability.

The Role of Market Dynamics and Automated Pricing

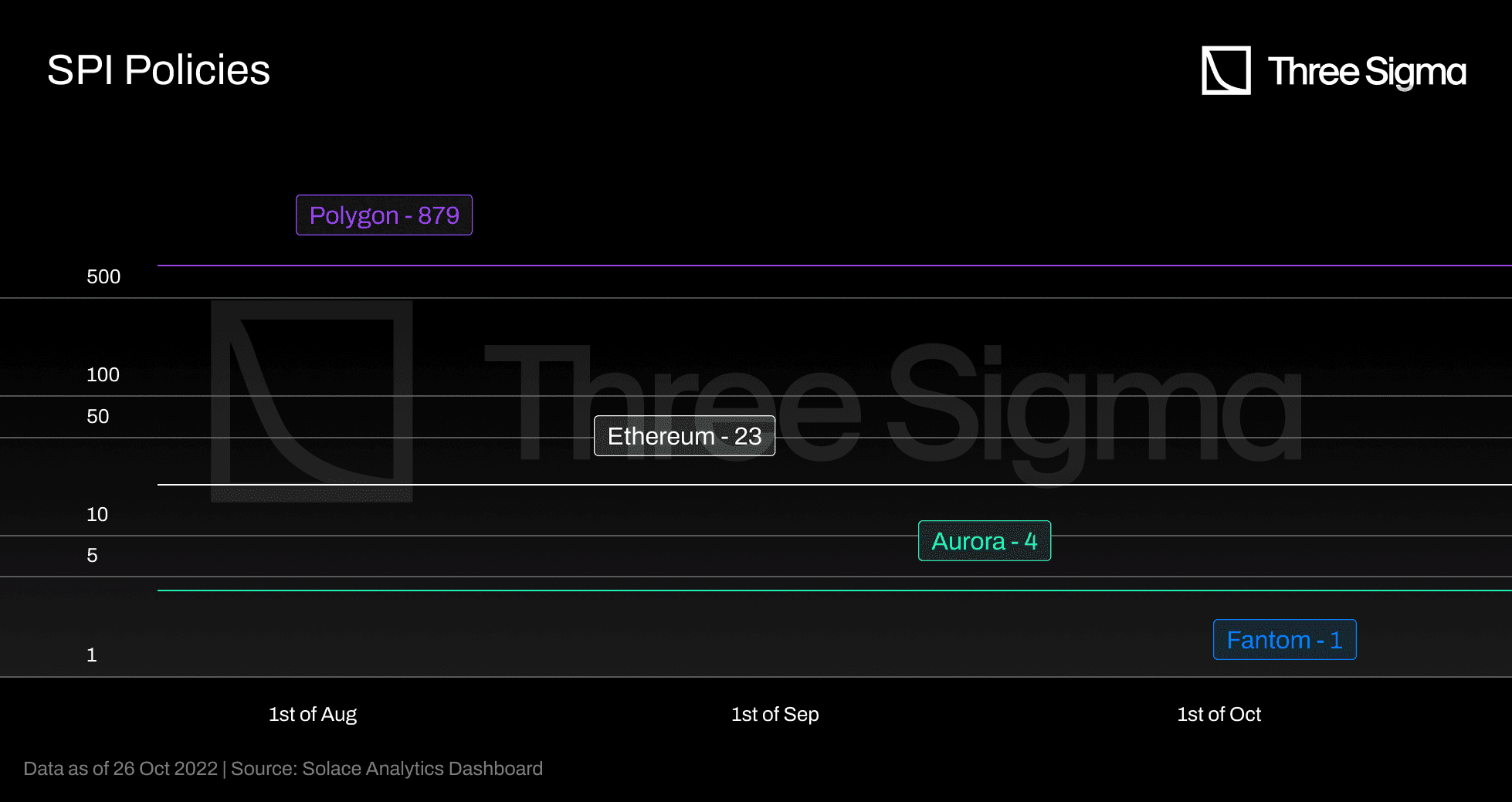

A unique aspect of DeFi insurance is its reliance on on-chain data and automated pricing models. Many protocols use parametric models that calculate risk in real time based on metrics like total value locked (TVL), historical volatility, and even user demand for coverage. For instance, as outlined by Three Sigma’s research, some platforms automatically reduce risk costs as more value is staked against a protocol – essentially spreading risk among more participants.

This dynamic approach means that DeFi insurance pricing can fluctuate rapidly with market sentiment and protocol health. If volatility spikes or if there’s an exploit scare in the ecosystem, expect premiums to adjust accordingly.

Comparing Exploit Coverage vs Depeg Insurance Rates

The calculation methods differ slightly between exploit coverage and depeg protection:

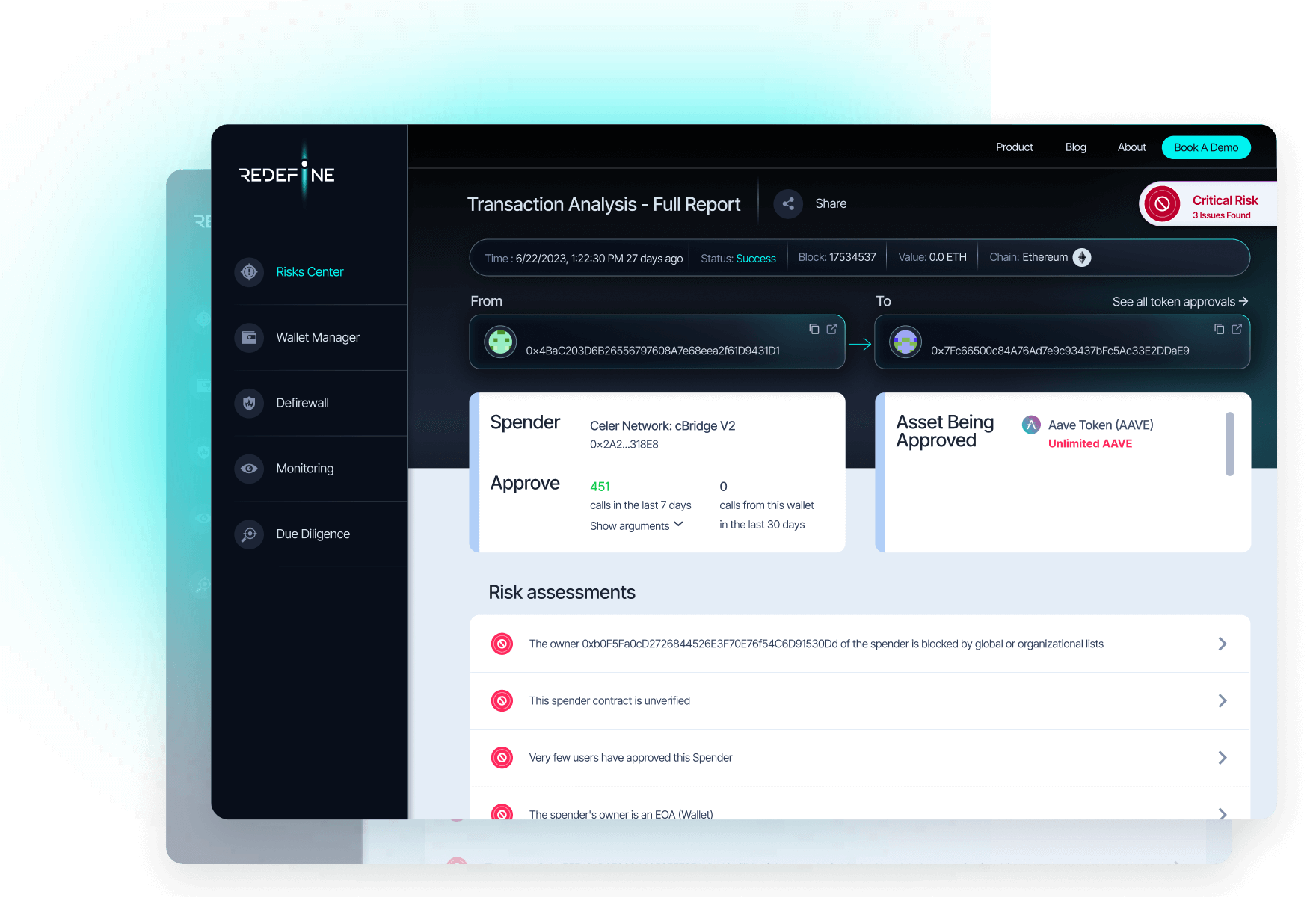

- Exploit Coverage Premium Calculation: Typically focuses on smart contract audit history, frequency/severity of past exploits, size of user funds at risk, and protocol governance structure.

- Depeg Insurance Rates: Depend heavily on stablecoin price history (often using TWAP via oracles like Chainlink), market liquidity depth, selected depeg thresholds, and observation windows.

You can find detailed explanations about these mechanisms in resources like DefiLean’s stablecoin depeg documentation, which breaks down how parameters like threshold selection directly affect your crypto insurance cost.

Navigating Protocol-Specific Models

No two protocols calculate premiums exactly alike. Some rely on mutual pools where members share risks collectively; others use strictly algorithmic models with no human intervention beyond initial parameter setting. For those interested in staking-based models or governance-driven adjustments to rates, further insights can be found at AstraSol Bond’s insights page.