The rapid evolution of decentralized finance (DeFi) has brought both innovation and risk. As smart contract exploits and protocol failures continue to threaten user funds, DeFi insurance platforms play a critical role in safeguarding digital assets. In 2024, users have access to a diverse range of decentralized insurance dapps designed specifically for smart contract exploit coverage. This article examines the 11 best DeFi insurance platforms, analyzing their security models, market relevance, and unique approaches to DeFi risk management.

Why Smart Contract Exploit Coverage Matters in DeFi

Smart contracts are the backbone of DeFi protocols but remain vulnerable to bugs, logic errors, and malicious attacks. Exploits can drain millions from liquidity pools in minutes, often leaving users with little recourse. Traditional insurance is ill-suited for these risks due to lack of transparency and slow claims processes. Decentralized insurance platforms address these gaps by leveraging blockchain technology for transparent underwriting, community-driven claims assessment, and real-time coverage tailored to digital assets.

“The best trade is a safe trade. “ – Tristan Monroe

Top 11 DeFi Insurance Platforms for Smart Contract Exploit Protection in 2024

Top 11 DeFi Insurance Platforms for 2024

-

Nexus Mutual: A leading decentralized insurance protocol on Ethereum, Nexus Mutual offers coverage for smart contract failures. Members use NXM tokens for governance and claims, with transparent, community-driven assessments. Current NXM Price: $99.69 (as of September 19, 2025).

-

InsurAce: A multi-chain insurance platform providing coverage for smart contract exploits, exchange hacks, and stablecoin de-pegging. InsurAce is known for its actuarial models and low premiums across Ethereum, BSC, and more.

-

Unslashed Finance: Specializing in protocol failure and smart contract attack coverage, Unslashed Finance features instant liquidity, tokenized coverage, and decentralized claims arbitration for DeFi users.

-

Bridge Mutual: A peer-to-peer insurance protocol offering protection for smart contract risks, stablecoin failures, and exchange hacks. Users stake BMI tokens to participate in governance and claims.

-

Sherlock: Sherlock provides smart contract exploit coverage with a focus on protocol security. It leverages expert auditors and a decentralized claims process to protect DeFi projects and users.

-

Etherisc: Etherisc is a decentralized insurance protocol building open-source, blockchain-based insurance products, including protection against smart contract exploits and technical failures.

-

Opium Insurance: Part of the Opium Protocol, Opium Insurance offers tokenized, tradable insurance products for smart contract hacks and stablecoin defaults, enabling flexible risk management for DeFi users.

-

Solace: Solace provides automated, pay-as-you-go smart contract insurance with dynamic pricing and instant claim payouts, focusing on seamless integration with DeFi applications.

-

Uno Re: Uno Re is a decentralized reinsurance platform enabling users to design, purchase, and trade insurance products, with a strong emphasis on smart contract exploit coverage.

-

OpenCover: OpenCover streamlines DeFi insurance purchases, making it easy and affordable to protect portfolios against smart contract vulnerabilities and protocol exploits.

-

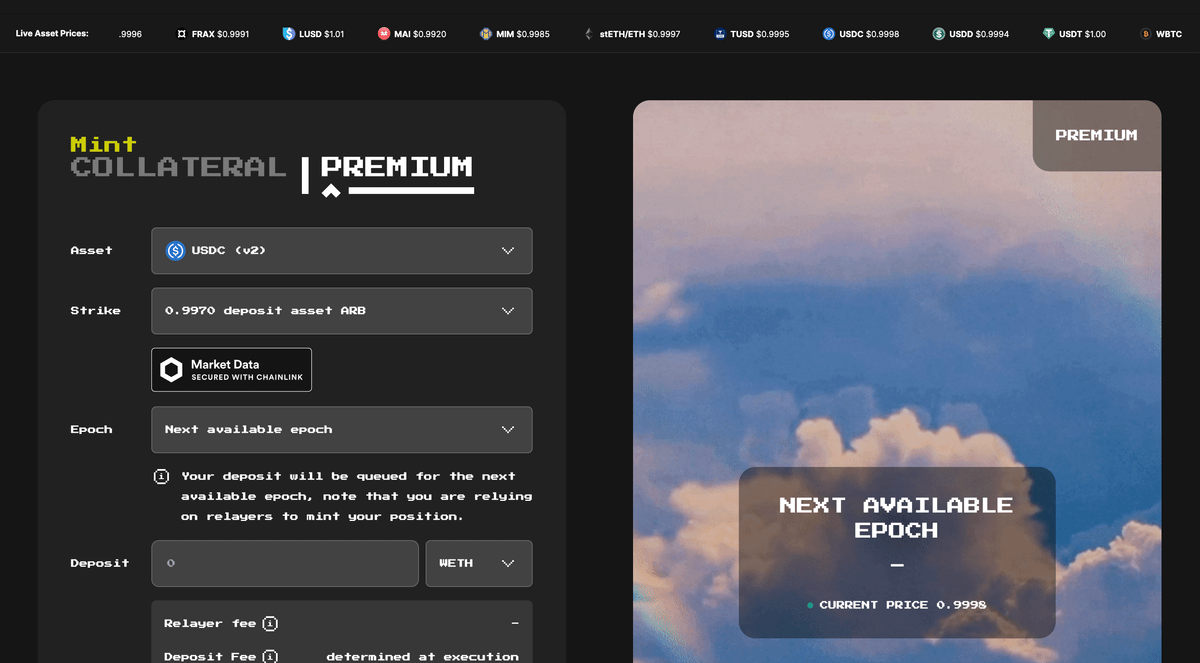

Y2K Finance: Y2K Finance offers innovative structured products for DeFi risk management, including coverage against smart contract failures and protocol-specific events.

Nexus Mutual: Leading the Mutual Model

Nexus Mutual remains the most established decentralized insurance protocol for smart contract exploit coverage. Operating as a member-owned mutual on Ethereum, it enables users to purchase cover against specific protocol risks and participate in governance via NXM tokens. As of September 19,2025, the price of NXM stands at $99.69, reflecting steady growth and strong community trust (source). Claims are assessed through a transparent voting process that incentivizes honest participation while deterring fraudulent activity.

InsurAce: Multi-Chain Flexibility and Actuarial Efficiency

InsurAce distinguishes itself with multi-chain support across Ethereum, BSC and more. It covers not only smart contract exploits but also exchange hacks and stablecoin depegs using advanced actuarial models to keep premiums competitive (source). This capital-efficient approach ensures robust reserves while allowing users to manage their risk portfolios across multiple chains seamlessly.

Unslashed Finance: Instant Liquidity and Tokenized Coverage

Unslashed Finance offers instant liquidity on claims through tokenized coverage products that can be integrated directly into Web3 applications. The platform uses decentralized arbitration for claims resolution and prioritizes capital efficiency by pooling significant cover capital from backers (source). Users benefit from flexible policy structures that adapt as their exposure changes over time.

Diversifying Coverage: Peer-to-Peer Models and Specialized Protocols

The next wave of DeFi insurance platforms expands beyond simple pooled risk models:

- Bridge Mutual: Leverages a peer-to-peer model where users stake BMI tokens to provide liquidity and participate in claims governance. Coverage spans smart contract exploits as well as stablecoin failures.

- Sherlock: Focuses on underwriting protocol-specific risks using expert audit committees combined with staked collateral pools.

- Etherisc: Pioneers open-source frameworks for customizable parametric insurance products, including protection against oracle failures or DAO attacks.

- Opium Insurance: Offers tradable tokenized positions against both hacking events and stablecoin depegs, enabling secondary market risk transfer.

- Solace: Provides automated coverage purchases based on user portfolio analytics across supported chains.

- Uno Re: Empowers the community to design bespoke cover products while participating in reinsurance pools for additional yield.

- OpenCover: Simplifies portfolio-wide protection by aggregating multiple policy types under one interface, streamlining user experience for active traders.

- Y2K Finance: Specializes in covering tail-risk events such as catastrophic protocol failures or black swan exploits via innovative vault-based mechanisms.

Together these platforms represent the cutting edge of crypto insurance in 2024, offering solutions tailored not just to individual protocols but also emerging threats unique to composable finance ecosystems. In the next section we’ll compare features such as claim processing times, premium structures and integration options across these leading solutions.

Comparing DeFi Insurance Platforms: Key Features and Considerations

When evaluating DeFi insurance platforms, users should analyze several core criteria: claim processing efficiency, premium pricing, ease of integration, and the breadth of coverage. While each protocol in this top 11 list brings unique strengths, understanding their operational differences is essential for optimal DeFi risk management.

| Platform | Claims Process | Premium Structure | Coverage Specialization | |

|---|---|---|---|---|

| Nexus Mutual | Community voting (NXM holders) | Dynamically priced by risk assessment | Smart contract exploits, protocol failures | |

| InsurAce | Decentralized claims committee | Actuarial model, multi-chain discounts | Smart contracts, exchange hacks, depegs | |

| Unslashed Finance | Instant liquidity/tokenized payouts | Pooled capital with flexible tokens | Protocol attacks, integrations via Web3 apps | |

| Bridge Mutual | P2P staking and governance voting (BMI) | User-staked pools; dynamic rates | Smart contracts, stablecoins, exchanges | |

| Sherlock | Audit committee and staked backers vote | Bespoke pricing per protocol risk profile | Audited protocols; focus on technical security assurance | |

| Etherisc | Crowdsourced claim validation; parametric triggers possible | User-defined oracles and payout logic | Bespoke parametric insurance (DAOs/oracles) | |

| Opium Insurance | Payouts via tokenized insurance positions traded on secondary markets | Dynamically priced by market demand | Bugs/hacks and stablecoin depeg events | /tr> |